======================================================

Introduction

In the fast-paced world of perpetual futures, quant tools for professional perpetual futures traders have become indispensable. Traders dealing with perpetual contracts require high precision, robust analytics, and advanced automation to stay competitive. With the rise of algorithmic strategies, real-time analytics, and machine learning integration, quant tools now allow professionals to process vast amounts of market data, manage risks effectively, and optimize execution strategies.

This article provides a comprehensive review of the best quant tools, strategies, and methods for perpetual futures traders. We’ll compare multiple approaches, highlight their strengths and weaknesses, and recommend best practices for different trading styles.

Understanding Quant Tools in Perpetual Futures

What Are Quant Tools?

Quantitative (quant) tools are advanced software and frameworks that leverage mathematics, statistics, and computational models to analyze market dynamics. They allow traders to test, validate, and execute strategies with measurable precision.

In perpetual futures trading, quant tools play a crucial role in:

- Market microstructure analysis

- Funding rate predictions

- Volatility modeling

- Execution optimization

- Risk management

Why Perpetual Futures Require Specialized Quant Tools

Unlike traditional futures, perpetual futures contracts have no expiry date and rely on funding rate mechanisms to maintain their peg to the spot market. This unique structure introduces additional complexities that require advanced quant frameworks for accurate modeling.

Professional traders need tools that can process real-time tick data, calculate optimal position sizing, and simulate risk scenarios under different funding environments.

Core Categories of Quant Tools for Perpetual Futures

1. Data Collection and Processing Platforms

Quant strategies rely on clean, accurate, and real-time data. Platforms like Kx Systems, QuantConnect, and custom Python pipelines are commonly used.

Strengths:

- High-frequency data processing

- Integration with multiple exchanges

- Flexible data transformation

Weaknesses:

- High infrastructure cost

- Steep learning curve

2. Backtesting and Simulation Engines

Backtesting allows traders to test strategies against historical data to ensure profitability and robustness. Popular engines include Backtrader, QuantLib, and proprietary C++ engines.

Strengths:

- Realistic performance metrics

- Stress testing under extreme volatility

- Helps avoid overfitting

Weaknesses:

- Past data doesn’t always reflect future behavior

- Requires significant computational resources

3. Execution Algorithms and Smart Order Routing

Execution quality is crucial in perpetual futures trading due to liquidity fragmentation across multiple exchanges. Quant execution tools provide VWAP, TWAP, and liquidity-seeking algorithms.

Strengths:

- Reduces slippage

- Automates execution across venues

- Improves scalability for large portfolios

Weaknesses:

- Complexity in customization

- High reliance on exchange APIs

4. Risk Management and Portfolio Optimization Tools

Risk is magnified in perpetual futures due to leverage. Quant tools like Portfolio Visualizer, RiskMetrics, and in-house VAR models are widely used.

Strengths:

- Real-time margin monitoring

- Dynamic leverage adjustments

- Hedging optimization

Weaknesses:

- Can give false confidence if assumptions are flawed

- Requires continuous calibration

5. Machine Learning and AI Quant Solutions

AI-driven quant tools are increasingly being adopted by professional traders. Tools like TensorFlow, PyTorch, and H2O.ai allow predictive modeling of volatility, funding rates, and liquidity shocks.

Strengths:

- Adaptive learning

- Can detect non-linear market patterns

- Improves predictive accuracy

Weaknesses:

- Black-box nature can reduce interpretability

- Requires large, clean datasets

Comparing Two Key Quant Strategies for Perpetual Futures

Strategy 1: Statistical Arbitrage with Funding Rate Exploitation

This method involves exploiting mispricing between the spot and perpetual futures through funding rate discrepancies.

- Pros: High profitability during volatile funding cycles; strong risk-adjusted returns.

- Cons: Requires significant capital and advanced execution infrastructure.

Strategy 2: Machine Learning-Based Predictive Models

These strategies use deep learning to forecast short-term price movements, volatility, and order book imbalances.

- Pros: Adaptive, scalable, and capable of handling complex datasets.

- Cons: High risk of overfitting; requires expertise in ML model training and validation.

Best Approach Recommendation:

For professional perpetual futures traders, combining statistical arbitrage (stable returns) with machine learning predictive signals (market adaptability) offers the most balanced and profitable strategy.

