========================================================

Introduction

Perpetual futures have become a cornerstone of modern crypto trading. Unlike traditional futures contracts, perpetuals have no expiration date, allowing traders to maintain positions indefinitely. For institutional investors, day traders, and crypto enthusiasts alike, Coinbase offers a secure, regulated environment to trade perpetual futures with advanced tools and competitive fees.

In this guide, we will provide step-by-step tutorials for perpetual futures on Coinbase, designed to take you from the basics of setting up an account to executing advanced strategies. We will also compare different trading methods, highlight real-world use cases, and share insider tips on managing risk effectively.

This article is structured for SEO optimization, integrates practical experience, and reflects the latest trends in perpetual futures trading.

Understanding Perpetual Futures on Coinbase

What Are Perpetual Futures?

Perpetual futures are derivative contracts that track the price of an underlying asset, such as Bitcoin or Ethereum, without an expiry date. Traders can open long (buy) or short (sell) positions and apply leverage to amplify exposure.

Key characteristics:

- No expiry: Positions can be held indefinitely.

- Funding rates: Periodic payments between long and short traders keep the contract price aligned with the spot market.

- Leverage: Traders can magnify gains (and risks) with multipliers such as 5x, 10x, or more.

Why Coinbase for Perpetual Futures?

Coinbase stands out for its regulatory compliance, transparency, and security, making it particularly attractive for professional and institutional investors. Features include:

- Deep liquidity pools for major pairs like BTC-PERP and ETH-PERP.

- Advanced order types (stop-limit, trailing stop, iceberg).

- Risk management tools integrated within the platform.

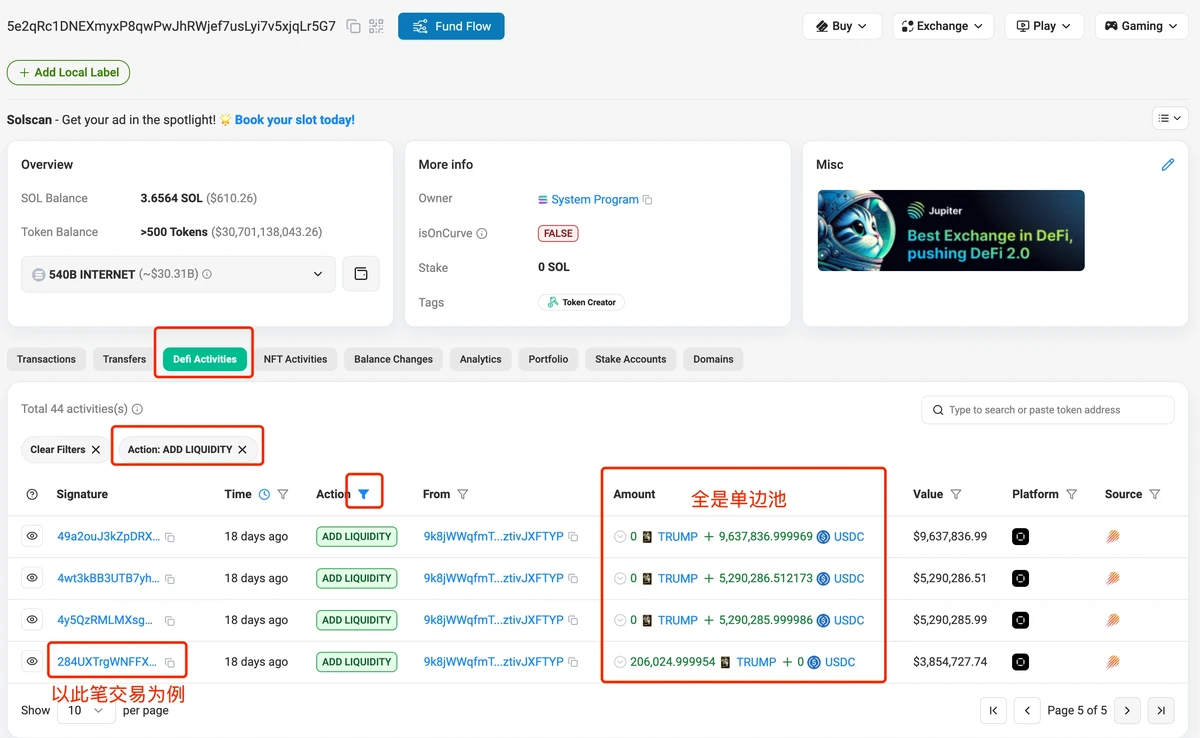

Step-by-Step Tutorial: Getting Started

Step 1: Create and Verify Your Coinbase Account

- Visit the Coinbase Pro (or Coinbase Advanced) trading portal.

- Complete KYC verification by submitting government ID and proof of address.

- Enable two-factor authentication (2FA) for account security.

