===================================================

In the complex world of investment management, understanding how to optimize risk and return is essential. One of the most powerful concepts that can aid financial advisors in creating well-balanced portfolios is the Efficient Frontier. This concept, rooted in Modern Portfolio Theory (MPT), allows advisors to identify the best possible risk-return combinations for their clients, based on their individual risk tolerance and investment goals. Whether you’re advising retail investors, institutional clients, or hedge funds, mastering the Efficient Frontier can enhance your ability to build effective portfolios.

This article provides a comprehensive guide to Efficient Frontier expertise for financial advisors, exploring its significance, application, and strategies for optimizing portfolios. By the end of this article, you will have a deeper understanding of how to leverage the Efficient Frontier to improve your investment strategies and deliver superior financial outcomes for your clients.

What is the Efficient Frontier?

1. Defining the Efficient Frontier

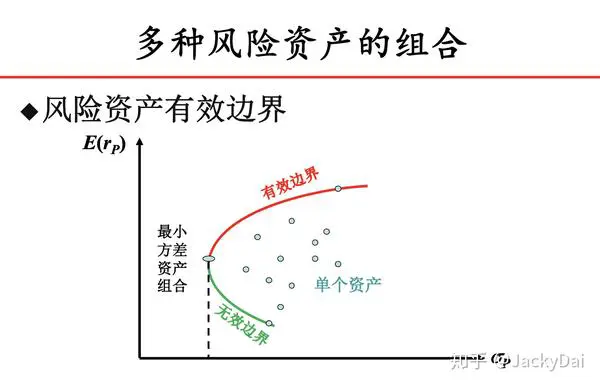

The Efficient Frontier is a concept from Modern Portfolio Theory (MPT), introduced by Harry Markowitz in 1952. It represents a curve on a graph that shows the optimal portfolio mix of risky assets that offers the highest return for a given level of risk (or the lowest risk for a given level of return). In simpler terms, it helps identify the best possible combinations of risk and return.

The graph itself consists of two axes:

- The horizontal axis (X-axis) represents risk, typically measured as portfolio volatility or standard deviation.

- The vertical axis (Y-axis) represents expected return, which is the average return that an investor can expect from the portfolio over time.

Portfolios on the Efficient Frontier are considered optimal because they offer the highest return for the least amount of risk.

2. Why is the Efficient Frontier Important for Financial Advisors?

For financial advisors, understanding the Efficient Frontier is crucial for several reasons:

- Personalized Investment Strategies: The Efficient Frontier helps advisors customize portfolios based on the client’s unique risk tolerance and return expectations.

- Risk Management: By identifying the best combinations of assets, the Efficient Frontier allows advisors to manage risk while maximizing potential returns.

- Diversification: The Efficient Frontier emphasizes the importance of diversification, helping advisors construct portfolios that spread risk across various asset classes.

How Financial Advisors Can Use the Efficient Frontier

1. Creating Customized Portfolios for Clients

Financial advisors use the Efficient Frontier to build personalized portfolios by selecting asset combinations that align with each client’s risk preferences. Here’s how you can incorporate it into your portfolio construction process:

Step-by-Step Approach:

- Step 1: Understand Client Goals: Understand the client’s risk tolerance, investment horizon, and return expectations.

- Step 2: Identify Assets: Choose assets that align with the client’s risk profile, such as stocks, bonds, commodities, or alternative investments.

- Step 3: Apply the Efficient Frontier: Use the Efficient Frontier model to find the portfolio mix that provides the best balance of risk and return.

- Step 4: Adjust the Portfolio Over Time: As market conditions or the client’s goals change, adjust the portfolio to maintain an optimal risk-return profile.

2. Optimizing Portfolio Performance

Advisors can use the Efficient Frontier to optimize portfolio performance by balancing risk and return. A common mistake many investors make is taking on excessive risk in hopes of higher returns. The Efficient Frontier prevents this by showing that higher returns don’t always require more risk.

Key Strategies for Optimization:

- Risk-Return Balancing: The Efficient Frontier helps advisors understand that higher returns can be achieved without taking on excessive risk. Portfolios lying on the frontier have an optimal balance between risk and return.

