=================================================

Introduction: Why Latency Matters in Futures Trading

In today’s highly competitive trading environment, latency—the time delay between a trader’s action and its execution—has become one of the most crucial performance metrics. Even a millisecond delay in futures trading can lead to missed opportunities, increased slippage, and reduced profitability.

This comprehensive guide to solving latency in futures explores the root causes of latency, evaluates strategies to mitigate it, compares different approaches, and provides actionable insights for traders ranging from retail participants to institutional quant desks.

By combining personal experience with the latest industry best practices, this guide aims to help traders develop a robust, low-latency trading framework that ensures efficiency and competitiveness in fast-moving futures markets.

Understanding Latency in Futures

What is Latency in Trading?

Latency in trading refers to the time delay that occurs between the moment a trading signal is generated and the moment the order is confirmed on the exchange. This delay is influenced by multiple factors such as network infrastructure, broker execution speed, exchange processing time, and even software inefficiencies.

How Does Latency Affect Futures Trading?

- Slippage: Orders may execute at a worse price due to delays.

- Arbitrage Failures: Event arbitrage or cross-exchange strategies may miss opportunities.

- HFT Vulnerability: High-frequency traders are most affected since their strategies depend on microsecond-level precision.

- Reduced Profitability: Over time, small delays accumulate, eroding returns.

Latency layers in trading: signal generation → order routing → exchange execution

Key Sources of Latency in Futures

1. Network Infrastructure

Network routing, bandwidth, and distance from exchange servers impact round-trip time.

2. Broker and Exchange Latency

Execution speed varies across brokers and exchanges. Some brokers offer low-latency direct market access (DMA), while others add additional delays through order routing.

3. Software Inefficiencies

Unoptimized code, outdated APIs, and inefficient algorithms contribute to increased latency.

4. Hardware Limitations

CPU speed, memory management, and even the choice of operating system can affect performance.

5. Market Data Feeds

Slow or delayed market data results in late decision-making, even if execution is instant.

Two Primary Strategies for Reducing Latency

Strategy 1: Colocation and Direct Market Access

How it Works: Traders place their servers in the same data center as the exchange, minimizing physical distance and network hops. DMA allows direct communication with the exchange, bypassing broker delays.

Advantages:

- Lowest possible latency (microsecond execution).

- Essential for high-frequency trading strategies.

- Reduces dependency on third-party brokers.

Disadvantages:

- High cost (rack space, maintenance, and licensing).

- Complex setup requiring technical expertise.

- Not accessible for most retail traders.

Best For: Institutional traders, quant funds, and HFT firms.

Strategy 2: Optimized Retail and Cloud-Based Low-Latency Solutions

How it Works: Retail traders leverage brokers with low-latency infrastructure and cloud-based virtual private servers (VPS) located near exchange servers.

Advantages:

- Affordable compared to colocation.

- Easy to scale as trading activity grows.

- Provides competitive execution for retail traders.

Disadvantages:

- Latency higher than colocation.

- Reliance on third-party providers introduces potential vulnerabilities.

Best For: Retail traders, independent quants, and small trading firms.

