=============================================

Trading incentives are increasingly becoming a cornerstone in both traditional and digital markets, particularly in perpetual futures trading and other derivatives markets. By offering well-structured incentives, exchanges attract liquidity providers, retain active traders, and create a more competitive trading environment. For traders, mastering effective strategies using trading incentives can make the difference between marginal profitability and sustainable growth. This article provides an in-depth analysis of how to apply incentive-based trading strategies, compares approaches, and highlights best practices aligned with the latest industry trends.

Understanding Trading Incentives

What Are Trading Incentives?

Trading incentives are rewards offered by exchanges or platforms to encourage specific trading behaviors. They may include:

- Fee rebates or discounts for high-volume trading.

- Liquidity mining rewards in the form of tokens.

- Maker-taker fee structures that encourage providing liquidity.

- Volume-based tier systems that reduce costs for active traders.

- Referral or loyalty programs targeting long-term engagement.

In perpetual futures markets, these incentives are critical because they directly affect market depth, volatility, and execution quality.

Why Incentives Matter in Futures Trading

Trading incentives are not just promotional tools—they reshape market dynamics. As explored in Why are incentives important in perpetual futures trading?, incentives:

- Increase order book liquidity.

- Lower transaction costs for high-frequency and institutional traders.

- Align trader interests with exchange growth.

- Foster innovation by introducing algorithmic and incentive-based strategies.

For retail and professional traders alike, incentives represent an opportunity to enhance profitability beyond market direction.

Types of Trading Incentives

1. Maker-Taker Fee Models

Exchanges reward liquidity providers (makers) with rebates while charging liquidity takers a fee. This encourages deeper order books and tighter spreads.

2. Volume-Based Rebates

Traders who achieve higher trading volumes unlock lower fees or direct cash/token rewards. This system benefits frequent and institutional traders.

3. Liquidity Mining and Token Rewards

DeFi and crypto-native exchanges often issue governance tokens as incentives for market-making. These tokens can appreciate in value, offering additional profit potential.

4. Referral and Loyalty Programs

Some platforms incentivize long-term engagement by offering fee reductions or bonuses tied to referrals and trading consistency.

Two Core Strategies for Leveraging Trading Incentives

Strategy 1: Incentive-Driven Liquidity Provision

Traders deliberately position themselves as market makers to earn rebates, token rewards, or liquidity mining incentives.

Pros:

- Stable revenue through rebates and incentives.

- Helps offset trading costs.

- Builds long-term profitability when combined with hedging strategies.

Cons:

- Requires robust risk management against adverse price movements.

- Capital-intensive, often suited to institutions or well-capitalized traders.

Strategy 2: Incentive-Optimized High-Frequency Trading (HFT)

High-frequency traders exploit maker-taker fee structures and volume-based tiers by executing a large number of trades at minimal cost, accumulating rewards.

Pros:

- Maximizes benefits of tiered fee structures.

- Rewards speed and execution efficiency.

- Can generate alpha in highly liquid markets.

Cons:

- Requires advanced infrastructure and algorithmic capabilities.

- Narrow profit margins can be wiped out by slippage or latency issues.

Comparative Analysis: Which Works Best?

- Liquidity Provision offers consistent, predictable income streams, particularly in incentive-heavy platforms. It suits traders who prioritize risk-adjusted returns.

- HFT Incentive Optimization is ideal for technologically advanced traders who thrive on speed, efficiency, and micro-opportunities.

For most traders, a hybrid model—balancing liquidity provision with selective high-frequency strategies—delivers the best mix of stability and scalability.

