================================================

Introduction: The Rise of Perpetual Futures

Perpetual futures contracts have become one of the most popular derivatives in the cryptocurrency and broader financial markets. Unlike traditional futures, perpetual contracts do not have an expiry date, making them attractive for traders who want to hold positions indefinitely while benefiting from leverage.

But the real question for newcomers and even seasoned investors is: where to learn about perpetual futures contracts in a structured, reliable, and professional way? With the abundance of resources online, it’s easy to get lost in the noise. This article provides a detailed roadmap for learning, explores the best educational platforms, compares self-learning versus structured training, and answers the most common questions traders ask when entering this dynamic field.

Understanding Perpetual Futures Contracts

What Makes Perpetual Futures Unique

A perpetual futures contract is a derivative that tracks the price of an underlying asset—commonly cryptocurrencies like Bitcoin or Ethereum—without an expiration date. Traders can keep positions open as long as they meet margin requirements.

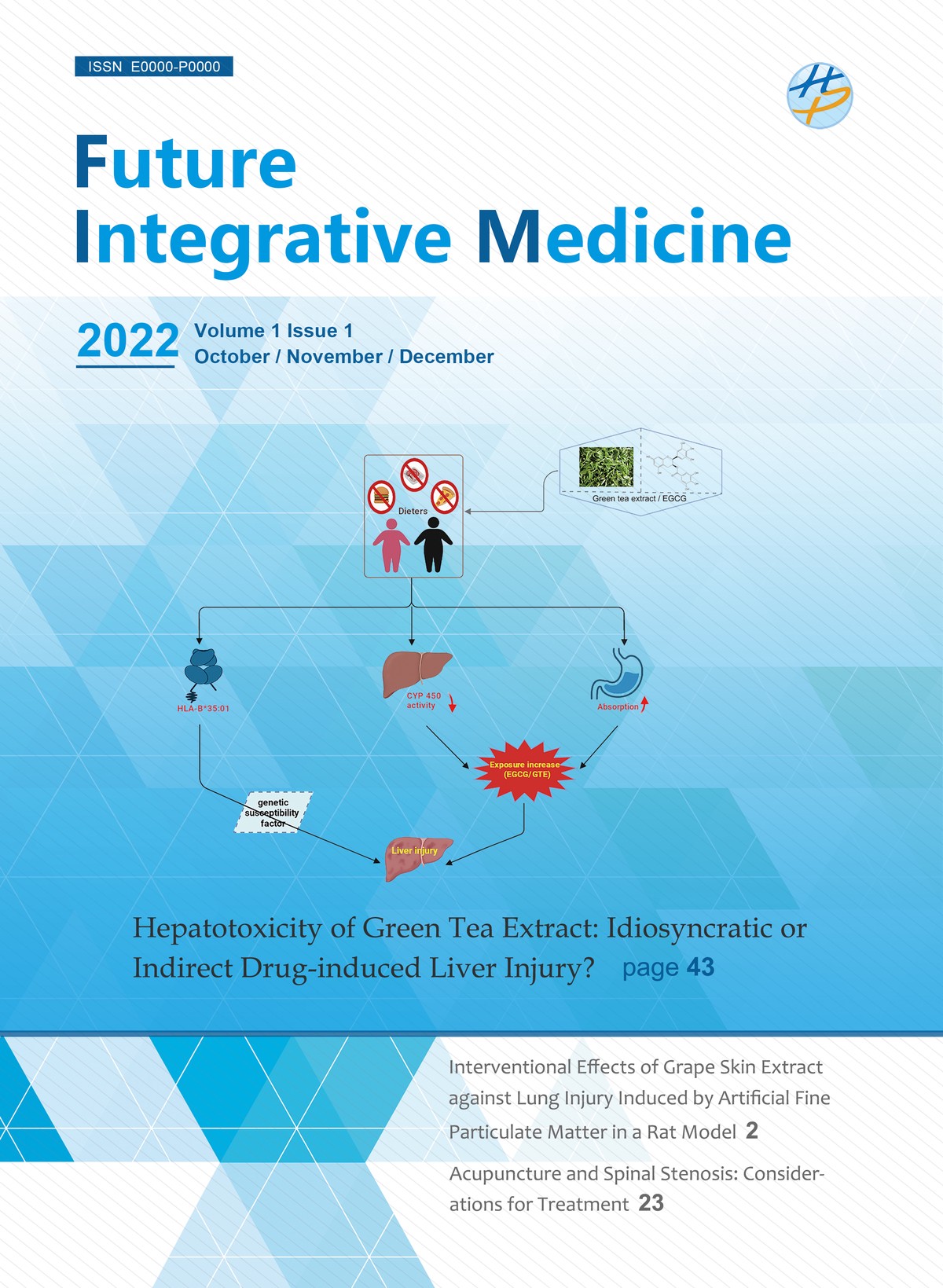

The defining feature is the funding rate mechanism, which ensures that the perpetual price stays aligned with the spot market. If the perpetual trades above the spot price, long traders pay short traders, and vice versa.

For beginners wondering how does a perpetual futures contract work, this mechanism is the backbone of maintaining price stability in the perpetual market.

