==================================================

The Sharpe Ratio is one of the most widely used metrics for evaluating risk-adjusted returns. In perpetual futures trading, it becomes even more valuable because of the high leverage, volatility, and 24⁄7 market conditions. Learning how to calculate Sharpe Ratio in perpetual futures allows traders to evaluate whether their trading strategy delivers sufficient return for the risk taken.

This guide provides a step-by-step explanation of the Sharpe Ratio calculation, explores two different methods, compares their effectiveness, and highlights practical applications in perpetual futures.

Understanding the Sharpe Ratio in Futures Trading

What Is the Sharpe Ratio?

The Sharpe Ratio measures the excess return of a trading strategy compared to a risk-free rate, divided by the standard deviation of returns (a proxy for volatility).

The formula:

SharpeRatio=Rp−RfσpSharpe Ratio = \frac{R_p - R_f}{\sigma_p}SharpeRatio=σpRp−Rf

Where:

- RpR_pRp = Portfolio or strategy return

- RfR_fRf = Risk-free rate (often U.S. Treasury rate)

- σp\sigma_pσp = Standard deviation of returns

Why Is Sharpe Ratio Crucial for Perpetual Futures?

Perpetual futures trading involves constant exposure to leveraged positions. Unlike traditional assets, the compounding effects of funding fees, volatility, and position rebalancing mean that risk-adjusted performance metrics matter more than absolute returns.

For example, a strategy returning 30% with extreme volatility might be less attractive than one generating 15% with much lower volatility.

Step-by-Step Guide: How to Calculate Sharpe Ratio in Perpetual Futures

Step 1: Gather Data

Collect daily, hourly, or trade-level returns of your perpetual futures strategy. Many traders use daily returns for consistency.

Step 2: Determine Risk-Free Rate

Choose a benchmark rate such as U.S. 3-month Treasury bills. In crypto, some traders assume a near-zero risk-free rate due to lack of stable benchmarks.

Step 3: Compute Excess Returns

Subtract the risk-free rate from each return observation.

Step 4: Calculate Standard Deviation

Find the standard deviation of excess returns — this measures volatility.

Step 5: Apply the Formula

Divide the average excess return by the standard deviation to get the Sharpe Ratio.

Example Calculation

Suppose a BTC perpetual futures strategy produces the following monthly returns:

- Jan: 8%

- Feb: -4%

- Mar: 10%

- Apr: 6%

Risk-free rate assumed: 0.25% per month

- Excess returns: (7.75%, -4.25%, 9.75%, 5.75%)

- Average excess return: 4.75%

- Standard deviation of returns: 6.3%

- Sharpe Ratio = 4.75 / 6.3 ≈ 0.75

This means the strategy provides 0.75 units of return per unit of risk, which is decent but not exceptional.

Two Methods of Sharpe Ratio Calculation in Perpetual Futures

Method 1: Traditional Periodic Sharpe Ratio

- Uses daily or monthly returns.

- Simple and widely accepted.

- Good for evaluating long-term consistency.

Pros: Easy to compute, universally recognized.

Cons: May miss intraday volatility important in perpetual futures.

Method 2: High-Frequency (Intraday) Sharpe Ratio

- Uses hourly or trade-level returns.

- Captures leverage effects and funding fee costs.

- More relevant for active traders.

Pros: More accurate for high-frequency strategies.

Cons: Requires extensive data and computational resources.

Comparing the Two Approaches

| Factor | Traditional Periodic Sharpe | Intraday Sharpe Ratio |

|---|---|---|

| Time Horizon | Daily/Monthly | Hourly/Trade-level |

| Data Requirements | Low | High |

| Best For | Long-term investors | Active perpetual traders |

| Sensitivity to Volatility | Moderate | High |

| Recommended Use | Strategy evaluation | Risk monitoring |

Recommendation: For most retail traders, the periodic Sharpe Ratio is sufficient. Professional and algorithmic traders may benefit more from the intraday version.

Real-World Applications of Sharpe Ratio in Perpetual Futures

- Comparing Trading Bots: Helps identify which automated strategy balances returns and volatility.

- Portfolio Allocation: Aids in choosing between BTC, ETH, and altcoin perpetuals.

- Risk Management: Detects when leverage leads to declining risk-adjusted returns.

This explains what is the importance of Sharpe Ratio in futures trading, as it guides smarter allocation and risk control.

