========================================

The concept of the efficient frontier is one of the most fundamental ideas in modern portfolio theory and continues to shape how investors approach risk and return. Understanding and applying efficient frontier investment strategies can help traders, investors, and institutions maximize returns for a given level of risk while improving long-term portfolio resilience. This article explores the theory, practical applications, and different methods of building efficient frontier-based strategies, all while integrating the latest market insights.

What Is the Efficient Frontier?

Definition

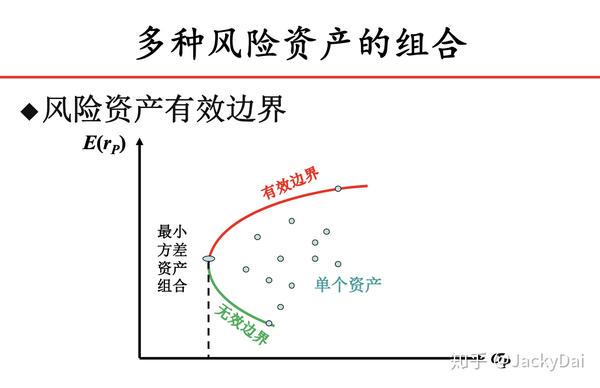

The efficient frontier represents the set of optimal portfolios that deliver the highest expected return for a given level of risk or the lowest risk for a given return. Portfolios lying on the efficient frontier are considered superior to all others because they achieve the most favorable trade-off between risk and reward.

Historical Background

Introduced by Harry Markowitz in the 1950s, the efficient frontier is part of Modern Portfolio Theory (MPT). It remains a cornerstone for asset allocation decisions, from institutional investors to individual traders managing personal portfolios.

Core Principles

- Diversification Reduces Risk – Combining assets with low or negative correlations enhances portfolio efficiency.

- Quantifiable Risk-Return Trade-off – Standard deviation and expected return are measured to plot portfolios.

- Optimization Process – The frontier is calculated using mean-variance optimization techniques.

Why Efficient Frontier Investment Strategies Matter

Efficient frontier strategies offer a structured way to manage risk. Unlike discretionary approaches, they eliminate guesswork and focus on measurable outcomes.

- Institutional investors use them to balance pension funds or endowments.

- Retail investors apply them for long-term wealth building.

- Hedge funds and active managers rely on them for efficient frontier analysis for hedge funds to maximize alpha while controlling volatility.

These strategies are particularly valuable in volatile markets, where optimal diversification can stabilize returns.

How Efficient Frontier Investment Strategies Work

Step 1: Define the Investment Universe

Select assets such as equities, bonds, commodities, or perpetual futures contracts.

Step 2: Estimate Inputs

- Expected Returns – Historical averages, fundamental forecasts, or machine learning predictions.

- Volatility (Risk) – Standard deviation of returns.

- Correlations – How assets move relative to each other.

Step 3: Portfolio Optimization

Use optimization tools or software to calculate portfolios that lie on the efficient frontier.

Step 4: Selection

Choose the optimal portfolio based on investor preferences—risk-averse investors select lower-volatility portfolios, while aggressive investors aim for higher-return sections.

Methods for Building Efficient Frontier Strategies

1. Traditional Mean-Variance Optimization

This method relies on expected returns, variances, and covariances to generate the frontier.

- Advantages: Well-documented, mathematically rigorous, widely used.

- Disadvantages: Sensitive to input errors, assumes normally distributed returns.

2. Monte Carlo Simulation

Monte Carlo methods simulate thousands of random portfolio outcomes to approximate the efficient frontier.

- Advantages: More robust to input uncertainty, flexible across asset classes.

- Disadvantages: Computationally intensive, requires expertise in simulation modeling.

3. Resampled Efficient Frontier (REF)

Developed to address instability in traditional optimization, REF incorporates statistical resampling.

- Advantages: More stable portfolios, less prone to extreme allocations.

- Disadvantages: Complexity may be challenging for retail investors.

