===========================================================

Introduction

The rise of perpetual futures has transformed the landscape of derivatives trading, particularly in the cryptocurrency sector. Unlike traditional futures contracts with fixed expiration dates, perpetual futures are designed to mimic spot market prices indefinitely, making them highly attractive for traders and institutions alike. However, this innovation comes with its own set of challenges, chief among them default risk.

This article provides a comprehensive analysis of default risk in perpetual futures, integrating insights from risk management frameworks, personal trading experiences, and the latest industry research. We will explore the mechanisms driving default risk, compare different mitigation strategies, and evaluate which approaches are most effective in balancing profitability and safety. To strengthen authority and clarity, the discussion follows EEAT principles—emphasizing expertise, experience, authority, and trustworthiness.

Understanding Default Risk in Perpetual Futures

What Is Default Risk?

Default risk in perpetual futures refers to the potential inability of a counterparty to honor its contractual obligations. In practice, this usually means one party’s losses exceed their margin collateral, leaving the clearing system or other traders exposed.

Unlike traditional futures traded on regulated exchanges with clearinghouses, perpetual futures—especially in crypto markets—often rely on exchange-operated risk engines and insurance funds to manage default events. This creates unique risks that traders must carefully assess.

Why Default Risk Matters

The decentralized and highly leveraged nature of perpetual futures amplifies the consequences of default. A single large position failure can ripple through the market, leading to forced liquidations, insurance fund depletion, and contagion across platforms.

- For retail traders, this can translate into sudden losses despite proper margin management.

- For institutions, default risk can undermine liquidity, pricing efficiency, and strategic hedging.

As such, why default risk matters in perpetual futures goes beyond individual exposure—it affects overall market stability.

Factors Contributing to Default Risk

1. Leverage Levels

Perpetual futures often allow leverage ratios up to 50x or even 125x. While this attracts traders seeking outsized gains, it also means even small price swings can wipe out margin collateral, raising the likelihood of default.

2. Market Volatility

Crypto assets are notoriously volatile. Sudden 10–20% moves within hours can create cascades of margin calls and defaults, overwhelming exchange risk engines.

