=========================================

Introduction

In the evolving world of cryptocurrency derivatives, pair trading system for perpetual futures has become one of the most effective strategies for managing risk and exploiting relative value opportunities. Perpetual futures, unlike traditional contracts, have no expiration date and use funding rates to balance long and short positions. This unique structure allows traders to build sophisticated market-neutral strategies, with pair trading standing out as a popular method.

In this article, we will explain what pair trading in perpetual futures means, dive into its mechanics, explore two professional methods, compare their strengths and weaknesses, and provide practical guidance for traders of different levels. Drawing from real-world experience and the latest trading trends, this guide aims to help professionals and serious investors create more resilient and profitable trading systems.

What is Pair Trading in Perpetual Futures?

Pair trading is a market-neutral strategy that involves taking opposing positions in two correlated assets. Instead of betting on the absolute direction of the market, traders profit from the relative movement between the two assets.

For perpetual futures, this often involves:

- Long Position: Buying one asset’s perpetual futures.

- Short Position: Selling another asset’s perpetual futures.

The goal is to benefit from changes in the spread between the two instruments rather than market-wide price direction.

Example of Pair Trading in Perpetual Futures

- Go long BTC/USDT perpetual.

- Go short ETH/USDT perpetual.

- If BTC outperforms ETH, the spread widens and the trade profits.

This approach reduces exposure to broad market swings while exploiting inefficiencies in asset relationships.

Why Use Pair Trading in Perpetual Futures?

There are several compelling reasons why professional traders favor this strategy:

- Market Neutrality – Reduces exposure to overall market volatility.

- Funding Rate Arbitrage – Differences in funding rates between two perpetual contracts create yield opportunities.

- Hedging Potential – Useful for hedging long-term positions while keeping exposure to relative asset performance.

- Diversification – Spreads risk across multiple assets instead of relying on one instrument.

For those new to the concept, resources on how to use pair trading in perpetual futures provide step-by-step breakdowns that help traders practice the strategy before scaling.

Core Strategies for Pair Trading in Perpetual Futures

Strategy 1: Statistical Arbitrage Pair Trading

Overview

This method uses historical price data and statistical models to identify mispriced relationships. Traders enter positions when the spread between two assets deviates significantly from its historical mean.

How It Works

- Measure correlation and cointegration between two perpetual futures (e.g., BTC & ETH).

- Define a z-score threshold to identify spread anomalies.

- Enter long/short positions when the spread is above or below the threshold.

- Exit when the spread reverts to its mean.

Advantages

- Strong mathematical foundation.

- Proven success in traditional equity markets, now adapted to crypto.

- Works well in sideways or mean-reverting markets.

Disadvantages

- Requires advanced statistical tools.

- Can underperform during strong directional trends.

- Risk of structural changes in asset relationships.

Strategy 2: Funding Rate Arbitrage Pair Trading

Overview

Funding rates in perpetual futures incentivize balance between longs and shorts. By pairing assets with different funding rates, traders can capture yield.

How It Works

- Identify assets with consistently high positive funding (e.g., altcoins).

- Pair them against assets with low or negative funding.

- Long the low-funding asset and short the high-funding asset.

- Profit from the net funding difference while staying market-neutral.

Advantages

- Generates passive yield through funding collection.

- Effective in highly speculative markets with large funding disparities.

- Lower reliance on price spread movements.

Disadvantages

- Funding rates can change quickly.

- Requires continuous monitoring and rebalancing.

- Profit margins are often smaller than directional trading.

Strategy Comparison

| Feature | Statistical Arbitrage | Funding Rate Arbitrage |

|---|---|---|

| Market Type | Mean-reverting, sideways markets | Highly speculative, volatile markets |

| Main Profit Source | Spread reversion | Funding rate differentials |

| Complexity | High (requires statistical modeling) | Medium (monitoring funding rates) |

| Risk Level | Moderate (relationship breakdown) | Low to Moderate (funding variability) |

| Time Horizon | Short to medium term | Intraday to medium term |

Recommendation

From my trading experience, the best approach is a hybrid system that combines both. Statistical arbitrage provides strong entry signals, while funding arbitrage enhances returns when funding spreads are favorable.

How to Implement a Pair Trading System in Perpetual Futures

Step 1: Asset Selection

- Choose assets with strong historical correlation (BTC-ETH, SOL-AVAX, etc.).

- Avoid illiquid pairs with wide spreads.

Step 2: Data Analysis

- Backtest correlations, cointegration, and spread behavior.

- Monitor historical funding rates to find persistent inefficiencies.

Step 3: Execution & Automation

- Use trading bots or APIs to execute positions instantly.