Perpetual futures contracts stay aligned with spot prices using funding rate payments between long and short traders.

Benefits of Learning Perpetual Futures

- Leverage opportunities: Amplify gains (and risks) with smaller capital.

- Hedging strategies: Hedge against spot market exposure.

- Liquidity and popularity: Major exchanges offer deep liquidity for perpetual markets.

- Flexibility: No expiry date means positions can be held indefinitely.

Where to Learn About Perpetual Futures Contracts

1. Online Learning Platforms

Structured courses on platforms like Coursera, Udemy, and Binance Academy provide beginner-friendly introductions and advanced modules.

- Pros: Organized content, expert instructors, certification options.

- Cons: Some courses are outdated, require payment.

- Best For: Beginners who want a guided learning path.

2. Exchange Academies and Tutorials

Most major exchanges—Binance, Bybit, OKX, and Bitget—offer free, high-quality tutorials and academies dedicated to perpetual trading.

- Pros: Practical, exchange-specific instructions, free of cost.

- Cons: Content may be biased toward promoting their platform.

- Best For: Traders who plan to trade directly on these platforms.

3. Books and Research Papers

Academic-style resources provide depth and theory behind perpetual futures contracts.

- Pros: Comprehensive understanding, suitable for professional or institutional investors.

- Cons: Less practical for active day-to-day trading.

- Best For: Traders seeking strong theoretical and risk management foundations.

4. Communities and Forums

Platforms like Reddit (r/cryptocurrency, r/BitcoinMarkets) and Discord groups offer real-time discussions, trading strategies, and peer-to-peer learning.

- Pros: Interactive, real-world experiences, access to trader insights.

- Cons: Risk of misinformation, no structured curriculum.

- Best For: Intermediate traders seeking market insights and community support.

5. Professional Mentorship and Coaching

Private coaching or joining hedge fund-style trading groups provides tailored, hands-on education.

- Pros: Personalized guidance, access to expert strategies.

- Cons: Expensive, requires careful vetting of mentors.

- Best For: Advanced traders with capital to invest in personalized training.

Different resources for learning perpetual futures: online courses, exchange academies, communities, and mentorship.

Strategies for Learning Perpetual Futures

Strategy 1: Self-Learning Through Free Resources

This approach involves using free materials like YouTube tutorials, blogs, and exchange academies.

- Advantages: Low cost, flexible pace.

- Disadvantages: Risk of incomplete or biased information, lack of structure.

- Best For: Beginners exploring whether trading is right for them.

Strategy 2: Structured Learning with Courses and Mentors

This involves paid courses, private coaching, or enrolling in structured programs offered by trading academies.

- Advantages: Comprehensive, systematic, often includes live simulations.

- Disadvantages: Higher upfront cost.

- Best For: Traders who want to accelerate learning and avoid costly mistakes.

Recommended Approach

A hybrid method works best: start with free resources to build foundational knowledge, then transition to structured paid learning to refine skills and gain professional strategies. This ensures both cost-effectiveness and credibility.

Practical Applications of Learning

For Day Traders

Day traders rely on perpetual futures for intraday opportunities. Learning resources focused on perpetual futures contracts for day traders are highly relevant here, as they emphasize short-term technical setups, risk control, and fast execution.

For Institutional Investors

Institutions adopt perpetuals for hedging and liquidity. Training should cover risk management for perpetual futures contracts, compliance, and institutional-grade strategy building.

Day traders focus on perpetual futures for short-term moves and leverage opportunities.

Common Challenges in Learning Perpetual Futures

Complexity of Leverage and Funding

Many beginners underestimate the impact of leverage. Misuse can amplify losses quickly.

Over-Reliance on Signal Groups

While communities can be helpful, relying solely on signals prevents traders from building independent judgment.

Lack of Risk Management

Without proper stop-losses and margin management, perpetual trading can lead to liquidation events.

FAQs

1. What is the best place to start learning perpetual futures contracts?

The best starting point is exchange academies like Binance Academy or Bybit Learn. They provide free, structured, and practical lessons designed for beginners. Once comfortable, you can expand to structured courses and books for deeper insights.

2. How do perpetual futures contracts differ from traditional futures?

Traditional futures have an expiry date and often settle quarterly or monthly. Perpetual futures, however, have no expiry and use funding rate mechanisms to keep prices aligned with spot markets. For those asking how is a perpetual futures contract different, this is the most important distinction.

3. Can I practice perpetual futures trading without risking real money?

Yes, most exchanges offer demo accounts or paper trading environments where you can simulate trades with virtual funds. This is an excellent way to learn without financial risk.

Conclusion: Take Action on Your Learning Journey

Perpetual futures contracts are powerful tools for traders of all levels—but mastering them requires structured learning, practical experience, and disciplined risk management.

If you’re wondering where to learn about perpetual futures contracts, start with free academies and communities, then transition into structured courses and mentorship for deeper expertise. Whether you’re a beginner or an aspiring professional, the right resources can dramatically shorten your learning curve.

👉 Are you currently learning or trading perpetual futures? Share your experiences, favorite learning platforms, and strategies in the comments below—and don’t forget to share this article with other traders who want to master perpetual futures!