==============================================

In the rapidly evolving digital asset ecosystem, perpetual futures have become one of the most actively traded derivatives. For analysts and traders who want to gain an edge, leveraging quant platforms for perpetual futures analysts is no longer optional—it is a necessity. Quantitative methods empower professionals to analyze large datasets, model interest rate fluctuations, and build strategies that outperform discretionary trading. This article provides a deep dive into the best practices, tools, and strategies for perpetual futures analysts seeking to optimize performance through quant platforms.

Why Quant Platforms Matter for Perpetual Futures Analysts

Perpetual futures are complex because their pricing is influenced by multiple factors: spot prices, funding rates, liquidity, volatility, and cross-exchange flows. A quant-driven approach allows analysts to systematize these variables into actionable models.

Key advantages of using quant platforms include:

- Data automation: Processing tick-level and funding rate data in real-time.

- Backtesting environments: Running strategies on historical perpetual futures datasets.

- Risk-adjusted execution: Implementing precise controls over leverage and drawdowns.

- Cross-market comparisons: Evaluating strategies across multiple exchanges with ease.

In practice, how quant improves perpetual futures trading lies in its ability to turn unpredictable markets into structured opportunities.

Core Functions of Quant Platforms for Perpetual Futures Analysts

1. Data Collection and Cleaning

Quant platforms specialize in ingesting raw market data from APIs and transforming it into structured datasets. For perpetual futures, this often means:

- Funding rate histories.

- Spot-to-perpetual spreads.

- Order book depth and liquidity profiles.

- Volatility indices derived from implied futures pricing.

This structured data forms the backbone for modeling and execution.

2. Strategy Backtesting

Backtesting is one of the most critical tools for perpetual futures analysts. It allows them to test hypotheses under various market conditions before risking capital.

- Event-driven backtesting: Testing strategy performance during volatile events (e.g., Fed announcements).

- Regime analysis: Evaluating strategies across bullish, bearish, and sideways markets.

- Parameter optimization: Identifying which leverage levels, stop-loss ranges, or entry signals are optimal.

A robust quant platform reduces survivorship bias and curve-fitting, giving analysts confidence in live deployment.

3. Execution and Risk Management

Quant platforms go beyond analysis—they provide infrastructure for execution. Risk modules calculate leverage, exposure, and Value-at-Risk (VaR) in real time, ensuring capital efficiency.

Practical tools include:

- Execution algorithms: VWAP, TWAP, and liquidity-seeking algorithms for perpetual futures.

- Automated hedging: Bots that dynamically reduce funding exposure.

- Cross-exchange arbitrage frameworks: Capturing spreads between perpetual contracts on Binance, Bybit, or OKX.

This aligns with how quant helps in perpetual futures risk management, giving analysts greater control over volatility.

Two Popular Quant Approaches for Perpetual Futures

Quant platforms support multiple strategies. Below we compare two of the most effective:

1. Statistical Arbitrage

Statistical arbitrage relies on mean reversion principles. Analysts identify mispricings between spot and perpetual futures or across exchanges.

Pros:

- High-frequency profitability potential.

- Minimal directional exposure.

- Works well in stable liquidity conditions.

Cons:

- Requires advanced infrastructure and low latency.

- Margins can shrink as more firms adopt similar models.

2. Machine Learning-Driven Forecasting

Machine learning (ML) techniques help forecast price movements, funding rates, or volatility clusters.

Pros:

- Can capture non-linear relationships.

- Adapts well to changing regimes.

- Useful for predictive modeling of funding rate direction.

Cons:

- Requires vast datasets and GPU resources.

- Risk of overfitting without strong validation frameworks.

Comparison and Best Use Case

| Feature | Statistical Arbitrage | Machine Learning Forecasting |

|---|---|---|

| Speed | Requires ultra-low latency | Tolerates higher latency |

| Complexity | Medium | High (requires ML expertise) |

| Capital Needs | Moderate | Higher, due to computing and margin requirements |

| Best Use Case | Cross-exchange spreads, intraday trading | Funding rate prediction, trend models |

Recommendation: For most perpetual futures analysts starting out, statistical arbitrage provides quicker returns and simpler infrastructure demands. Over time, adding machine learning forecasting offers scalability and innovation.

