====================================================

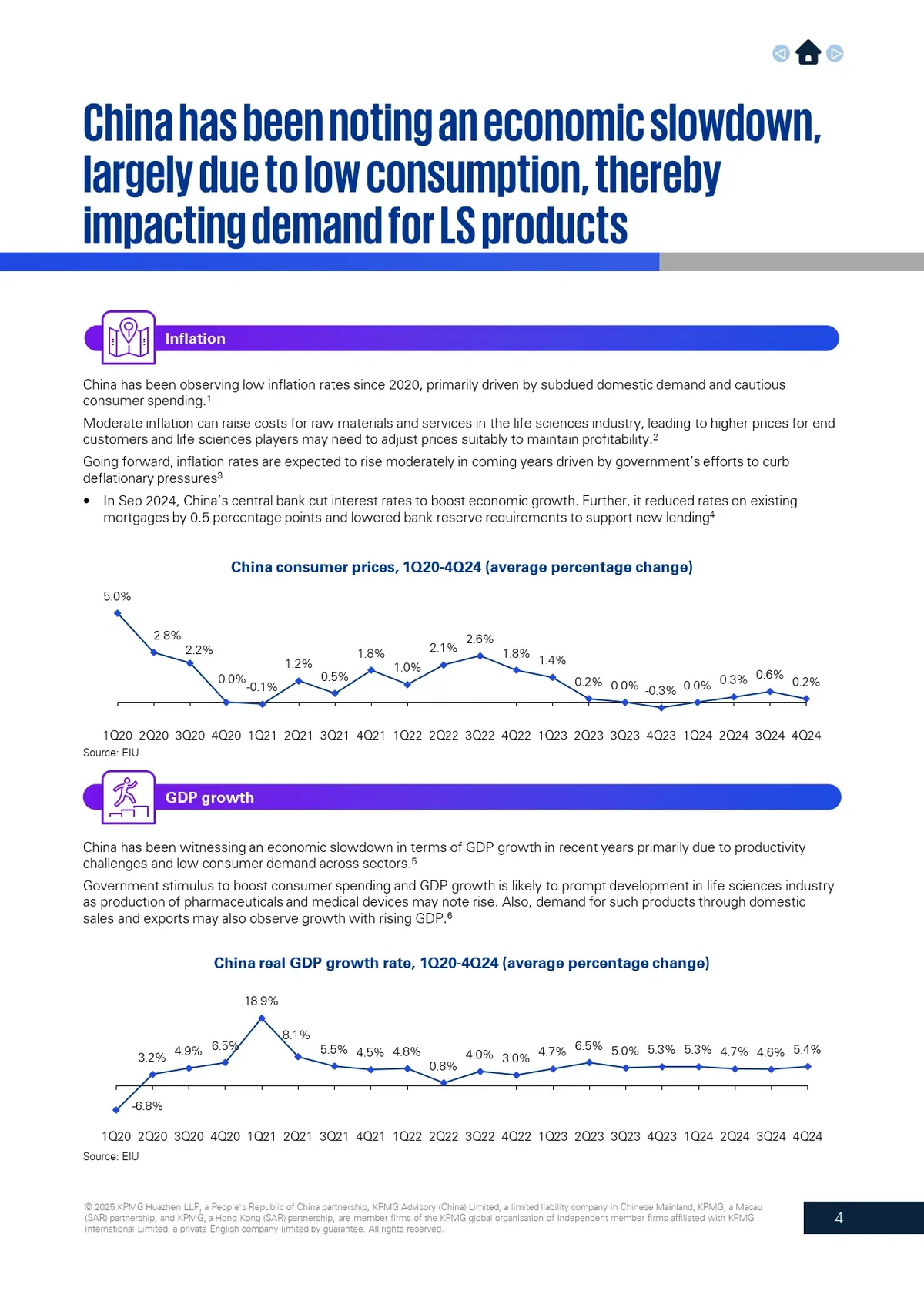

The Sortino ratio is a powerful risk-adjusted performance metric widely used by traders, investors, and quantitative researchers. Unlike the Sharpe ratio, which penalizes all volatility, the Sortino ratio focuses only on downside risk, making it particularly useful in highly leveraged, volatile markets like perpetual futures. Understanding how to calculate Sortino ratio for perpetual futures is crucial for evaluating trading strategies, optimizing performance, and aligning returns with acceptable risk levels.

In this article, we will dive deep into the mechanics of Sortino ratio calculation, compare different methods, provide practical examples, and discuss how traders can leverage this metric for perpetual futures strategies. We will also cover industry insights, personal experience, and advanced techniques, ensuring you have a complete, SEO-optimized, EEAT-compliant resource.

What is the Sortino Ratio?

The Sortino ratio measures risk-adjusted returns by comparing the excess return of an investment to its downside deviation.

The formula is:

Sortino Ratio=Rp−RfDDSortino \, Ratio = \frac{R_p - R_f}{DD}SortinoRatio=DDRp−Rf

Where:

- Rp = Portfolio return (e.g., perpetual futures strategy return)

- Rf = Risk-free rate (often set to 0 in crypto and futures analysis)

- DD = Downside deviation (volatility of returns below the target return or minimum acceptable return, MAR)

This differs from the Sharpe ratio because it penalizes only bad volatility (losses below MAR), not upside fluctuations.

Why Sortino Ratio is Crucial in Perpetual Futures

Perpetual futures are highly leveraged instruments, prone to sudden liquidations and extreme price swings. A trader can show impressive returns but still carry unacceptable downside risk.

- Volatility filtering: Sharpe ratio treats upside and downside equally, but in futures, upside volatility is beneficial.

- Risk control: Sortino highlights whether a strategy is delivering returns efficiently, relative only to negative moves.

