=================================================

Introduction

With the explosive growth of cryptocurrency markets, perpetual futures contracts have emerged as one of the most popular trading instruments. Unlike traditional futures, perpetuals have no expiry date, making them suitable for both short-term speculation and long-term hedging. For professional traders and institutions, designing and implementing quantitative trading models for perpetual futures has become essential for achieving consistent returns while managing risks in highly volatile environments.

In this article, we will explore how quantitative strategies are applied to perpetual futures, evaluate two major approaches in depth, and highlight their strengths, weaknesses, and best practices. Additionally, we will link practical methods with risk management frameworks, emerging industry trends, and real-world case insights to create a comprehensive resource for traders, analysts, and risk managers.

Understanding Perpetual Futures

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of an asset without ever worrying about expiry. Their design relies on funding rates, which balance long and short positions to keep the contract price anchored near the spot market.

Key Features

- No Expiration: Contracts can be held indefinitely.

- Funding Payments: Longs and shorts exchange periodic payments to prevent price divergence.

- High Leverage Options: Often up to 100x leverage is available.

- Liquidity Depth: Popular pairs (BTC/USDT, ETH/USDT) offer deep liquidity.

Why Are They Popular?

The crypto market trades 24⁄7, and perpetuals provide flexibility, hedging opportunities, and capital efficiency. For professional traders, the focus is on designing quantitative trading models that automate decision-making and adapt to rapid changes.

Core Elements of Quantitative Models for Perpetual Futures

Market Data and Inputs

Quantitative strategies rely on multiple data streams:

- Price Action: Tick-level data, candlestick patterns, and microstructure signals.

- Funding Rates: Historical and real-time funding data to exploit arbitrage opportunities.

- Volatility Indicators: Implied vs. realized volatility for regime detection.

- Order Book Dynamics: Bid-ask spreads, depth, and liquidity shifts.

Risk Parameters

- Leverage Controls: Adjusting exposure according to volatility conditions.

- Position Sizing: Using algorithms like Kelly Criterion or volatility targeting.

- Stop-Loss and Drawdown Limits: Preventing catastrophic losses.

Two Quantitative Approaches to Perpetual Futures

Strategy 1: Market-Making Models

Market-making models seek to profit from bid-ask spreads by continuously placing buy and sell orders around the current market price.

Advantages

- Consistent Returns: Small profits accumulate across thousands of trades.

- Liquidity Provider Incentives: Some exchanges offer rebates for providing liquidity.

- Low Market Bias: Profitability does not depend on direction.

Disadvantages

- Inventory Risk: Holding positions during volatile moves can create large losses.

- Latency Competition: Requires high-frequency infrastructure.

- Capital Intensive: Best suited for institutions with robust technology.

Strategy 2: Trend-Following Quantitative Models

These models use statistical filters, moving averages, or momentum indicators to identify and ride directional moves.

Advantages

- Captures Big Moves: Highly profitable during strong trends.

- Easier Implementation: Less infrastructure-dependent than market-making.

- Adaptable to Multiple Timeframes: Can be applied intraday or long-term.

Disadvantages

- Whipsaw Risk: Prone to losses during choppy, sideways markets.

- Lagging Signals: Trends are only confirmed after they begin.

- Drawdown Sensitivity: Requires strict stop-loss policies.

Recommended Approach: Hybrid Models

The best solution for professional traders is often a hybrid strategy that combines the stability of market-making with the profitability of trend-following. For instance, during low volatility regimes, the model prioritizes spread capture, while in trending markets, it shifts to directional exposure.

This adaptive system allows traders to exploit why perpetual futures are popular in trading markets—namely, their constant liquidity and high leverage—while maintaining resilience across different conditions.

Applications of Quantitative Models in Perpetual Futures

Arbitrage Opportunities

Models can detect mispricing between spot, perpetuals, and dated futures, enabling how to use perpetual contracts in trading as part of a hedging or arbitrage portfolio.

Volatility Trading

By using options-implied volatility and realized volatility, models can predict funding rate changes and adjust positions accordingly.

High-Frequency Trading (HFT)

Latency-sensitive strategies benefit from order book microstructure analysis to predict short-term movements and optimize trade execution.

