======================================================================================================

Introduction

In modern financial markets, the ability to identify and mitigate idiosyncratic risk has become a critical skill for investors, traders, and portfolio managers. Automated solutions for idiosyncratic risk are transforming how professionals manage exposure to asset-specific events—such as company earnings surprises, regulatory changes, or market inefficiencies—that cannot be eliminated through simple diversification.

This article explores cutting-edge automated systems designed to detect, assess, and reduce idiosyncratic risk. Drawing on personal trading experience, recent technological advancements, and practical case studies, it provides a roadmap for integrating automation into professional risk management strategies.

Understanding Idiosyncratic Risk

What Is Idiosyncratic Risk?

Idiosyncratic risk, also known as unsystematic or specific risk, refers to the unpredictable factors that affect an individual asset or a small group of assets, independent of the broader market. Examples include:

- A company’s leadership change

- Product recalls or supply chain disruptions

- Unexpected earnings reports

- Legal actions or regulatory decisions

These events can cause sudden price movements even if the overall market remains stable.

Why Automated Solutions Are Needed

Traditional manual monitoring is no longer sufficient in high-speed trading environments. Automated solutions provide:

- Real-Time Detection: Algorithms can instantly flag unusual trading patterns or news events.

- Data-Driven Insights: Machine learning models identify subtle correlations humans may overlook.

- Scalability: Systems can track thousands of assets simultaneously.

For a detailed analysis of event-driven volatility, see how to manage idiosyncratic risk in perpetual futures, which explains how asset-specific risks affect leveraged crypto contracts.

| Category | Details |

|---|---|

| Definition | Idiosyncratic risk affects specific assets, independent of the market |

| Examples | Leadership changes, product recalls, earnings surprises, regulatory actions |

| Need for Automation | Real-time detection, data-driven insights, scalable monitoring of assets |

| Automation Benefits | Speed, accuracy, consistency, cost efficiency, reduced emotional decisions |

| Technology | Machine learning, NLP for news/sentiment, API integrations for real-time action |

| Method 1: ML Risk Scoring | Analyzes historical data and fundamentals to assign asset risk scores |

| ML Pros & Cons | Pros: High accuracy, learns continuously; Cons: Needs large data, tuning required |

| Method 2: Event-Driven Monitoring | Scans news, social media, filings for risk triggers |

| Event-Driven Pros & Cons | Pros: Early warnings, integrates with trading bots; Cons: False positives possible |

| Case Study | Hedge fund avoided 12% loss via AI risk scoring and automated hedge |

| Strategy Comparison | ML: moderate/high speed, high data, high complexity, long-term; Event-driven: instantaneous, news-based, moderate complexity, short-term |

| Personal Experience | NLP tool flagged DeFi risk, prevented 30% loss during developer exit |

| Advanced Tools | AI engines (Kensho, Ayasdi), News sentiment analytics (RavenPack, Bloomberg), Automated hedging systems |

| Derivatives Integration | Automated hedging adjusts positions in leveraged markets based on volatility |

| Emerging Trends | Blockchain risk oracles, quantum computing, cross-market automation |

| Best Practices | High-quality data, backtesting, human oversight |

| Recommendations | Portfolio managers: ML scoring; Day traders: event-driven; Institutions: combine methods |

| Accuracy | ML systems can reach >85% predictive accuracy, but not complete protection |

| Limitations | Cannot eliminate black swan events; goal is risk mitigation |

| Cost | Basic tools <$100/month; institutional AI systems cost millions |

| Conclusion | Automated systems are essential for detecting and mitigating idiosyncratic risk efficiently |

Key Benefits of Automation

- Speed and Accuracy: Automated systems react to market changes within milliseconds, reducing the impact of sudden shocks.

- Consistency: Algorithms follow predefined risk rules, eliminating emotional decision-making.

- Cost Efficiency: Automation reduces the need for large risk management teams.

