================================================================

In the dynamic world of cryptocurrency derivatives, quant insights for perpetual futures investors are becoming essential for building sustainable, profitable trading strategies. Perpetual futures—contracts without expiry dates—combine the leverage of futures with the flexibility of spot markets. However, their complexity demands systematic, data-driven approaches. Quantitative analysis (quant) provides exactly that—rigorous frameworks for modeling, risk control, and execution.

This article explores why quant is crucial for perpetual futures, compares two major quant approaches, and provides detailed strategies supported by personal experience and current market trends. By the end, investors will gain actionable insights on how to enhance their performance with quant-based techniques.

Understanding Perpetual Futures and the Role of Quant

Perpetual futures are a cornerstone of modern crypto trading, accounting for a significant share of exchange volumes. Their unique funding rate mechanism ensures contract prices align with spot markets, but this introduces additional complexities in pricing, risk, and strategy.

Quantitative methods allow investors to:

- Model funding rate cycles and exploit arbitrage opportunities.

- Optimize leverage and position sizing through systematic portfolio models.

- Backtest strategies with high-fidelity tick-level data.

- Automate execution to minimize slippage and latency costs.

As industry experts emphasize, why quant is essential for perpetual futures lies in its ability to manage both volatility and liquidity challenges with precision.

Key Quant Strategies for Perpetual Futures

Strategy 1: Statistical Arbitrage

Statistical arbitrage focuses on identifying short-term mispricings between perpetual futures and spot markets or across exchanges.

- How it works: By monitoring spreads and funding rates, algorithms exploit deviations from fair value.

- Pros: Low directional risk, high-frequency opportunities.

- Cons: Infrastructure-intensive, requires low-latency execution.

This strategy illustrates how quant improves perpetual futures trading, as it leverages real-time data analytics to extract consistent gains.

Strategy 2: Trend-Following with Quant Filters

Trend-following strategies enhanced with quant indicators (such as moving average crossovers, volatility filters, or machine learning signals) allow investors to ride sustained market moves while controlling drawdowns.

- How it works: Algorithms detect momentum shifts and adjust leverage dynamically.

- Pros: Effective during volatile bull/bear cycles.

- Cons: Vulnerable to false signals during range-bound markets.

By combining classical trend-following with advanced quant filters, traders can reduce whipsaws and improve long-term profitability.

Strategy Comparison

| Aspect | Statistical Arbitrage | Trend-Following with Quant Filters |

|---|---|---|

| Market Condition | Range-bound, mean-reverting | Trending markets |

| Risk Exposure | Minimal directional risk | Moderate directional risk |

| Execution Needs | High-frequency, low-latency | Medium frequency |

| Infrastructure | Expensive (colocation, data feeds) | Moderate (cloud platforms) |

| Best For | Quant teams, institutions | Advanced retail & funds |

Recommendation: For most perpetual futures investors, a hybrid approach—using trend-following as a core strategy and overlaying statistical arbitrage during sideways markets—delivers optimal balance.

Integrating Quant into Perpetual Futures Platforms

Investors can integrate quant strategies into perpetual futures platforms through:

- Python/R frameworks (Pandas, NumPy, Backtrader) for research and backtesting.

- Exchange APIs (Binance, Bybit, OKX) for real-time execution.

- Dedicated quant platforms for trading perpetual futures offering built-in strategy libraries and order execution systems.

Scalable infrastructure is critical, especially when running multiple strategies across exchanges.

Industry Trends Driving Quant in Perpetual Futures

- AI-Driven Forecasting: Neural networks are being used to predict funding rate changes and volatility spikes.

- Cross-Exchange Arbitrage Bots: Growing adoption of latency-optimized arbitrage systems.

- Decentralized Derivatives: Quants now extend strategies to on-chain perpetual futures platforms.

- Risk Management Automation: Position-sizing and liquidation prevention powered by quant frameworks.

Risk Management with Quant

Effective quant insights go beyond alpha generation—they enhance risk control.

- Leverage optimization: Dynamic adjustment based on volatility models.

- Funding rate hedging: Balancing long/short exposures to neutralize costs.

- Stop-loss automation: Preventing catastrophic drawdowns in volatile markets.

Practical experience shows that many retail traders underestimate how quant helps in perpetual futures risk management, especially when funding rates turn negative or liquidation risks rise rapidly.

