=====================================================

Efficient trading in perpetual markets requires more than just market insight—it demands strategic approaches to maximize liquidity and profitability. One crucial factor often overlooked by traders is turnover, which reflects the frequency and volume of trading activity within a market. Optimizing turnover can significantly enhance profits, reduce risk exposure, and improve overall market efficiency. This article delves deep into turnover optimization techniques in perpetual markets, comparing strategies, highlighting their pros and cons, and offering actionable insights for both institutional and retail traders.

Understanding Turnover in Perpetual Markets

What is Turnover in Perpetual Futures?

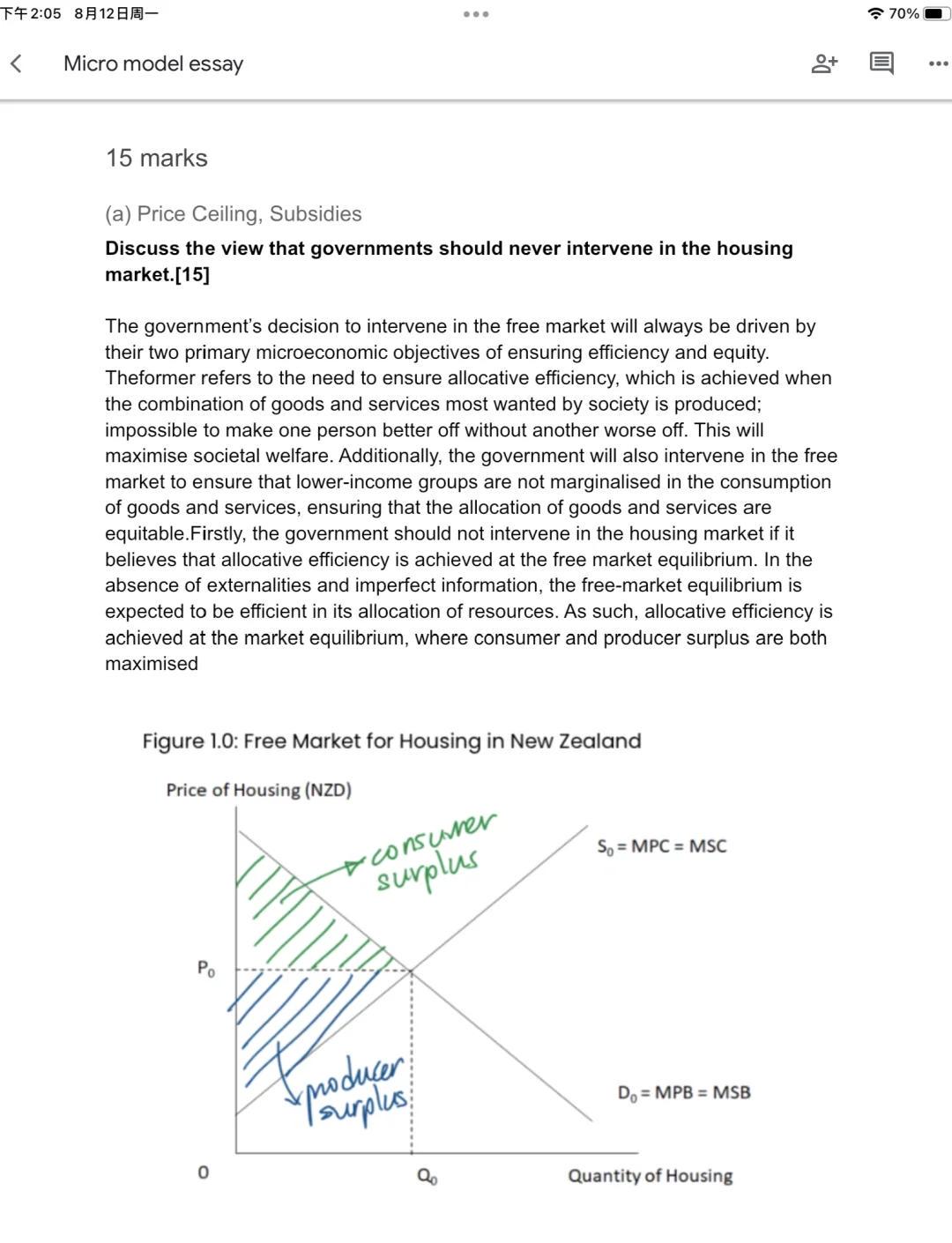

Turnover refers to the total volume of assets traded over a specific period relative to the total available assets or contracts. In perpetual futures, turnover is particularly important because these contracts do not have expiration dates, making liquidity and trading frequency critical metrics.

High turnover indicates active participation, tighter spreads, and greater market depth, while low turnover can signal inefficiencies or liquidity constraints.

Internal link naturally embedded: Learning how to calculate turnover in perpetual futures helps traders accurately gauge market activity and plan strategies accordingly.

Why Turnover Matters

- Liquidity Assessment: High turnover ensures easier entry and exit without significant price slippage.

- Profitability: Frequent trading opportunities allow traders to capitalize on market movements, especially in volatile environments.

