============================================================================

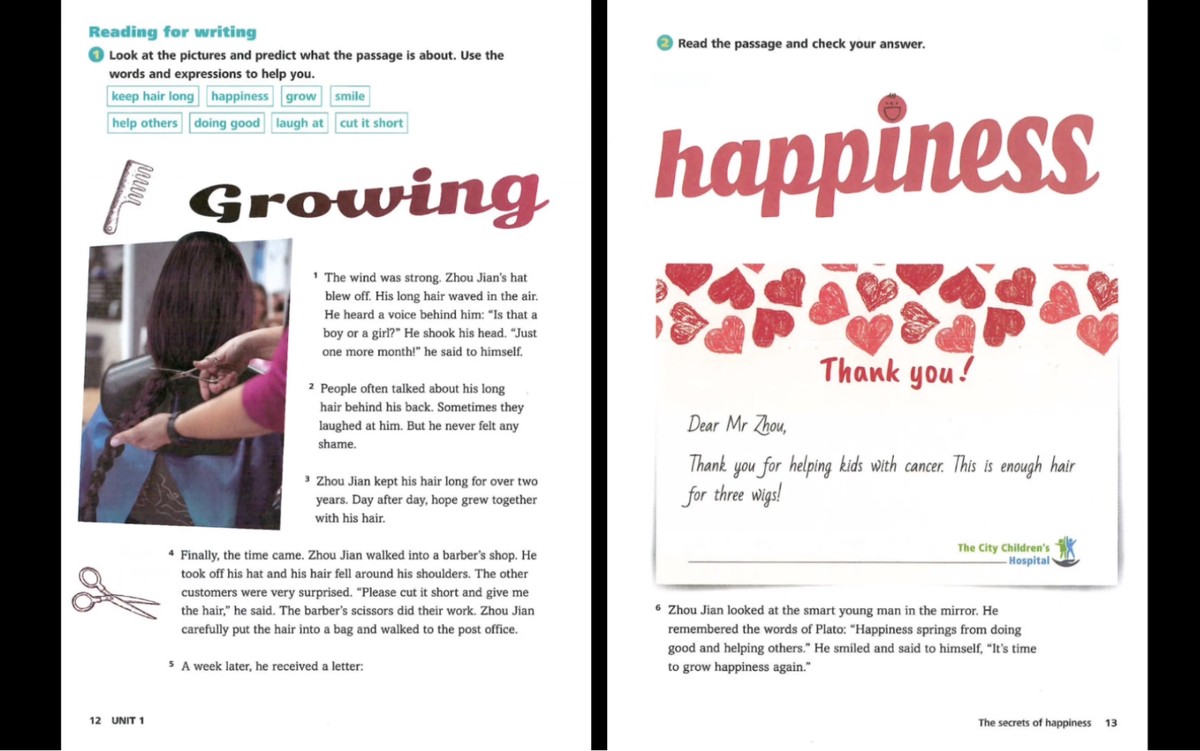

Introduction

If you are asking yourself where to learn about perpetual futures contracts, you are not alone. Perpetual futures have become one of the most widely traded instruments in crypto and traditional markets. They combine the leverage of futures with the flexibility of spot trading—without an expiration date.

However, because perpetual futures are complex instruments, it’s important to approach learning systematically. This article provides a step-by-step guide to the best resources, methods, and strategies for learning about perpetual futures. You’ll gain both theoretical foundations and practical insights so you can build your knowledge with confidence.

We’ll also compare different learning strategies, analyze their pros and cons, and offer recommendations for traders at various levels—beginners, professionals, and institutional investors.

What Are Perpetual Futures Contracts?

Defining Perpetual Futures

A perpetual futures contract is a derivative product that allows traders to speculate on the price of an underlying asset (like Bitcoin or Ethereum) without ever needing to settle or deliver the asset. Unlike traditional futures, perpetual contracts have no expiry date.

Key Features

- Funding Rate Mechanism: Balances the contract price with the spot market.

- Leverage: Allows traders to control large positions with relatively small capital.

- 24⁄7 Trading: Especially important in crypto markets.

Understanding these features is critical, which ties closely to how does a perpetual futures contract work.

Where to Learn About Perpetual Futures Contracts

1. Online Trading Academies and Courses

Platforms like Coursera, Udemy, and Binance Academy offer structured learning for both beginners and advanced traders.

Pros:

- Step-by-step explanations.

- Often taught by professionals.

- Certificates to demonstrate skills.

- Step-by-step explanations.

Cons:

- Paid options may be expensive.

- May lack real-world trading simulations.

- Paid options may be expensive.

2. Crypto Exchange Education Hubs

Many top exchanges (Binance, Bybit, OKX) provide free learning hubs dedicated to perpetual futures.

Pros:

- Real-time examples from their own platforms.

- Easy transition from learning to practice.

- Often include webinars and tutorials.

