======================================

Introduction

The rise of perpetual futures has transformed the global derivatives landscape. As crypto traders and institutions increasingly adopt perpetual contracts, perpetual futures volume forecast 2023 has become a key research focus for both investors and analysts. Trading volume is not just a reflection of market activity — it is a critical indicator of liquidity, market sentiment, and volatility expectations.

This article provides an in-depth exploration of perpetual futures volume trends in 2023, analyzing factors driving growth, forecasting models, and trading strategies. We will examine two major approaches to volume forecasting, evaluate their pros and cons, and recommend best practices for traders and institutions.

What Are Perpetual Futures?

Definition and Key Characteristics

Perpetual futures are derivative contracts similar to traditional futures but without an expiration date. Instead, they use funding rates to ensure prices remain close to the underlying asset’s spot price.

Key characteristics include:

- No fixed settlement date.

- Use of funding payments between long and short positions.

- High leverage opportunities.

- Significant role in crypto markets, particularly on exchanges like Binance, Bybit, and OKX.

Why Volume Matters in Perpetual Futures

Volume is the backbone of perpetual futures trading. It indicates:

- Liquidity levels — higher volume often means lower slippage.

- Market participation — volume reflects the degree of trader interest.

- Volatility signals — sudden spikes often precede major price moves.

As highlighted in studies of how perpetual futures volume impacts liquidity, volume serves as both a predictive and confirmatory metric for market trends.

Perpetual Futures Market Trends in 2023

Market Growth

In 2023, perpetual futures remain the dominant product in crypto derivatives, accounting for over 70% of total trading activity on major platforms. Despite market corrections, trading activity in perpetual contracts has shown resilience, with daily volumes often exceeding billions of dollars.

Key Drivers of 2023 Volume

- Institutional Participation: Hedge funds and family offices increasingly use perpetual futures for hedging and speculative purposes.

- Retail Growth: Lower barriers to entry and access to leverage attract retail traders globally.

- Volatility Events: Macroeconomic uncertainty, regulatory changes, and crypto market shocks drive volume spikes.

- Technological Tools: More advanced volume analysis for beginner perpetual futures traders and institutional platforms make forecasting more reliable.

Forecasting Methods for Perpetual Futures Volume

1. Historical Data and Statistical Models

One traditional way to forecast trading volume is to analyze historical data using time-series models such as ARIMA, GARCH, or Exponential Smoothing.

Advantages:

- Data-driven and objective.

- Useful for identifying seasonality and cyclical patterns.

Limitations:

- Struggles with sudden market shocks (e.g., black swan events).

- Relies heavily on clean, high-quality historical data.

Practical application: Many traders rely on where to get historical volume data for perpetual futures, such as exchange APIs or market data providers, to build these models.

2. Machine Learning and AI-Driven Models

The second approach involves AI-based forecasting using algorithms like Random Forests, LSTMs (Long Short-Term Memory networks), and Gradient Boosting. These models can capture non-linear relationships between trading volume and external factors such as news sentiment, funding rates, and volatility indexes.

Advantages:

- Adapts to changing market regimes.

- Incorporates diverse variables (macroeconomic events, on-chain data, sentiment analysis).

Limitations:

- Requires large datasets and computational resources.

- Potential for overfitting if not properly validated.

Machine learning models are increasingly used by institutional players and quant firms, especially those integrating volume prediction models with automated trading systems.

Comparing Forecasting Strategies

| Method | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Statistical Models | Traders seeking simplicity | Transparent, data-driven | Limited adaptability |

| AI Models | Institutional investors, quants | Handles complexity, adapts to trends | Data-intensive, risk of overfitting |

Recommendation: For 2023 and beyond, a hybrid approach combining statistical baselines with machine learning adjustments provides the most robust framework for volume forecasting.

Perpetual Futures Volume Case Studies

Example 1: Volume Spikes in Bitcoin Perpetual Futures

When Bitcoin broke above \(30,000 in 2023, perpetual futures volume surged, with daily contracts traded exceeding \)50B. This confirmed the principle of how volume spikes indicate price changes in perpetual futures.

Example 2: Low-Volume Risks in Altcoin Perpetual Futures

Smaller altcoin perpetual contracts often suffer from low volume, leading to higher slippage and manipulation risks. This validates the insight that why low volume risky in perpetual futures is an essential consideration for both retail and institutional traders.