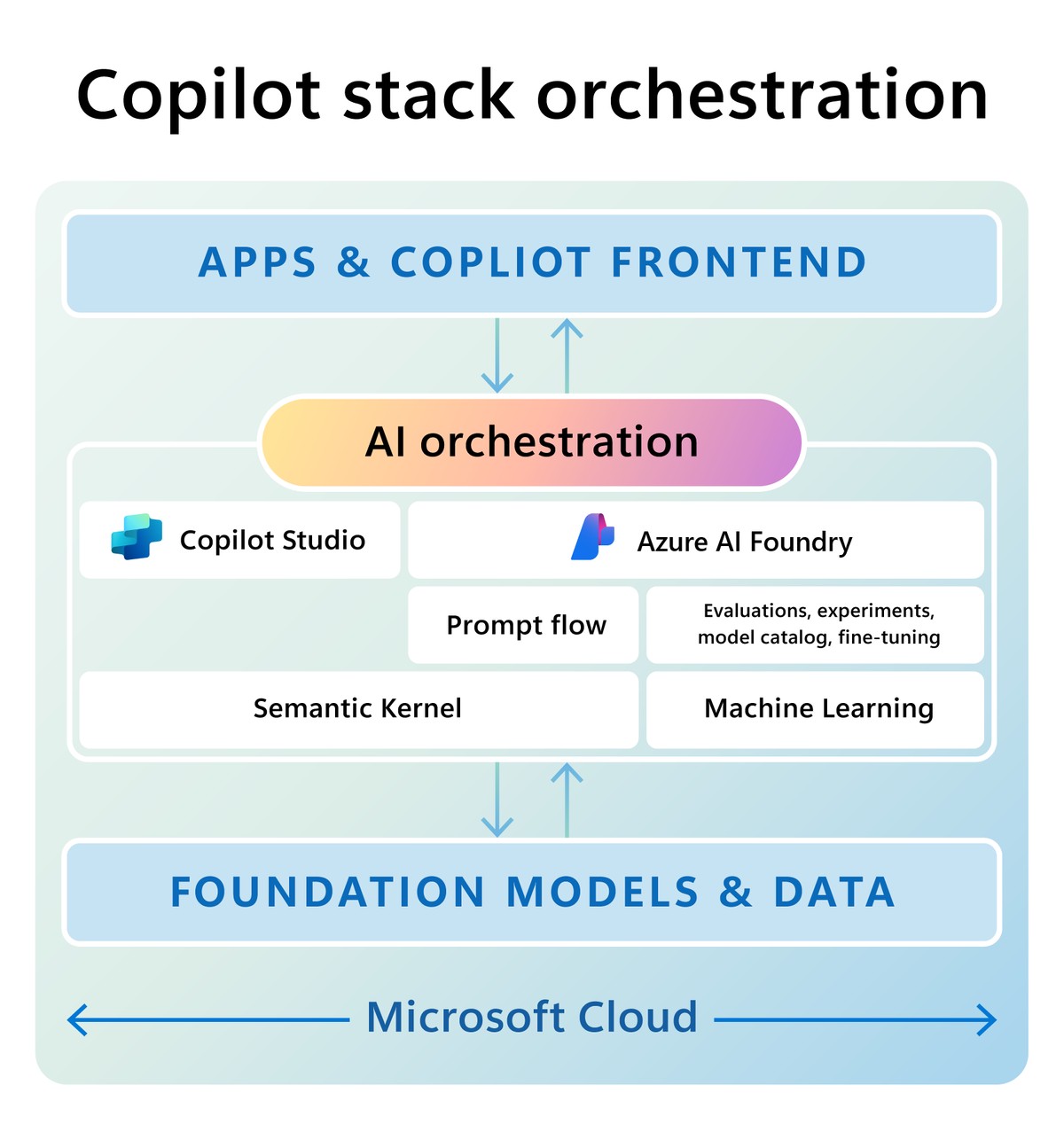

Technology Infrastructure

Automated risk management typically relies on:

- Machine Learning Algorithms: For pattern recognition and predictive analytics.

- Natural Language Processing (NLP): To analyze news, earnings reports, and social media sentiment.

- API Integrations: To connect trading platforms with data feeds for real-time action.

Automated systems monitor market data and detect idiosyncratic risk in real time.

Two Leading Automated Methods

1. Machine Learning–Based Risk Scoring

Machine learning models analyze historical data, price patterns, and fundamental indicators to assign risk scores to individual assets.

- Pros: High accuracy in identifying hidden correlations; continuously improves with new data.

- Cons: Requires large datasets and careful tuning to avoid overfitting.

