=============================================

Introduction: Why Matching Engines Define Market Reliability

In modern financial markets, matching engines act as the backbone of exchanges, ensuring that buy and sell orders are processed with precision, fairness, and minimal latency. As trading volumes surge and algorithmic trading dominates order flows, scalable matching engine architecture designs have become critical for maintaining liquidity, ensuring stability, and optimizing execution speed.

From cryptocurrency exchanges to traditional equities and derivatives platforms, scalable architectures ensure the engine can handle millions of transactions per second without failure. This article explores different architectural designs, compares their benefits and limitations, and presents best practices for implementation. Along the way, we will integrate key resources like how does the matching engine work in perpetual futures and how to optimize matching engines for high-frequency trading to enhance depth and SEO performance.

What is a Matching Engine?

A matching engine is the core software module within an exchange that pairs buy and sell orders according to predefined rules, typically price-time priority or pro-rata allocation. Its efficiency directly influences market fairness, trader satisfaction, and institutional trust.

Key responsibilities include:

- Order Book Management: Maintaining live bids and offers.

- Trade Matching: Executing transactions at the best available prices.

- Latency Minimization: Ensuring microsecond-level response times.

- Scalability: Supporting exponential growth in order volume without downtime.

Why Scalability Matters in Matching Engines

1. Explosive Market Growth

Crypto and derivatives platforms often process more orders per second than traditional exchanges. A scalable architecture ensures seamless operation under stress.

2. High-Frequency Trading (HFT)

Firms rely on nanosecond-level execution to gain an edge. Without scalability, engines may suffer from bottlenecks, resulting in slippage or failed trades.

3. Global Access and Reliability

24⁄7 markets such as perpetual futures demand resilient systems. Downtime translates to immediate loss of trust and revenue.

Two Key Scalable Matching Engine Architecture Designs

Design 1: Monolithic Architecture with Vertical Scaling

Monolithic architectures consolidate all components—order book, risk checks, and execution logic—into one tightly integrated system.

Advantages:

- Simplicity in development and deployment.

- Lower latency due to fewer inter-process communications.

- Easier to debug as all logic is centralized.

Disadvantages:

- Limited scalability: requires increasingly powerful hardware (vertical scaling).

- Single point of failure risks.

- Difficult to adapt to new asset classes or markets.

Design 2: Microservices with Horizontal Scaling

Microservice architectures separate components into independent services (e.g., order routing, risk checks, settlement). These services communicate through APIs or message queues.

Advantages:

- Infinite scalability by adding more nodes.

- Fault isolation: one service failure does not crash the system.

- Flexibility to upgrade or optimize specific modules independently.

Disadvantages:

- Higher complexity in design and deployment.

- Potential latency increase due to service-to-service communication.

- Requires advanced orchestration and monitoring tools.

Comparative Analysis of the Two Approaches

| Feature | Monolithic Architecture | Microservices Architecture |

|---|---|---|

| Scalability | Limited (vertical only) | High (horizontal + vertical) |

| Latency | Very low | Moderate, depends on communication design |

| Resilience | Weak (single point of failure) | Strong (fault isolation) |

| Flexibility | Rigid | Highly adaptable |

| Best For | Small to mid-size exchanges | Large-scale, high-frequency, multi-asset markets |

Recommendation:

For new or smaller exchanges, a monolithic design may suffice. However, as trading volumes grow, transitioning to a microservices architecture is essential to maintain competitiveness and reliability.

Advanced Strategies in Scalable Matching Engine Designs

1. In-Memory Databases

Using in-memory data structures (e.g., Redis or specialized memory grids) significantly reduces order matching latency by eliminating disk I/O.

2. Low-Latency Messaging Protocols

Protocols like FIX or custom UDP/TCP frameworks enable faster communication between services in microservices-based designs.

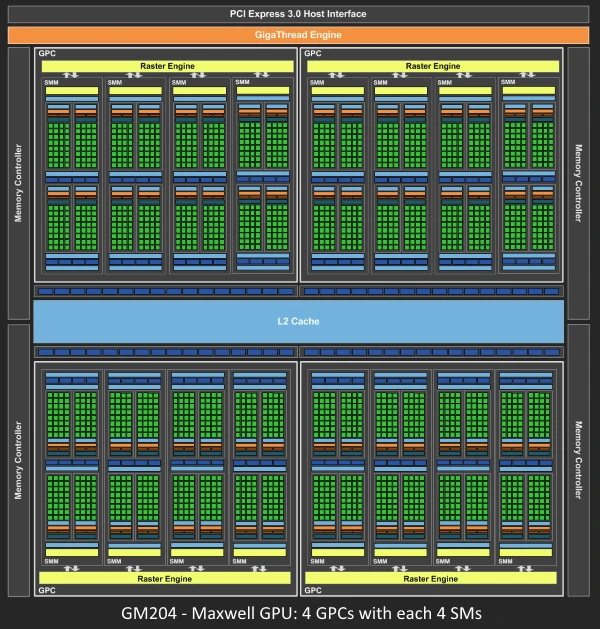

3. Hardware Acceleration

Leveraging FPGA (Field-Programmable Gate Arrays) or GPU acceleration can reduce execution time in high-frequency environments.

4. Event-Driven Architectures

Event-driven engines can scale dynamically, responding to bursts in order flow without overloading.