- Asset Allocation: The Efficient Frontier guides advisors in selecting the appropriate mix of stocks, bonds, and other assets, ensuring that clients are not overexposed to one particular asset class.

- Continuous Monitoring: Markets change, and so should portfolios. Advisors can use the Efficient Frontier to track the performance of portfolios and make adjustments when needed to stay on the frontier.

Advanced Techniques for Applying the Efficient Frontier

1. Incorporating Asset Correlations

One of the critical aspects of the Efficient Frontier is the consideration of how assets correlate with one another. By incorporating correlations, advisors can better understand the relationships between asset classes and reduce the overall risk of the portfolio.

Example:

- Negative Correlations: Some assets, like stocks and bonds, have a negative correlation, meaning when stocks go down, bonds tend to go up. By combining these in a portfolio, an advisor can reduce overall risk.

- Positive Correlations: Assets within the same sector or industry often have positive correlations, meaning they move in the same direction. Advisors must be mindful of this to avoid overconcentration in a particular sector.

2. Monte Carlo Simulations for Portfolio Construction

For advisors looking to optimize portfolios more precisely, using Monte Carlo simulations is a sophisticated approach. This technique uses random sampling and statistical modeling to predict potential future outcomes of a portfolio, considering various market conditions and uncertainties.

How It Works:

- Monte Carlo simulations generate thousands of potential portfolio outcomes based on historical data and assumptions about future market behavior.

- Advisors can use this data to assess the probability of achieving specific returns within a certain level of risk.

Efficient Frontier for Different Types of Clients

1. Efficient Frontier for Risk-Averse Investors

For clients who are risk-averse, such as retirees or conservative investors, the Efficient Frontier can help identify portfolios that minimize risk while still offering moderate returns. These portfolios typically consist of a larger proportion of low-risk assets such as government bonds or blue-chip stocks.

Key Considerations:

- Lower Volatility: Focus on portfolios with lower standard deviation (volatility).

- Stable Income: Include income-generating assets like bonds or dividend-paying stocks to meet clients’ income needs.

2. Efficient Frontier for High-Risk Tolerant Clients

For more aggressive investors, like young professionals or hedge fund managers, the Efficient Frontier can guide advisors in selecting portfolios with higher risk profiles that offer the potential for higher returns. These portfolios often include a larger proportion of equities, commodities, and other volatile asset classes.

Key Considerations:

- Maximizing Returns: Seek portfolios on the upper end of the Efficient Frontier for higher expected returns.

- Diversification Across Riskier Assets: Include assets with higher growth potential but also higher volatility, such as emerging markets or tech stocks.

Frequently Asked Questions

1. What is the Efficient Frontier in financial advising?

The Efficient Frontier is a concept in Modern Portfolio Theory that helps financial advisors identify the optimal mix of risky assets that maximizes returns for a given level of risk. It’s used to build diversified, risk-adjusted portfolios for clients.

2. How can I use the Efficient Frontier for my clients?

To use the Efficient Frontier, begin by understanding your client’s risk tolerance and financial goals. From there, select assets that align with their profile and use the Efficient Frontier model to find the portfolio with the best possible risk-return combination. Continuously monitor and adjust the portfolio as needed.

3. What are the advantages of using the Efficient Frontier?

The Efficient Frontier helps financial advisors optimize portfolios by balancing risk and return. It allows you to:

- Create personalized investment strategies.

- Improve risk management by diversifying asset classes.

- Provide clients with data-driven portfolio recommendations that align with their risk preferences.

Conclusion

Mastering the Efficient Frontier is an essential skill for financial advisors who want to optimize their clients’ portfolios while effectively managing risk. By using the Efficient Frontier, advisors can craft personalized strategies that maximize returns and minimize risk, ensuring the best outcomes for both risk-averse and high-risk tolerant clients. Whether you’re advising on perpetual futures or more traditional assets, leveraging the Efficient Frontier can significantly enhance your portfolio construction and risk management practices.

If you’d like to explore efficient frontier insights for crypto investors or learn how to calculate the efficient frontier with perpetual futures, let us know in the comments!