======================================================

Understanding volume analysis is a crucial skill for anyone entering the world of perpetual futures trading, especially beginners. Volume provides insights into market activity, liquidity, and potential price movements, helping traders make more informed decisions. This comprehensive guide explores the fundamentals of volume analysis, key strategies, and practical methods tailored for beginner perpetual futures traders.

Understanding Volume in Perpetual Futures

What Is Trading Volume?

Trading volume refers to the number of contracts traded within a given period. In perpetual futures markets, volume indicates the level of market participation and reflects the intensity of buying and selling pressure.

- High volume often signifies strong interest and can validate price trends.

- Low volume may indicate market uncertainty or the potential for price manipulation.

Internal Link: Learn how to calculate trading volume in perpetual futures to track market activity accurately.

Why Volume Matters in Perpetual Futures

Volume is not just a number; it provides actionable insights for traders:

- Trend Confirmation: High volume during a price increase confirms bullish sentiment, while high volume during a decline confirms bearish momentum.

- Liquidity Assessment: Understanding volume helps traders evaluate the ease of entering and exiting positions.

- Volatility Prediction: Sudden spikes in volume often precede significant price movements.

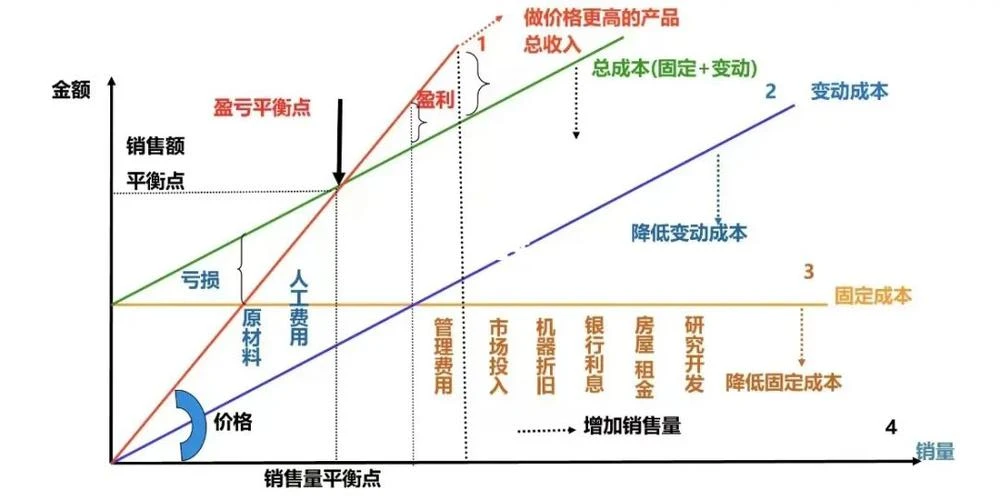

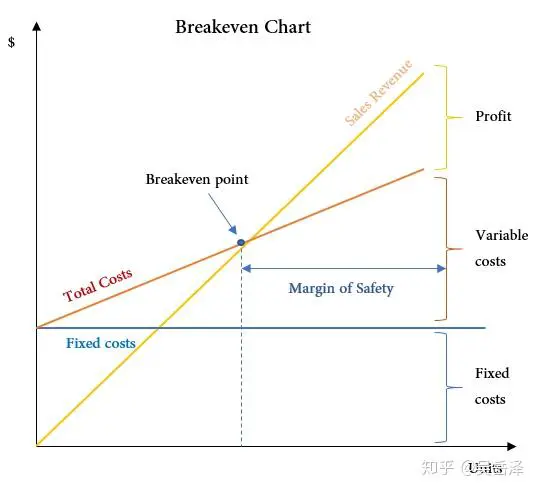

Graph illustrating how trading volume correlates with price movement in perpetual futures.

Key Volume Analysis Methods

Method 1: Volume Indicators

Overview

Volume indicators combine price and volume data to provide actionable signals. Popular indicators include:

- Volume Moving Average (VMA): Smooths volume data to identify trends.

- On-Balance Volume (OBV): Measures buying and selling pressure.

- Volume Weighted Average Price (VWAP): Shows average price based on volume distribution.

Advantages

- Provides objective measures of market activity.

- Can be combined with technical analysis for enhanced insights.

