The explosive growth of cryptocurrency markets has brought perpetual futures into the spotlight as one of the most popular derivative instruments. While perpetual futures provide flexibility and liquidity, they also expose traders and institutions to systematic risks—risks tied to market-wide factors that cannot be diversified away. Developing a systematic risk assessment framework for perpetual futures is critical for both novice and professional investors seeking to manage volatility, protect capital, and ensure sustainable long-term trading strategies.

This article explores practical methods, frameworks, and strategies for assessing and mitigating systematic risk, blending academic insights, professional risk management practices, and personal trading experience.

Understanding Systematic Risk in Perpetual Futures

Systematic risk refers to market-wide uncertainties that affect all assets within a given market, such as global recessions, monetary policy changes, inflation spikes, or sudden shifts in liquidity. Unlike idiosyncratic risks, systematic risks cannot be eliminated through diversification.

In perpetual futures trading, systematic risk manifests through:

- Market-wide price shocks (e.g., Bitcoin flash crashes).

- Funding rate volatility, affecting long/short positioning costs.

- Liquidity crunches, leading to high slippage or forced liquidations.

- Macro events such as regulatory crackdowns or interest rate changes.

Understanding why systematic risk matters in perpetual futures trading is essential, as these risks can trigger cascading liquidations, exchange outages, or black swan events.

Step-by-Step Systematic Risk Assessment Framework

A robust risk assessment framework involves structured steps that integrate both qualitative and quantitative approaches:

1. Identify Sources of Systematic Risk

- Macroeconomic factors: Inflation, unemployment, policy rates.

- Market structure: Exchange liquidity, open interest concentration.

- Technology risk: Exchange downtime or blockchain congestion.

2. Collect and Analyze Risk Data

Reliable data is key. Traders often ask where to find systematic risk data for perpetual futures. Useful sources include:

- On-chain analytics platforms (Glassnode, IntoTheBlock).

- Market risk dashboards on major exchanges.

- Macro-financial databases (FRED, IMF).

3. Quantitative Modeling

- Value-at-Risk (VaR): Estimates potential loss at a confidence interval.

- Beta Analysis: Measures sensitivity of perpetual futures relative to overall crypto or traditional markets.

- Stress Testing: Models extreme but plausible market scenarios.

4. Qualitative Risk Evaluation

In addition to quantitative data, expert judgment helps capture risks beyond models—such as political instability or exchange governance.

5. Develop Mitigation Strategies

This involves creating hedging, diversification, and capital allocation strategies to reduce exposure to systemic shocks.

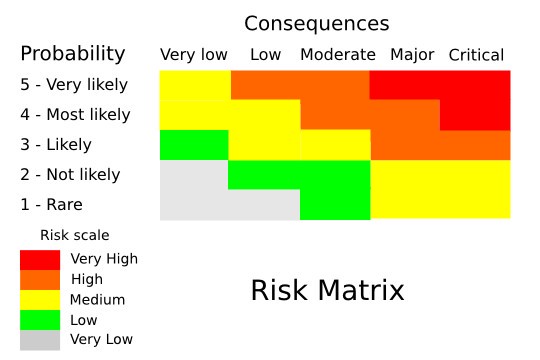

Systematic risk assessment framework from identification to mitigation.

Two Key Strategies for Managing Systematic Risk

Strategy 1: Hedging with Cross-Asset Correlations

Traders often hedge perpetual futures positions with correlated or inversely correlated assets:

- Using Bitcoin perpetual futures against Ethereum futures.

- Hedging crypto futures with macro assets such as gold or U.S. Treasury bonds.

Pros: Provides immediate downside protection, widely practiced in institutions.

Cons: Requires margin in multiple markets, may increase transaction costs.

Strategy 2: Dynamic Leverage Adjustment

Since perpetual futures amplify exposure through leverage, dynamically adjusting leverage levels in response to volatility is a powerful risk tool.

- Lower leverage during high-volatility events.

- Increase position sizing cautiously in stable markets.

Pros: Simple, effective in avoiding liquidations.

Cons: May reduce profit potential if over-conservative.

Comparing Risk Management Strategies

| Feature | Cross-Asset Hedging | Dynamic Leverage Adjustment |

|---|---|---|

| Complexity | High (requires multiple assets) | Low (applies to existing positions) |

| Cost | Higher (transaction & funding fees) | Lower (minimal extra costs) |

| Effectiveness | Strong against systemic shocks | Effective in liquidation prevention |

| Best Use | Institutional & professional investors | Retail & novice traders |

Recommendation: Combining both strategies offers a balanced risk control framework: hedging mitigates systemic shocks, while dynamic leverage prevents margin calls.

Comparison of cross-asset hedging vs. dynamic leverage adjustment strategies.

Best Practices for Risk Assessment in Perpetual Futures

- Regular Stress Testing – Simulate extreme market crashes monthly.

- Funding Rate Monitoring – Track cumulative costs of long/short positions.

- Correlation Analysis – Understand how perpetual futures align with equity indices, bonds, or commodities.

- Capital Allocation Discipline – Never risk more than 1-2% of portfolio capital on a single leveraged trade.

- Use of Stop-Loss Protocols – Automate risk control to avoid emotional decision-making.

These practices align closely with how to assess systematic risk in perpetual futures, ensuring traders build resilience into their trading strategies.

Integration with Institutional Risk Management

Institutions and hedge funds often expand the framework with advanced tools:

- Systematic risk evaluations for perpetual futures traders using AI-driven analytics.

- Portfolio optimization models balancing futures with spot crypto and traditional assets.

- Scenario-based governance to prepare for black swan market shocks.

This institutional approach provides a higher level of resilience but requires more resources and data infrastructure.

Frequently Asked Questions (FAQ)

1. What is systematic risk in perpetual futures?

Systematic risk refers to market-wide risks—such as macroeconomic shocks, liquidity crises, or correlated sell-offs—that affect all perpetual futures contracts simultaneously. Unlike idiosyncratic risk, it cannot be eliminated through diversification.

2. How to calculate systematic risk in perpetual futures?

Systematic risk is often calculated through beta analysis (measuring correlation with broader crypto or equity indices), Value-at-Risk (VaR) models, and stress testing scenarios. Combining these gives a more comprehensive risk profile.

3. How to mitigate systematic risk in perpetual futures?

Key mitigation strategies include:

- Diversifying across assets and markets.

- Using cross-asset hedging strategies.

- Reducing leverage during high-volatility periods.

- Constantly monitoring market indicators such as funding rates and liquidity depth.

Common trader questions on systematic risk explained.

Final Thoughts

Developing a systematic risk assessment framework for perpetual futures is no longer optional—it is a necessity for sustainable trading in volatile crypto markets. By combining quantitative modeling, qualitative evaluation, and actionable strategies such as hedging and leverage management, traders can significantly reduce exposure to systemic shocks.

Whether you are a retail investor or an institutional risk manager, systematic risk assessment helps transform unpredictable volatility into manageable trading outcomes.

Have you implemented a systematic risk framework in your perpetual futures strategy? Share your approach in the comments, and don’t forget to forward this article to colleagues and trading communities to enhance awareness of systemic risk management.

Would you like me to expand this framework with a practical case study (e.g., systematic risk modeling during the 2020 Bitcoin crash) to give readers a real-world application?