======================================================

Perpetual futures have become a cornerstone for modern traders and investors due to their unique characteristics and potential for profit. This article aims to provide a comprehensive tutorial on perpetual futures techniques, exploring key strategies, risks, and their role in the broader financial ecosystem. We will delve into two major trading approaches, analyze their advantages and disadvantages, and guide you toward choosing the best strategy.

Understanding Perpetual Futures

What Are Perpetual Futures?

Perpetual futures are unique financial instruments that allow traders to speculate on the price movements of underlying assets without a set expiration date. Unlike traditional futures contracts, which have fixed expiration dates, perpetual futures are designed to trade indefinitely. These contracts mimic spot trading, but with leverage, offering high-risk, high-reward opportunities for those who know how to manage them effectively.

How Do Perpetual Futures Work in Trading?

Perpetual futures allow traders to enter and exit positions at any time. They are continuously rolled over into the next contract, and prices are determined by a mix of supply and demand on the exchange. Crucially, perpetual futures have no expiry date, meaning they can be held indefinitely, but they do have a mechanism called funding rates to ensure the price stays close to the underlying asset’s spot price.

Key Features:

- No Expiry Date: Unlike traditional futures, perpetual futures don’t require rolling over contracts.

- Leverage: Traders can use leverage to increase potential returns, but this also magnifies risk.

- Funding Rates: Every few hours, traders either pay or receive funding fees, depending on the position’s direction and the market’s overall sentiment.

Strategies for Trading Perpetual Futures

1. Trend Following Strategy

The trend-following strategy is one of the most common and effective approaches when trading perpetual futures. Traders using this strategy aim to identify a prevailing market trend—either bullish or bearish—and make trades that align with this direction.

How It Works:

- Identify Trend: Use tools like moving averages (e.g., 50-day MA, 200-day MA) to spot trends.

- Enter Position: Enter long positions during upward trends or short positions during downward trends.

- Exit Strategy: Use trailing stops to lock in profits while allowing the trend to run.

Advantages:

- Works well in trending markets.

- Allows traders to capitalize on long-term price movements.

Disadvantages:

- Can lead to losses in sideways or choppy markets.

- Requires patience and discipline.

2. Mean Reversion Strategy

The mean reversion strategy operates on the assumption that price will eventually revert to its mean or average after diverging significantly. This is especially useful in highly volatile markets where price fluctuations are frequent and extreme.

How It Works:

- Identify Overbought or Oversold Conditions: Use technical indicators like the Relative Strength Index (RSI) or Bollinger Bands.

- Enter Position: Buy when the asset is oversold and sell when overbought.

- Exit Strategy: Take profits when the price returns to the mean.

Advantages:

- Effective in sideways or range-bound markets.

- Lower risk if applied correctly, as it capitalizes on price corrections.

Disadvantages:

- Can lead to losses in strong trending markets.

- Requires precise timing and execution.

Risk Management in Perpetual Futures

How to Manage Risks with Perpetual Futures

Trading perpetual futures is inherently risky, especially due to their leverage and volatility. Proper risk management techniques are essential to avoid catastrophic losses.

1. Use Stop-Loss Orders

A stop-loss order ensures that you limit potential losses if the market moves against you. Always set a stop-loss based on your risk tolerance and never trade without one.

2. Position Sizing

Position sizing is crucial in risk management. Avoid overexposing your capital to a single trade by calculating your position size based on your total capital and the risk you are willing to take per trade.

3. Diversification

While perpetual futures offer exciting opportunities, it’s crucial not to put all your capital into a single asset. Diversifying across different markets or assets can reduce risk and smooth out the overall performance of your portfolio.

Why Use Perpetual Futures in Investing?

Perpetual futures offer several advantages over traditional investment strategies:

- No Expiry Date: Unlike traditional futures contracts, perpetual futures can be held indefinitely, providing more flexibility.

- Leverage: Traders can take larger positions with less capital, increasing the potential for profit.

- Continuous Trading: Perpetual futures are available for trading 24⁄7, allowing traders to respond to market events in real time.

Frequently Asked Questions (FAQs)

1. What are the key differences between perpetual futures and traditional futures?

Perpetual futures differ from traditional futures in that they have no expiration date. Traditional futures require traders to close or roll over their contracts before the expiration date, whereas perpetual futures can be held indefinitely. Additionally, perpetual futures use funding rates to keep their prices in line with the underlying asset, unlike traditional futures.

2. How are perpetual futures priced?

The price of perpetual futures is primarily determined by the spot price of the underlying asset, with adjustments made based on supply and demand on the exchange. The funding rate mechanism helps to keep the price of the perpetual futures contract aligned with the spot price.

