===================================================================

Introduction

The growing popularity of perpetual futures has reshaped modern trading, offering leverage, flexibility, and continuous trading opportunities. However, this innovation comes with heightened risks—particularly credit risk. Credit risk in perpetual futures refers to the chance that one party in the contract fails to fulfill obligations, leading to losses for the counterparty or the platform.

This article delivers a comprehensive credit risk reduction strategies in perpetual futures, grounded in real-world insights, risk management frameworks, and institutional-grade practices. Drawing on personal experience as a trader and industry research, I’ll compare multiple strategies, highlight best practices, and provide actionable steps for both retail and institutional investors.

Understanding Credit Risk in Perpetual Futures

What Is Credit Risk?

Credit risk in perpetual futures is the potential loss resulting from counterparties or platforms failing to meet their margin, settlement, or collateral obligations. Unlike traditional futures with fixed expirations, perpetual contracts have continuous settlement, creating persistent exposure to credit risks.

Why Credit Risk Matters

Unmanaged credit risk can lead to systemic failures—traders may experience forced liquidations, exchanges may suffer liquidity crunches, and confidence in the market could collapse. Thus, why credit risk matters in perpetual futures trading is not just a theoretical question; it directly impacts market stability, trust, and individual profitability.

Key Sources of Credit Risk

- Counterparty default due to insufficient margin

- Exchange-level failures from liquidity mismatches

- Leverage misuse by traders leading to cascading liquidations

- Extreme market volatility, amplifying exposure

Core Credit Risk Reduction Strategies

1. Margin Optimization and Collateral Management

Efficient margin and collateral systems form the first line of defense against credit risk.

- How it works: Traders deposit collateral, and exchanges enforce margin calls to ensure obligations are met.

- Benefits: Reduces default risk, promotes discipline in leveraged trading.

- Drawbacks: Overly strict margin requirements can reduce liquidity and trading activity.

Best practice involves dynamic margin requirements—increasing margin in high volatility while easing requirements in stable conditions.

2. Centralized Risk Pools and Insurance Funds

Exchanges like Binance and Bybit maintain insurance funds to cover deficits from liquidations.

- Pros: Protects traders from sudden counterparty defaults, enhances exchange credibility.

- Cons: Funds may be depleted in extreme volatility, creating systemic vulnerability.

This method works best when paired with transparent reporting and periodic fund audits.

3. Real-Time Risk Monitoring Systems

Advanced platforms deploy real-time credit risk monitoring, tracking exposure levels, leverage ratios, and trader behavior.

- Advantages: Immediate intervention reduces contagion risk.

- Limitations: Expensive to implement, requires continuous data integration.

This ties into the discussion on what are the best practices for managing credit risk in perpetual futures, where real-time monitoring emerges as a cornerstone of modern risk frameworks.

Comparing Two Strategies in Depth

Strategy A: Conservative Margin Policies

- Strengths: Enhances credit safety by ensuring all positions are well-collateralized.

- Weaknesses: Limits trader flexibility, discourages smaller investors.

- Best for: Institutions and exchanges prioritizing long-term stability over volume.

Strategy B: Adaptive Risk Engines with Insurance Backing

- Strengths: Balances flexibility and protection by combining adaptive margining with insurance funds.

- Weaknesses: Heavily dependent on the accuracy of predictive models and fund sufficiency.

- Best for: Exchanges catering to retail traders seeking higher leverage opportunities.

Recommendation: The optimal solution is a hybrid model—using adaptive margin systems supported by robust insurance funds. This balances flexibility with protection, ensuring both liquidity and security.

Advanced Tools and Frameworks

1. Stress Testing and Scenario Analysis

Simulating extreme volatility events allows traders and platforms to anticipate systemic risks.

2. Diversified Collateral Options

Permitting stablecoins, fiat, and multiple digital assets as collateral reduces dependency on a single asset’s volatility.

3. Automated Liquidation Systems

Sophisticated liquidation engines help close risky positions before they endanger the system.

4. Institutional-Grade Credit Risk Frameworks

Borrowing concepts from traditional finance—like Basel III principles—creates scalable, resilient credit risk models for crypto futures markets.

Personal Insights and Industry Experience

In my trading journey, I’ve seen traders underestimate the impact of leverage-driven credit risks. For example, during a volatile Bitcoin drop, many retail traders using high leverage faced cascading liquidations. Platforms with adaptive liquidation engines minimized systemic fallout, while others saw credit risk spiral into broader exchange issues.

My experience supports the importance of:

- Using conservative leverage as an individual trader.