Coinbase account setup for perpetual futures access

Step 2: Fund Your Account

- Deposit USD, EUR, or crypto such as USDC.

- Stablecoins are the most common collateral for perpetual futures.

Step 3: Navigate to the Perpetual Futures Section

Coinbase provides a dedicated interface for derivatives. If you are unsure where to find perpetual futures on Coinbase, check the derivatives tab under “Markets” and select perpetual contracts like BTC-PERP.

Step 4: Understand the Trading Interface

- Order book: Shows live buy/sell activity.

- Charting tools: Technical analysis indicators like RSI, MACD, and Bollinger Bands.

- Leverage controls: Select leverage levels based on your risk appetite.

Step 5: Place Your First Order

- Market Order: Executes immediately at current price.

- Limit Order: Executes at your chosen price or better.

- Stop-Limit Order: Useful for risk management.

Advanced Strategies for Perpetual Futures

Strategy 1: Leverage Trading

Leverage amplifies gains but also magnifies losses. For instance, at 10x leverage, a 5% move in Bitcoin could result in a 50% gain or loss.

- Pros: Maximizes capital efficiency.

- Cons: High liquidation risk if market moves against you.

Strategy 2: Hedging Spot Positions

Institutions often hedge spot holdings with perpetual futures. For example, if holding BTC spot, they may short BTC-PERP to protect against downside risk.

- Pros: Reduces portfolio volatility.

- Cons: Funding fees may erode profits over time.

Recommended Approach

For beginners and cautious investors, hedging strategies are safer than high-leverage speculative trades. More advanced traders can gradually integrate leverage once they understand funding mechanics and margin requirements.

Risk Management in Perpetual Futures

Understanding Liquidation

If your margin balance falls below the maintenance threshold, Coinbase will liquidate your position.

Tools to Manage Risk

- Stop-loss orders: Automatically close losing trades before they become catastrophic.

- Position sizing: Never risk more than 1–2% of your portfolio on a single trade.

- Diversification: Use multiple assets (BTC, ETH, SOL) instead of concentrating exposure.

Platform Safety Features

Coinbase integrates risk management solutions for perpetual futures on Coinbase, such as margin alerts and liquidation buffers, making it easier for traders to stay protected.

Market Analysis with Perpetual Futures

Coinbase provides advanced charting tools, but traders can enhance their strategies by combining technical and fundamental analysis:

- Technical: Use RSI, moving averages, and Fibonacci retracements.

- On-chain: Monitor wallet inflows/outflows and stablecoin supply.

- Macro: Factor in U.S. interest rates, inflation, and geopolitical risks.

For deeper insight, many traders explore how to analyze perpetual futures market on Coinbase using professional third-party analytics platforms.

Technical charting for perpetual futures on Coinbase

Comparing Two Approaches

| Approach | Use Case | Pros | Cons |

|---|---|---|---|

| Leverage Speculation | Short-term gains | High return potential | High risk of liquidation |

| Hedging Spot Holdings | Portfolio protection | Reduces downside risk | Funding fees reduce profitability |

Recommendation: Institutions and risk-conscious investors should prioritize hedging strategies, while experienced day traders can allocate a portion to leveraged speculation.

FAQ: Perpetual Futures on Coinbase

1. How does perpetual futures work on Coinbase?

Perpetual futures track the underlying asset’s price and use a funding rate mechanism to ensure the futures price aligns with the spot market. Traders pay or receive funding depending on whether they are long or short.

2. What leverage is available on Coinbase perpetual futures?

Coinbase typically offers leverage up to 5x–20x, depending on the asset and jurisdiction. Institutions may receive customized leverage solutions, but higher leverage significantly increases risk.

3. Can beginners trade perpetual futures on Coinbase?

Yes, but with caution. Beginners should start small, focus on learning market mechanics, and explore perpetual futures for beginners on Coinbase guides before applying significant leverage.

Conclusion

Perpetual futures on Coinbase offer powerful tools for both speculation and risk management. By following structured, step-by-step tutorials, traders can confidently navigate the platform, implement strategies, and protect their portfolios.

Whether you’re a beginner exploring crypto derivatives or a professional investor optimizing hedging strategies, Coinbase provides a secure and transparent trading environment.

💡 If this guide helped you, share it with your trading community, comment with your experiences, and subscribe for more in-depth guides to perpetual futures on Coinbase.

Image Suggestions (Markdown Insertions)

- Coinbase logo with derivatives market highlighted

Coinbase account setup for perpetual futures access

- Example perpetual futures chart

Technical charting for perpetual futures on Coinbase

- Funding rate diagram

Funding rate mechanism in perpetual futures

Would you like me to expand this into a 4-part mini-course format (beginner, intermediate, advanced, professional) so you can publish it as a series of tutorials instead of just one article? This could boost engagement and SEO ranking even further.