3. What is the best strategy for beginners in perpetual futures trading?

For beginners, it’s advisable to start with a trend-following strategy, as it is easier to understand and execute. This strategy requires less timing precision compared to mean reversion strategies and works well in trending markets.

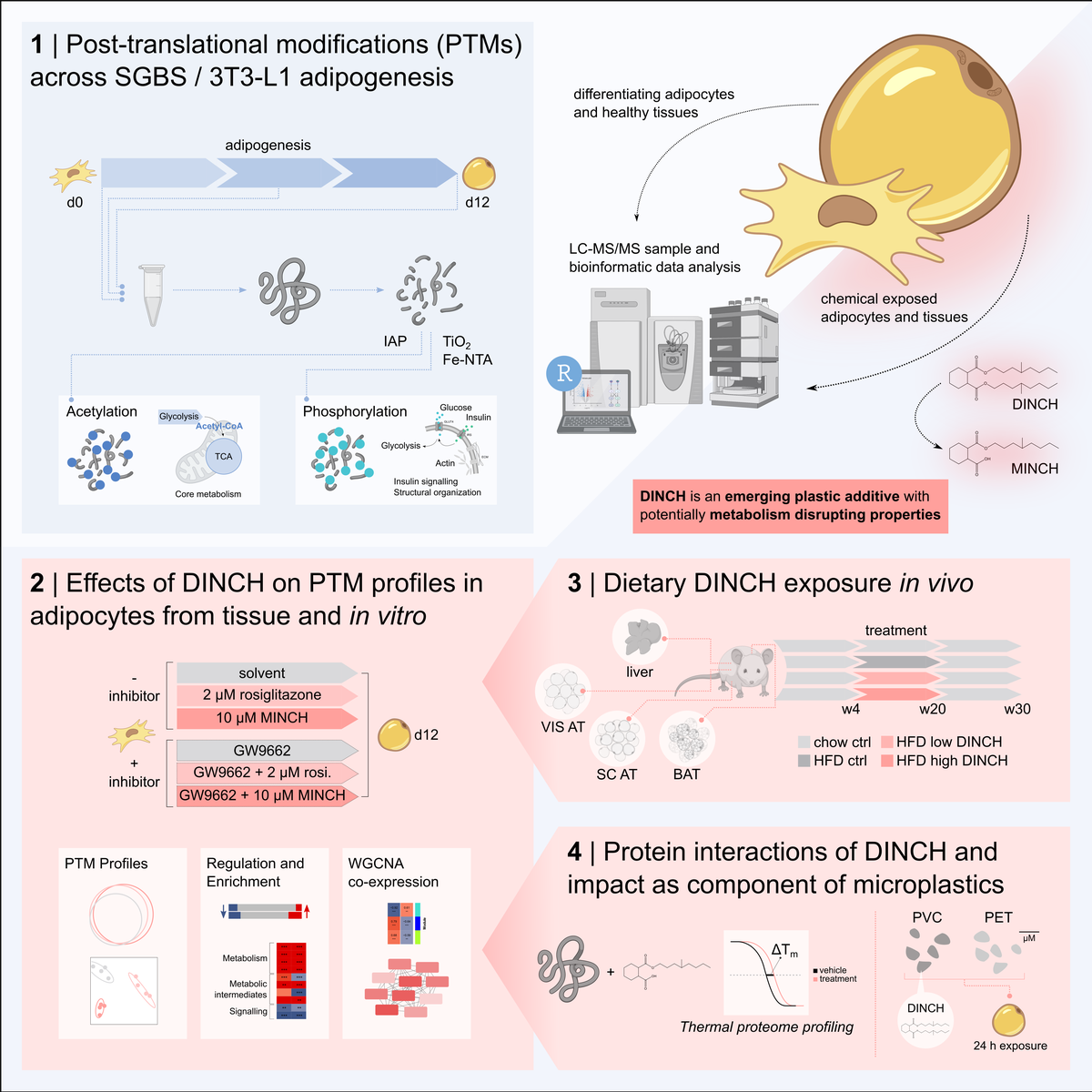

Visual Insights

Example of Perpetual Futures Price Action

This chart illustrates how perpetual futures can follow the underlying asset’s spot price while incorporating funding fees and price deviations.

Conclusion: The Best Approach to Perpetual Futures

In conclusion, perpetual futures offer unique advantages for traders who seek leverage, flexibility, and continuous trading. While strategies like trend following and mean reversion are effective in different market conditions, choosing the right approach depends on your risk tolerance and market outlook. Effective risk management, including using stop-loss orders and appropriate position sizing, is essential for success in this volatile market.

Share Your Thoughts

If you found this tutorial helpful, please feel free to share it with your trading community or leave a comment with your experience in perpetual futures trading. What strategies do you use, and how have they worked for you?