==========================================================

In the rapidly evolving world of cryptocurrency trading, perpetual futures have become a favorite instrument for both retail and institutional investors. One crucial aspect that often goes unnoticed is the process of claiming rebates in perpetual futures. Understanding this process can significantly impact profitability and trading efficiency. This article provides an in-depth guide on the topic, combining practical strategies, industry insights, and step-by-step methods to maximize rebate benefits.

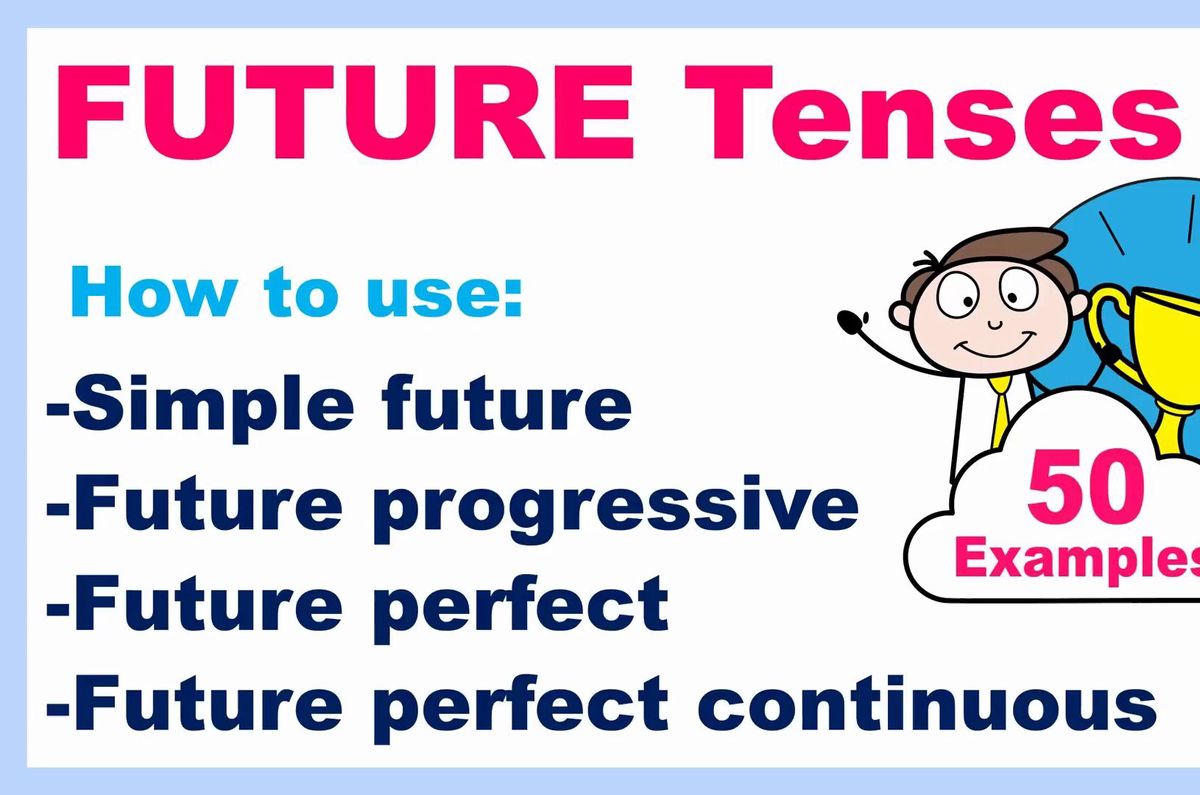

Understanding Rebate in Perpetual Futures

Rebate in perpetual futures refers to a refund or reward provided by exchanges to traders, typically based on their trading volume or participation in liquidity provision. This system is designed to incentivize traders to maintain active trading activity and liquidity in the markets.

What is a Perpetual Futures Rebate?

A perpetual futures rebate is a fee return mechanism offered by exchanges. When a trader executes trades, part of the transaction fee may be refunded based on specific eligibility criteria. These rebates can vary across exchanges, with some offering tiered systems for different trading volumes.

Key Points:

- Rebates encourage market liquidity.