- Trading on exchanges with transparent insurance fund policies.

- Monitoring credit risk tools for experienced perpetual futures traders rather than relying solely on platform guarantees.

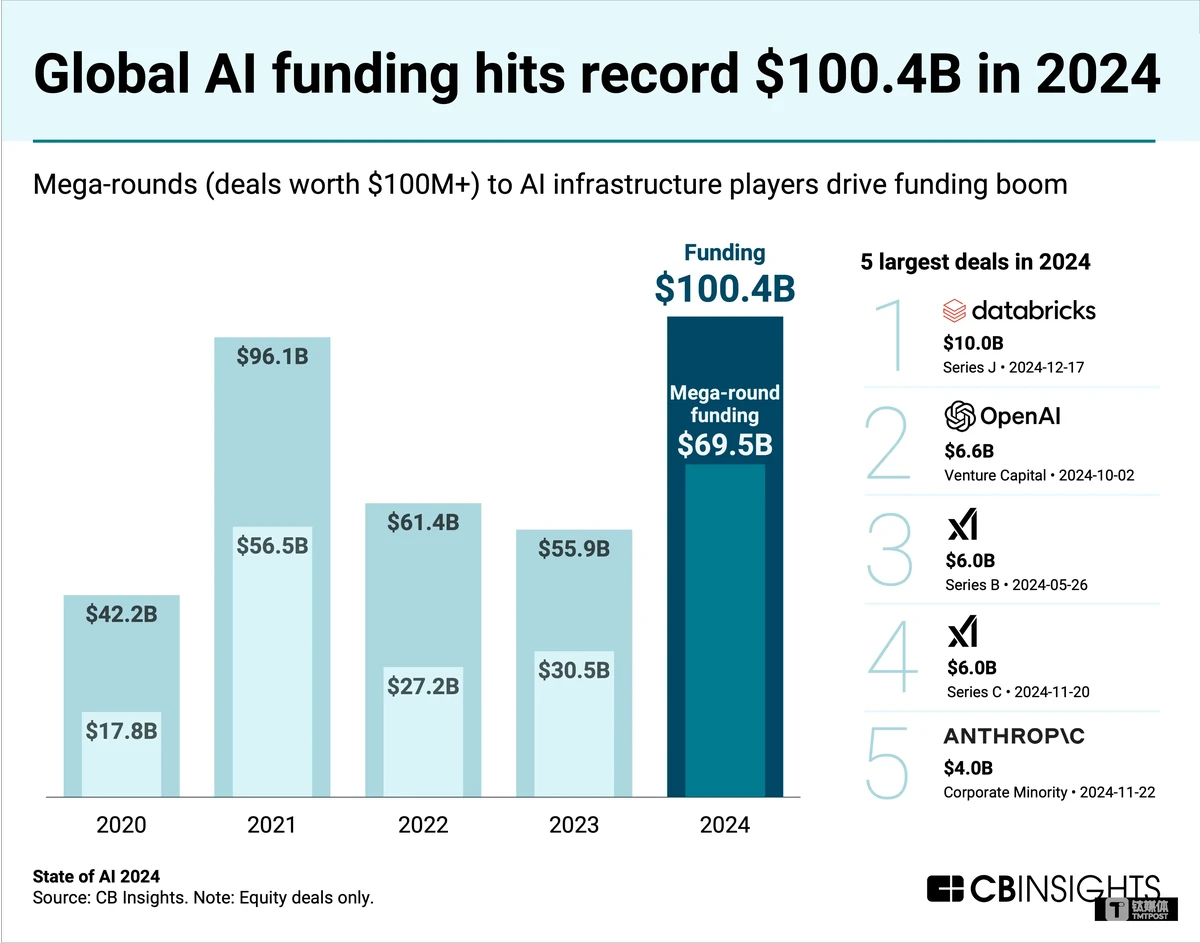

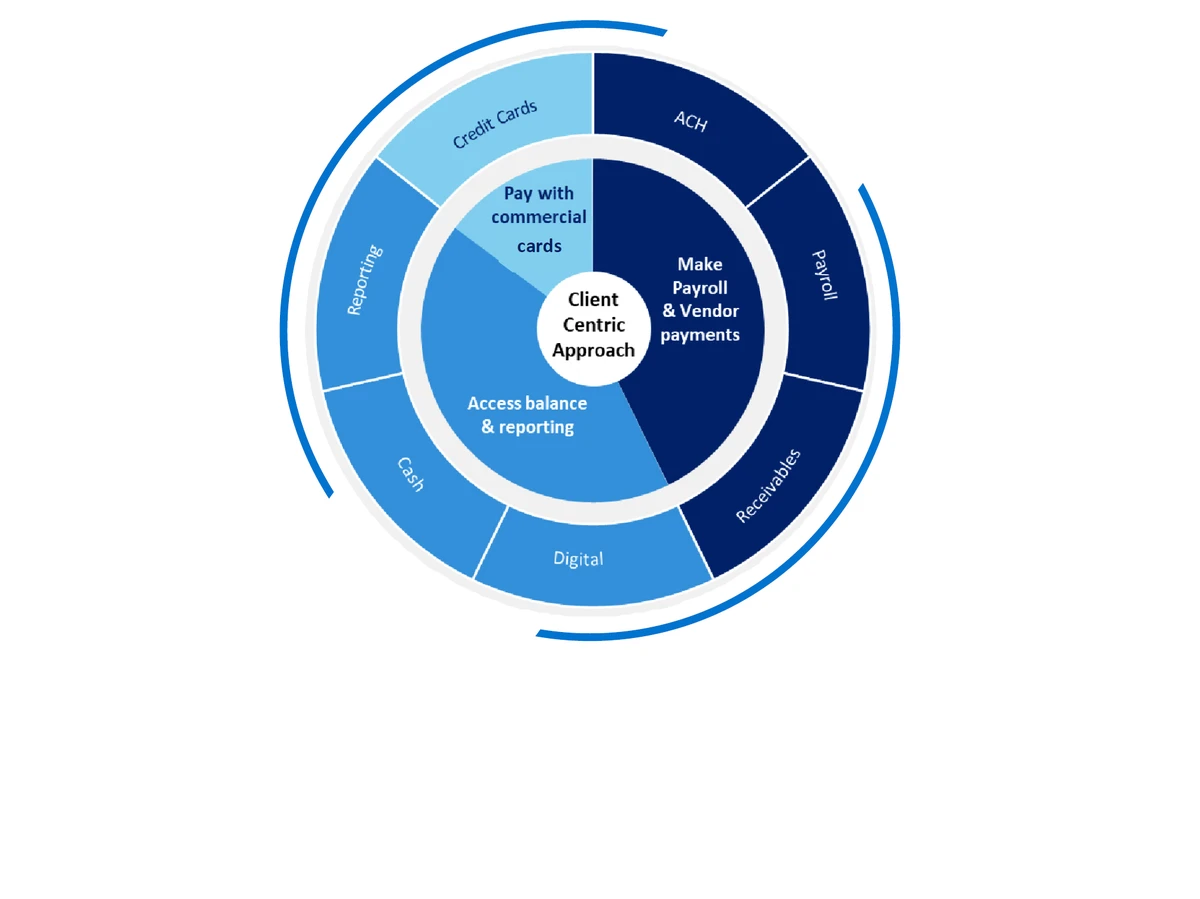

Visual Representation

Risk management in perpetual futures requires layered defenses: margin control, monitoring, and systemic safeguards.

Future Trends in Credit Risk Reduction

- AI-driven risk engines: Leveraging machine learning to anticipate trader defaults.

- On-chain credit scoring systems: Using blockchain transparency to assess risk profiles.

- Decentralized insurance models: Community-driven pools protecting against systemic shocks.

- Regulatory integration: Future compliance standards may enforce more stringent credit risk measures across exchanges.

FAQ

1. How can traders mitigate personal credit risk in perpetual futures?

Traders should use lower leverage, diversify collateral, and select exchanges with transparent insurance mechanisms. Personal risk management, including setting stop-loss orders, is equally critical.

2. Are perpetual futures riskier than traditional futures?

Yes. Since perpetual futures have no expiry date, exposure is continuous. This makes credit risk management even more important compared to traditional futures, where obligations settle periodically.

3. What happens if an exchange’s insurance fund is depleted?

If the insurance fund is insufficient, losses may be socialized among traders, or exchanges may suspend services. This highlights why trading on well-capitalized platforms with robust credit safeguards is essential.

Conclusion

The comprehensive credit risk reduction strategies in perpetual futures include margin optimization, insurance funds, adaptive monitoring, and systemic safeguards. Both conservative and adaptive approaches have merits, but the most effective solution is a layered hybrid model that balances liquidity and protection.

As perpetual futures markets evolve, traders who understand credit risk frameworks and adopt robust personal strategies will outperform those who overlook these risks.

Final Call-to-Action

If you found this guide helpful, share it with your trading community and leave a comment below. How do you personally manage credit risk in perpetual futures? Let’s exchange insights and help build safer, more resilient trading environments together.