========================================

The bitcoin perpetual futures market outlook is one of the most closely watched areas in the cryptocurrency ecosystem. With the rapid growth of derivative trading and the increasing participation of institutional and retail traders, perpetual contracts have become the cornerstone of modern crypto markets. They provide traders with opportunities to hedge, speculate, and gain exposure to Bitcoin without owning the underlying asset. This article explores the current state of the market, strategies used by traders, potential risks, and where the industry is heading.

Introduction to Bitcoin Perpetual Futures

What Are Bitcoin Perpetual Futures?

Bitcoin perpetual futures are derivative contracts that allow traders to speculate on the future price of Bitcoin without expiration dates. Unlike traditional futures, they can be held indefinitely as long as margin requirements are met.

These contracts are kept in line with spot market prices through a funding rate mechanism, where long and short traders pay each other depending on market conditions. Understanding this system is crucial for analyzing the bitcoin perpetual futures market outlook.

Why They Matter

- High liquidity: Perpetual futures often have higher daily trading volumes than spot markets.

- Leverage opportunities: Traders can amplify returns (and risks) with leverage.

- Market impact: Perpetual futures directly influence spot prices due to arbitrage activities.

Current Market Trends in Bitcoin Perpetual Futures

Rising Institutional Participation

Institutional investors are increasingly adopting Bitcoin perpetual futures. Major trading firms and hedge funds use them for hedging and speculation, adding legitimacy to the market.

Increased Retail Activity

Platforms like Binance, Bybit, and OKX have made perpetual futures accessible to retail traders worldwide. Retail volumes now account for a significant portion of daily activity.

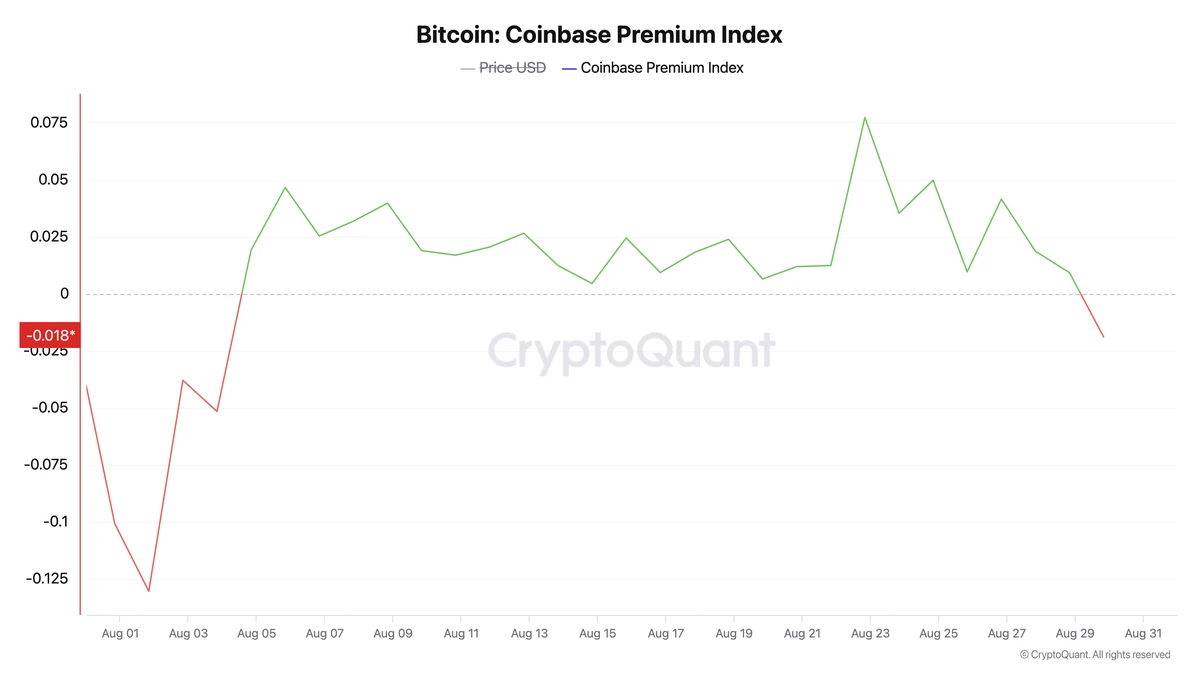

Correlation With Spot Markets

The funding rate mechanism ensures perpetual contracts stay close to Bitcoin’s spot price, but during volatile events, decoupling may occur, creating arbitrage opportunities.