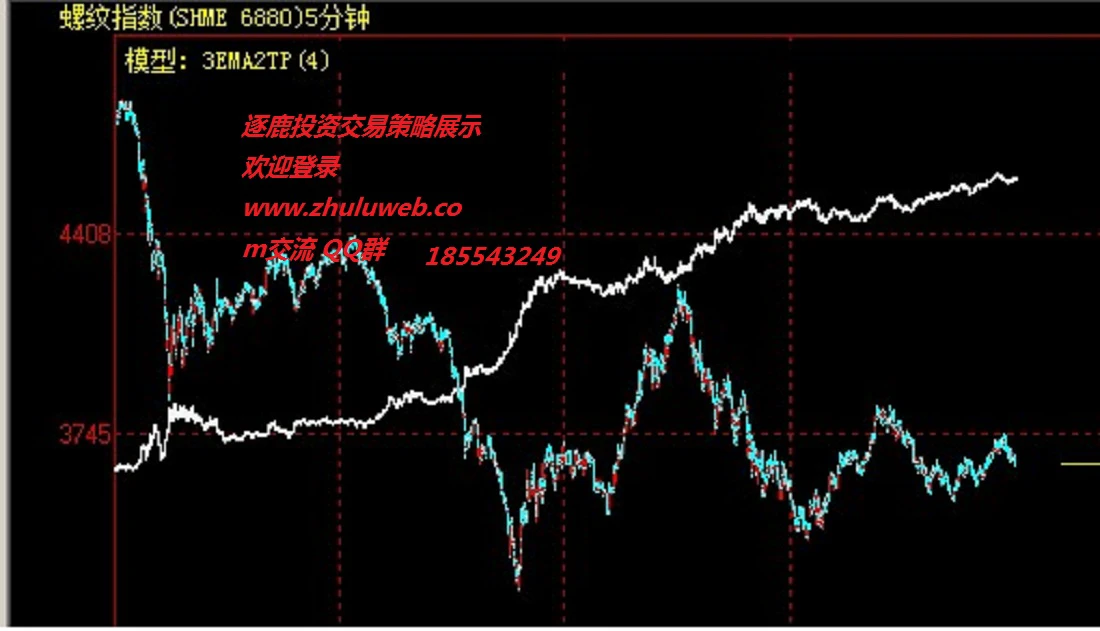

Visual Insights

Funding rate changes directly affect quantitative model profitability.

A hybrid model combines market-making with trend-following to adapt to regimes.

Order book dynamics provide essential signals for perpetual futures trading algorithms.

Industry Trends

AI and Machine Learning in Perpetuals

Machine learning models improve trend recognition, anomaly detection, and execution optimization.

Institutional Adoption

Hedge funds and trading firms increasingly deploy professional traders’ perpetual futures strategies, integrating them into cross-asset portfolios.

Regulatory Developments

As perpetuals gain mainstream attention, regulatory scrutiny increases. Quantitative models must account for evolving compliance requirements.

Common Challenges in Model Development

- Overfitting Risk: Models tuned too closely to historical data may fail in live trading.

- Liquidity Shocks: Thin order books during extreme events can cause slippage.

- System Reliability: Technical downtime can result in catastrophic losses.

Case Study: Quantitative Model in BTC Perpetual Futures

A quantitative trading firm implemented a hybrid strategy on BTC perpetuals. During low volatility, it deployed market-making, collecting spreads with minimal risk. When volatility spiked, the model switched to momentum-driven entries, riding strong price moves.

The result: steady monthly returns with controlled drawdowns, outperforming single-strategy compe*****s.

Frequently Asked Questions (FAQ)

1. What makes perpetual futures ideal for quantitative trading?

Perpetual futures trade 24⁄7, have deep liquidity, and offer leverage. This environment is ideal for algorithms that rely on continuous data inputs and rapid execution.

2. Can beginners use quantitative models for perpetual futures?

While beginners can experiment with basic models, effective implementation requires technical skills, risk management, and infrastructure. A safer path is starting with beginner’s perpetual futures trading guides before moving into advanced modeling.

3. How do funding rates impact quantitative strategies?

Funding rates determine the cost of holding positions. Quant models must account for positive or negative funding to avoid profit erosion. Arbitrage strategies often exploit funding rate imbalances.

Conclusion

Designing quantitative trading models for perpetual futures requires balancing technical expertise, risk controls, and adaptive strategies. While market-making and trend-following remain dominant approaches, hybrid models offer the best long-term resilience.

As AI-driven analysis, institutional adoption, and regulatory frameworks evolve, perpetual futures will continue to be a central arena for innovation in algorithmic trading.

If this guide helped you understand perpetual futures modeling, feel free to share it with your network, comment with your insights, and join the conversation to advance the discussion on quantitative strategies in crypto markets.