===============================================

Introduction

Scalping has gained significant popularity among retail crypto investors as a short-term trading method that seeks to profit from small price fluctuations. Unlike swing trading or long-term holding, scalping is highly intensive, requiring fast execution, sharp analysis, and effective risk management. The scalping advantages for retail crypto investors extend beyond just quick profits; it provides unique opportunities to manage risk exposure, take advantage of market volatility, and build trading discipline.

In this article, we will explore in depth the benefits of scalping for retail traders, compare two popular scalping methods, examine industry trends, and integrate personal experiences. We will also highlight FAQs to help clarify doubts for beginners and experienced investors.

Understanding Scalping in the Crypto Market

What Is Scalping?

Scalping is a trading strategy where investors execute numerous trades within short timeframes—sometimes seconds or minutes—to profit from small price movements. The key principle is high frequency with controlled risk.

Retail crypto investors benefit from scalping because cryptocurrencies often show greater volatility than traditional assets. Small swings of 0.2%–0.5% can happen within minutes, which is ideal for scalpers.

Why Retail Investors Prefer Scalping

- Lower Exposure to Overnight Risk: Unlike holding positions for days, scalpers typically close trades quickly, avoiding sudden market shocks.

- Consistent Opportunities: Even in sideways markets, small fluctuations offer profitable setups.

- Capital Efficiency: Scalping can be executed with smaller accounts using leverage, though proper risk management is crucial.

Key Scalping Advantages for Retail Crypto Investors

1. Fast Return on Capital

Retail traders often face liquidity constraints. Scalping allows them to recycle capital quickly without waiting for long-term trends to materialize.

2. Flexibility Across Market Conditions

Whether markets are bullish, bearish, or consolidating, scalping strategies can be adjusted to profit from volatility.

3. Skill Development and Discipline

Scalping requires precise timing, strict stop-losses, and emotional control. This cultivates good trading habits, especially valuable for retail investors who may lack institutional training.

4. Lower Overnight Risk Exposure

By not holding positions overnight, retail traders avoid risks from sudden announcements, exchange hacks, or global macroeconomic shifts.

Scalping generates frequent small wins compared to longer but less frequent profits from swing trading.

Comparing Two Scalping Methods

Method 1: Order Book Scalping

This approach focuses on monitoring bid-ask spreads, liquidity depth, and micro price imbalances. Scalpers capitalize on inefficiencies between buy and sell orders.

Advantages:

- Real-time reaction to market microstructure.

- Useful on high-liquidity exchanges with tight spreads.

Disadvantages:

- Requires advanced tools and fast execution systems.

- Can be overwhelming for beginners.

Method 2: Indicator-Based Scalping

This strategy uses technical indicators like moving averages, Bollinger Bands, and RSI for quick entry/exit signals.

Advantages:

- Easier for retail traders to implement.

- Can be automated through bots with simple rules.

Disadvantages:

- Prone to false signals in highly volatile conditions.

- Requires constant monitoring and strategy optimization.

Which Method Is Better for Retail Investors?

For most retail crypto investors, indicator-based scalping provides a more accessible starting point due to its simplicity and automation potential. However, order book scalping can deliver superior results for traders with access to advanced platforms and lower latency execution.

To enhance understanding, investors can explore guides like How to use scalping strategy in perpetual futures for structured step-by-step methods.

Scalping in the Context of Perpetual Futures

Retail investors frequently use scalping within perpetual futures contracts due to leverage and 24⁄7 trading opportunities. These contracts amplify both profits and risks, making scalping strategies particularly attractive.

One strong benefit is that perpetual futures allow traders to go long or short instantly, matching scalping’s need for rapid entry/exit. It also provides access to higher liquidity compared to spot markets.

Resources such as Why scalping is effective in perpetual futures can help retail traders understand the deeper mechanics of futures scalping.