- High-frequency traders often benefit the most.

- Rebate structures may include maker/taker models.

Why Traders Seek Rebate in Perpetual Futures

Rebates provide traders with a way to reduce trading costs, improve net returns, and even create additional income streams through strategic trading. Professional traders particularly seek rebates to enhance profitability without increasing capital risk.

Step-by-Step Guide to Claiming Rebate

Claiming a rebate in perpetual futures involves a systematic approach. Below are the practical methods used by traders.

Step 1: Identify Eligible Accounts

Not all accounts are eligible for rebates. Traders must ensure that their account meets the exchange’s criteria, such as:

- Minimum trading volume.

- Verified KYC status.

- Adherence to trading rules and limits.

Step 2: Understand Rebate Terms

Before claiming, it is essential to review the exchange’s rebate terms. These often include:

- Qualification thresholds.

- Applicable trading pairs.

- Frequency of rebate distribution.

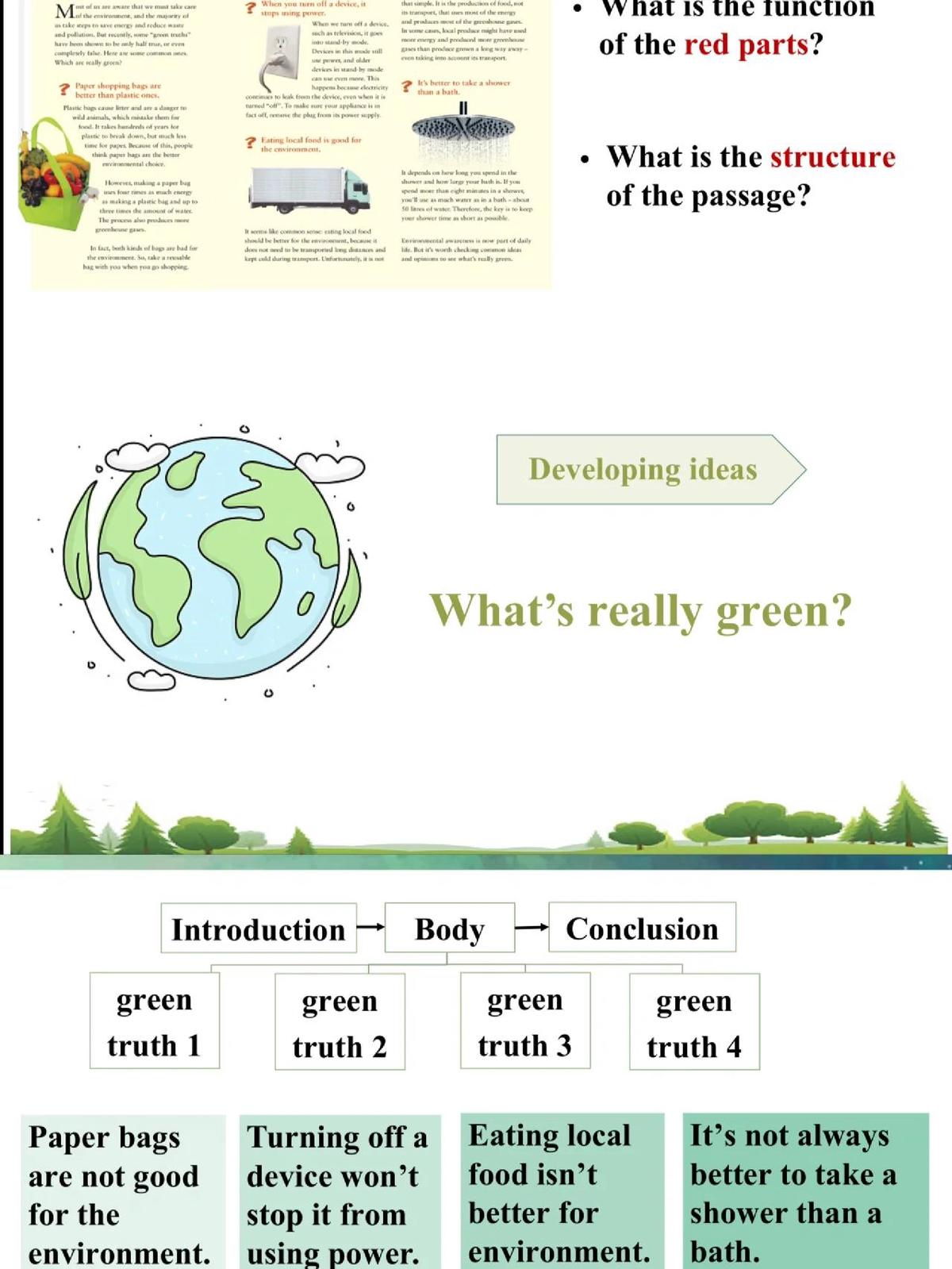

Image:

Rebate eligibility requirements across different exchanges.

Step 3: Execute Qualifying Trades

Traders must actively participate in trading activities that qualify for rebates. This typically involves:

- Maker trades (providing liquidity to the order book).

- High-volume trades within specific pairs.

Step 4: Apply for Rebate

Depending on the platform, rebates may be automatically credited or require a formal claim. Methods include:

- Submitting an online rebate request form.

- Using dedicated rebate tools provided by the exchange.

Step 5: Monitor and Optimize

Traders should continually monitor rebate performance. This includes tracking:

- Rebate amounts received.

- Adjusting trading strategies to maximize rebate potential.

- Using analytics tools for better planning.

Embedded Internal Link: For detailed insights, see how to get rebate for perpetual futures.

Methods and Strategies to Maximize Rebate

While the basic process is straightforward, implementing strategic approaches can enhance rebate efficiency.

Method 1: Maker-Taker Optimization

How it Works

Maker trades often receive higher rebate rates compared to taker trades. By strategically placing limit orders instead of market orders, traders can maximize rebates.

