In the fast-evolving world of perpetual futures trading, understanding and managing systematic risk is critical for traders, hedge funds, and institutional investors. A robust systematic risk assessment framework for perpetual futures enables market participants to identify potential threats, optimize risk exposure, and implement effective mitigation strategies. This article provides a comprehensive analysis of systematic risk, explores practical assessment methods, and presents actionable strategies for traders seeking to navigate complex perpetual futures markets.

Understanding Systematic Risk in Perpetual Futures

What is Systematic Risk in Perpetual Futures?

Systematic risk, also known as market risk, refers to the inherent risk that affects the entire market or asset class, rather than specific instruments. In perpetual futures:

- Systematic risk arises from market-wide events such as interest rate changes, economic shocks, or global geopolitical crises.

- Unlike idiosyncratic risk, systematic risk cannot be fully diversified away.

- Traders must proactively measure and manage it to prevent significant losses.

For those new to perpetual futures, resources on how to assess systematic risk in perpetual futures provide step-by-step guidance on quantifying and analyzing market-wide exposures.

Key Sources of Systematic Risk

- Macroeconomic Factors: Inflation rates, GDP growth, and monetary policies can influence perpetual futures pricing.

- Market Liquidity Risk: Sudden liquidity shortages can amplify price volatility.

- Interest Rate Changes: Futures markets are sensitive to interest rate fluctuations, impacting funding and margin requirements.

- Regulatory Shifts: Regulatory announcements can trigger rapid market adjustments.

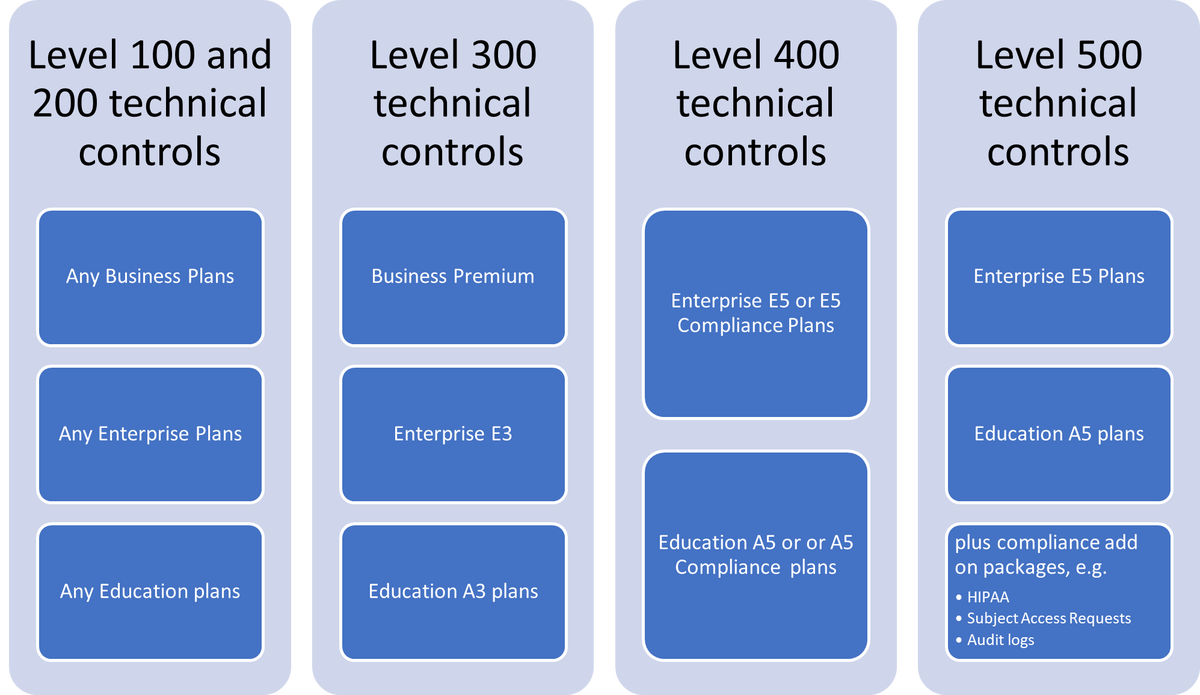

Key components contributing to systematic risk in perpetual futures markets, including macroeconomic, liquidity, and regulatory factors.

Building a Systematic Risk Assessment Framework

Step 1: Data Collection and Preprocessing

- Gather historical price, volume, and volatility data.

