===========================================

Introduction

Perpetual futures are among the most popular instruments in modern crypto and derivatives trading. They combine the leverage and flexibility of traditional futures with the continuous trading features of spot markets. One of the most powerful risk measurement tools in this space is beta—a metric that measures the relationship between an asset and its benchmark market. Understanding how to calculate beta in perpetual futures can help traders refine their strategies, manage risk, and maximize returns.

In this comprehensive guide, we will explore the definition of beta in perpetual futures, multiple methods for calculating it, the pros and cons of each approach, and how professional traders use beta in decision-making. By the end, you will have a step-by-step framework for calculating and interpreting beta in perpetual futures trading.

What is Beta in Perpetual Futures?

Beta is a measure of systematic risk that shows how much a perpetual futures contract moves relative to a benchmark index, such as Bitcoin vs. a crypto market index, or Ethereum perpetuals compared to BTC.

- Beta > 1: The contract is more volatile than the market.

- Beta < 1: The contract is less volatile than the market.

- Beta = 1: The contract moves in line with the market.

- Negative Beta: The contract moves inversely to the benchmark.

In perpetual futures trading, beta is critical for:

- Risk management: Estimating exposure to market-wide movements.

- Strategy optimization: Selecting assets with desired correlation levels.

- Portfolio construction: Balancing aggressive and defensive positions.

Why Traders Should Calculate Beta in Perpetual Futures

Beta helps traders answer key questions such as:

- How sensitive is my perpetual futures position to overall market changes?

- Can I use beta to hedge against unexpected price swings?

- Which contracts should I use for aggressive growth versus stable income?

This makes beta particularly important for both retail investors and institutional traders. As highlighted in research on how to interpret beta in perpetual futures analysis, beta serves as a bridge between traditional finance risk models and the fast-evolving crypto derivatives market.

Methods to Calculate Beta in Perpetual Futures

1. Regression-Based Calculation

The most common method for calculating beta is through linear regression analysis.

Step-by-Step Process:

- Collect Data: Historical price returns of the perpetual futures contract and its benchmark (e.g., BTC index).

- Calculate Returns: Use daily (or intraday) percentage changes.

- Run Regression: Regress the contract’s returns against the benchmark’s returns.

- Extract Slope: The slope of the regression line = beta.

Pros:

- Statistically robust.

- Provides confidence intervals.

- Widely recognized across financial markets.

Cons:

- Requires sufficient historical data.

- Sensitive to outliers.

- Less reliable in highly volatile markets with structural breaks.

2. Covariance/Variance Formula

Another direct method is using the formula:

Beta = Covariance(Asset, Benchmark) ÷ Variance(Benchmark)

Step-by-Step Process:

- Compute the covariance between the contract returns and benchmark returns.

- Compute the variance of the benchmark returns.

- Divide covariance by variance.

Pros:

- Faster and easier than regression.

- Less computationally intensive.

Cons:

- Does not provide statistical significance.

- May oversimplify relationships in volatile environments.

3. Rolling Beta Analysis

Instead of calculating one static beta, traders often use rolling windows (e.g., 30-day or 60-day).

Advantages:

- Captures beta dynamics in real-time.

- Adjusts for changing market conditions.

Disadvantages:

- Computationally heavier.

- Requires continuous data updates.

Practical Example: Calculating Beta for BTC Perpetuals

Let’s say we want to calculate the beta of BTC perpetual futures relative to a crypto index (CIX).

Collect 90 days of daily returns for BTC perpetuals and CIX.

Compute covariance between BTC returns and CIX returns.

- Example: 0.0025

- Example: 0.0025

Compute variance of CIX returns.

- Example: 0.0010

- Example: 0.0010

Beta = 0.0025 ÷ 0.0010 = 2.5

This means BTC perpetual futures are 2.5x more volatile than the market index—a strong indication of aggressive risk exposure.

Comparing Methods: Which is Best?

- Regression is ideal for professional traders and institutions who want statistical rigor.

- Covariance/Variance works best for quick calculations and beginners.

- Rolling Beta is the most advanced approach, suitable for dynamic strategies and hedge funds.

If you’re new to beta analysis, start with the covariance/variance formula, and then progress toward regression or rolling analysis as your trading becomes more sophisticated.

How Beta Affects Perpetual Futures Trading

Beta influences everything from leverage decisions to portfolio diversification. For instance, if your perpetual futures contract has a beta of 3, a 1% market move could result in a 3% move in your position—useful for aggressive profit-seeking but risky without proper hedging.

