============================================================================================

In today’s competitive financial landscape, online traders need more than just basic knowledge to succeed. One of the most powerful concepts in modern portfolio theory is the efficient frontier, a critical tool that helps traders and investors optimize their risk and return profiles. An efficient frontier course for online traders equips you with the knowledge to implement this concept in real-world trading strategies. In this article, we will explore the fundamentals of the efficient frontier, its application in trading, and how online traders can use this concept to improve their decision-making and portfolio management.

What is the Efficient Frontier?

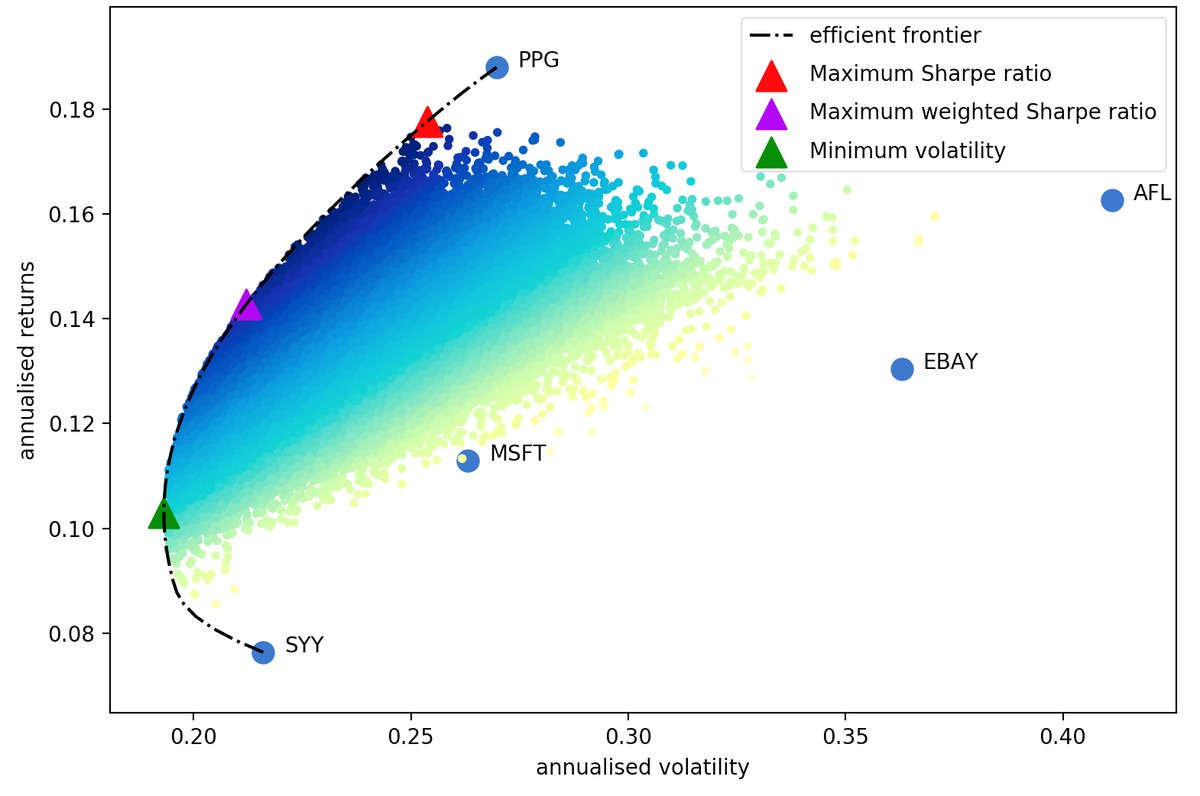

The efficient frontier is a fundamental concept in modern portfolio theory (MPT), introduced by Nobel laureate Harry Markowitz in 1952. It represents the set of optimal portfolios that offer the highest expected return for a given level of risk (or the least risk for a given level of expected return). Traders and investors use the efficient frontier to make informed decisions about which assets to include in their portfolio, maximizing potential returns while minimizing unnecessary risks.

1. Risk and Return in the Efficient Frontier

The efficient frontier is plotted on a graph where the x-axis represents risk (usually measured as standard deviation) and the y-axis represents return (typically measured as the expected rate of return). Portfolios lying on the efficient frontier are considered optimal because they provide the best possible returns for their level of risk.

2. How the Efficient Frontier Helps Online Traders

For online traders, the efficient frontier helps identify the optimal allocation of assets in a portfolio based on individual risk tolerance. Traders can use it to determine how much of their portfolio should be allocated to high-risk, high-reward assets and how much should be in safer, more stable investments.

Why is the Efficient Frontier Important for Online Traders?

1. Improved Risk Management

The efficient frontier helps traders visualize the risk-return tradeoff. By understanding this, they can make better decisions about which assets to include in their portfolios. Whether you’re trading stocks, forex, or cryptocurrencies, the efficient frontier allows you to balance your portfolio’s risk exposure and expected returns more effectively.

2. Optimization of Portfolio Allocation

One of the key benefits of the efficient frontier is portfolio optimization. With a well-constructed efficient frontier model, online traders can maximize returns for a given level of risk. This helps them avoid overexposure to riskier assets, which could lead to significant losses, while still achieving desired returns.