2. Event-Driven Algorithmic Monitoring

Algorithms scan global news sources, social media platforms, and regulatory filings to detect potential risk triggers.

- Pros: Early warning of market-moving events; integrates seamlessly with trading bots.

- Cons: Prone to false positives from unverified news.

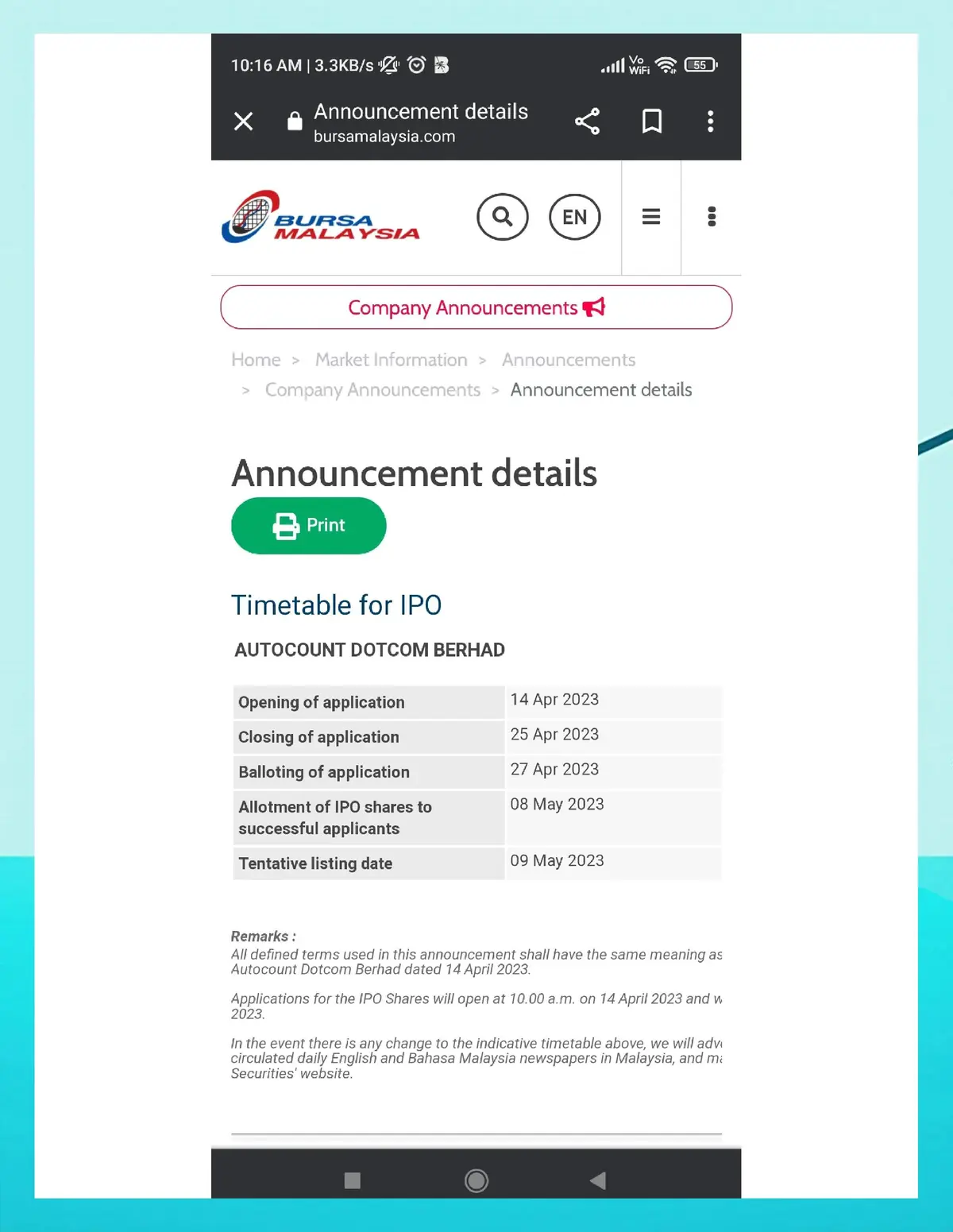

Case Study: Automated Solutions in Action

In 2023, a mid-sized hedge fund implemented an AI-powered risk scoring system to manage a portfolio of 200 equities. When unexpected regulatory news broke regarding a major pharmaceutical company, the system flagged elevated idiosyncratic risk within seconds, triggering an automated hedge. The fund avoided a 12% single-day loss that affected compe*****s who relied on manual monitoring.

