=====================================================

Backtesting has become a cornerstone of modern trading, especially in highly leveraged markets like perpetual futures. By simulating trades using historical data, traders can validate strategies, optimize performance, and manage risk effectively. This guide provides a step-by-step approach to backtesting perpetual futures strategies, highlighting practical techniques, tools, and insights for both novice and professional traders.

Understanding Backtesting in Perpetual Futures

What is Backtesting?

Backtesting is the process of testing a trading strategy using historical market data to evaluate its performance. In perpetual futures, where positions can be held indefinitely and leverage magnifies both gains and losses, accurate backtesting is critical.

Why Backtesting Matters

Backtesting allows traders to:

- Identify profitable trading strategies before committing capital.

- Understand risk exposure and drawdowns in extreme market conditions.

- Fine-tune entry and exit rules based on historical patterns.

Internal Reference: For those new to the concept, learning how to perform backtesting in perpetual futures can provide a structured framework for testing strategies with minimal risk.

Step 1: Define Your Trading Strategy

Developing a Clear Hypothesis

Before backtesting, define your strategy’s parameters:

- Entry conditions: e.g., breakout, mean reversion, or momentum.

- Exit conditions: e.g., stop-loss, take-profit, or trailing stops.

- Position sizing and leverage limits.

A well-defined strategy reduces ambiguity and ensures consistent testing.

Choosing the Appropriate Timeframe

Select a timeframe aligned with your trading objectives:

- Scalping: 1–5 minute intervals.

- Day trading: 5–30 minute intervals.

- Swing trading: 1–4 hour intervals.

The chosen timeframe significantly affects backtesting results and risk assessment.

Step 2: Collect and Prepare Historical Data

Sourcing Reliable Data

High-quality historical data is essential for realistic backtesting. Key sources include exchange APIs, data aggregators, and professional backtesting platforms.

- Spot errors, missing entries, and time gaps in data.

- Normalize data to include funding rates and perpetual futures fees.

Internal Reference: Knowing where to find perpetual futures backtesting tools can save time and enhance the accuracy of simulations.

Cleaning and Formatting Data

Ensure data consistency:

- Align timestamps across exchanges.

- Adjust for splits, rollovers, or contract expirations.

- Convert all prices to a common currency unit if necessary.

Step 3: Choose Your Backtesting Method

Manual Backtesting

Manual backtesting involves trading on historical charts and recording performance manually. While time-consuming, it helps beginners understand market behavior and decision-making processes.

Pros:

- Enhances learning for novice traders.

- Provides intuition on market patterns.

Cons:

- Slow and error-prone.

- Limited scalability.

Automated Backtesting

Automated backtesting uses scripts or platforms to simulate trades over historical data. Popular tools include Python frameworks, TradingView Pine Script, and proprietary platforms.

Pros:

- High-speed testing over large datasets.

- Accurate performance metrics and risk analytics.

Cons:

- Requires programming knowledge or pre-built platforms.

- Overfitting risk if parameters are excessively tuned.