- Implement rules for entry, exit, and stop-losses.

- For advanced setups, explore how to automate pair trading strategies in perpetual futures to enhance execution efficiency.

Step 4: Risk Management

- Allocate capital evenly across pairs.

- Use volatility-adjusted position sizing.

- Always set stop-losses in case correlations break down.

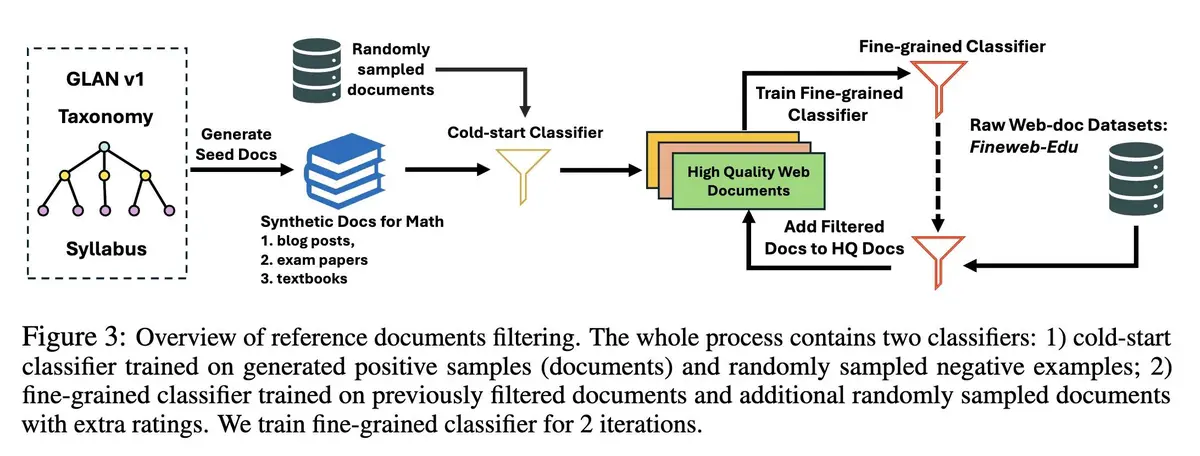

Visual Guide to Pair Trading

Pair trading system workflow in perpetual futures

Risk Management in Pair Trading Systems

Even though pair trading is market-neutral, it is not risk-free. Traders must be cautious of:

- Correlation Breakdown: Assets may decouple permanently.

- Liquidity Shocks: Slippage can erode profits during large trades.

- Funding Rate Reversals: Profitable positions may flip if funding changes direction.

- Leverage Risk: Overleveraging magnifies spread errors and liquidation risks.

Mitigation strategies include diversification across multiple pairs, regular recalibration of models, and strict leverage control.

Current Trends in Pair Trading for Perpetual Futures (2025)

- AI-Based Correlation Models: Machine learning is increasingly used to identify non-linear asset relationships.

- Cross-Exchange Pair Trading: Exploiting price inefficiencies across multiple exchanges.

- DeFi Pair Trading: Perpetuals offered by decentralized exchanges are creating new opportunities for funding arbitrage.

- Institutional Adoption: Hedge funds and proprietary trading firms are deploying capital into pair trading systems for diversification.

FAQ: Pair Trading System for Perpetual Futures

1. How does pair trading work in perpetual futures?

Pair trading involves opening long and short positions in two correlated perpetual futures contracts. Profits are generated from the change in the spread between the two, rather than absolute price direction.

2. Why choose pair trading for perpetual futures instead of spot markets?

Perpetual futures provide higher leverage, continuous trading, and funding rate opportunities. These features enhance the flexibility and yield potential of pair trading compared to traditional spot markets.

3. Where can I find pair trading strategies for perpetual futures?

Traders can explore professional trading communities, academic research on cointegration, exchange-provided insights, and dedicated tutorials that offer both statistical and funding-based strategies.

Conclusion

The pair trading system for perpetual futures is a powerful tool for professional traders seeking market-neutral strategies in volatile crypto markets. Whether through statistical arbitrage or funding rate exploitation, this method allows traders to profit while reducing exposure to broad market risk.

For long-term success, a hybrid approach—backed by automation, data analysis, and robust risk management—is the most effective. As perpetual futures markets mature, pair trading will remain a cornerstone for sophisticated investors, hedge funds, and institutional traders.

If you found this guide valuable, share it with your trading community, leave a comment with your thoughts, and help spread knowledge on advanced perpetual futures strategies.

Would you like me to also create a step-by-step backtesting template in Excel or Python for testing pair trading strategies before deploying them live?