============================================

Introduction

In today’s fast-moving crypto derivatives markets, traders need reliable tools to evaluate risk, forecast market behavior, and optimize strategies. Among these tools, perpetual futures volume simulation software has become increasingly important. This specialized software allows traders to simulate different trading volumes, analyze liquidity conditions, and understand how volume impacts price discovery in perpetual futures markets.

Unlike traditional backtesting, which primarily focuses on price, perpetual futures volume simulation integrates market depth, order book activity, and trading behavior. This provides a more realistic perspective of how strategies might perform under varying liquidity scenarios.

In this article, we will explore the fundamentals of perpetual futures volume simulation, compare leading approaches, and evaluate their advantages and limitations. We’ll also look at practical use cases, industry trends, and professional tips for implementation.

Why Perpetual Futures Volume Simulation Matters

Volume as a Key Trading Metric

Volume is one of the most critical indicators in futures trading. It represents the amount of contracts traded within a given timeframe, and it directly influences liquidity, volatility, and execution quality. Traders monitor volume to determine:

- Liquidity availability: High volume indicates a liquid market, reducing slippage.

- Price momentum: Sudden spikes in volume often signal price breakouts.

- Market sentiment: Sustained increases in volume reflect strong trader participation.

Understanding how to calculate trading volume in perpetual futures is essential for both beginners and professionals, as it lays the foundation for simulation accuracy.

Why Simulation Is Critical

Live trading environments are unpredictable. Without testing under different volume conditions, traders risk executing strategies that fail in real-world scenarios. Simulation helps mitigate this risk by:

- Modeling high and low liquidity environments.

- Stress-testing strategies against volume spikes and droughts.

- Preparing traders for unexpected order execution delays or slippage.

Core Features of Perpetual Futures Volume Simulation Software

1. Historical Volume Replay

Traders can replay past market conditions, analyzing how strategies would have performed during both stable and volatile periods.

2. Order Book Simulation

Advanced software replicates real order book depth, ensuring traders understand execution quality under different liquidity levels.

3. Scenario Testing

Users can simulate what happens if volume doubles, halves, or spikes unexpectedly, helping traders plan for diverse situations.

4. Performance Metrics

Key indicators such as win rate, slippage, PnL under different volumes, and risk-adjusted returns are measured and compared.

Methods of Volume Simulation in Perpetual Futures

Method 1: Monte Carlo Simulation

Monte Carlo models generate thousands of randomized scenarios based on historical volume data. This method is powerful for stress-testing extreme situations.

- Advantages: Captures rare but impactful events, such as sudden liquidity crashes.

- Disadvantages: Computationally intensive and may overestimate risks.

Method 2: Agent-Based Simulation

Agent-based models replicate the behavior of market participants (e.g., retail traders, institutions, market makers) and simulate interactions.

- Advantages: Provides realistic microstructure insights, including how liquidity providers react to volume changes.

- Disadvantages: Requires complex modeling and assumptions about trader behavior.

Recommendation

For most traders, a hybrid approach—combining Monte Carlo simulations with agent-based logic—delivers the most balanced results, capturing both statistical randomness and market psychology.

Comparing Professional vs. Retail Volume Simulation Tools

| Feature | Professional Platforms (e.g., TT, CQG) | Retail Platforms (e.g., CryptoSim, Tradovate add-ons) |

|---|---|---|

| Data Depth | Institutional-level order book, tick-by-tick | Limited, often OHLC with volume |

| Customization | Highly flexible, API access | Basic scenario settings |

| Cost | High subscription or license fees | Affordable, sometimes free |

| User Base | Institutional, hedge funds, quant desks | Retail day traders, crypto enthusiasts |

For traders starting out, retail software provides a good entry point. Professionals, however, benefit from institutional-grade tools that integrate historical tick-level data and AI-driven forecasting.

How Volume Simulation Improves Trading Strategies

Risk Management

By testing how strategies behave during volume spikes, traders avoid catastrophic losses when liquidity vanishes.

Strategy Optimization

Simulation helps refine entry/exit timing by aligning with liquidity zones. For example, traders can test how volume affects perpetual futures prices during funding rate changes.

Confidence Building

New traders often lack the confidence to execute strategies. Simulation provides hands-on practice without real capital at risk.

