=====================================================================

The Efficient Frontier is a crucial concept in modern portfolio theory (MPT), guiding investors toward an optimal portfolio that maximizes returns for a given level of risk. For those seeking to make informed and efficient investment choices, an Efficient Frontier Calculator Online can be a game-changer. In this comprehensive guide, we will explore what the Efficient Frontier is, how to use an online calculator, and strategies for incorporating it into your investment planning. Whether you’re an individual investor, a financial advisor, or a portfolio manager, understanding and utilizing the Efficient Frontier can significantly enhance your decision-making process.

What is the Efficient Frontier?

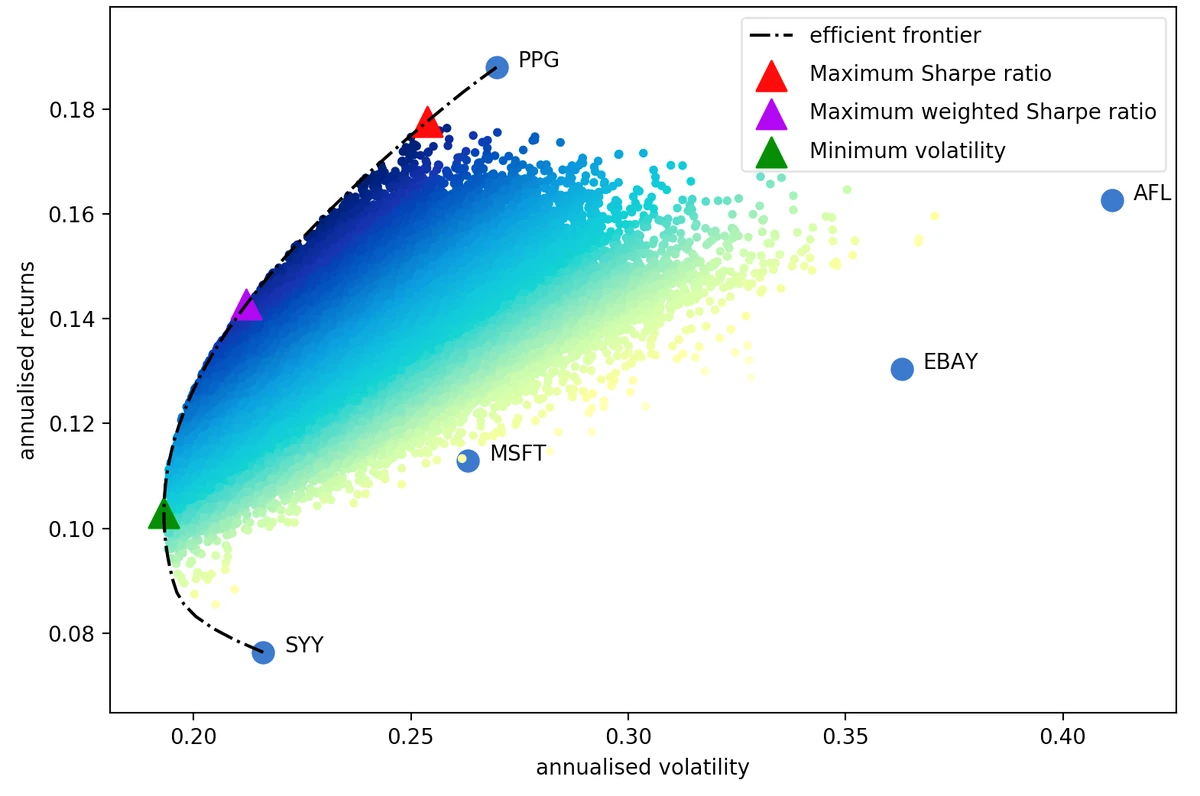

The Efficient Frontier represents the set of portfolios that offer the highest expected return for a given level of risk (volatility). It was first introduced by Harry Markowitz in 1952 and remains a cornerstone of modern investment theory. The key concept is diversification: by combining different assets, investors can reduce risk without sacrificing potential returns.

Key Components of the Efficient Frontier:

- Risk (Standard Deviation): This measures the volatility or risk of the portfolio.

- Return (Expected Return): This is the average return an investor expects from the portfolio.

- Diversification: The strategy of combining assets with different risk-return profiles to reduce overall risk.

The Efficient Frontier helps investors choose the best combination of risk and return based on their risk tolerance.

How to Use an Efficient Frontier Calculator Online

1. Understanding the Inputs

An Efficient Frontier Calculator requires several inputs to generate the frontier curve:

- Expected Returns: The anticipated return of each asset or asset class in the portfolio.

- Standard Deviations: The volatility of each asset’s returns.

- Correlation Matrix: This shows how different assets move relative to each other. Assets that are highly correlated may increase risk, while negatively correlated assets can help reduce risk.

- Portfolio Weights: The proportion of each asset in the portfolio.

2. Choosing a Calculator

Several online tools and software solutions allow investors to visualize the Efficient Frontier. Some calculators provide basic functionality, while others offer advanced modeling capabilities. A few popular options include:

- Morningstar Direct

- Portfolio Visualizer

- Efficient Frontier Tools by Investopedia

These tools allow users to input data and generate an efficient frontier curve, showing the optimal portfolio allocation for different risk levels.