3. Strategic Decision Making

By using the efficient frontier, traders can evaluate different asset classes, sectors, or even individual securities to make informed decisions about which trades to take. It also helps traders assess their current portfolios and determine if adjustments are needed to improve risk-adjusted returns.

How to Build an Efficient Frontier

To build the efficient frontier, online traders must follow these steps:

1. Select Assets or Asset Classes

The first step is to identify the assets or asset classes that will form the portfolio. For example, in crypto trading, traders might consider assets like Bitcoin, Ethereum, and smaller altcoins, or even exchange-traded funds (ETFs) that track the crypto market.

2. Estimate Expected Returns

Once assets are selected, the next step is to estimate their expected returns. Traders can use historical data, market forecasts, or model-based approaches to estimate the expected return for each asset in the portfolio.

3. Calculate the Risk (Standard Deviation)

Risk is typically measured using standard deviation, which reflects the volatility or variability of returns. Traders can calculate the standard deviation for each asset based on historical price movements.

4. Correlations Between Assets

The key to efficient portfolio construction is understanding how assets interact with one another. Traders must calculate the correlations between the assets in their portfolio to understand how they move together. Low or negative correlations are ideal, as they help reduce overall portfolio risk.

5. Plotting the Efficient Frontier

With expected returns, risk, and correlations in hand, traders can use optimization techniques to create a set of portfolios. These portfolios will form the efficient frontier, with each point representing an optimal mix of risk and return.

Different Methods for Analyzing the Efficient Frontier

1. Mean-Variance Optimization

The traditional method for constructing the efficient frontier is mean-variance optimization, which considers the expected return of a portfolio and its variance (a measure of risk). This method is widely used due to its simplicity and applicability in different asset classes.

Pros:

- Well-established and widely used in both traditional and modern finance.

- Simple to implement and understand.

Cons:

- Assumes that returns are normally distributed, which may not always hold true, especially in volatile markets like crypto.

- Sensitive to input data—small changes in expected returns or risk estimates can lead to large changes in optimal portfolio weights.

2. Monte Carlo Simulations

Monte Carlo simulations offer a more robust method for constructing the efficient frontier, especially in markets with complex risk profiles like cryptocurrency. This method uses random sampling to simulate a range of possible outcomes for different portfolios, allowing traders to assess the risk and return distributions under various scenarios.

Pros:

- More flexible than mean-variance optimization.

- Can handle non-normal return distributions, such as those in crypto markets.

Cons:

- Computationally intensive and requires advanced tools.

- Requires large datasets to produce accurate results.

Applying the Efficient Frontier to Online Trading

Now that we understand the theory and methodology behind the efficient frontier, let’s explore how it can be applied in online trading.

1. Cryptocurrency Trading

In the crypto market, where volatility is higher and asset correlation patterns can change rapidly, the efficient frontier can help traders allocate their capital between different crypto assets based on their risk appetite. For instance, a trader might balance between high-volatility assets like Bitcoin and lower-volatility assets like stablecoins or large-cap tokens like Ethereum.

2. Forex Trading

For forex traders, the efficient frontier helps in selecting optimal currency pairs for trading. By analyzing the correlations between different currencies, traders can balance their portfolios to reduce risk exposure while still aiming for higher returns.

3. Stocks and Commodities

Traditional asset classes like stocks and commodities can also benefit from the efficient frontier. By diversifying across different sectors and regions, traders can optimize their portfolios to achieve a better risk-adjusted return.

Tools and Resources for Online Traders

1. Efficient Frontier Calculators

Online traders can find several efficient frontier calculators available on financial platforms like Investopedia, Morningstar, and Portfolio Visualizer. These tools allow traders to input their portfolio data and quickly generate the efficient frontier, helping them visualize the trade-off between risk and return.

2. Optimization Software

Advanced traders may use software like MATLAB, R, or Python to implement their own efficient frontier models. These platforms provide the flexibility to customize the model and apply it to various asset classes, including stocks, bonds, crypto, and forex.

FAQs on Efficient Frontier for Online Traders

1. How can I apply the efficient frontier to my crypto portfolio?

By selecting a diverse range of cryptocurrencies with varying risk profiles, you can use the efficient frontier to optimize your portfolio. Focus on assets that have low correlations with each other, allowing you to reduce overall portfolio risk while maximizing potential returns.

2. What is the main drawback of using the efficient frontier?

The main drawback is that the efficient frontier assumes markets are efficient and returns are normally distributed, which may not hold true, especially in volatile markets like cryptocurrencies. Additionally, it relies heavily on accurate input data, and any mistakes in estimating returns or correlations can lead to poor outcomes.

3. How can I learn more about efficient frontier analysis?

To learn more about efficient frontier analysis, you can take online courses such as the Efficient Frontier Course for Online Traders, which covers portfolio optimization and risk management. Additionally, you can read research papers, use online calculators, or explore resources like QuantInsti for algorithmic trading and optimization techniques.

Conclusion

Mastering the efficient frontier is a crucial skill for any online trader looking to optimize their risk-return profile. By understanding the principles behind the efficient frontier, traders can make more informed decisions and create better, more diversified portfolios. Whether you’re involved in stocks, forex, or cryptocurrency trading, the efficient frontier provides a valuable framework for maximizing returns while managing risk. By leveraging optimization tools, Monte Carlo simulations, and other advanced techniques, online traders can gain a significant edge in the highly competitive financial markets.