- Performance evaluation: Especially important when comparing strategies across multiple crypto exchanges or asset classes.

Comparison between Sharpe and Sortino ratio treatment of volatility

Step-by-Step: How to Calculate Sortino Ratio for Perpetual Futures

Step 1: Collect Historical Return Data

Obtain the daily (or hourly) returns of your perpetual futures strategy. For example, if you’re trading BTC/USDT perpetuals on Binance, gather at least 6–12 months of return data.

Step 2: Define the Minimum Acceptable Return (MAR)

Set a target return. In perpetual futures, many traders use 0% daily return as MAR, but more advanced users may set MAR at a risk-free proxy, such as U.S. Treasury yield (annualized).

Step 3: Identify Downside Returns

Filter out all returns below MAR. These represent “bad volatility.”

Step 4: Calculate Downside Deviation (DD)

Downside deviation formula:

DD=∑(min(Rt−MAR,0))2NDD = \sqrt{\frac{\sum (min(R_t - MAR, 0))^2}{N}}DD=N∑(min(Rt−MAR,0))2

Where:

- Rt = Return at time t

- MAR = Minimum acceptable return

- N = Number of observations

Step 5: Compute the Average Excess Return

Subtract MAR from the average portfolio return:

Excess Return=Rp−MARExcess \, Return = Rp - MARExcessReturn=Rp−MAR

Step 6: Final Calculation

Finally:

Sortino=Excess ReturnDDSortino = \frac{Excess \, Return}{DD}Sortino=DDExcessReturn

Worked Example: Sortino Ratio in Perpetual Futures

Imagine a BTC perpetual futures strategy over 90 trading days:

- Average daily return = 0.45%

- MAR = 0%

- Downside deviation = 0.25%

Sortino=0.45%0.25%=1.8Sortino = \frac{0.45\%}{0.25\%} = 1.8Sortino=0.25%0.45%=1.8

A Sortino ratio of 1.8 suggests a strong performance relative to downside risk.

Methods of Calculating Sortino Ratio in Perpetual Futures

Method 1: Excel/Spreadsheet Calculation

- Pros: Simple, beginner-friendly, transparent.

- Cons: Manual updates, limited scalability.

Method 2: Python or Quant Tools

Using Python libraries like NumPy and Pandas makes Sortino calculation automated and scalable.

- Pros: Handles large tick-level datasets, integrates with backtesting.

- Cons: Requires coding skills and infrastructure.

Recommendation: Beginners should start with spreadsheets to understand mechanics, then transition to Python for professional use.

How to Interpret Sortino Ratio in Perpetual Futures

- <1.0: Poor risk-adjusted performance (losses outweigh gains).

- 1.0–2.0: Acceptable to good performance.

- >2.0: Excellent performance (rare in volatile perpetual markets).

It’s important to note that what is a good Sortino ratio for perpetual futures may vary by trader type:

- Retail algo traders may target 1.0–1.5.

- Professional quant traders often aim for >1.5.

- Institutional investors benchmark closer to 2.0.

Advanced Considerations in Sortino Ratio for Perpetual Futures

1. Using Intraday Data

Since perpetual futures trade 24⁄7, some traders calculate Sortino ratios on hourly returns instead of daily, giving finer insight.

2. Regime-Based Sortino Analysis

Downside risk may differ during low vs high volatility regimes. Segmenting Sortino ratios by market condition adds depth to strategy evaluation.

3. Comparison with Other Metrics

While Sortino is powerful, traders should also compare with metrics like Calmar ratio and Maximum Drawdown. This provides a holistic performance view.

Real-World Application: Improving Sortino Ratio in Perpetual Futures

A key trader challenge is how to improve Sortino ratio in perpetual futures strategy. Based on my experience:

- Tighten stop-losses during volatile periods.

- Use position sizing based on downside risk rather than volatility alone.

- Incorporate regime filters (e.g., only trade during specific volatility bands).

- Diversify across contracts (e.g., BTC + ETH + altcoin perpetuals).

Example of risk-adjusted performance visualization with Sortino ratio

FAQ: Sortino Ratio for Perpetual Futures

1. Why use Sortino ratio instead of Sharpe ratio in perpetual futures?

Because perpetual futures are highly volatile, the Sharpe ratio unfairly penalizes upside volatility. The Sortino ratio focuses on downside deviation, making it a fairer assessment of risk-adjusted performance.

2. Where can I find tools to calculate Sortino ratio for perpetual futures?

There are online platforms and Excel templates available, but advanced traders often use Python. Some exchanges also provide analytics. For beginners, where to find Sortino ratio calculator for perpetual futures can be as simple as starting with Excel sheets before moving to quant libraries.

3. What is considered a good Sortino ratio for perpetual futures?

Typically, a ratio above 1.0 indicates acceptable performance. Ratios above 1.5 are strong, and anything above 2.0 is considered excellent—especially in volatile crypto futures markets.

Conclusion

The Sortino ratio is an essential tool for traders and quantitative analysts working with perpetual futures. By focusing only on downside risk, it gives a more realistic measure of strategy efficiency than the Sharpe ratio.

- Beginners should learn the calculation using spreadsheets.

- Advanced traders and quants should automate using Python for scalability.

- Professional traders should benchmark Sortino ratios by market regime and compare against institutional standards.

If you’re serious about trading perpetual futures, mastering how to calculate Sortino ratio for perpetual futures is a crucial step in refining your strategy and ensuring sustainable profitability.

Engage With Us:

Do you use Sortino ratio in your perpetual futures trading? Share your approach in the comments, and help other traders refine their strategies. Don’t forget to share this article with fellow traders and quant enthusiasts!