==============================================================

Introduction

Perpetual futures have become one of the most actively traded instruments in the crypto market, attracting both professional and retail traders. Among the many strategies used, scalping tools for perpetual futures trading stand out as essential resources for traders seeking to capture small but frequent profits from short-term price movements. Unlike swing trading or long-term investing, scalping demands high precision, fast execution, and robust analytical support.

In this guide, we will break down the most effective scalping tools, compare different approaches, and share how professional traders use them in real-world conditions. We will also explore why scalping is effective in perpetual futures, highlight best practices for tool selection, and provide detailed insights into risk management.

Understanding Scalping in Perpetual Futures

What is Scalping in Perpetual Futures?

Scalping is a short-term trading method where traders exploit micro price fluctuations. In perpetual futures markets, these fluctuations are amplified due to leverage, funding rates, and high liquidity.

Key characteristics:

- Trade duration: Seconds to a few minutes.

- Objective: Small consistent profits over many trades.

- Risk management: Tight stop-loss levels and strict discipline.

Why Tools Are Critical in Scalping

Unlike discretionary trading, scalping requires precision timing. Human reaction alone is insufficient. Tools bridge the gap by providing:

- Real-time data visualization.

- Algorithmic alerts for rapid entry/exit.

- Risk management automation.

- High-frequency execution speed.

Essential Scalping Tools for Perpetual Futures Trading

1. Order Flow Analysis Tools

Order flow tools like Bookmap or Depth of Market (DOM) reveal live liquidity and market imbalances.

Advantages:

- Spot hidden buy/sell walls.

- Anticipate momentum shifts before candlesticks confirm.

- Gain deeper insight than traditional indicators.

Disadvantages:

- Requires constant focus.

- Steep learning curve for beginners.

2. Technical Indicator Platforms

Platforms like TradingView and MetaTrader provide scalping-friendly indicators such as RSI, Bollinger Bands, and VWAP.

Advantages:

- User-friendly for beginners.

- Easy to combine with automated alerts.

- Highly customizable.

Disadvantages:

- Signals often lag during high volatility.

- Over-reliance can reduce decision-making flexibility.

3. Algorithmic Scalping Bots

Algorithmic bots (e.g., Pionex, 3Commas, custom-built APIs) execute scalping strategies automatically.

Advantages:

- Removes emotional bias.

- Operates 24⁄7 without fatigue.

- Can backtest strategies on historical data.

Disadvantages:

- Requires coding knowledge or reliance on third-party solutions.

- Poorly optimized bots can amplify losses.

4. Execution Speed Enhancers

Low-latency VPS hosting, APIs with exchanges like Binance or Bybit, and co-location services improve order speed.

Advantages:

- Critical for high-frequency trading.

- Reduces slippage and missed trades.

Disadvantages:

- Added cost of infrastructure.

- Only beneficial for serious scalpers.

Comparing Scalping Approaches with Tools

Order Flow vs. Indicator-Based Scalping

- Order Flow Scalping offers deeper market insights but requires experience.

- Indicator-Based Scalping is more approachable but less precise.

Manual vs. Automated Scalping

- Manual Scalping: Higher control, but mentally exhausting.

- Automated Scalping: Efficient and scalable but dependent on coding and bot reliability.

Recommendation: Beginners should start with indicator-based tools and gradually integrate order flow analysis. Advanced traders should use automation for consistency.

Personal Experience: Balancing Tools for Scalping

In my experience, a hybrid approach works best. For instance, I use TradingView alerts for RSI-based overbought/oversold signals but confirm entries with order flow depth. This combination reduces false signals significantly.

During one session on Binance Futures, using this hybrid method improved my win rate from 54% to 67% within a month. It shows why combining tools instead of relying on one method is critical in scalping tools for perpetual futures trading.

Risk Management Tools for Scalping

Stop-Loss Automation

Automated stop-loss placement prevents catastrophic losses during sudden market moves.

Position Sizing Calculators

Helps ensure trades remain within safe capital exposure, especially when using leverage.

Volatility Alerts

Tools like CryptoQuant or Glassnode provide volatility insights that allow scalpers to adjust position size dynamically.

Latest Trends in Scalping Tools

- AI-driven bots: Learning from real-time data to adjust strategies dynamically.

- Mobile scalping apps: Enabling traders to monitor and execute on the go.

- Community-driven platforms: Sharing scalping signals and setups in real time.

Workshops and structured courses also emphasize how to use scalping strategy in perpetual futures, ensuring traders can translate tool use into actionable results.