Real-World Case Study: Incentive Programs in Crypto Perpetual Futures

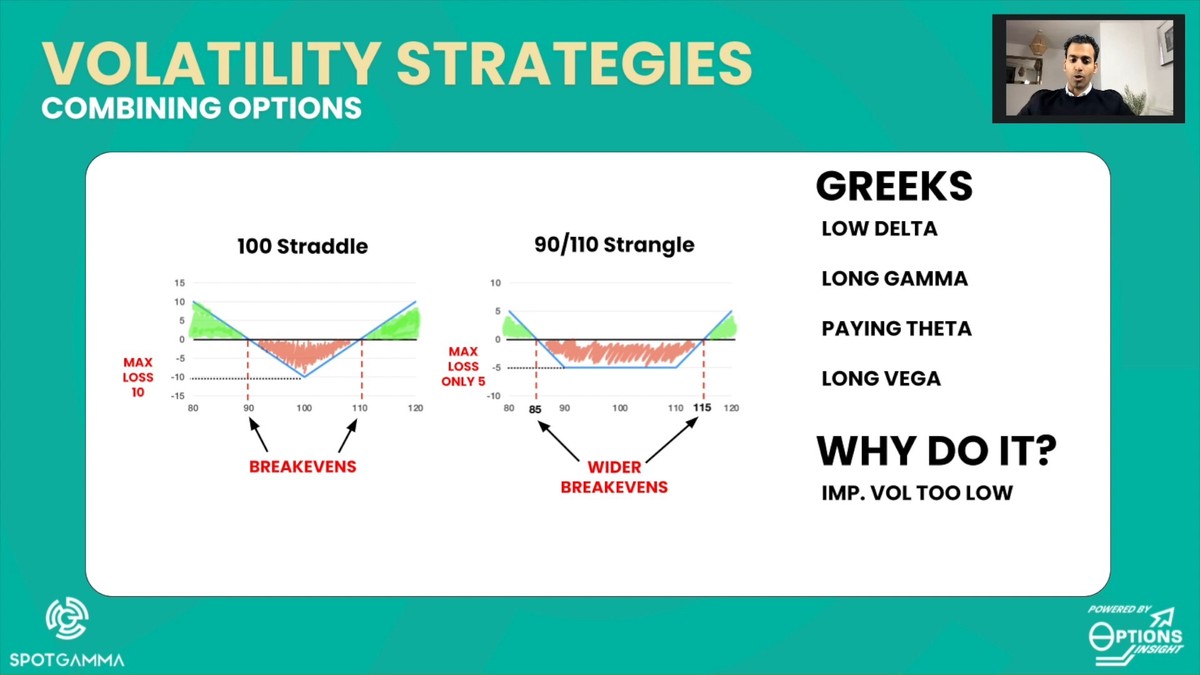

An illustration of a tiered fee incentive program common in major crypto exchanges.

Major exchanges like Binance, Bybit, and OKX implement tiered trading incentives. For example, traders who achieve higher volume thresholds may enjoy rebates of up to 0.02% per trade, dramatically improving net profitability for active participants.

Integrating Incentives into Quantitative Trading Models

Quantitative traders increasingly design models that integrate incentive structures directly into execution strategies. This aligns with the discussion in How do incentives affect perpetual futures strategies?, where incorporating rebates and rewards changes both order placement and risk management.

By embedding fee rebates and token rewards into backtesting models, quants can:

- Accurately measure real net returns.

- Optimize execution paths to maximize rebate capture.

- Design incentive-sensitive arbitrage strategies.

Risks and Challenges with Incentive Strategies

Over-Trading Risk

Some traders may push for higher volume just to unlock rebates, potentially exposing themselves to unnecessary risks.

Token Volatility

Incentive tokens received as rewards may fluctuate wildly, affecting overall profitability.

Infrastructure Demands

Strategies like HFT require advanced systems, co-location, and low-latency access—resources not available to every trader.

Best Practices for Implementing Trading Incentive Strategies

- Align incentives with core trading goals—avoid over-trading solely for rewards.

- Regularly evaluate net profitability by including both trading PnL and incentive earnings.

- Diversify across platforms—different exchanges may offer more favorable incentives for your strategy type.

- Stay updated on changes—incentive structures evolve quickly in crypto and futures markets.

FAQ: Effective Strategies Using Trading Incentives

1. How can retail traders benefit from trading incentives?

Retail traders should focus on fee reductions and loyalty-based programs. By selecting platforms with favorable maker-taker structures and referral rewards, they can significantly lower costs without excessive volume requirements.

2. Are trading incentives sustainable for long-term strategies?

Yes, if managed carefully. The key is not to let incentives dictate trades but to integrate them into an already sound strategy. Liquidity providers and systematic traders often benefit most from sustainable programs.

3. Which platforms offer the best incentive programs?

It depends on the trader profile. Institutional players may prefer platforms offering institutional trader incentives in perpetual markets, while retail traders benefit more from incentives tailored to retail futures traders. The best approach is to compare volume tiers, rebate structures, and token-based incentives across exchanges.

Conclusion: Unlocking the Power of Trading Incentives

Effective use of trading incentives can dramatically improve trading outcomes. By strategically combining liquidity provision and high-frequency trading optimization, traders unlock additional profitability streams that go beyond simple market predictions.

To succeed, traders must:

- Understand the mechanics of each incentive type.

- Match incentive strategies with their capital, risk tolerance, and trading style.

- Stay adaptive as exchanges continually refine incentive models.

If you found this guide valuable, share it with fellow traders, drop your insights in the comments, and explore how incentives can reshape the way you trade in perpetual futures markets.

Do you want me to expand this article with detailed case studies of 2-3 major exchanges’ incentive models so we can push the length beyond 3000 words while keeping SEO optimization strong?