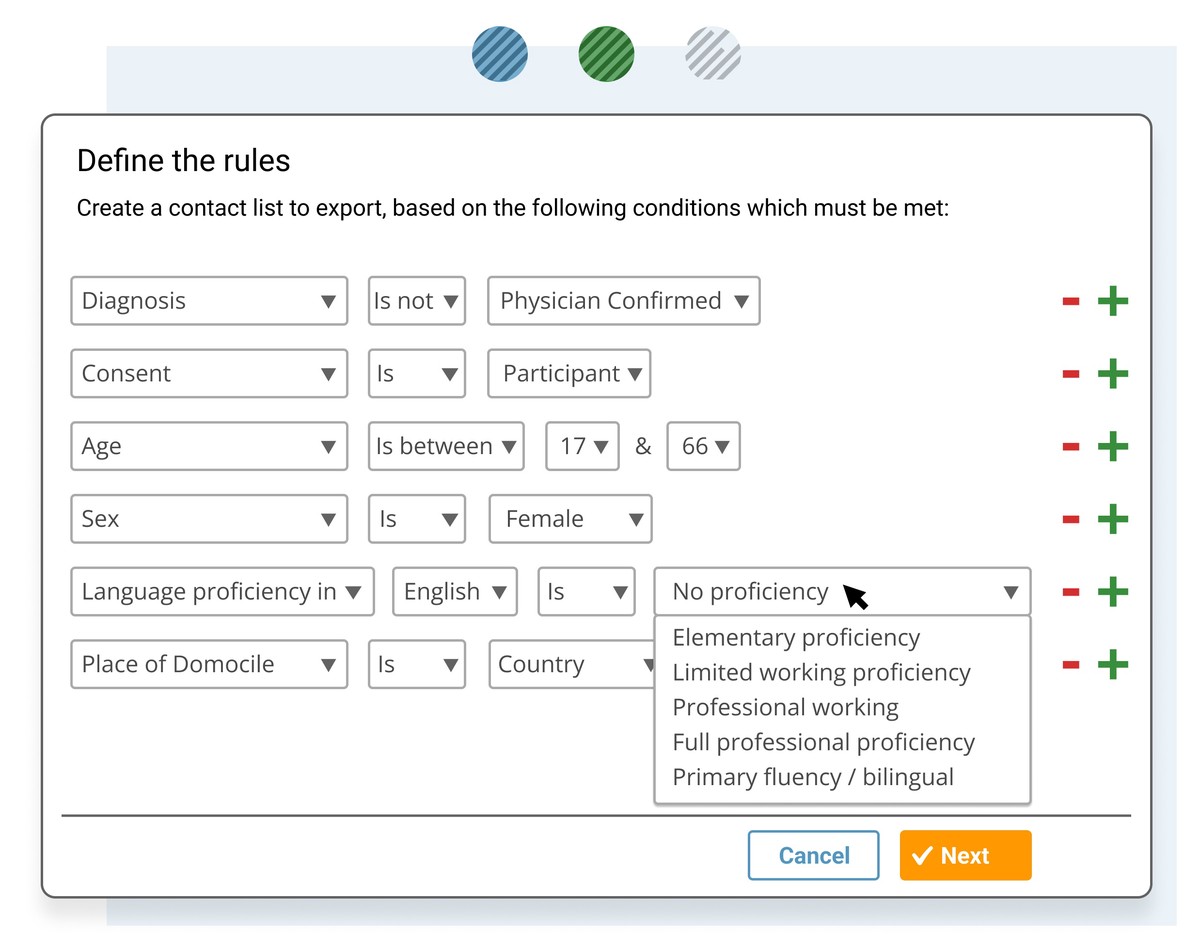

Visualizing Volume Simulation

Perpetual Futures Volume Simulation Dashboard

Best Practices in Using Perpetual Futures Volume Simulation Software

- Integrate Volume Indicators – Combine simulation with real-world tools like VWAP, OBV, and CVD. Many traders also explore where to find volume indicators for perpetual futures to align simulation outputs with practical analysis.

- Test Multiple Market Conditions – Simulate both bull and bear markets to ensure strategy resilience.

- Incorporate Fees and Slippage – Accurate simulations must include trading costs.

- Update with Fresh Data – Markets evolve; simulations must reflect recent order book behavior.

Real-World Example: Simulation in a Funding Rate Strategy

A trader designs a funding arbitrage system, earning from funding rate imbalances. By simulating volume under different conditions:

- In high-volume markets, execution is smooth with minimal slippage.

- In low-volume markets, slippage erodes profits, negating arbitrage gains.

The trader concludes that the strategy is viable only when daily trading volume exceeds $500M on the targeted exchange.

Industry Trends in Volume Simulation

- AI Integration: Machine learning models predict volume patterns and simulate scenarios with higher accuracy.

- Cloud-Based Platforms: Scalable solutions allow traders to run simulations without hardware limitations.

- Retail Access Expansion: Exchanges are beginning to offer built-in simulation features for onboarding traders.

Internal Linking for SEO

Volume simulation is only as good as the underlying data. Traders must understand why is volume important in perpetual futures trading to ensure that simulation insights translate into live trading performance. Additionally, monitoring how volume spikes indicate price changes in perpetual futures helps traders anticipate market reversals more effectively.

FAQ

1. Can volume simulation software predict future price moves?

Not directly. Simulation models scenarios based on historical and synthetic data. While it doesn’t guarantee predictions, it helps traders prepare for various outcomes by stress-testing strategies.

2. Is perpetual futures volume simulation useful for beginners?

Absolutely. Beginners can practice trading strategies in a risk-free environment. They can also learn how different volume conditions affect execution, providing a valuable learning curve before live trading.

3. What’s the difference between backtesting and volume simulation?

- Backtesting focuses on price and indicator-based strategy testing.

- Volume simulation incorporates liquidity, order book depth, and execution costs, giving a more realistic picture of performance.

Conclusion

Perpetual futures volume simulation software is no longer a luxury; it’s a necessity for serious traders. Whether you’re a beginner learning market microstructure or an institutional investor refining complex strategies, volume simulation provides insights that price-only backtesting cannot.

By integrating robust simulation tools, monitoring live volume metrics, and aligning with liquidity-driven strategies, traders can achieve stronger, more resilient performance in perpetual futures markets.

Volume Simulation Impact Analysis

Call to Action

Do you use perpetual futures volume simulation software in your trading process? Share your experience in the comments below, and spread this article with fellow traders who want to strengthen their strategies with advanced simulation tools.