============================================

Perpetual futures have become one of the most dynamic instruments in the financial and crypto markets. For market analysts, identifying perpetual futures trends is essential for forecasting price action, managing risks, and offering actionable insights to investors. Unlike traditional futures, perpetual contracts never expire, and their pricing mechanisms introduce unique opportunities and challenges. This article offers a deep dive into perpetual futures trends for market analysts, exploring strategies, current industry shifts, and best practices for data-driven forecasting.

Understanding Perpetual Futures

Perpetual futures are derivatives that allow traders to speculate on the price of an asset without owning it directly. Unlike regular futures, they have no expiry date, meaning positions can be held indefinitely, provided margin requirements are met.

Key Features of Perpetual Futures

- No Expiry: Traders don’t need to roll over contracts.

- Funding Rate Mechanism: Ensures that prices remain aligned with the underlying spot market.

- Leverage Options: Traders can amplify both profits and losses.

- High Liquidity: Especially prominent in crypto markets.

Analysts often highlight these unique features when explaining how perpetual futures work in trading, since they shape both opportunities and risks.

Why Perpetual Futures Matter for Market Analysts

1. Market Transparency

Perpetual contracts provide continuous real-time pricing, allowing analysts to measure market sentiment more effectively.

2. Risk Management Insights

Because perpetual futures are widely used for hedging, analysts can track large-scale positions to identify institutional strategies.

3. Data Availability

Unlike traditional derivatives, perpetual contracts often come with open interest and funding rate data readily available, which makes it easier to monitor market health.

Current Perpetual Futures Trends

Trend 1: Institutional Adoption

Hedge funds and asset managers are increasingly using perpetual futures to hedge exposure and capture arbitrage opportunities. The launch of regulated perpetual exchanges has further attracted institutional capital.

Trend 2: Advanced Risk Controls

As volatility remains high, there’s a growing focus on risk management solutions in perpetual futures. More firms are integrating dynamic stop-loss systems, cross-margining, and automated liquidation monitoring.

Trend 3: Cross-Market Arbitrage

Arbitrage strategies between perpetual contracts and spot markets continue to dominate. Analysts highlight funding rate disparities as key indicators of market inefficiencies.

Trend 4: Retail Participation

Retail investors now represent a significant portion of perpetual futures volume. Analysts must account for behavior-driven volatility, as retail sentiment can amplify short-term trends.

Two Analytical Approaches for Market Analysts

Approach 1: Quantitative Model-Based Forecasting

This method uses mathematical models, machine learning, and data-driven algorithms to predict perpetual futures movements.

Pros:

- Objective and consistent.

- Capable of handling large datasets (funding rates, open interest, volatility).

- Can detect hidden correlations.

Cons:

- Requires extensive data and computing power.

- Models can fail during black swan events or structural shifts.

Approach 2: Market Microstructure and Behavioral Analysis

This approach focuses on order book depth, retail sentiment, and institutional flows. Analysts track funding rates, liquidation clusters, and volume imbalances.

Pros:

- Useful for short-term predictions.

- Provides insights into why markets move, not just where they might move.

- Captures emotional drivers behind volatility.

Cons:

- Less precise for long-term forecasting.

- Highly dependent on analyst skill and real-time monitoring.

Recommended Approach

A hybrid model combining quantitative forecasting with behavioral insights offers the most robust framework. Analysts can use machine learning for trend detection while integrating human expertise to interpret anomalies.

Case Studies in Perpetual Futures Trends

Case Study 1: Funding Rate Arbitrage

In early 2023, Bitcoin perpetual futures funding rates turned highly positive during a retail-driven rally. Market analysts flagged this as over-leverage risk, leading many institutions to short perps while hedging with spot positions. The outcome confirmed the analyst prediction: a sharp correction followed.

Case Study 2: Institutional Hedging

An asset management firm utilized perpetual futures to hedge against ETH volatility before a major network upgrade. Market analysts tracking open interest data correctly predicted reduced volatility post-event, validating the hedging use case.

Case Study 3: Retail-Driven Liquidations

During a 2022 sell-off, analysts noticed an unusually high concentration of leveraged long positions in perpetuals. Once liquidations began, cascading sell orders triggered a flash crash, highlighting how retail leverage can accelerate downturns.

