====================================================

Introduction

Perpetual futures have become one of the most popular instruments in cryptocurrency and derivatives trading. Unlike traditional futures, they don’t have an expiry date, making them both highly liquid and continuously risky. Effective risk management is therefore crucial, and this is where quantitative (quant) methods come into play.

This article explores how quant helps in perpetual futures risk management, providing insights into the tools, strategies, and frameworks that traders and institutions can adopt. By combining financial mathematics, statistical modeling, and algorithmic execution, quant strategies can significantly reduce exposure to volatility while improving capital efficiency.

We will examine different quant approaches, compare their pros and cons, and provide actionable insights for traders and investors.

What is Perpetual Futures Risk Management?

Unique Characteristics of Perpetual Futures

- No expiry date: Contracts can be held indefinitely.

- Funding rate mechanism: Keeps perpetual prices in line with spot markets.

- High leverage availability: Traders often operate with 50x or more, amplifying both gains and losses.

Risk Management Challenges

- Leverage Risk: Sudden liquidation due to small market moves.

- Funding Rate Fluctuations: Costs or gains depending on market sentiment.

- Liquidity Risk: Especially in extreme market conditions.

- Volatility Risk: Crypto markets are inherently more volatile than traditional assets.

How Quant Helps in Risk Management

Quantitative techniques provide structure and precision to risk management. Instead of relying on intuition, quant frameworks rely on statistical models, backtesting, and automated execution to minimize risk.

Core Quantitative Methods in Perpetual Futures Risk Management

1. Volatility Forecasting Models

Quant strategies often use GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models, implied volatility analysis, or machine learning models to predict short-term volatility.

- Pros: Provides better margin allocation, reduces unexpected liquidation.

- Cons: Can fail during black swan events when volatility spikes unpredictably.

2. Value at Risk (VaR) and Expected Shortfall

VaR models help estimate the maximum loss a portfolio might face with a certain confidence level. For example, a 95% daily VaR of \(10,000 means losses should not exceed \)10,000 on 95% of trading days.

- Pros: Clear, interpretable risk measure.

- Cons: Assumes normal market conditions, underestimates extreme tail risks.

3. Dynamic Hedging with Quant Models

Quantitative hedging involves using correlated instruments (e.g., BTC spot vs. BTC perpetuals or ETH perpetuals vs. ETH options) to neutralize exposure.

- Pros: Reduces directional exposure, protects against funding rate costs.

- Cons: Requires continuous rebalancing, adding transaction costs.

4. Quant Algorithms for Position Sizing

Algorithms based on Kelly Criterion, mean-variance optimization, or reinforcement learning adjust trade sizes according to risk appetite and volatility forecasts.

- Pros: Optimizes long-term growth, prevents overleveraging.

- Cons: Sensitive to inaccurate input assumptions.

5. Funding Rate Arbitrage

Quants build models to exploit inefficiencies in funding rates by going long in one market and short in another.

- Pros: Generates relatively stable returns.

- Cons: Exposed to liquidity crunches and exchange reliability risks.

Comparing Two Key Quant Strategies

Strategy A: Quantitative Volatility Control

- Uses machine learning and GARCH to adjust leverage dynamically.

- Advantage: Protects against sudden liquidation.

- Disadvantage: May reduce profits in stable conditions by being overly conservative.

Strategy B: Statistical Arbitrage with Funding Rate Exploitation

- Balances positions across exchanges to capture funding rate spreads.

- Advantage: Low correlation with market direction.

- Disadvantage: Requires strong infrastructure, susceptible to exchange outages.

Best Approach Recommendation: For most professional traders, a hybrid quant model that combines volatility control with funding rate arbitrage provides a balanced risk-reward framework.

Practical Examples from Industry

- Crypto Hedge Funds: Firms deploy quant algorithms for perpetual futures trading to maintain neutral market exposure while generating consistent yield from funding rate differentials.

- Retail Traders Using Quant Tools: Even smaller traders can apply simplified versions of quant models by using automated risk calculators and volatility-adjusted stop-loss systems.

- Institutional Players: Investment firms often implement complex frameworks like Monte Carlo simulations to stress test perpetual futures portfolios.