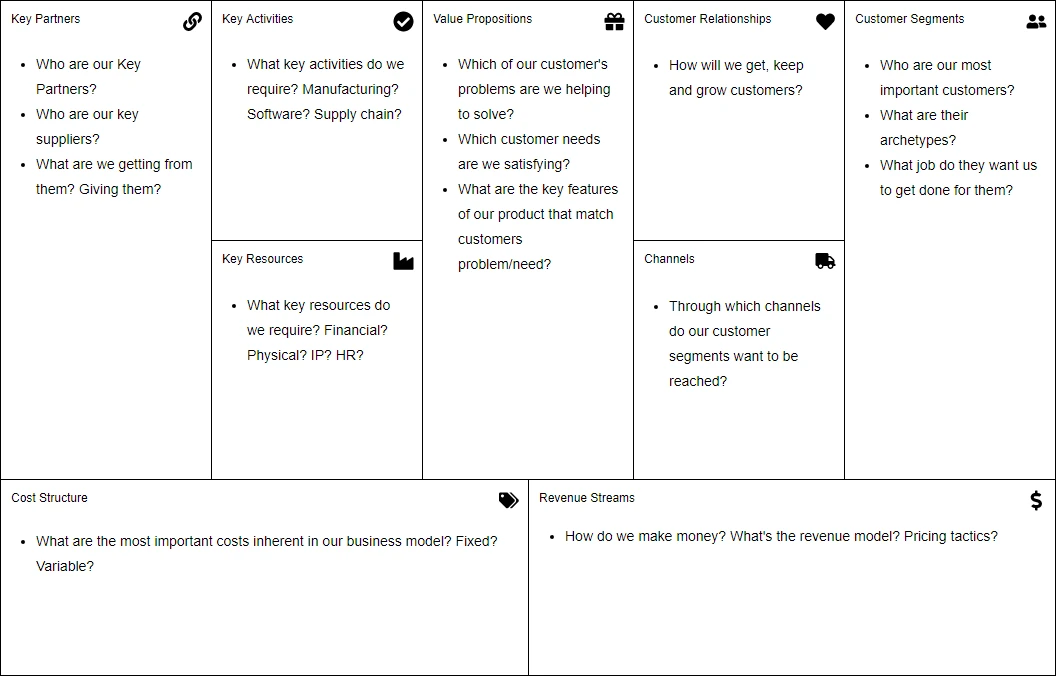

Comparison of colocation vs. cloud VPS latency strategies

Comparing Latency Reduction Strategies

| Strategy | Latency Level | Cost | Complexity | Suitable For |

|---|---|---|---|---|

| Colocation + DMA | Ultra Low (microseconds) | High $$$ | Advanced | Institutional & HFT firms |

| Cloud VPS Near Exchange | Low (milliseconds) | Moderate $$ | Medium | Retail & semi-pro traders |

| Retail Broker Optimization | Medium-Low | Low $ | Easy | Beginner traders |

From my experience, retail traders should start with cloud VPS solutions combined with brokers known for low-latency routing. Institutions should invest in colocation and direct exchange access for maximum performance.

Best Practices for Solving Latency in Futures

1. Optimize Software and APIs

Use lightweight, optimized code. Replace outdated APIs with faster FIX or WebSocket connections.

2. Monitor Latency in Real-Time

Utilize monitoring tools to track execution delays, helping identify bottlenecks. (For deeper analysis, see how to measure latency in trading systems.)

3. Diversify Brokers and Routes

Test multiple brokers to compare latency benchmarks. Understanding how latency impacts algorithmic trading can guide broker selection.

4. Upgrade Hardware

Use high-performance CPUs, low-latency RAM, and solid-state drives.

5. Choose the Right Data Feeds

Invest in premium low-latency data feeds to ensure you react to market events before compe*****s.

Advanced Techniques for Institutional Traders

- Kernel Bypass Networking: Techniques like Solarflare or DPDK reduce OS overhead.

- FPGA Acceleration: Hardware-based order processing for microsecond execution.

- Custom Network Protocols: Proprietary ultra-low-latency routing.

- Smart Order Routing: Dynamically selects the fastest and most liquid venues.

These advanced strategies are cost-prohibitive but necessary for top-tier HFT performance.

Frequently Asked Questions (FAQ)

1. How can retail traders realistically reduce latency?

Retail traders can use brokers with low-latency order routing, deploy VPS servers near exchanges, and optimize software to reduce delays. While they cannot achieve institutional-level speeds, they can still minimize slippage and improve execution.

2. Is latency reduction worth the investment for day traders?

Yes. Even modest latency improvements can reduce slippage and improve trade entry/exit prices. Day traders operating on short time frames benefit significantly from latency reduction.

3. How do I know if my system has a latency problem?

You should measure round-trip execution times, compare broker performance, and monitor slippage. If you consistently notice worse fills than expected, latency is likely an issue.

4. Do all trading strategies require low latency?

No. Long-term strategies (swing trading, position trading) are less affected. Latency optimization is most critical for scalpers, day traders, and algorithmic or high-frequency traders.

Conclusion: Building a Low-Latency Futures Framework

Latency is no longer a niche concern—it is a core competitive factor in futures trading. By understanding its sources, comparing reduction strategies, and applying tailored solutions, traders can protect profits and enhance efficiency.

- Retail traders should focus on cloud VPS and broker selection.

- Institutional traders must invest in colocation and advanced infrastructure.

- Continuous monitoring and optimization are essential for maintaining competitiveness.

This comprehensive guide to solving latency in futures demonstrates that latency reduction is a strategic decision that affects profitability, execution quality, and long-term success.

If you found this guide useful, share it with your trading network and comment on your own experiences dealing with latency in futures markets. Your input can help fellow traders find innovative solutions to one of trading’s biggest challenges.

Would you like me to create a step-by-step latency troubleshooting checklist (with benchmarks for retail vs. institutional traders) that you can use as a practical tool?