=====================================================

Perpetual futures have rapidly become a cornerstone of the crypto derivatives market, attracting retail traders, institutions, and algorithmic investors alike. For learners aspiring to master this complex but rewarding field, quant courses suitable for perpetual futures learners offer the structured knowledge and practical skills needed to succeed. These programs bridge the gap between theoretical quantitative finance and real-world perpetual futures trading, ensuring learners are equipped to design, test, and implement strategies effectively.

This article provides a comprehensive guide to quant courses tailored for perpetual futures learners, exploring the core curriculum, comparing methodologies, analyzing advantages and challenges, and offering practical recommendations.

Understanding the Relevance of Quant in Perpetual Futures

Why Quant Skills Are Critical

Quantitative analysis underpins nearly every professional approach to perpetual futures. Unlike traditional futures contracts, perpetual futures have no expiry date, and their pricing is linked to an underlying index through funding rates. This unique structure demands:

- Continuous risk management (to handle leverage and funding volatility)

- Real-time strategy optimization (to adapt to fast-changing market microstructures)

- Backtesting and simulation (to validate strategies across different market conditions)

Quant skills allow learners to model price dynamics, test algorithmic strategies, and evaluate performance metrics that matter in perpetual futures, such as funding impact, slippage, and liquidity constraints.

Bridging Finance and Technology

Modern perpetual futures trading blends financial mathematics with data science and programming. Courses that integrate topics such as stochastic calculus, machine learning, and API-driven execution give learners the dual edge of theory and technology.

Core Curriculum of Quant Courses for Perpetual Futures

1. Financial Derivatives Fundamentals

Learners are introduced to perpetual futures contract mechanics, margining systems, and funding rate models. Courses emphasize differences between perpetuals and standard futures, with case studies on crypto exchanges.

2. Quantitative Modeling

This includes stochastic processes (e.g., Brownian motion, jump diffusion), volatility modeling (GARCH, stochastic volatility models), and pricing techniques. For perpetuals, models often extend to include funding rate modeling and liquidity-adjusted VaR.

3. Programming & Data Handling

Python, R, and MATLAB remain the dominant languages. Learners practice:

- Market data scraping via APIs

- Building backtesting engines

- Implementing trading bots for perpetual futures

4. Risk Management & Portfolio Optimization

Perpetual futures amplify leverage risks. Courses teach hedging with spot and options, capital allocation models, and drawdown control techniques.

5. Strategy Development & Backtesting

Hands-on modules often culminate in projects where learners develop momentum, mean-reversion, or arbitrage strategies in perpetual futures, followed by stress testing under varying volatility regimes.

Comparing Two Common Approaches in Quant Courses

Method 1: Traditional Quantitative Finance Approach

- Description: Focused on rigorous mathematical foundations—probability theory, stochastic calculus, and econometrics.

- Strengths: Deep understanding of risk, robust in theory-driven modeling, prepares learners for institutional quant roles.

- Weaknesses: Slower to implement real trading systems; less emphasis on coding and execution speed.

Method 2: Applied Data Science & Algorithmic Trading Approach

- Description: Emphasizes Python-based coding, machine learning applications, and hands-on strategy implementation.

- Strengths: Practical and industry-aligned; directly applicable to perpetual futures algorithm development.

- Weaknesses: May sacrifice theoretical depth, leading to fragile models when market regimes shift.

Recommended Balance

The best courses integrate both methods: strong mathematical foundations combined with applied coding. This ensures learners can design robust strategies and implement them efficiently.

Latest Trends in Quant Courses for Perpetual Futures

- Machine Learning Integration: Courses increasingly cover reinforcement learning, neural networks for volatility prediction, and adaptive strategies.

- Exchange-Specific Modules: Tailored case studies on Binance, Bybit, and OKX perpetual futures.

- Hands-On Simulation Labs: Using real-time APIs and paper-trading accounts for live strategy testing.

- Quant Bootcamps and Online Programs: Flexible, short-term intensive courses that combine theory with coding projects.

How Quant Education Translates to Real Trading Success

To understand the impact of structured education, let’s look at two practical applications:

Funding Rate Arbitrage

- Learners analyze the funding cost structure and apply carry trade strategies across perpetual and spot markets.

- Risk is modeled using quant techniques, ensuring drawdowns are minimized.

Momentum with Volatility Adjustment

- By applying GARCH models, learners detect volatility clusters.

- Strategies dynamically adjust position sizing in perpetual futures based on predicted volatility.