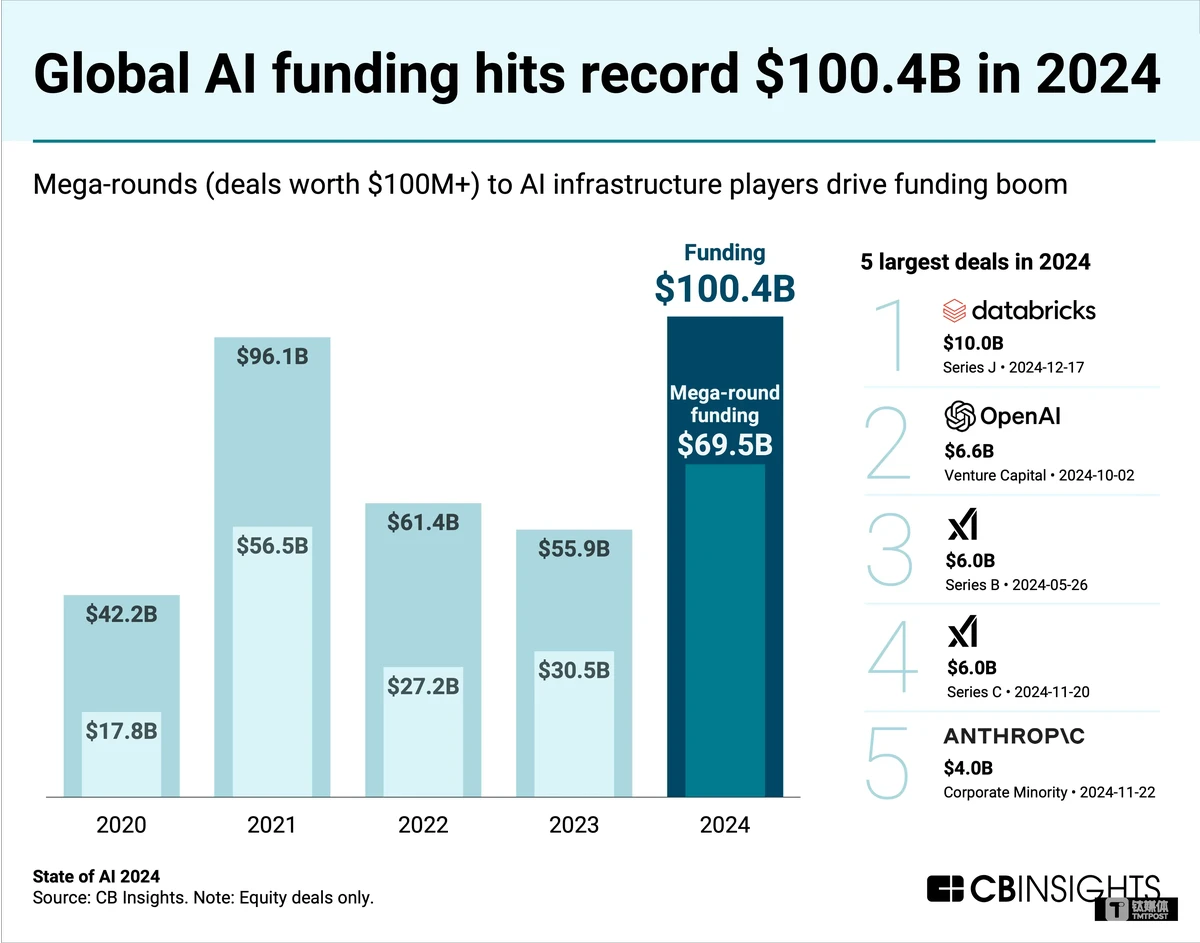

Example Visualization

Quant-driven models help perpetual futures investors optimize strategies with funding rate and volatility analysis.

Comparison of statistical arbitrage and quant-enhanced trend-following strategies in perpetual futures.

Common Challenges

- Data overload: Tick-level perpetual futures data can be overwhelming without proper processing.

- Execution risks: API limits and slippage reduce performance if not handled quantitatively.

- Funding unpredictability: Sudden funding rate spikes challenge static models.

- Overfitting risk: Quant models may fail in live markets if overly tuned to past data.

Frequently Asked Questions (FAQ)

1. How do I start using quant in perpetual futures trading?

Begin by learning the basics of quantitative analysis, including backtesting, risk modeling, and order execution. Many investors start with how to use quant in perpetual futures through Python tutorials, then scale into exchange API integration.

2. What quant tools are best for perpetual futures investors?

Popular tools include quant analysis tools for perpetual futures like Python (NumPy, Pandas, Scikit-learn), cloud data pipelines, and specialized trading frameworks (Backtrader, Zipline). For professional setups, dedicated quant platforms and co-located servers may be required.

3. Can quant strategies work for both beginners and professionals?

Yes. Quant strategies for novice perpetual futures traders often involve simple moving averages and volatility filters, while professionals use machine learning, statistical arbitrage, and multi-exchange execution. The key is to scale complexity with experience.

Conclusion

Quant insights for perpetual futures investors are no longer optional—they are a necessity in markets where leverage, volatility, and competition intersect. By combining systematic approaches such as statistical arbitrage and trend-following, investors can navigate uncertainty with confidence.

The best path forward is adopting a hybrid framework that integrates quant analysis, backtesting, and risk management while leveraging modern platforms and AI tools. Whether you are a beginner or a seasoned professional, quant provides the discipline and precision required to succeed in perpetual futures markets.

If you found this guide valuable, share it with your network, comment on your experiences with quant strategies, and help foster a smarter trading community.

Would you like me to also expand this guide into a step-by-step quant trading workflow (from data collection → backtesting → live execution) specifically tailored for perpetual futures? That could make it even more practical for both novice and advanced readers.