Bitcoin perpetual futures volume comparison

Methods and Strategies in Bitcoin Perpetual Futures

1. Hedging Strategies

Traders often use perpetual futures to protect against price swings. For example, miners hedge future Bitcoin production to lock in stable revenue streams.

- Pros: Reduces exposure to market volatility; ideal for long-term players.

- Cons: Requires careful monitoring of margin and funding rates.

2. Speculative Leverage Trading

High leverage attracts speculators aiming for quick profits. While potentially rewarding, it also increases liquidation risks.

- Pros: Potential for outsized gains; suitable for short-term momentum traders.

- Cons: High risk of liquidation, especially in volatile markets.

3. Arbitrage Opportunities

Professional traders engage in funding rate arbitrage—going long in spot while shorting perpetual futures, or vice versa.

- Pros: Low-risk profits if executed correctly.

- Cons: Requires significant capital and technical expertise.

Recommendation: For most traders, a balanced strategy that combines hedging with moderate leverage is the best approach. Understanding how to analyze bitcoin perpetual futures market helps in creating effective strategies.

Risk Factors in the Bitcoin Perpetual Futures Market

Funding Rate Volatility

Sudden changes in funding rates can erode profits or increase costs for traders holding positions long-term.

Leverage-Induced Liquidations

High leverage magnifies both gains and losses. Liquidations are common during sharp price swings, causing cascading effects.

Market Manipulation Concerns

Whales and large institutions can influence funding rates or trigger liquidation cascades, creating challenges for smaller traders.

Bitcoin Perpetual Futures Market Outlook for 2024 and Beyond

Increased Regulation

Governments are paying closer attention to crypto derivatives. Stricter compliance requirements may reduce risks but could limit leverage offerings.

Growing Institutional Infrastructure

CME and other regulated platforms are expanding Bitcoin derivative products, attracting more professional investors.

Integration With Traditional Finance

We may see perpetual futures integrated into broader financial instruments, enabling hybrid trading strategies between crypto and equities.

Expanding Educational Resources

More platforms now offer courses on bitcoin perpetual futures for beginners, reflecting growing demand for structured learning.

Personal Insights and Industry Experience

From my experience, the perpetual futures market has matured dramatically in the past three years. Early trading environments were dominated by retail speculation with little oversight, but today, algorithmic traders, institutional desks, and risk managers play an increasingly large role.

A key takeaway is that traders who understand how bitcoin perpetual futures affect price and apply risk management tools have a significant advantage. Blind leverage trading, while exciting, has historically led to higher liquidation rates among retail participants.

FAQ: Bitcoin Perpetual Futures Market Outlook

1. How do bitcoin perpetual futures differ from traditional futures?

Unlike traditional futures, perpetual futures have no expiration date. They rely on funding rates to keep prices close to spot markets, whereas traditional contracts settle on fixed dates.

2. Are bitcoin perpetual futures suitable for beginners?

Yes, but with caution. Beginners should start with low leverage and understand the mechanics of funding rates before entering larger positions. Platforms often provide demo accounts to practice.

3. How do bitcoin perpetual futures impact Bitcoin’s overall price?

Perpetual futures can amplify spot price volatility. Large positions in the futures market often trigger liquidation cascades, which in turn affect spot markets. However, they also improve liquidity and price discovery.

Conclusion: The Future of Bitcoin Perpetual Futures

The bitcoin perpetual futures market outlook remains strong, with rising adoption among both institutional and retail investors. As regulatory clarity improves and trading infrastructure matures, perpetual futures are set to play an even bigger role in Bitcoin’s global market structure.

For traders, the key lies in education, discipline, and risk management. Whether you are hedging, speculating, or arbitraging, perpetual futures can be powerful tools—if used responsibly.

💬 What’s your outlook on bitcoin perpetual futures? Share this article, leave a comment with your perspective, and join the discussion to help shape the future of crypto derivatives.