3. Interpreting the Results

The output of an Efficient Frontier Calculator is typically a curve that shows the relationship between expected return and risk. Here’s what to look for:

- The Optimal Portfolio: The point on the frontier where the curve is tangential to a line representing the risk-free rate. This portfolio offers the highest return for a given level of risk.

- Risk vs. Return Balance: Depending on the investor’s risk tolerance, they can select portfolios that lie along the curve, balancing risk and return.

Practical Applications of the Efficient Frontier in Investment Strategy

1. Diversification for Risk Management

One of the primary uses of the Efficient Frontier is to help investors diversify their portfolios. By combining different assets with varying risk and return profiles, investors can create a portfolio that minimizes risk while maximizing returns.

- Example: An investor who is risk-averse might select a portfolio that lies to the left of the Efficient Frontier, focusing on low-risk, low-return assets. A more risk-tolerant investor might opt for a portfolio on the right side of the frontier, focusing on high-return, high-risk assets.

2. Maximizing Returns at Acceptable Risk Levels

The Efficient Frontier helps investors identify portfolios that provide the best return for the level of risk they are willing to take. This can be particularly useful in asset allocation decisions.

- Example: If an investor has a specific return target, they can use the Efficient Frontier to find the lowest risk portfolio that achieves that target return.

3. Performance Comparison

Investors can use the Efficient Frontier to compare their portfolio’s performance against the optimal portfolios identified on the frontier. This can help assess whether their current asset allocation is efficient or needs adjustment.

Benefits of Using an Efficient Frontier Calculator Online

1. Simplicity and Speed

Using an Efficient Frontier calculator online simplifies the process of portfolio optimization. It allows investors to quickly visualize the best portfolio allocations without the need for complex calculations or software programming.

2. Customization

Most online calculators allow users to input their own data, giving them the flexibility to tailor the tool to their specific needs. Whether you’re managing a small retail portfolio or working with large institutional funds, these calculators can handle a wide range of asset types and data inputs.

3. Data Visualization

An online tool typically provides easy-to-understand visual representations of the Efficient Frontier, making it easier for investors to understand how changes in asset allocation affect the risk-return profile.

Comparing Strategies: Efficient Frontier vs. Other Portfolio Optimization Methods

1. Traditional Asset Allocation

Traditional asset allocation focuses on dividing investments among various asset classes based on an investor’s risk tolerance, without the use of advanced optimization tools. While this method is straightforward, it may not provide the most efficient solution, especially for more complex portfolios.

- Pros: Simple to implement; offers a quick, rule-of-thumb approach.

- Cons: Doesn’t account for correlations between assets or the most efficient risk-return combination.

2. Monte Carlo Simulations

Monte Carlo simulations involve running multiple scenarios to predict potential outcomes for a portfolio. While this method is more computationally intensive than the Efficient Frontier, it offers a broader set of simulations that can be useful for assessing risk under uncertain conditions.

- Pros: Provides a wide range of scenarios; can be used for complex portfolios.

- Cons: Requires more advanced modeling and computing power; can be time-consuming.

3. Black-Litterman Model

The Black-Litterman model is an advanced portfolio optimization technique that combines market equilibrium data with investor opinions to generate a more customized efficient frontier. This method is especially useful for institutional investors and large portfolios but requires sophisticated data and expertise.

- Pros: Tailored to the investor’s views and market assumptions; used in institutional settings.

- Cons: Requires expert knowledge and complex modeling; not suitable for beginners.

FAQ: Common Questions About Efficient Frontier Calculators

1. What is the best tool for calculating the Efficient Frontier online?

Several platforms provide efficient frontier calculators, with Portfolio Visualizer and Morningstar Direct being two of the most popular and reliable. They allow for comprehensive analysis, including various asset classes and investment horizons.

2. Can the Efficient Frontier be applied to cryptocurrency investments?

Yes, the Efficient Frontier can be applied to any asset class, including cryptocurrencies. However, due to their higher volatility, cryptocurrencies may result in a wider spread on the frontier. It’s essential to consider these factors when allocating crypto assets.

3. How does the Efficient Frontier change with market conditions?

The Efficient Frontier is sensitive to changes in market conditions. For example, during periods of high volatility or market stress, the efficient portfolios may shift to more conservative allocations. Regular rebalancing and recalculation are necessary to adjust for market changes.

Conclusion: Maximizing Investment Potential with Efficient Frontier Calculators

The Efficient Frontier Calculator Online is a powerful tool for investors looking to optimize their portfolios and improve their risk-return balance. By using these calculators, investors can easily visualize the optimal allocation of assets that maximizes returns for a given level of risk. Whether you are a retail investor, financial advisor, or institutional manager, integrating the Efficient Frontier into your investment strategy is essential for making informed, data-driven decisions.

As the markets continue to evolve, leveraging such tools will help you stay ahead of the curve, ensuring that your portfolio is both diversified and optimized for maximum potential.