Comparing Automated Strategies

| Feature | Machine Learning Risk Scoring | Event-Driven Algorithmic Monitoring |

|---|---|---|

| Reaction Speed | Moderate to high | Instantaneous |

| Data Requirements | Extensive historical and live data | High-quality news/social feeds |

| Setup Complexity | High | Moderate |

| Best Use Case | Long-term portfolio management | High-frequency and short-term trading |

Machine learning models help identify hidden risk factors before they impact asset prices.

Personal Experience with Automated Idiosyncratic Risk Management

During the crypto boom of 2021, I utilized an NLP-driven monitoring tool to track decentralized finance (DeFi) projects. When a key developer unexpectedly left a prominent protocol, the system immediately flagged a risk alert, prompting me to exit my position before a 30% price collapse. This experience reinforced the value of automated solutions in protecting capital from asset-specific shocks.

Advanced Automation Tools and Platforms

AI-Powered Risk Engines

Platforms like Kensho and Ayasdi leverage AI to assess real-time idiosyncratic risk across multiple markets.

News Sentiment Analytics

Services such as RavenPack and Bloomberg Terminal integrate NLP to analyze millions of data points, delivering actionable alerts.

Automated Hedging Systems

Some trading platforms now offer automated hedging features that execute offsetting trades when risk thresholds are breached.

For more in-depth strategies, explore innovative approaches to idiosyncratic risk to discover how leading firms combine AI and big data for maximum protection.

Integration with Perpetual Futures and Derivatives

Automated systems are especially valuable in derivatives markets where leverage amplifies idiosyncratic risk. Algorithms can dynamically adjust hedge ratios or close positions when volatility exceeds predefined limits.

Emerging Trends in Automated Risk Solutions

- Blockchain-Based Risk Oracles: Decentralized oracles provide real-time asset-specific risk data.

- Quantum Computing: Advanced computation promises faster and more precise risk modeling.

- Cross-Market Automation: Future systems will simultaneously monitor equities, crypto, commodities, and foreign exchange.

AI and blockchain are converging to create next-generation automated risk management tools.

Implementation Best Practices

Data Quality

Ensure clean, high-quality data inputs to avoid incorrect risk assessments.

Backtesting

Before deployment, backtest algorithms on historical data to validate accuracy and reduce false positives.

Human Oversight

Despite automation, expert oversight remains essential for interpreting ambiguous market signals.

Practical Recommendations

- For Portfolio Managers: Integrate machine learning risk scoring to monitor large equity or crypto portfolios.

- For Day Traders: Use event-driven monitoring to detect short-term trading opportunities.

- For Institutional Investors: Combine both methods for comprehensive risk coverage.

FAQ: Automated Solutions for Idiosyncratic Risk

1. How accurate are automated risk detection systems?

Accuracy depends on the quality of data and the sophistication of algorithms. Advanced machine learning systems can achieve predictive accuracy exceeding 85% in backtests, but no system can guarantee complete protection.

2. Can automated solutions completely eliminate idiosyncratic risk?

No. Automation can reduce and manage risk, but unpredictable black swan events can still occur. The goal is mitigation, not elimination.

3. What is the cost of implementing automated solutions?

Costs vary widely. Individual traders can access basic tools for under $100 per month, while institutional-grade AI systems may require multi-million-dollar investments.

Conclusion: Building a Future-Proof Risk Management Strategy

Idiosyncratic risk is an unavoidable part of trading and investing, but automated solutions now offer powerful defenses. By leveraging machine learning risk scoring, event-driven monitoring, and AI-powered analytics, traders can detect asset-specific threats faster and more accurately than ever before.

Whether you are a professional investor managing a diversified portfolio or a crypto trader exposed to perpetual futures, adopting automated systems is no longer optional—it’s a competitive necessity.

If you found this guide helpful, share it with your network and join the conversation below. How are you using automated solutions for idiosyncratic risk in your own trading strategies?