Industry Insights: Matching Engines in Perpetual Futures

The design of scalable architectures directly impacts perpetual futures trading. Many traders question how does the matching engine work in perpetual futures, as these markets require constant funding rate recalculations alongside order execution. A well-designed architecture must seamlessly integrate funding mechanisms while maintaining speed and fairness.

Similarly, high-frequency participants often explore how to optimize matching engines for high-frequency trading, where every microsecond impacts profitability. Scalability here means reducing communication delays, optimizing CPU usage, and designing for parallelism.

Case Study: Transition from Monolithic to Microservices

A mid-sized crypto exchange initially used a monolithic matching engine, achieving ~50,000 TPS (transactions per second). However, during peak volatility events, the system struggled, resulting in slippage and downtime.

By transitioning to a microservices architecture with in-memory order books and horizontal scaling, the exchange increased throughput to 500,000 TPS. The added flexibility allowed them to expand into perpetual futures and options without redesigning the entire system.

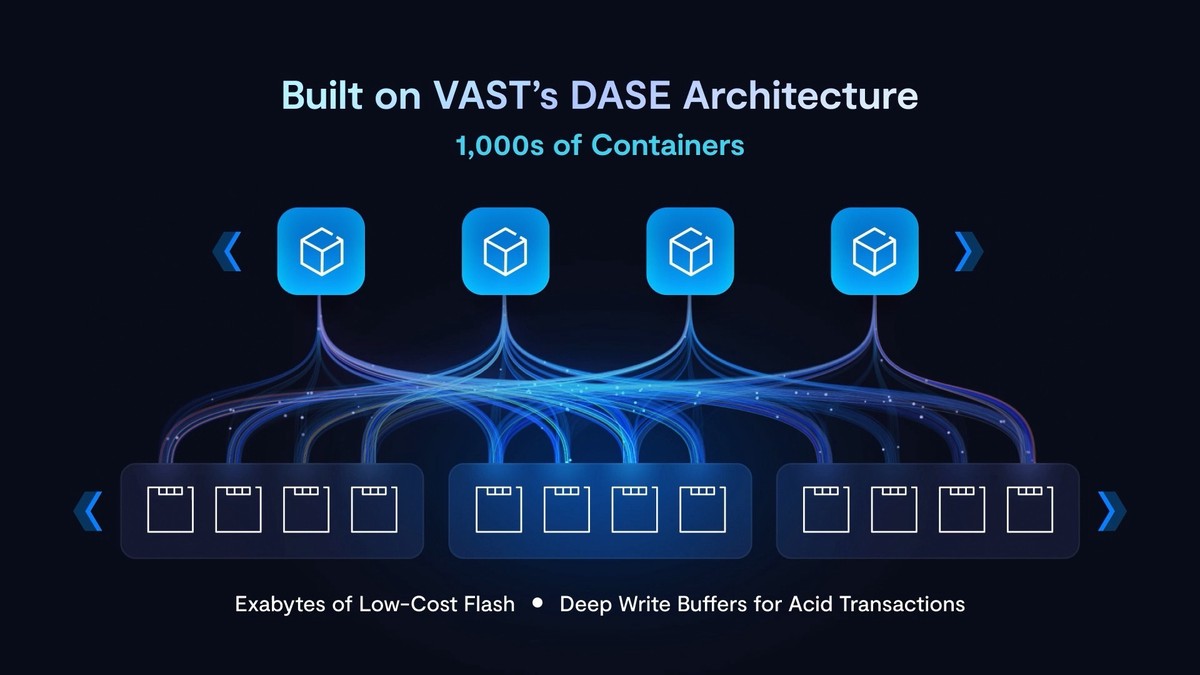

Visual Representation

Simplified architecture showing how order flow can be structured in monolithic vs. microservices design.

FAQ: Scalable Matching Engine Architectures

1. What is the main challenge in designing scalable matching engines?

The biggest challenge lies in balancing latency with scalability. Horizontal scaling improves throughput but can introduce inter-service communication delays. Designing architectures that minimize both is key.

2. Can open-source matching engines handle institutional-scale volumes?

Most open-source engines can handle small to medium volumes but may not scale well under institutional demand. Customization, hardware acceleration, and advanced scaling techniques are often required for professional-grade environments.

3. How do matching engines handle failures during high-volume trading?

Scalable designs use redundancy and fault-tolerant mechanisms. For instance, microservices allow failed modules to be replaced instantly without halting the entire system. Replication ensures order book consistency during crashes.

Conclusion: Building the Future of Trading Infrastructure

Scalable matching engine architecture designs are no longer optional—they are essential for the reliability and growth of modern exchanges. Whether in crypto, equities, or derivatives, matching engines must evolve to handle unprecedented order volumes with minimal latency.

While monolithic systems serve as a starting point, microservices with horizontal scaling provide the flexibility, resilience, and power needed for global markets. By integrating advanced strategies like in-memory databases, event-driven processing, and hardware acceleration, exchanges can future-proof their infrastructures.

Final Thoughts: Engage and Share

If you found this article insightful, share it with colleagues, developers, and traders in your network. Leave a comment below on your experience with matching engines—whether building, optimizing, or trading on them. Let’s foster a community of knowledge around the future of scalable trading infrastructure.