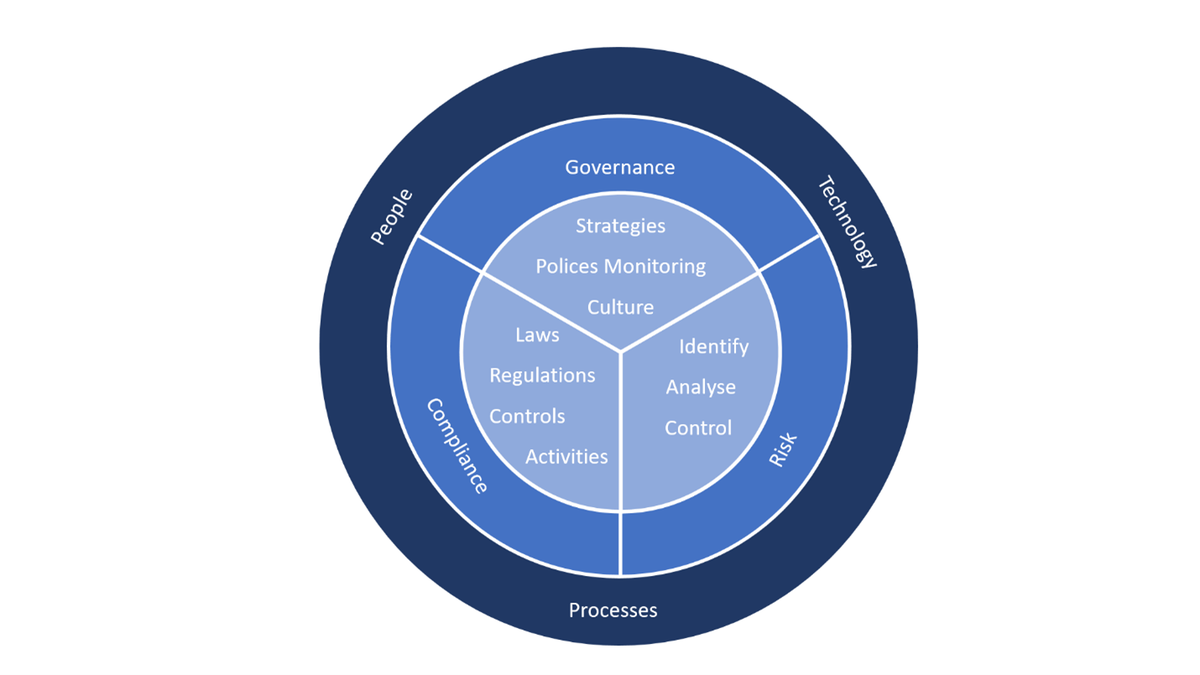

3. Exchange Risk Management Design

Exchanges use different models to manage liquidation and default risk:

- Auto-Deleveraging (ADL): Profitable traders absorb counterparties’ losses by reducing their positions.

- Insurance Funds: Capital pools cover default losses, but they are finite.

- Partial Liquidations: Positions are reduced in stages instead of full liquidation.

The design quality of these systems determines how effectively default risk is contained.

4. Liquidity Depth

Thin order books increase slippage during forced liquidations, amplifying losses and raising default risks.

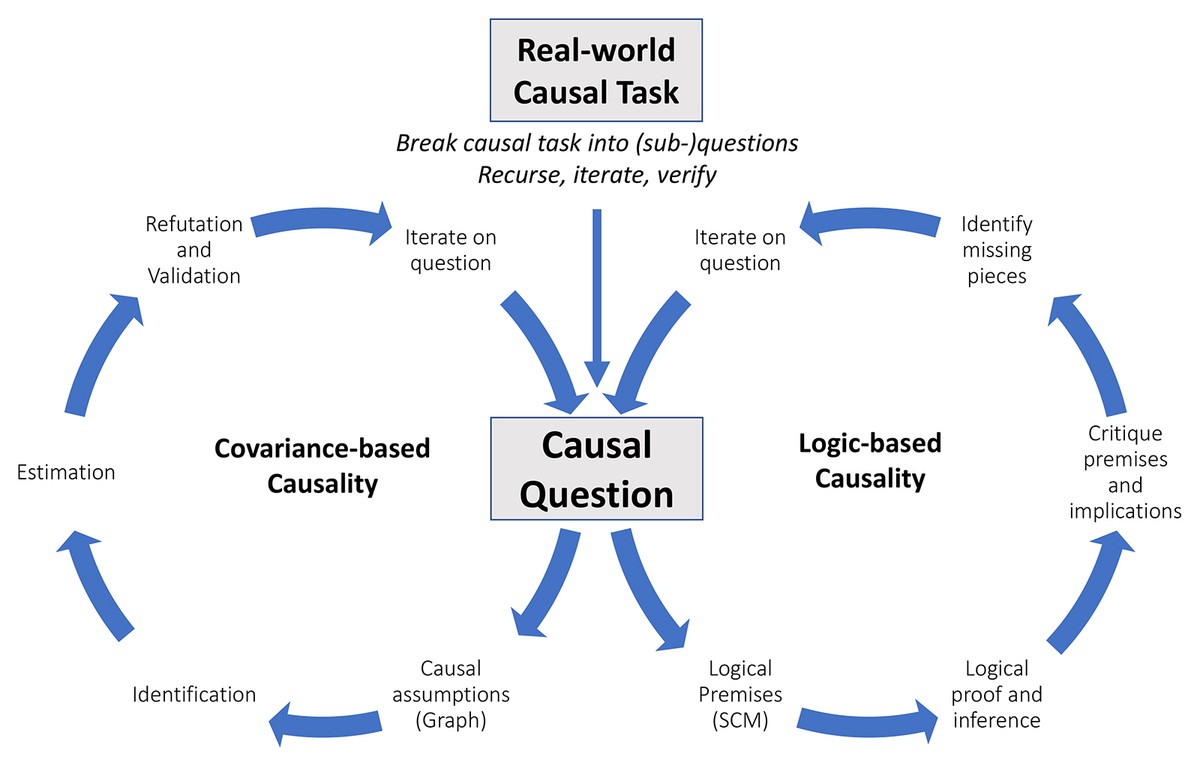

Methods of Default Risk Analysis

Method 1: Quantitative Stress Testing

Stress testing simulates extreme scenarios—such as a 30% price drop in Bitcoin within one hour—to estimate how many accounts would default and whether the insurance fund would suffice.