Industry Trends in Retail Crypto Scalping

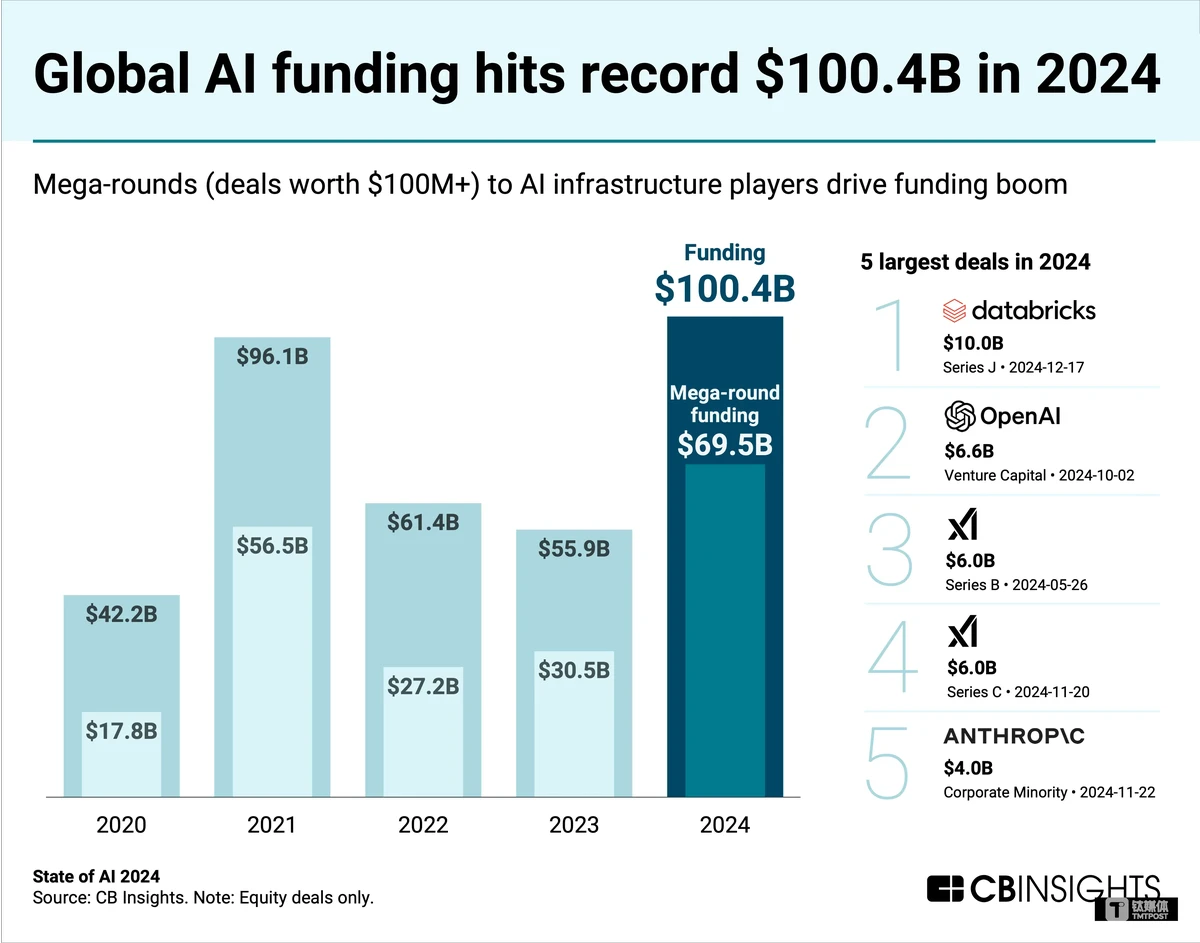

Automation and AI Tools

Trading bots and AI-driven signal providers are increasingly available, lowering barriers for retail scalpers.

Lower Exchange Fees

Major exchanges now offer reduced fees for high-frequency traders, directly benefiting scalpers who execute many trades daily.

Integration with Mobile Platforms

The rise of mobile trading apps allows retail investors to scalp on the go, expanding opportunities for part-time traders.

The growing adoption of AI and bots makes scalping more efficient for retail investors.

Personal Experience in Retail Scalping

From my experience, starting with indicator-based scalping on Ethereum futures was less intimidating. I initially used 1-minute RSI divergence signals with strict 0.5% stop-losses. Over time, I integrated order book depth analysis for confirmation, which significantly improved win rates.

The most valuable lesson was risk management—never risking more than 1% of the account per trade. Scalping requires discipline; a single careless trade can wipe out dozens of small wins.

Risk Management Essentials for Scalpers

- Position Sizing: Keep each trade small relative to account size.

- Stop-Loss Discipline: Always set automated stop-losses to avoid emotional exits.

- Fee Awareness: Trading fees accumulate fast; choose exchanges with low maker/taker fees.

- Mental Stamina: Scalping can be stressful. Break sessions into manageable time blocks.

FAQ

1. Is scalping suitable for beginners in crypto trading?

Yes, but beginners should start with small capital and focus on indicator-based scalping before advancing to order book strategies. Education and demo trading are highly recommended.

2. How much capital do I need to start scalping crypto?

Technically, scalping can start with as little as \(100–\)500, but fees and slippage matter. A balance above $1,000 is often more practical to cover costs and still secure profits.

3. Can scalping be automated for retail traders?

Absolutely. Many exchanges offer API integration for bots. Automated scalping reduces human error, though traders must backtest strategies thoroughly before using real funds.

Conclusion

The scalping advantages for retail crypto investors are clear: faster returns, flexibility across market conditions, improved discipline, and reduced overnight risk. While order book scalping is more advanced, indicator-based scalping is more accessible for beginners and retail traders.

Industry trends, such as trading bots and mobile access, continue to make scalping an increasingly viable approach. By managing risk carefully and using structured strategies, retail crypto investors can build consistent profitability.

Balancing frequent small gains with disciplined risk control is key to successful scalping.

Call to Action

If you found this guide helpful, share it with other traders in your network. Leave a comment with your own scalping experiences—whether successful or challenging. Your insights may inspire and guide fellow retail crypto investors exploring this high-potential strategy.