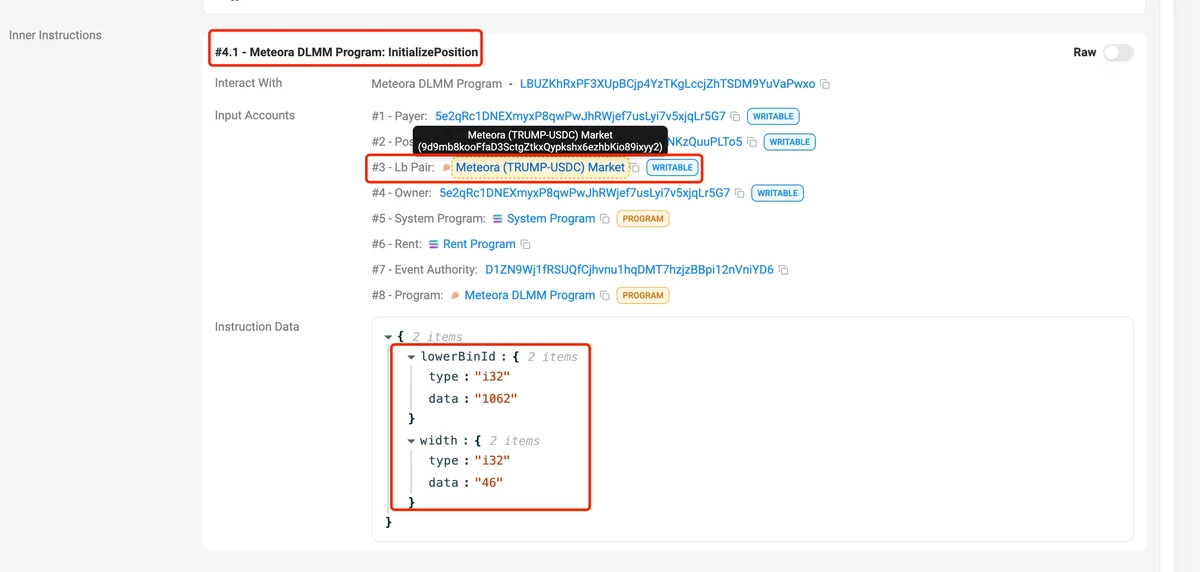

Example Image:

Automated backtesting platforms can execute thousands of historical trades within seconds, generating detailed performance reports.

Step 4: Conduct the Backtest

Implementing the Strategy

- Program your strategy logic into the chosen platform.

- Incorporate trading costs, leverage, slippage, and funding rates for realism.

Running Multiple Simulations

- Test across different market conditions: bullish, bearish, and sideways.

- Use Monte Carlo simulations to evaluate variability and drawdown risks.

Interpreting Backtest Results

Focus on metrics like:

- Net profit/loss.

- Win rate and risk-reward ratios.

- Maximum drawdown.

- Sharpe and Sortino ratios for risk-adjusted performance.

Step 5: Optimize and Refine

Strategy Optimization

Adjust parameters such as:

- Stop-loss levels.

- Take-profit points.

- Leverage ratios.

Use optimization carefully to avoid overfitting, which can make the strategy ineffective in live trading.

Scenario Testing

Run backtests across extreme volatility scenarios to ensure robustness. Evaluate how your strategy behaves during flash crashes or rapid funding rate changes.

Step 6: Forward Testing and Paper Trading

Simulate Real-Time Trading

Forward testing involves running the strategy in live market conditions using a demo account. This helps identify:

- Latency issues.

- Execution gaps.

- Behavioral adjustments.

Transition to Live Trading

After consistent performance in forward testing, gradually deploy capital while monitoring risk closely.

Image Example:

Forward testing allows traders to validate backtested strategies in real-time market conditions before using real capital.

Step 7: Continuous Improvement

Monitoring Strategy Performance

- Track metrics consistently.

- Compare real-time results with historical backtesting performance.

Incorporating Feedback Loops

Update and refine strategies based on live feedback, market trends, and volatility changes.

Comparing Two Popular Backtesting Approaches

| Method | Advantages | Disadvantages |

|---|---|---|

| Manual | Enhances learning, intuitive understanding | Time-consuming, limited data coverage |

| Automated | Fast, scalable, accurate metrics | Requires coding, risk of overfitting |

For professional traders, automated backtesting with rigorous parameter validation typically provides the most actionable insights.

Advanced Techniques for Perpetual Futures Backtesting

Data-Driven Machine Learning Models

Use historical price, volume, and order book data to train predictive models. Machine learning can uncover non-linear patterns missed by traditional rule-based strategies.

Multi-Asset Strategy Testing

Simulate strategies across multiple correlated futures contracts to assess portfolio-level performance and hedge effectiveness.

FAQ

Q1: How do I select the right backtesting platform for perpetual futures?

A1: Consider data coverage, automation capabilities, programming flexibility, and integration with live trading APIs. Platforms like Python libraries (Backtrader, Zipline) or TradingView are widely used.

Q2: How long should a backtesting period be?

A2: Ideally, include multiple market cycles (bullish, bearish, sideways) covering at least 1–3 years of historical data. Longer periods reduce the risk of overfitting to short-term trends.

Q3: Can backtesting guarantee profitability in live trading?

A3: No. Backtesting validates strategies under historical conditions. Market dynamics may change, so forward testing and risk management are essential for live deployment.

Conclusion

Step-by-step backtesting for perpetual futures is an indispensable process for traders seeking consistency and profitability. By combining automated and data-driven approaches, leveraging historical insights, and continuously optimizing strategies, traders can build robust frameworks capable of navigating volatile crypto markets.

Encourage social sharing and discussion: Share this guide with fellow traders, comment with your backtesting experiences, and explore different tools and platforms to refine your perpetual futures strategies.