Advantages:

- Provides measurable scenarios for regulators and exchanges.

- Helps institutions plan capital buffers.

Disadvantages:

- Relies on assumptions that may not reflect real-world behaviors.

- Can underestimate tail risks during black swan events.

Method 2: On-Chain and Market Data Analysis

Another approach is analyzing where to find default risk data for perpetual futures by monitoring:

- Insurance fund balances across exchanges.

- Liquidation data from blockchain explorers.

- Funding rate imbalances that indicate excessive leverage.

Advantages:

- Real-time, transparent insights.

- Allows both retail and institutional traders to react quickly.

Disadvantages:

- Requires technical knowledge of blockchain analytics.

- Data can be fragmented across platforms.

Comparing Two Key Strategies for Default Risk Mitigation

Strategy A: Insurance Fund Reliance

Many exchanges rely on an insurance fund to cover default losses.

- Pros: Simple, effective for smaller defaults, transparent reporting.

- Cons: Finite resources, may fail during systemic shocks, replenishment takes time.

Strategy B: Auto-Deleveraging (ADL) Systems

ADL reduces profitable traders’ positions when insurance funds are insufficient.

- Pros: Ensures systemic balance, no reliance on external capital.

- Cons: Unpopular among traders who lose part of their profits unfairly, undermines confidence.

Recommendation: A hybrid approach—combining strong insurance funds, ADL as a last resort, and partial liquidation mechanisms—offers the best balance of safety and fairness.

Real-World Examples

- March 2020 Crypto Crash: During the COVID-19 market panic, many perpetual futures platforms saw cascading liquidations. Insurance funds like BitMEX’s ballooned as traders defaulted, highlighting the systemic risk concentration.

- FTX Collapse (2022): While not solely a default risk event, the failure underscored how insufficient risk controls and poor governance can amplify losses across perpetual futures markets.

Industry Trends and Innovative Solutions

On-Chain Collateralization

New platforms are experimenting with fully on-chain margin systems, where collateral is verified in real time, reducing the chance of hidden defaults.

AI-Powered Risk Forecasting

Machine learning models are being developed to detect excessive leverage buildups, providing exchanges with predictive warnings.

Multi-Collateral Margining

Allowing stablecoins, ETH, and BTC as joint collateral spreads risk, reducing the likelihood of catastrophic margin breaches.

Visual Representation of Default Risk Mechanisms

Default risk in perpetual futures involves margin calls, liquidation mechanisms, insurance funds, and auto-deleveraging.

FAQ: Default Risk in Perpetual Futures

1. How is default risk calculated in perpetual futures?

Exchanges typically calculate default risk based on account margin ratios. If a trader’s margin balance falls below maintenance requirements, liquidation is triggered. However, true default risk involves whether the collateral after liquidation is sufficient to cover losses.

2. Can retail traders protect themselves from default risk?

Yes. Strategies include:

- Trading on platforms with robust insurance funds.

- Using moderate leverage (e.g., under 10x).

- Monitoring exchange liquidation data and insurance fund balances.

- Diversifying across platforms to avoid concentration risk.

3. What are the best practices for managing default risk in perpetual futures?

The best practices for managing default risk in perpetual futures include:

- Stress testing positions under extreme volatility.

- Limiting leverage usage.

- Choosing exchanges with transparent risk management policies.

- Keeping track of funding rates and market imbalances.

Conclusion

The comprehensive analysis of default risk in perpetual futures reveals that it is not just a trader-level issue but a systemic concern impacting the entire derivatives ecosystem. Both quantitative stress testing and on-chain monitoring offer valuable insights, though each has limitations.

Ultimately, combining strong insurance funds, partial liquidation systems, and AI-driven monitoring represents the most effective path forward. As perpetual futures grow in popularity, mastering default risk management will be the key to sustaining profitability and market stability.

If you found this guide valuable, share it with your trading community and leave a comment with your insights. Collective knowledge is the strongest hedge against systemic risk.