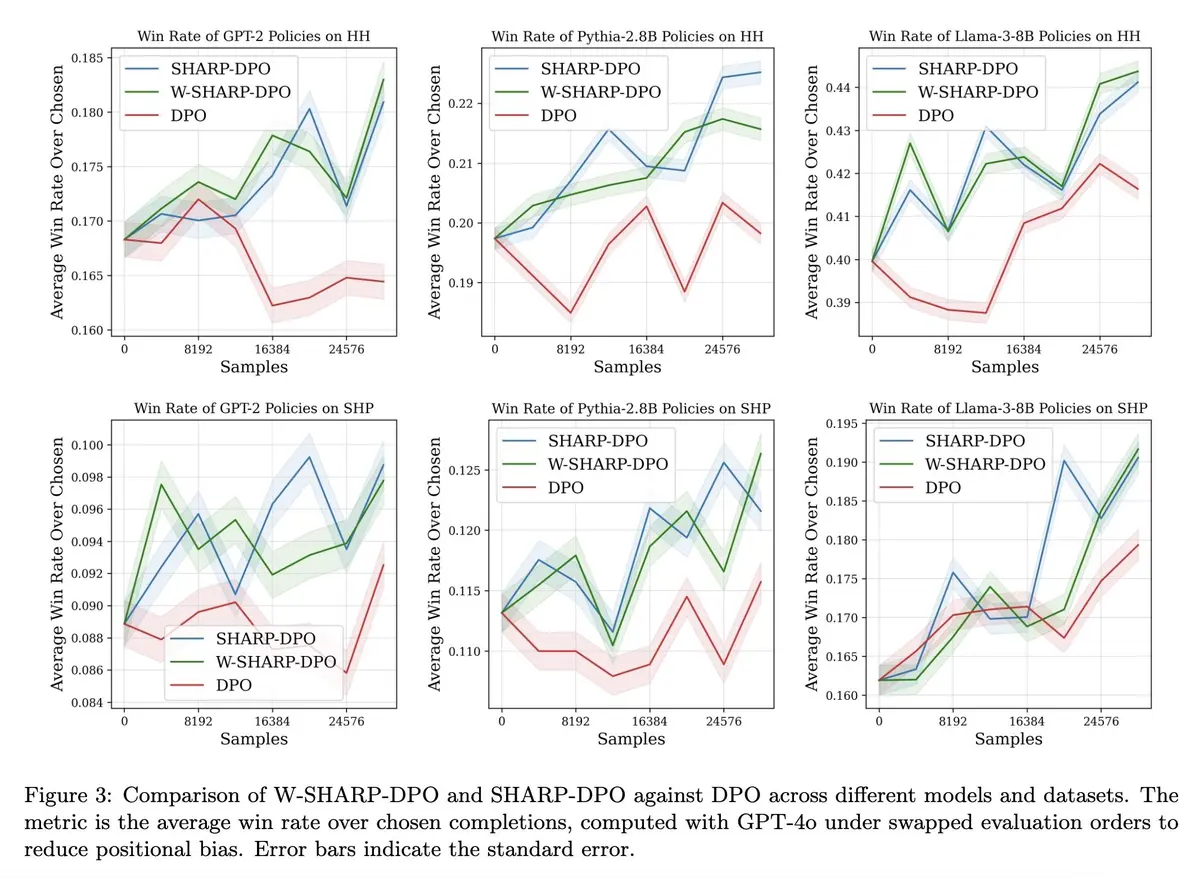

Visual Examples

The Sharpe Ratio balances returns against volatility.

High volatility reduces the Sharpe Ratio even when returns are strong.

Traders compare strategies’ Sharpe Ratios to optimize portfolio allocation.

Best Practices for Improving Sharpe Ratio

- Reduce drawdowns: Use strict stop-losses.

- Optimize leverage: Avoid overexposure that increases volatility.

- Diversify assets: Trade multiple perpetual contracts.

- Incorporate hedging: Smooths volatility and improves consistency.

- Monitor funding rates: They directly impact net returns.

For further insights, traders can explore why use Sharpe Ratio for evaluating risks in perpetual futures markets.

FAQ: How to Calculate Sharpe Ratio in Perpetual Futures

1. What is considered a “good” Sharpe Ratio?

- Below 1.0: Weak strategy

- 1.0–1.5: Acceptable

- 1.5–2.0: Strong

- Above 2.0: Excellent risk-adjusted performance

2. Should I use daily or intraday data for Sharpe Ratio in perpetual futures?

It depends on your trading frequency. Daily data works for swing traders, while scalpers and HFTs benefit from intraday Sharpe Ratios.

3. How does Sharpe Ratio compare with other metrics like Sortino Ratio?

Sharpe Ratio considers total volatility (both upside and downside). Sortino Ratio focuses only on downside risk, making it more useful when drawdowns matter more than general fluctuations.

Conclusion: Using Sharpe Ratio for Smarter Futures Trading

Understanding how to calculate Sharpe Ratio in perpetual futures is essential for traders aiming to evaluate risk-adjusted performance. Whether you use the traditional periodic approach or intraday calculations, the Sharpe Ratio provides a powerful lens for decision-making.

By integrating Sharpe analysis into risk management, traders can optimize strategies, manage leverage, and achieve more consistent returns in volatile perpetual futures markets.

If you found this article useful, share it with your trading community, comment on your own experiences calculating Sharpe Ratios, and let’s exchange insights to trade smarter together.

Would you like me to also create an Excel template for calculating Sharpe Ratio in perpetual futures, so you can plug in your own strategy returns?