Both strategies show how quant courses suitable for perpetual futures learners equip participants to move from theory to executable strategies.

Practical Guidance: Where to Learn

If you’re wondering where to learn quant techniques for perpetual futures, options include:

- University Programs: Advanced finance or data science courses with electives in derivatives.

- Specialized Online Courses: Platforms like Coursera, QuantInsti, or university-backed MOOCs.

- Workshops & Bootcamps: Short-term but highly practical, often led by industry professionals.

Visual Learning Support

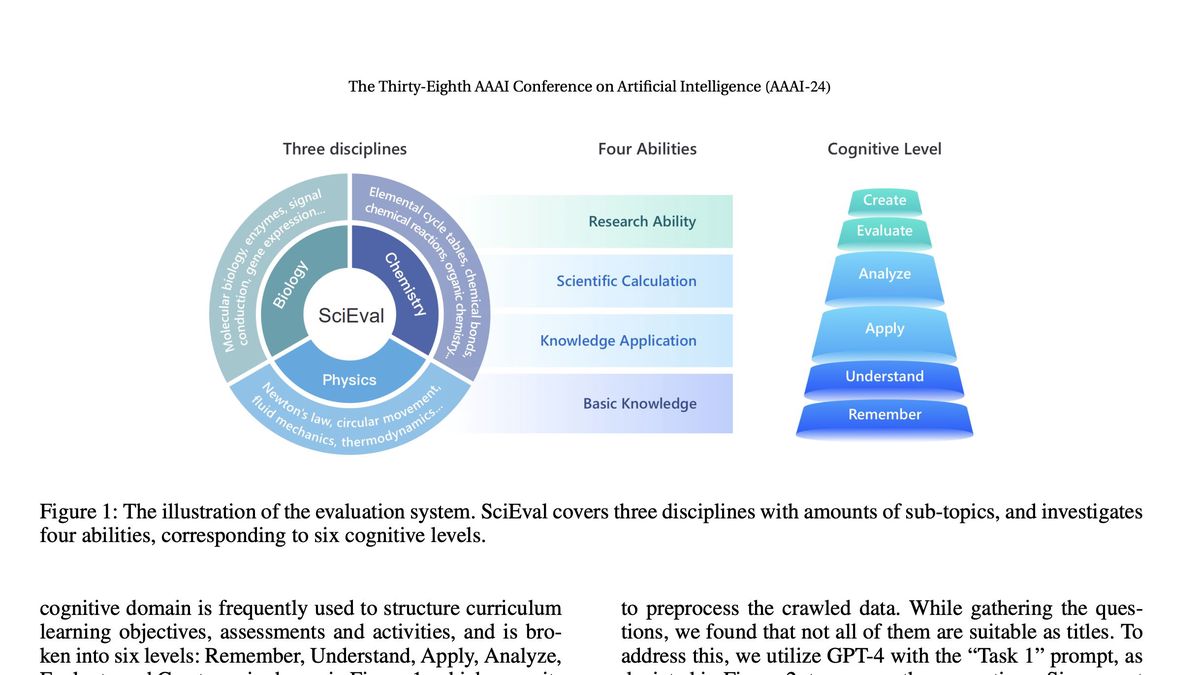

Below are some illustrative visuals to deepen understanding:

Core components of quant courses for perpetual futures

Comparison of traditional vs applied quant approaches

Backtesting workflow for perpetual futures strategies

FAQ: Common Questions from Perpetual Futures Learners

1. Are quant courses too advanced for beginners in perpetual futures?

Not necessarily. Many programs offer introductory tracks covering basics of derivatives and Python coding. Beginners can progress step by step, starting with core concepts before tackling advanced models.

2. How long does it take to become proficient in quant for perpetual futures?

With consistent study, learners can reach basic strategy-building competence in 6–12 months. Mastery, including risk management and machine learning techniques, typically takes 2–3 years of structured learning and practice.

3. Do I need a strong math background to succeed?

A solid foundation in statistics and probability is recommended. However, applied programs allow learners without a deep math background to focus on coding, backtesting, and practical applications, while gradually building quantitative rigor.

Encouraging Collaboration and Sharing

Quant education is best approached as a community-driven journey. By sharing insights, backtesting results, and course experiences, learners can collectively refine their approaches.

If you found this guide useful, consider sharing it with peers, joining online quant communities, or commenting below with your personal experiences. Together, we can make quant courses suitable for perpetual futures learners more accessible and impactful.

Would you like me to create a comparison table of top quant courses (online, bootcamp, and academic) to add credibility and help learners choose the best fit?