Limitations

- Lagging indicators may not capture rapid market changes in real-time.

- Requires proper calibration to avoid false signals.

Method 2: Volume-Price Analysis

Overview

Volume-price analysis focuses on how volume interacts with price action to identify potential market moves:

- Rising Prices + Rising Volume: Trend confirmation.

- Rising Prices + Falling Volume: Potential trend reversal.

- Falling Prices + Rising Volume: Strong selling pressure.

- Falling Prices + Falling Volume: Weak downtrend, potential consolidation.

Advantages

- Simple and intuitive, suitable for beginners.

- Provides early warnings of trend reversals.

Limitations

- Interpretation can be subjective without supporting indicators.

- Requires consistent observation of volume patterns.

Internal Link: For further insights, see why monitor volume in perpetual futures to understand its impact on trading decisions.

Chart showing examples of volume-price relationships in perpetual futures trading.

Method 3: Volume Profile Analysis

Overview

Volume profile analysis examines volume distribution across different price levels, identifying support and resistance zones:

- High-Volume Nodes (HVNs): Price levels with significant trading activity, often acting as support/resistance.

- Low-Volume Nodes (LVNs): Price levels with low activity, often leading to fast price movement when breached.

Advantages

- Provides precise areas for trade entry and exit.

- Enhances risk management by defining key price levels.

Limitations

- Requires historical data and charting tools.

- Complex for beginners without proper guidance.

Practical Volume Strategies for Beginners

Strategy 1: Trend Confirmation with Volume

- Use OBV or VMA alongside candlestick patterns.

- Confirm breakout or breakdown only if volume supports the move.

- Avoid trading on low-volume signals to reduce false breakouts.

Strategy 2: Volume Spike Alert System

- Set automated alerts for sudden volume increases.

- High volume spikes often indicate institutional activity or major market shifts.

- Combine with price action analysis for better timing of entries and exits.

Strategy 3: Integrating Volume with Risk Management

- Adjust position sizes based on observed liquidity.

- Avoid entering large positions during low-volume periods to minimize slippage.

- Monitor volume trends across multiple timeframes for consistency.

Example showing how a volume spike preceded a breakout in perpetual futures.

Comparing Volume Analysis Methods

| Method | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Volume Indicators | Objective, integrates with technical analysis | Lagging, may generate false signals | Trend confirmation and signal filtering |

| Volume-Price Analysis | Simple, intuitive | Subjective, requires practice | Identifying trend reversals and market momentum |

| Volume Profile | Precise support/resistance identification | Requires historical data, complex | Defining entry/exit points and risk zones |

Advanced Tips for Beginner Traders

- Combine Methods: Using indicators, price-volume analysis, and volume profiles together provides a comprehensive understanding.

- Use Historical Data: Backtesting strategies using historical volume data helps refine trading decisions.

- Track Multiple Timeframes: Daily, hourly, and minute-level volume trends offer different perspectives.

- Practical Tools: Beginners can leverage volume calculators and charting platforms to automate analysis and reduce manual effort.

FAQs

1. How do I calculate trading volume in perpetual futures?

Trading volume is calculated by summing the total number of contracts traded over a specific period. Many platforms provide built-in volume metrics, but manual calculation can be done by totaling executed buy and sell orders.

2. Why is volume important in perpetual futures trading?

Volume indicates market participation, liquidity, and momentum. It helps traders distinguish between strong trends and false breakouts, ensuring safer entry and exit points.

3. Where can I find volume indicators for perpetual futures?

Most exchanges and trading platforms provide built-in volume indicators, such as OBV, VMA, and VWAP. Additionally, third-party charting tools and analytics platforms offer advanced visualization and alerts.

Conclusion

Volume analysis is an indispensable tool for beginner perpetual futures traders. By understanding how volume interacts with price, using volume indicators, and implementing volume-based strategies, traders can make more informed decisions, manage risk, and improve trading performance.

Monitoring volume trends, combining multiple analytical methods, and applying practical tools will empower beginners to navigate the fast-paced perpetual futures markets confidently.

Visual representation of a successful trade guided by volume analysis and risk management.

This comprehensive guide equips beginners with the knowledge to perform volume analysis for perpetual futures, helping them transition from novice traders to informed market participants.