Visual Insights

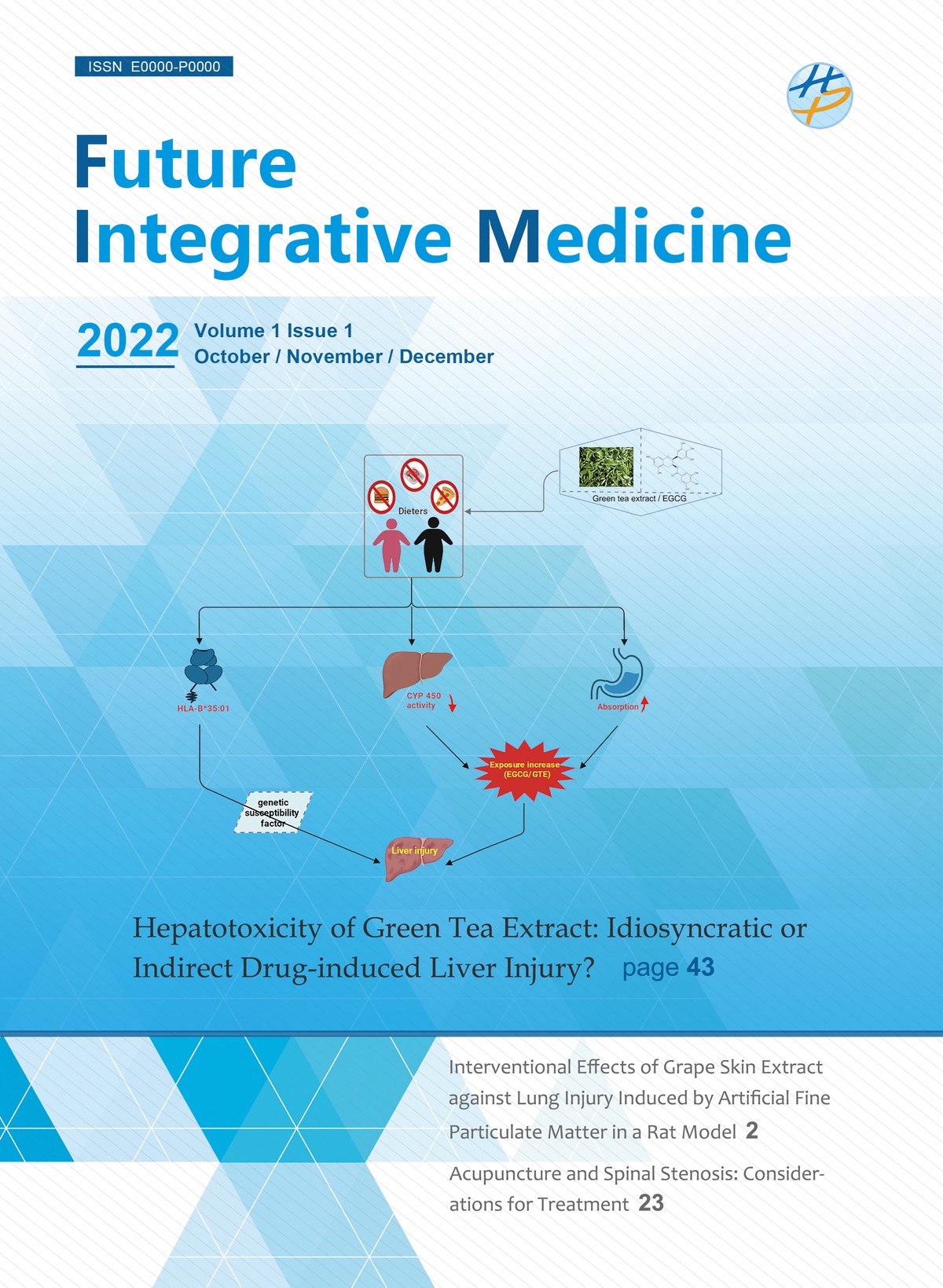

Perpetual futures volume trends and forecast for 2023

Practical Strategies for Traders

1. Volume-Weighted Strategies

Using VWAP (Volume-Weighted Average Price) or OBV (On-Balance Volume) indicators helps align trades with the strength of market participation.

2. Cross-Market Volume Analysis

Comparing perpetual futures volume with spot market volume provides insight into speculative versus hedging demand.

3. Risk Management via Volume Monitoring

Traders should monitor volume alerts for retail perpetual futures traders to identify liquidity squeezes and avoid slippage-heavy markets.

FAQs: Perpetual Futures Volume Forecast 2023

1. How does volume affect perpetual futures prices?

Volume affects order book depth and slippage. High volume usually narrows spreads, while low volume increases volatility and risks of price manipulation. This reflects the principle of how volume affects perpetual futures prices.

2. Where can I find reliable perpetual futures volume data?

Reliable data sources include exchange APIs (Binance, Bybit, OKX), market analytics platforms like Glassnode and Kaiko, and specialized perpetual futures volume analysis reports.

3. Is high perpetual futures volume always good for traders?

Not necessarily. While high volume generally indicates strong liquidity, volume driven by extreme speculation can signal unsustainable price moves. Traders must balance opportunities with risk assessment.

Conclusion

The perpetual futures volume forecast 2023 shows that despite market volatility, these instruments continue to dominate crypto derivatives. Volume forecasting, whether through historical statistical models or advanced AI-driven techniques, plays a central role in understanding liquidity trends and anticipating price movements.

For traders, monitoring volume is not optional — it is a critical risk management and strategy optimization tool. Institutions and advanced investors should lean toward hybrid forecasting models, while retail traders can benefit from simplified volume indicators and tutorials.

Call to Action

What’s your take on perpetual futures volume in 2023?

Share this article with fellow traders, comment with your experiences, and let’s discuss which forecasting methods work best in different market conditions.

Would you like me to create a step-by-step tutorial on building a perpetual futures volume prediction model using real market data?