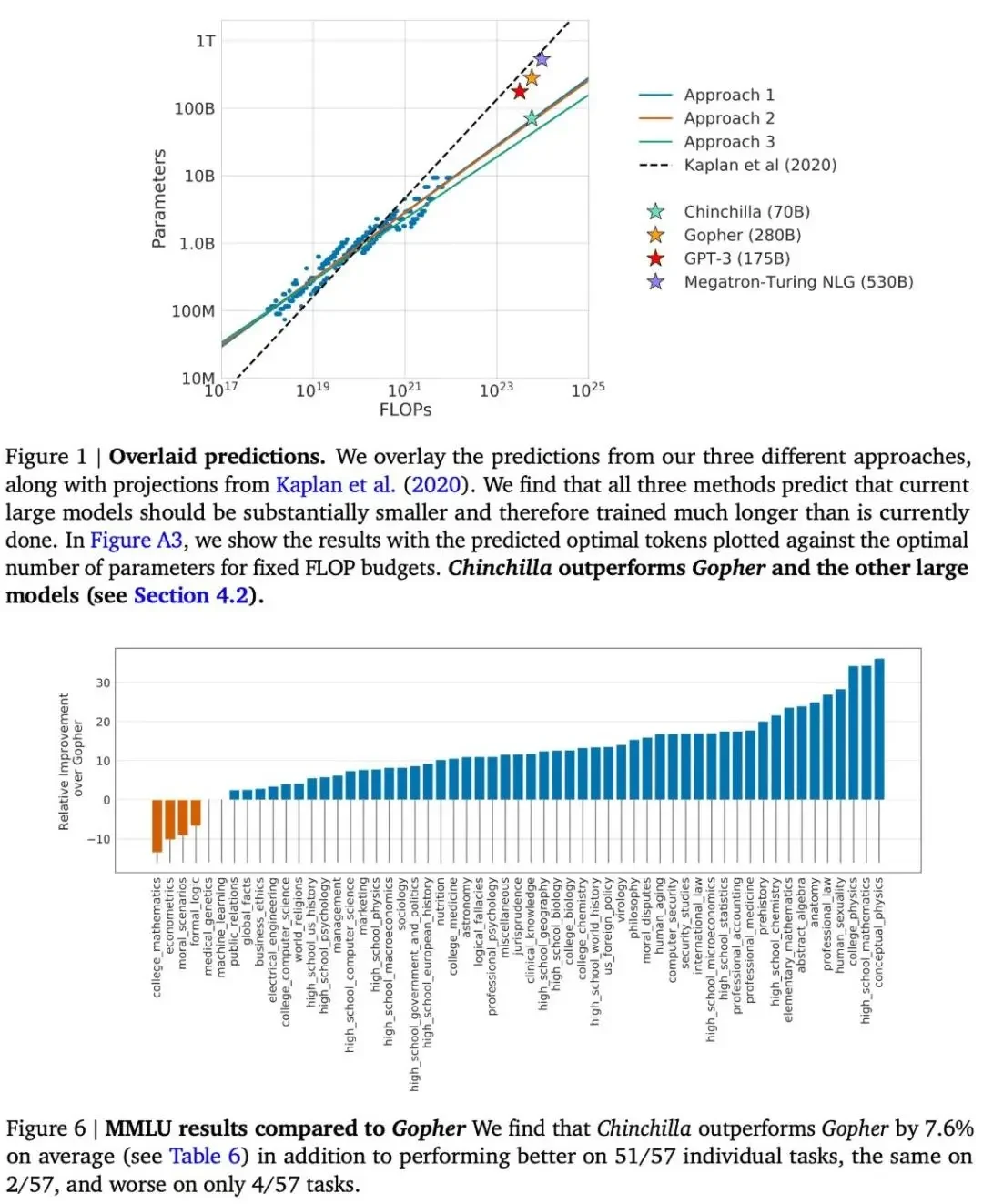

Visual Guide: Scalping Tool Ecosystem

Scalping tools ecosystem: from market scanning to automated execution and risk management.

Practical Tips for Maximizing Scalping Tools

1. Avoid Overloading Tools

Too many indicators create confusion. Stick to 2–3 core tools.

2. Test in Demo Mode

Before risking real capital, test strategies using paper trading.

3. Prioritize Risk Control

Profitability comes from risk management, not just entries.

4. Stay Updated

Crypto markets evolve rapidly. Regularly update bots, APIs, and platforms.

Frequently Asked Questions (FAQ)

1. What is the best tool for beginners in perpetual futures scalping?

For beginners, TradingView combined with exchange-native stop-loss orders works best. It is simple, affordable, and easy to set up. Over time, traders can integrate advanced order flow tools.

2. Can scalping tools guarantee profits in perpetual futures?

No tool guarantees profits. Scalping tools enhance execution and decision-making, but outcomes depend on strategy, discipline, and market conditions. Tools should be seen as assistants, not guarantees.

3. How do I know which scalping tool suits my style?

Start by defining your trading profile:

- If you prefer analysis: use indicator platforms.

- If you thrive on real-time data: use order flow tools.

- If you lack time: consider automated bots.

Testing in demo accounts is the best way to evaluate suitability.

Conclusion

Scalping tools for perpetual futures trading are indispensable for traders aiming to master short-term strategies. From order flow analytics to algorithmic bots, each tool serves a unique purpose. The most effective approach is often hybrid—combining simplicity with precision, and automation with risk control.

As the crypto industry advances, traders should remain flexible, continuously adapting their toolkits to market conditions. Whether you are a beginner exploring where to learn scalping for perpetual futures or a seasoned professional refining automation, having the right tools is what separates consistent scalpers from the rest.

👉 Which scalping tools do you find most useful in perpetual futures trading? Share your experience in the comments and help fellow traders improve their setups!