- Market Efficiency: Turnover reflects the ability of markets to incorporate information quickly, reducing arbitrage opportunities.

- Risk Management: Understanding turnover patterns helps identify periods of low liquidity that may amplify trading risk.

Visual representation of turnover levels and market efficiency in perpetual futures contracts.

Key Turnover Optimization Strategies

Strategy 1: Algorithmic Execution for High-Frequency Trading

Algorithmic trading allows traders to systematically manage order flow, optimizing turnover through rapid and precise execution.

Implementation Steps:

- Order Splitting: Break large trades into smaller orders to minimize market impact.

- Smart Order Routing: Use algorithms to route orders to the venues with the best liquidity.

- Adaptive Timing: Adjust order placement dynamically based on real-time market conditions.

Advantages:

- Increases trade execution efficiency.

- Reduces slippage and transaction costs.

- Enhances turnover without significantly moving the market.

Challenges:

- Requires sophisticated technology and low-latency infrastructure.

- Algorithmic errors can lead to amplified losses in volatile markets.

Internal link naturally embedded: Understanding turnover analysis for algorithmic trading in futures is crucial for deploying these techniques effectively.

Strategy 2: Dynamic Position Sizing and Portfolio Rotation

Dynamic position sizing involves adjusting trade volumes based on market volatility and liquidity conditions, ensuring optimal turnover while controlling risk. Portfolio rotation involves shifting capital across contracts or assets to exploit high-liquidity periods.

Implementation Steps:

- Liquidity Assessment: Monitor turnover trends to identify active trading windows.

- Volatility Adjustment: Scale positions based on risk-adjusted volatility.

- Portfolio Rotation: Shift investments among perpetual contracts to maintain consistent turnover and exposure.

Advantages:

- Balances risk with turnover optimization.

- Exploits periods of high liquidity for increased profit potential.

Challenges:

- Requires continuous monitoring and real-time analytics.

- Misjudging liquidity or volatility can result in underperformance.

Illustration showing how dynamic portfolio rotation aligns with market turnover patterns.

Advanced Turnover Optimization Techniques

Leveraging Market Microstructure

- Analyze order book depth, bid-ask spreads, and trade clustering to anticipate turnover fluctuations.

- Employ microstructure-aware algorithms to improve execution and maintain consistent turnover rates.

Cross-Exchange Arbitrage

- Exploit discrepancies in perpetual futures prices across exchanges.

- Increases overall turnover while minimizing directional risk.

Predictive Analytics for Turnover Forecasting

- Use historical turnover data and market indicators to forecast periods of high activity.

- Plan trades strategically to coincide with peak turnover periods, enhancing execution efficiency.

Comparative Analysis of Turnover Strategies

| Strategy | Pros | Cons | Best For |

|---|---|---|---|

| Algorithmic Execution | High efficiency, reduces slippage | High tech requirements | High-frequency traders |

| Dynamic Positioning & Portfolio Rotation | Risk-adjusted turnover, adaptable | Requires monitoring | Day traders & swing traders |

| Market Microstructure Optimization | Precise execution, informed decisions | Complex modeling | Quantitative analysts |

| Cross-Exchange Arbitrage | Exploits inefficiencies | Infrastructure intensive | Institutional traders |

Optimal Approach: Combining algorithmic execution with dynamic position sizing provides a balance of high turnover, risk management, and adaptability to market conditions.

Practical Tools and Resources

- Turnover Analysis Software: Platforms offering real-time turnover visualization and reporting.

- APIs for Liquidity Data: Integrate live market turnover metrics into trading algorithms.

- Backtesting Tools: Evaluate how turnover optimization strategies perform under historical market conditions.

FAQ – Turnover Optimization in Perpetual Markets

1. How can retail traders improve turnover in perpetual markets?

Retail traders can focus on using limit orders during high-liquidity periods, employing smaller trade sizes to avoid slippage, and monitoring turnover trends across multiple contracts for opportunities.

2. Is high turnover always beneficial for profits?

Not necessarily. While higher turnover indicates liquidity and trading opportunities, excessive turnover can increase transaction costs and amplify exposure to short-term volatility. Efficiency and strategic execution are key.

3. How do turnover strategies differ for institutional vs. retail traders?

Institutions leverage advanced algorithms, cross-exchange arbitrage, and large-scale portfolio rotation, while retail traders typically rely on order timing, position sizing, and targeted liquidity windows to optimize turnover.

Conclusion

Turnover optimization techniques in perpetual markets are essential for maximizing liquidity, enhancing execution efficiency, and boosting profitability. By combining algorithmic execution, dynamic position sizing, and leveraging market insights, skilled traders can maintain high turnover while minimizing risk exposure. Understanding turnover dynamics, monitoring trends, and employing predictive analytics allow traders to remain agile and competitive in the fast-moving perpetual futures landscape.

Comprehensive workflow illustrating turnover optimization from market analysis to execution and performance tracking.

Implementing these strategies with discipline and technology ensures traders can maximize market participation, improve profitability, and sustainably manage risk in perpetual markets.