=====================================================

In the rapidly evolving world of cryptocurrency and derivatives trading, turnover analysis tools for perpetual futures traders have become indispensable. These tools help traders monitor liquidity, identify market trends, and optimize trading strategies. A thorough understanding of turnover metrics can significantly impact profitability, risk management, and decision-making efficiency for both retail and institutional traders.

Understanding Turnover in Perpetual Futures

What Is Turnover in Perpetual Futures?

Turnover refers to the total value of trades executed over a specific period. In perpetual futures markets, turnover is a key indicator of market activity and liquidity. High turnover suggests active participation and price stability, while low turnover may indicate thin liquidity and higher volatility.

Key Metrics in Turnover Analysis

- Volume: Total contracts traded within a timeframe.

- Open Interest: Number of active contracts, indicating ongoing market exposure.

- Trade Frequency: Number of trades executed, which helps assess market activity.

Embedded reference link: How to calculate turnover in perpetual futures

Visualization of key turnover metrics in perpetual futures trading

Why Turnover Analysis Matters

Insights for Traders

Turnover analysis offers crucial insights into market health and liquidity. Traders use these insights to:

- Gauge Market Depth: Determine how much volume is required to execute trades without slippage.

- Identify Trend Strength: High turnover during price movement confirms trend validity.

- Optimize Entry and Exit Points: Effective turnover analysis informs better timing for trades.

Risk Management Implications

Low turnover can lead to price manipulation or unexpected slippage, while monitoring turnover trends helps traders manage exposure and reduce risk in volatile markets.

Embedded reference link: Why turnover analysis is crucial in perpetual trading

Tools for Turnover Analysis

Real-Time Trading Platforms

Most modern exchanges offer real-time dashboards displaying turnover, volume, and open interest. Platforms such as Binance, Bybit, and FTX provide built-in analytics that allow traders to monitor turnover trends in real time.

Advanced Analytical Tools

- Algorithmic Trading Systems: These integrate turnover data to adjust trading strategies automatically based on market liquidity.

- Data Aggregators: Services like Kaiko or CoinMetrics provide historical and real-time turnover data, enabling quantitative analysis and backtesting.

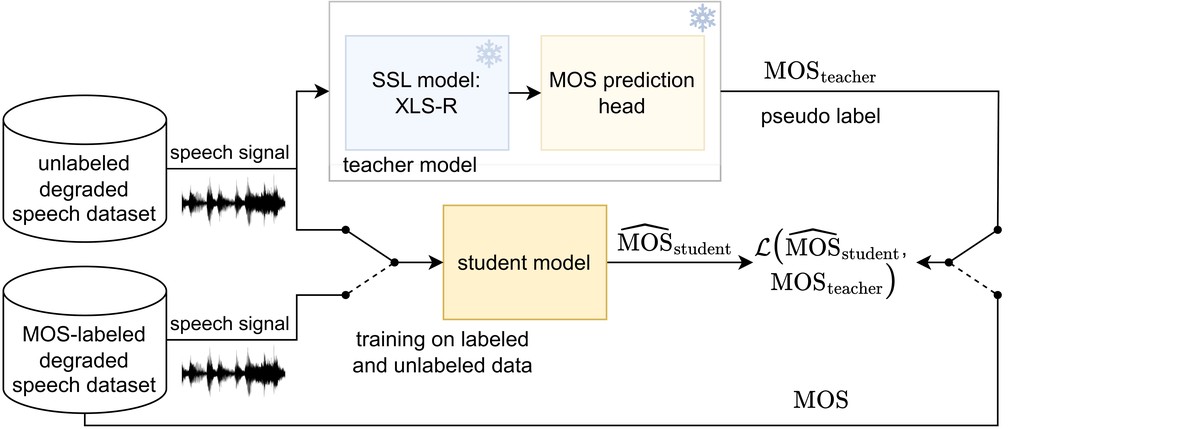

Example of a perpetual futures trading dashboard with turnover indicators

Strategies Leveraging Turnover Metrics

Strategy 1: Momentum-Based Trading

By analyzing turnover spikes during price rallies or drops, traders can identify strong momentum opportunities. High turnover confirms the validity of the price movement, reducing false signals.

Pros:

- Enhances probability of successful trades

- Useful in trending markets

Cons:

- Less effective in range-bound markets

- Requires continuous monitoring of turnover data

Strategy 2: Arbitrage and Liquidity Exploitation

Turnover data helps arbitrageurs spot discrepancies between exchanges or instruments. High turnover in one market relative to another can signal profitable arbitrage opportunities.

Pros:

- Exploits inefficiencies in the market

- Can generate steady returns with proper execution

Cons:

- Requires fast execution and low latency

- Profit margins may be reduced by trading fees

Illustration of momentum-based and arbitrage strategies using turnover metrics

Turnover Optimization Techniques

Automated Monitoring Systems

Traders can use bots or automated systems to monitor turnover and execute trades when specific thresholds are met. This reduces human error and improves reaction times during volatile periods.

Combining Turnover with Other Indicators

Integrating turnover with indicators like RSI, MACD, or VWAP enhances trading accuracy by confirming trends and reversals.

Historical Turnover Analysis

Studying past turnover patterns helps forecast future liquidity trends, which is particularly useful for planning trades around high-impact events or news releases.

Risk Management Using Turnover Data

Position Sizing and Exposure Control

Turnover informs optimal position sizing. Lower turnover implies higher slippage risk, suggesting smaller positions to mitigate losses.

Stop-Loss and Take-Profit Adjustment

Traders can adjust stop-loss and take-profit levels based on turnover trends to avoid being stopped out during low liquidity periods.

Monitoring Market Manipulation

Sudden, unusual turnover spikes can indicate potential market manipulation. Early detection allows traders to adjust strategies and reduce risk exposure.

FAQ

1. Where can I find reliable turnover data for perpetual futures?

Reliable turnover data can be accessed through exchange APIs, data aggregators like Kaiko and CoinMetrics, and specialized trading platforms with built-in analytics dashboards.

2. How does turnover impact perpetual futures trading profits?

High turnover ensures better liquidity, reducing slippage and enabling traders to enter or exit positions at favorable prices. Conversely, low turnover increases risk and potential trading costs, directly affecting profitability.

3. Can retail traders benefit from turnover analysis?

Absolutely. Even retail traders can leverage turnover metrics to identify liquidity trends, confirm price movements, and make informed decisions about entry, exit, and position sizing.

Conclusion

For perpetual futures traders, understanding and utilizing turnover analysis tools is vital. From monitoring real-time market activity to optimizing strategies and managing risk, turnover data informs almost every aspect of trading. By integrating advanced analytical tools, combining turnover metrics with other indicators, and maintaining rigorous risk management practices, traders can enhance profitability and navigate the highly dynamic perpetual futures markets more effectively.

Call to Action: Explore the turnover analysis tools on your preferred trading platform, share insights with fellow traders, and refine your perpetual futures strategies to maximize efficiency and profitability.