Pros

- Reduces trading fees.

- Encourages disciplined trading strategies.

- Can significantly increase long-term returns.

Cons

- May require patience and active order management.

- Market conditions can affect execution speed.

Method 2: Volume Tier Exploitation

How it Works

Exchanges often reward high-volume traders with increased rebate rates. Planning trades to hit specific volume tiers can unlock higher rebates.

Pros

- High potential reward for frequent traders.

- Encourages data-driven strategy.

Cons

- May require substantial capital.

- Risk of overtrading if not managed carefully.

Embedded Internal Link: Learn more about how to maximize rebate in perpetual futures for strategic planning.

Image:

Comparison of maker vs. taker rebate strategies.

Common Challenges in Rebate Claims

Delay in Rebate Credit

Some exchanges may delay rebate distribution due to verification or system processing.

Misunderstanding Eligibility

Traders often overlook qualification rules, resulting in missed rebates.

Dynamic Rebate Structures

Rebate percentages may fluctuate based on market liquidity, trading volume, and exchange policies.

FAQ: Practical Insights on Rebate in Perpetual Futures

1. How long does it take to receive a rebate?

Rebate distribution times vary by exchange. Typically, automatic rebates are credited within 24-72 hours, while manual claims may take up to a week. Traders should check the specific exchange policy.

2. Can rebates offset trading losses?

Yes, while rebates reduce trading fees and can partially offset losses, they should not be relied upon as a primary profit source. Effective risk management is essential.

3. Are all trading pairs eligible for rebate?

Not necessarily. Most exchanges limit rebate eligibility to high-liquidity pairs or specific contract types. Review the exchange’s rebate program to confirm applicable pairs.

Best Practices for Effective Rebate Management

- Use Analytical Tools: Track trading volume and rebate accumulation to optimize strategies.

- Align Trading with Rebate Programs: Focus on maker orders and eligible pairs.

- Regularly Review Terms: Exchanges update rebate policies; staying informed ensures consistent claims.