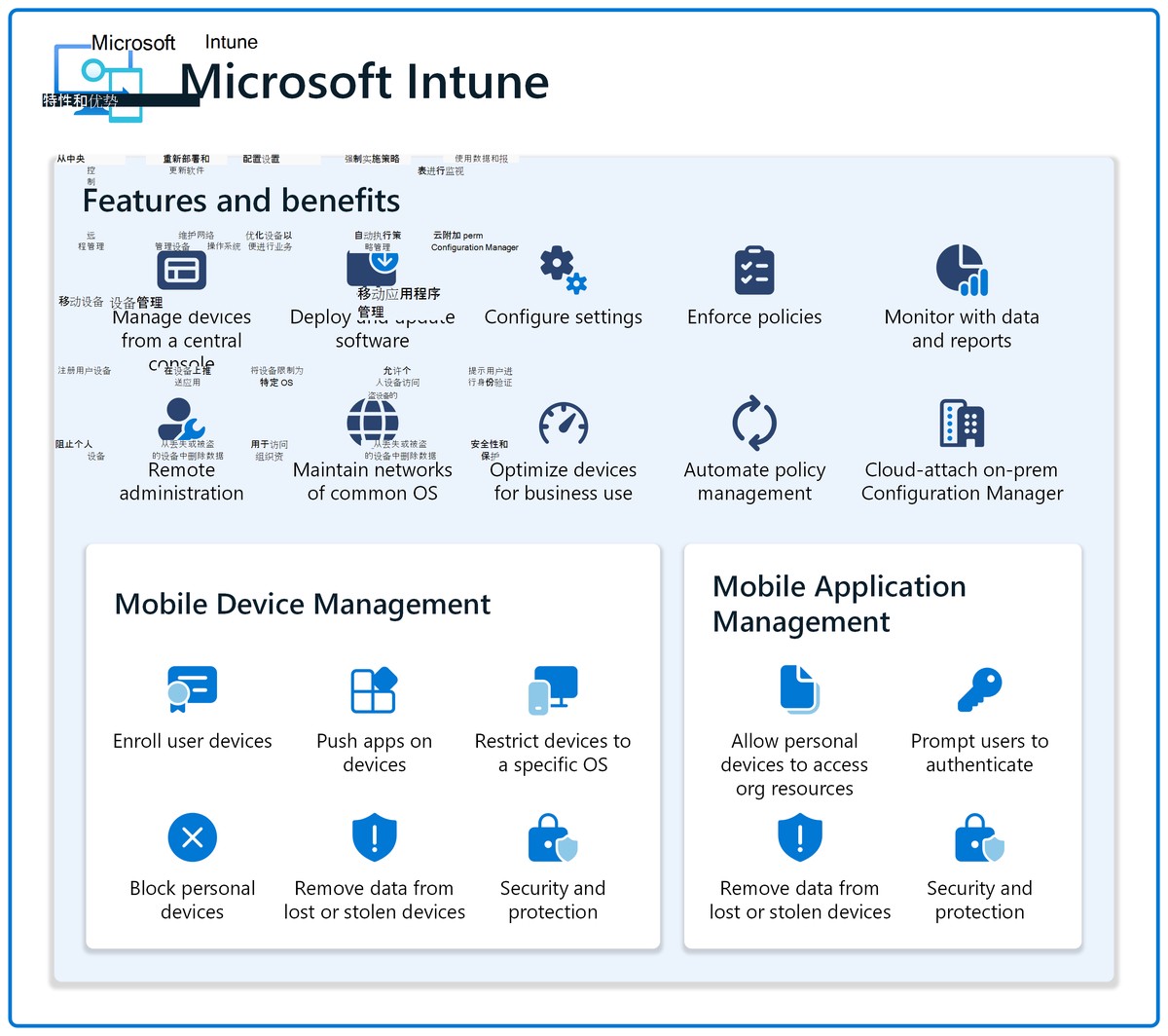

Visual Insight

Quantitative Risk Management in Perpetual Futures

Where Quant Fits Best in Perpetual Futures

Quantitative frameworks are increasingly vital in derivatives trading. For further exploration, you may want to read about how quant improves perpetual futures trading and where to apply quant strategies in perpetual futures. Both resources expand on practical ways quants optimize leverage, volatility, and execution in real-world environments.

FAQ: How Quant Helps in Perpetual Futures Risk Management

1. Can retail traders use quant methods in perpetual futures risk management?

Yes, retail traders can adopt simplified quant tools such as volatility-based position sizing or automated risk calculators. While they may not have access to advanced infrastructure, retail quants can still improve discipline and reduce emotional trading risks.

2. Are quant models always reliable in crypto perpetuals?

Not always. Quant models work well under typical market conditions but can break down during extreme volatility events. This is why quants often combine models with stress testing and scenario analysis to account for tail risks.

3. How do quant strategies reduce liquidation risk in high leverage trading?

Quants use volatility forecasting and dynamic margin allocation to automatically adjust leverage. By lowering position size during periods of high volatility, they reduce the probability of forced liquidation, which is the biggest risk in perpetual futures trading.

Conclusion

Quantitative methods provide the backbone of perpetual futures risk management, offering traders structured approaches to control volatility, optimize leverage, and exploit inefficiencies. By using models such as volatility forecasting, VaR, and arbitrage strategies, traders can mitigate the inherent risks of perpetual futures.

The future of trading lies in quant integration. Whether you are a retail trader or a professional hedge fund manager, adopting quant frameworks can mean the difference between sustainable growth and catastrophic losses.

💡 What do you think? Have you used quant strategies in managing perpetual futures risk? Share your experience in the comments and pass this article along to colleagues who want to strengthen their risk management practices.