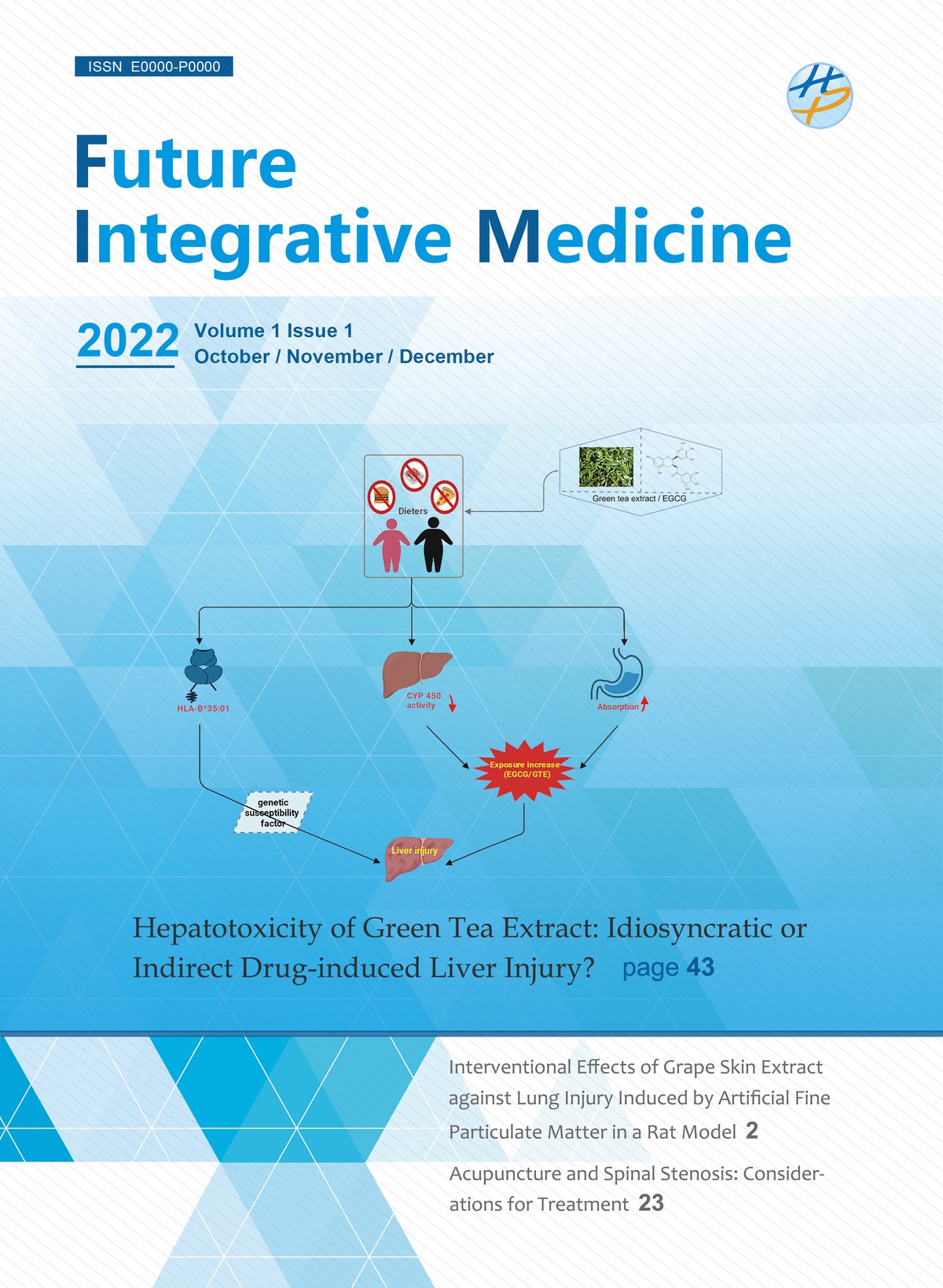

Visual Example: Market Analysts and Perpetual Futures

Analysts use perpetual futures data (funding rates, open interest, volatility metrics) to forecast market movements.

How Perpetual Futures Differ from Regular Futures

Market analysts must be clear about distinctions:

- Expiry Dates: Regular futures expire, while perpetual futures roll indefinitely.

- Pricing Mechanism: Traditional futures use time-based pricing, while perpetuals rely on funding rates.

- Liquidity Cycles: Expiring contracts concentrate liquidity around expiry; perpetuals spread liquidity continuously.

Understanding these nuances is crucial when exploring why perpetual futures have no expiry and how analysts can leverage them for deeper insights.

Opportunities for Market Analysts

- Alpha Generation: Identifying funding rate trends to forecast market reversals.

- Risk Monitoring: Tracking leveraged positions to predict potential liquidation cascades.

- Institutional Reporting: Providing insights on perpetual trends for hedge funds and family offices.

- Retail Guidance: Educating day traders on perpetual futures tips for managing volatility.

Common Mistakes Analysts Should Avoid

- Ignoring Funding Rates – Overlooking this metric can lead to false conclusions about sentiment.

- Overreliance on Models – Purely algorithmic forecasting without behavioral context can misfire.

- Neglecting Exchange Risk – Different perpetual exchanges may display price discrepancies and varying liquidity levels.

FAQ: Perpetual Futures Trends for Market Analysts

1. How do perpetual futures help in forecasting market sentiment?

Perpetual futures provide continuous funding rate data and open interest figures, making them excellent sentiment indicators. Positive funding rates suggest bullish leverage, while negative rates indicate bearish sentiment.

2. Are perpetual futures riskier than traditional futures?

Yes and no. They allow indefinite positions, which increases exposure, but they also offer flexible hedging tools. With proper risk management (stop-losses, cross-margining), perpetual futures can be safer than rolling regular futures.

3. What are the best strategies for analyzing perpetual futures trends?

The best strategies combine quantitative models (for statistical forecasts) with behavioral analysis (for order flow and sentiment). This hybrid approach provides a more holistic view.

Final Thoughts

For market analysts, understanding perpetual futures trends is no longer optional—it’s a requirement for effective forecasting and advisory. By blending quantitative models with behavioral insights, analysts can identify opportunities, mitigate risks, and guide both institutional and retail investors toward smarter decisions.

As perpetual futures continue to grow in popularity, analysts who stay ahead of these trends will be positioned as leaders in financial research.

💬 What trends do you see shaping perpetual futures in the next 12 months? Share your insights in the comments below and join the discussion with fellow market analysts.