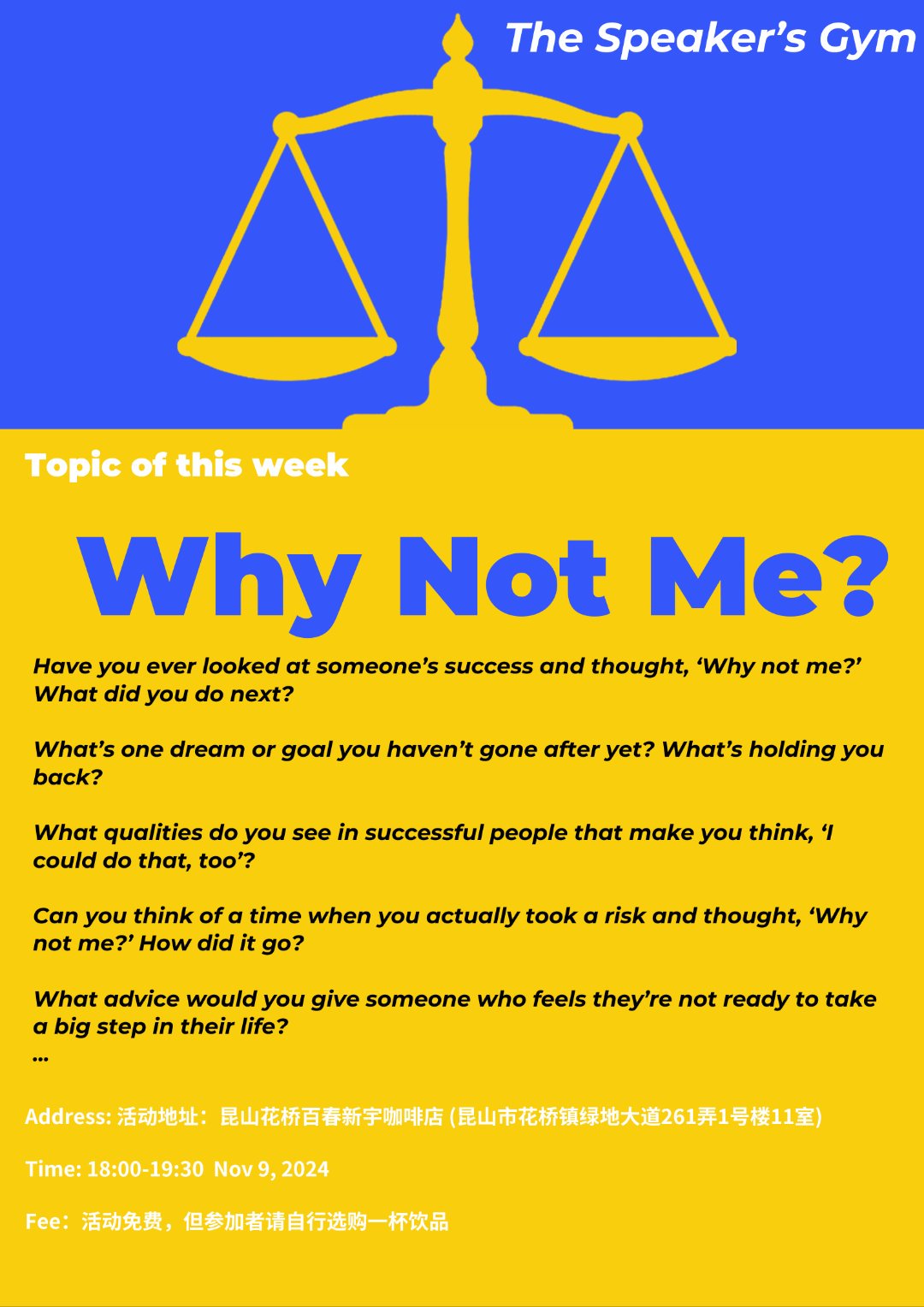

Image:

Dashboard view for tracking rebate accumulation and optimizing trades.

Conclusion

Understanding and effectively claiming rebates in perpetual futures is a vital strategy for both new and experienced traders. By combining knowledge of exchange rules, strategic trading methods, and practical management tools, traders can enhance profitability and optimize their trading performance. Start implementing these practical solutions today to fully leverage rebate opportunities in perpetual futures.

Engage with Us: Share your experiences in claiming rebates, discuss strategies with fellow traders, and spread knowledge by commenting and sharing this guide.