- Include macroeconomic indicators, funding rates, and market-wide sentiment data.

- Cleanse and normalize data to ensure consistency and reduce noise.

Best Practices:

- Integrate multiple data sources for accuracy.

- Maintain real-time data feeds for high-frequency or automated trading systems.

Step 2: Risk Quantification Methods

1. Value-at-Risk (VaR) Models

- VaR estimates the maximum potential loss over a specified period with a given confidence level.

- Historical simulation, Monte Carlo methods, and parametric VaR are widely used.

Pros:

- Provides clear risk thresholds.

- Widely accepted by regulators and institutional investors.

Cons:

- May underestimate extreme market events (tail risk).

- Sensitive to model assumptions and data quality.

2. Stress Testing and Scenario Analysis

- Simulate extreme market conditions, such as liquidity crises or large market swings.

- Assess portfolio resilience under adverse scenarios.

Pros:

- Identifies vulnerabilities not captured by standard VaR.

- Supports contingency planning and capital allocation decisions.

Cons:

- Requires extensive scenario modeling expertise.

- Can be computationally intensive for large portfolios.

Step 3: Correlation and Beta Analysis

- Measure asset sensitivity to market movements using beta coefficients.

- Identify correlations between perpetual futures contracts and underlying spot markets.

Application:

- Helps in systematic risk evaluations for perpetual futures traders, allowing traders to gauge potential market-wide exposure.

Example of a beta correlation heatmap highlighting systematic risk relationships between perpetual futures and underlying assets.

Practical Strategies for Managing Systematic Risk

1. Diversification Across Assets

- Reduce exposure to a single market or asset class.

- Include instruments with low or negative correlations to mitigate potential losses.

Advantages:

- Minimizes portfolio volatility.

- Provides a buffer during market-wide downturns.

Disadvantages:

- Over-diversification can dilute returns.

- May require complex portfolio monitoring.

2. Dynamic Hedging Techniques

- Use derivatives such as options and swaps to hedge market-wide exposures.

- Adjust hedge ratios based on real-time risk assessments.

Advantages:

- Offers tailored risk mitigation.

- Flexible and adaptable to changing market conditions.

Disadvantages:

- Hedging costs can be high.

- Requires expertise in derivative instruments and perpetual futures mechanics.

Advanced Risk Monitoring

- Implement real-time risk dashboards.

- Monitor leverage, margin utilization, and funding rates.

- Use alert systems for significant market shifts affecting systemic risk.

Real-time dashboard for monitoring systematic risk indicators, including leverage ratios, margin utilization, and market volatility.

Comparative Analysis of Assessment Methods

| Method | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|

| Value-at-Risk (VaR) | Standardized, easy to communicate | Underestimates tail risk | Regulatory reporting, daily monitoring |

| Stress Testing | Captures extreme scenarios | Computationally intensive | Portfolio resilience, contingency planning |

| Beta and Correlation Analysis | Measures sensitivity to market movements | Cannot capture sudden shocks | Portfolio allocation and diversification |

| Dynamic Hedging | Customizable, responsive to market changes | Costs and complexity | Active trading and risk mitigation |

FAQ

1. How does systematic risk affect perpetual futures investments?

Answer: Systematic risk impacts the overall volatility and potential losses of perpetual futures positions. Investors exposed to high systematic risk may experience amplified drawdowns during market downturns, making proactive risk assessment essential.

2. What are the best tools for systematic risk monitoring?

Answer: Advanced trading platforms offer risk dashboards, beta correlation matrices, VaR calculators, and stress-testing modules. Institutional investors can integrate systematic risk management for perpetual futures in finance solutions to ensure continuous monitoring and timely interventions.

3. How can traders mitigate systematic risk effectively?

Answer: Traders can combine diversification, dynamic hedging, and scenario analysis. Establishing real-time risk monitoring, setting leverage limits, and adjusting exposure based on market conditions are also key mitigation strategies.

Conclusion

A systematic risk assessment framework for perpetual futures is vital for navigating complex and volatile markets. By combining robust data collection, quantitative modeling, real-time monitoring, and strategic hedging, traders and institutional investors can optimize risk-adjusted returns. Implementing such a framework allows market participants to anticipate potential threats, safeguard capital, and execute more confident trading strategies.

Engage with this guide by sharing your experiences or discussing which systematic risk assessment methods work best for your trading style.