Where Quant Tools Fit into Perpetual Futures Trading

Professional traders must understand not only how to use quant in perpetual futures but also where to apply quant strategies in perpetual futures for maximum effectiveness. Some key areas include:

- Funding arbitrage desks optimizing rates across exchanges

- Market-making algorithms managing bid-ask spreads

- Portfolio managers seeking balanced leverage allocation

- Hedge funds using ML quant engines for alpha generation

By integrating quant tools strategically, traders can enhance both execution efficiency and risk-adjusted returns.

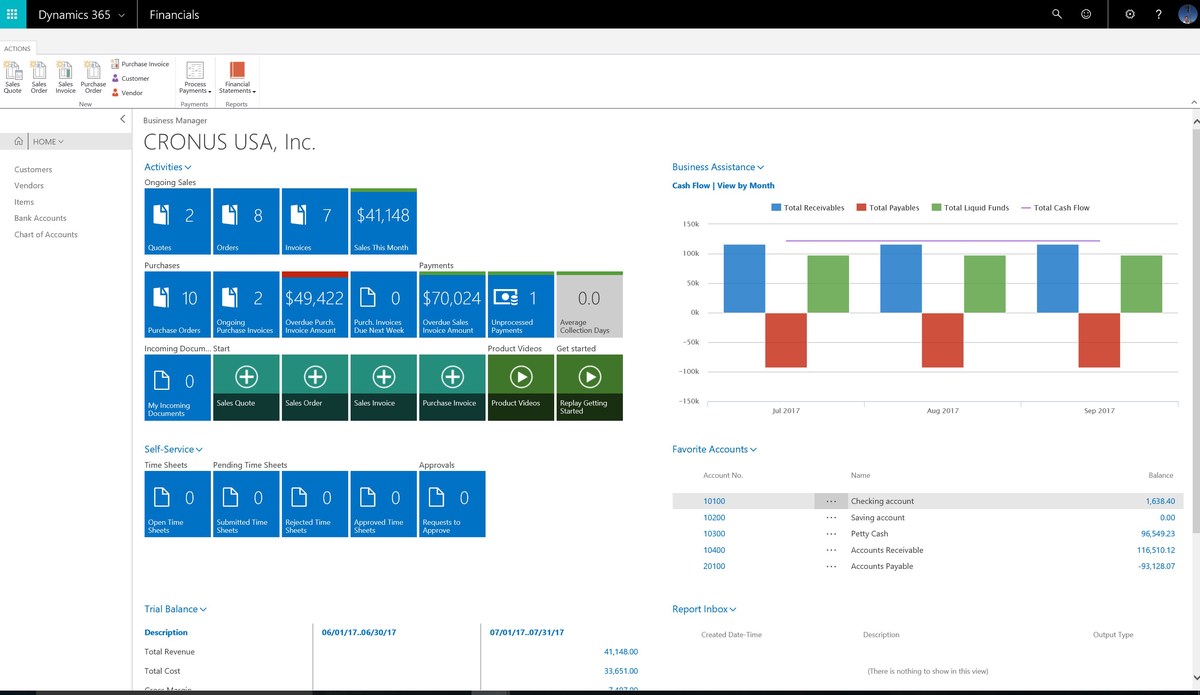

Visual Example: Quant Workflow for Perpetual Futures

Quant workflow showing data collection, modeling, execution, and risk monitoring stages.

FAQ Section

1. What are the best quant tools for professional perpetual futures traders?

Some of the most effective include Backtrader for backtesting, Kx for data pipelines, custom Python/C++ quant engines for execution, and TensorFlow for machine learning predictions. The best choice depends on whether you prioritize execution, risk management, or predictive modeling.

2. How do quant strategies improve perpetual futures trading performance?

Quant strategies bring systematic discipline to trading. They reduce emotional decision-making, provide real-time execution optimization, and allow traders to model funding rates, volatility, and liquidity risks effectively.

3. Can retail traders use professional quant tools for perpetual futures?

Yes, but with limitations. While professional tools require infrastructure and capital, retail traders can still access open-source platforms like QuantConnect, Backtrader, and TensorFlow to replicate parts of institutional strategies.

Conclusion

Quant tools are no longer optional—they are mandatory for professional perpetual futures traders seeking consistent profitability. From data pipelines and backtesting engines to AI-driven prediction systems, these tools allow traders to execute with precision, manage leverage risks, and adapt to rapidly changing market conditions.

By blending statistical arbitrage models with machine learning predictive strategies, traders can achieve a balance between stability and adaptability.

If you found this guide insightful, share it with fellow traders and comment with your favorite quant tools. Let’s build a knowledge-driven trading community together.