- Real-time examples from their own platforms.

Cons:

- Content may focus only on that exchange’s features.

- Not always comprehensive.

- Content may focus only on that exchange’s features.

3. Books and Academic Resources

Books on derivatives and trading provide deeper insights into perpetual futures mechanics and risk management.

Example: Derivatives Markets by Robert L. McDonald.

Pros:

- In-depth theory and models.

- Great for building strong foundations.

- In-depth theory and models.

Cons:

- Can be too technical for beginners.

- Limited coverage of crypto-specific perpetuals.

- Can be too technical for beginners.

4. Community Learning (Reddit, Discord, Telegram)

Trading communities provide real-time discussions, case studies, and peer support.

Pros:

- Practical tips from active traders.

- Networking opportunities.

- Practical tips from active traders.

Cons:

- Quality of advice varies.

- Risk of misinformation.

- Quality of advice varies.

5. Practice with Demo Accounts

Most exchanges offer paper trading or demo accounts where users can test perpetual futures without risking real money.

Pros:

- Safe environment to practice.

- Builds confidence before live trading.

- Safe environment to practice.

Cons:

- Doesn’t replicate emotions tied to real money.

- Limited by platform restrictions.

- Doesn’t replicate emotions tied to real money.

Visual breakdown of the most common learning resources for perpetual futures contracts

Comparing Learning Strategies

| Learning Method | Best For | Advantages | Drawbacks |

|---|---|---|---|

| Online Courses | Beginners & intermediates | Structured, easy to follow | Costly, sometimes outdated |

| Exchange Hubs | Beginners & retail traders | Free, practical | Limited to one platform |

| Books & Academia | Advanced traders | Strong theory, quantitative depth | Not crypto-specific |

| Communities | All levels | Real-time insights | Risk of bad advice |

| Demo Accounts | Beginners & day traders | Practice without risk | Doesn’t simulate emotions |

Recommendation: Combine exchange education hubs and demo accounts for a strong foundation, then expand into books and communities for deeper expertise.

Advanced Strategies to Deepen Knowledge

Method 1: Simulation and Backtesting

Traders can use Python or specialized platforms (e.g., TradingView Pine Script, QuantConnect) to simulate strategies. This teaches how perpetual futures contracts impact trading when tested against real market data.

Pros:

- Provides measurable results.

- Develops quantitative skills.

Cons:

- Steep learning curve.

- Requires coding knowledge.

Method 2: Mentorship and Professional Programs

For traders who want to go beyond self-learning, mentorship programs or hedge-fund style bootcamps can accelerate expertise.

Pros:

- One-on-one guidance.

- Access to institutional-level insights.

Cons:

- Often expensive.

- Quality depends on the mentor.

An example of a structured roadmap for learning perpetual futures contracts

Risk Management: An Essential Learning Area

When learning perpetual futures, risk management is as important as strategy. Common methods include:

- Setting stop-loss orders.

- Using conservative leverage (2x–5x instead of 20x).

- Diversifying exposure across multiple assets.

This ties directly to how to minimize risk with perpetual futures contracts, an essential area that every beginner should master before trading with real capital.

Common Mistakes to Avoid When Learning

- Skipping Risk Education: Many traders focus on leverage and profits while ignoring downside risks.

- Overreliance on One Source: Relying only on YouTube videos or Discord groups can create knowledge gaps.

- Not Practicing: Without demo accounts, theoretical knowledge has little practical value.

- Chasing High Leverage: Beginners often blow accounts by misusing leverage.

Frequently Asked Questions (FAQ)

1. Is it better to learn perpetual futures from online courses or directly on exchanges?

Both are useful. Courses give structured learning, while exchanges provide hands-on experience. Ideally, use both for well-rounded knowledge.

2. How long does it take to learn perpetual futures contracts?

It depends on your background. Beginners may need 3–6 months of study and practice, while experienced traders can adapt in weeks. Consistent demo trading accelerates the process.

3. Can perpetual futures be self-taught, or do I need professional training?

You can absolutely self-teach through exchange hubs, books, and communities. However, professional training offers accelerated learning and access to advanced techniques that self-learners might miss.

Conclusion: Building Knowledge in Perpetual Futures

Learning perpetual futures contracts is not just about memorizing definitions—it’s about combining structured education, practical simulation, and real-world application.

The best way to approach it is:

- Start with exchange education hubs.

- Practice with demo accounts.

- Expand into books and communities for deeper insights.

- Apply knowledge with real trading—starting small.

By following this roadmap, traders can confidently move from beginners to advanced perpetual futures professionals.

If you found this guide helpful, share it with your trading peers, leave a comment with your learning experiences, and let’s make the world of perpetual futures more accessible to everyone.

Would you like me to create a step-by-step learning roadmap infographic (beginner → intermediate → professional) to visually guide readers through their perpetual futures education journey?