As discussed in why beta is important in perpetual futures, traders can adjust their exposure based on desired risk levels. High-beta contracts are excellent for momentum strategies, while low-beta contracts suit defensive hedging.

Best Practices for Using Beta in Perpetual Futures

- Use multiple timeframes: Compare 30-day, 60-day, and 90-day betas.

- Combine with volatility metrics: Beta alone does not capture idiosyncratic risk.

- Backtest strategies: Always test beta-driven strategies on historical data.

- Update regularly: Markets evolve quickly, especially in crypto.

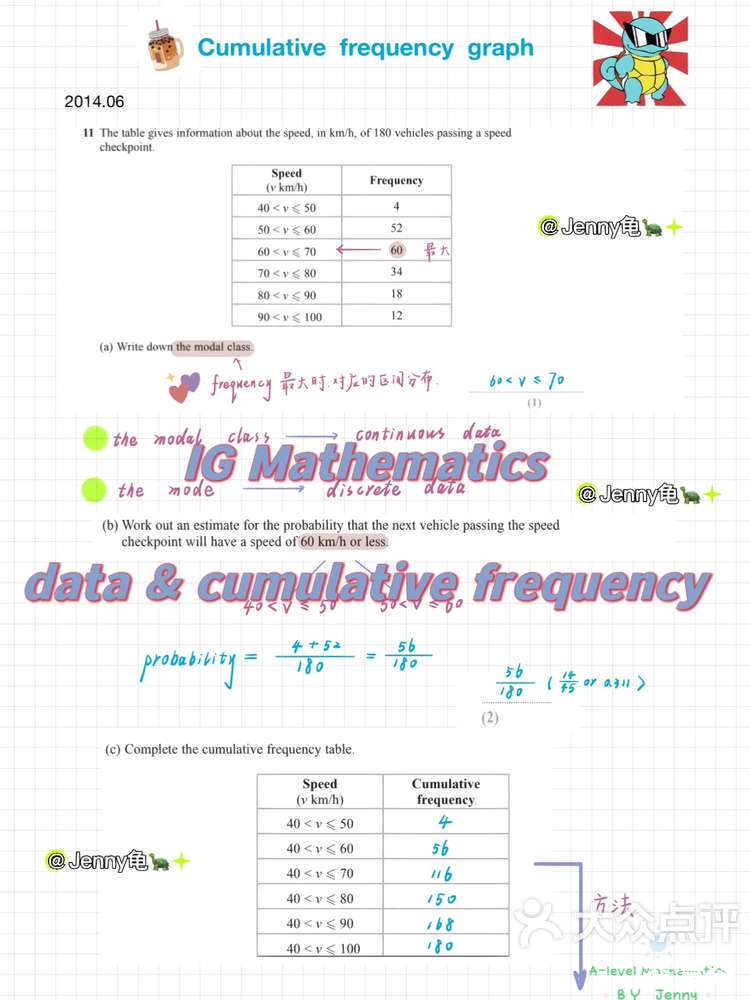

Visual Illustration

Beta calculation methods explained: regression vs. covariance/variance.

FAQ on Calculating Beta in Perpetual Futures

1. How much historical data is needed to calculate beta accurately?

Ideally, traders should use at least 60–90 days of daily data for regression or covariance analysis. However, intraday traders might use shorter intervals, like hourly returns, provided the sample size is large enough.

2. Can beta be negative in perpetual futures?

Yes. A negative beta indicates the contract tends to move inversely to the benchmark. For example, some altcoin perpetuals may show negative beta against BTC during specific market phases.

3. How does beta interact with leverage in perpetual futures?

Leverage amplifies the effects of beta. A contract with a beta of 2 and 10x leverage can behave like a 20-beta exposure. This makes risk management essential when combining beta with leverage.

Conclusion

Understanding how to calculate beta in perpetual futures gives traders a powerful tool to assess market sensitivity, manage risk, and optimize strategies. From regression analysis to covariance methods and rolling beta, traders can select the approach that fits their trading style.

In a world where perpetual futures markets evolve rapidly, beta serves as a bridge between traditional finance risk models and crypto-native strategies. Whether you are a beginner or a professional, integrating beta into your trading analysis will enhance both your confidence and your profitability.

If you found this guide useful, share it with your trading community, leave a comment below, and join the discussion—because mastering beta is a journey best traveled together.

Would you like me to create a step-by-step Python code snippet that traders can use to calculate beta in perpetual futures automatically? That way, readers could directly implement what they learn.