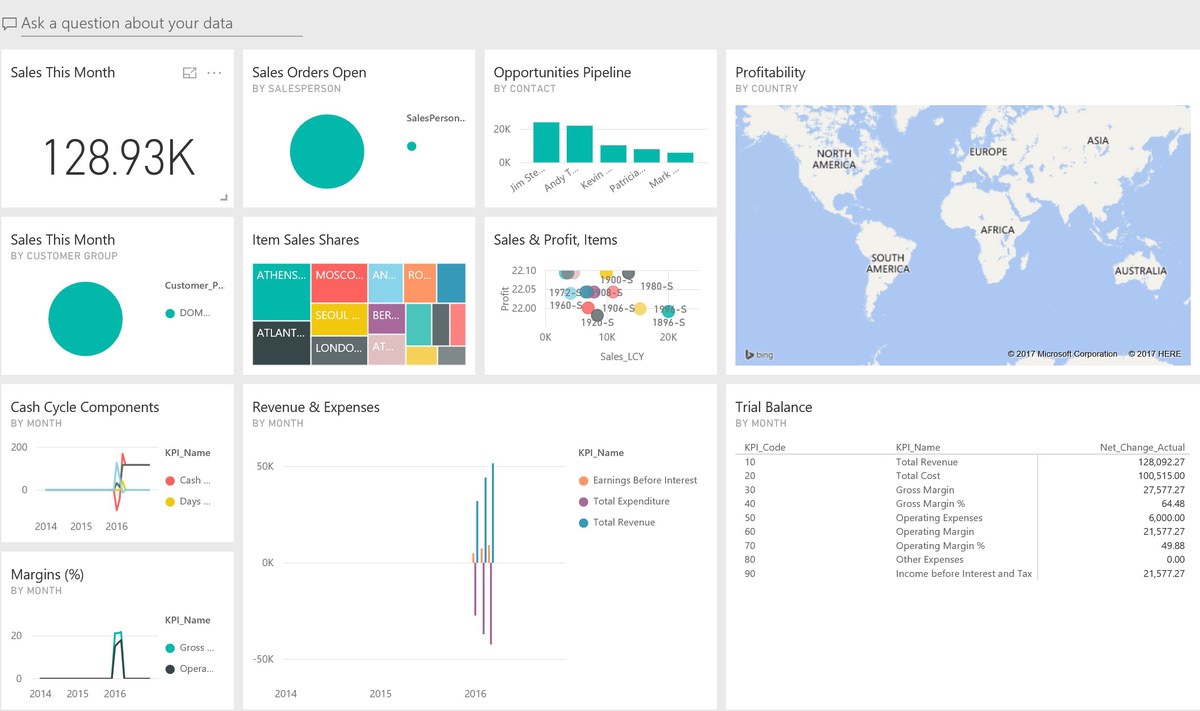

Quant-driven perpetual futures dashboard with backtesting and risk modules.

Practical Experience: Lessons from Quant Trading Desks

Having worked with perpetual futures portfolios, I’ve learned that:

- Data granularity matters: Tick-level order book data often reveals hidden arbitrage opportunities.

- Execution latency is decisive: Even the best strategy fails if order routing is slow.

- Discipline beats prediction: Risk management through quant controls prevents overexposure during market shocks.

These experiences highlight why quant platforms are indispensable for analysts.

Key Features to Look for in Quant Platforms

When selecting quant platforms for perpetual futures, analysts should prioritize:

- API Connectivity: Low-latency access to Binance, Bybit, Deribit, and OKX.

- Scalability: Ability to handle tick-level datasets and run simulations across years of data.

- Customizability: Support for Python, R, or C++ frameworks to tailor strategies.

- Visualization Tools: Graphical dashboards to interpret funding rate behaviors.

- Security: Reliable custody integrations and strict access controls.

The best quant platforms also integrate quant backtesting methods in perpetual futures, enabling analysts to validate strategies under diverse scenarios.

Integration with Risk Models and DeFi

Modern perpetual futures quant platforms are expanding to integrate with decentralized finance (DeFi). Analysts can borrow, lend, or collateralize assets directly within quant workflows. This creates additional hedging options while enhancing transparency in funding rate modeling.

Backtesting models to predict funding rate shifts in perpetual futures.

Emerging Trends in Quant Platforms for Perpetual Futures

- AI-driven execution engines that dynamically route orders for cost efficiency.

- Blockchain-native datasets powering transparent interest rate calculations.

- Hybrid cloud architectures enabling global teams to collaborate on strategy research.

These innovations underline why quant trading solutions for perpetual futures are at the frontier of financial technology.

FAQ: Quant Platforms for Perpetual Futures Analysts

1. What are the best quant platforms currently available for perpetual futures analysts?

Top options include institutional-grade solutions like Kx, QuantConnect, and proprietary in-house systems. Retail analysts often rely on Python-based frameworks integrated with exchange APIs. The choice depends on budget, scale, and required latency.

2. How do quant platforms reduce funding rate risk?

Quant platforms monitor funding rates in real time and automate hedging actions, such as opening offsetting positions or reallocating exposure. By applying quant analysis tools for perpetual futures, analysts minimize costs while preserving capital efficiency.

3. Can beginners use quant platforms effectively?

Yes, but beginners should start small. Platforms offering educational modules—such as tutorials on how to use quant in perpetual futures—help novice analysts develop skills without overexposing capital. Over time, they can progress to advanced backtesting and machine learning.

Conclusion: Building Smarter Futures with Quant Platforms

Quant platforms have transformed the way perpetual futures are analyzed and traded. By enabling sophisticated data analysis, robust backtesting, and automated execution, these platforms empower analysts to outperform discretionary methods. Whether through statistical arbitrage or machine learning forecasting, the ability to manage funding rate risk, optimize strategies, and scale execution is what defines success in this competitive market.

As perpetual futures grow in volume and complexity, analysts who master quant platforms will not only survive but thrive.

Quant workflow visualization for perpetual futures analysts: from data collection to execution.

💬 Have you explored quant platforms for perpetual futures analysts? Share your experience below and forward this article to your trading network. Let’s build a community of analysts advancing the future of quantitative crypto trading.