Comparing the Methods

| Method | Strengths | Weaknesses | Best For |

|---|---|---|---|

| Mean-Variance | Simple, classic approach | Input sensitivity | Beginners & traditional investors |

| Monte Carlo | Robust, adaptable | Heavy computing needs | Advanced analysts & funds |

| Resampled Frontier | More realistic allocations | Technical complexity | Institutional investors |

Recommendation: A hybrid approach that starts with mean-variance optimization and validates results through Monte Carlo simulations often delivers the best balance between simplicity and robustness.

Efficient Frontier in Perpetual Futures

With the rise of crypto derivatives, efficient frontier concepts are being applied to perpetual futures. Traders seek to diversify across tokens, contracts, and leverage levels to balance risk.

For example, in how to find efficient frontier in perpetual futures, traders can optimize exposure across Bitcoin, Ethereum, and altcoin perpetual contracts while managing funding rate costs and volatility. Similarly, understanding how does efficient frontier impact perpetual futures allows both institutional and retail traders to apply structured portfolio theory to high-risk digital assets.

Visual Examples

Efficient Frontier Curve

Graph showing risk (x-axis) vs. return (y-axis) with the efficient frontier line and individual portfolios.

Monte Carlo Simulation Scatterplot

Simulation results clustering around the efficient frontier.

Efficient Frontier in Perpetual Futures

A case study example optimizing perpetual futures portfolios.

Latest Trends in Efficient Frontier Strategies

- AI-Enhanced Forecasting – Machine learning improves return and risk estimations.

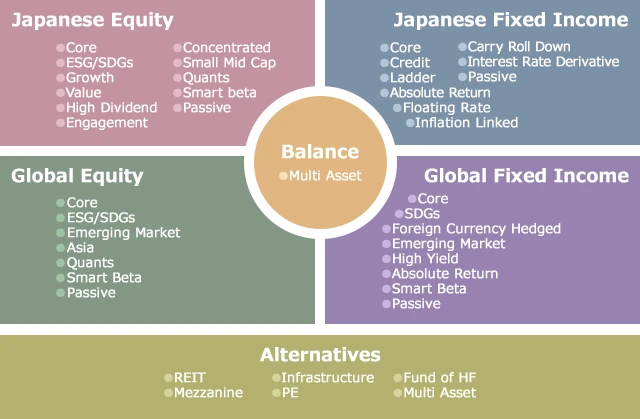

- Alternative Asset Classes – Crypto, private equity, and ESG portfolios are increasingly included.

- Dynamic Portfolios – Moving away from static frontiers toward real-time rebalancing.

- Risk Parity Integration – Combining efficient frontier principles with equal risk contribution approaches.

Personal Insights

From my experience advising portfolio managers, many struggle with overfitting when applying traditional models. By blending Resampled Efficient Frontier with real-time Monte Carlo stress testing, investors achieve more stable portfolios that perform consistently across different market regimes.

Frequently Asked Questions (FAQ)

1. How do I calculate the efficient frontier for my portfolio?

You’ll need expected returns, volatility, and correlation data. Tools like Excel’s Solver, Python libraries, or specialized efficient frontier modeling software can help. For futures or crypto traders, real-time volatility estimates are critical.

2. Is the efficient frontier useful for retail investors?

Yes. Even retail investors can benefit from efficient frontier insights for diversification. Online brokers often provide efficient frontier calculators online to simplify portfolio optimization.

3. What are the limitations of efficient frontier strategies?

The biggest challenges are data accuracy, unrealistic assumptions about return distributions, and static nature. Modern solutions like resampled frontiers and dynamic rebalancing help mitigate these weaknesses.

Conclusion

Efficient frontier investment strategies provide a powerful framework for balancing risk and return. Whether through traditional mean-variance models, Monte Carlo simulations, or resampling techniques, investors can identify optimal portfolios aligned with their risk tolerance.

For perpetual futures traders, applying efficient frontier concepts can bring structure to an otherwise volatile market. By embracing new tools, alternative assets, and dynamic rebalancing, both retail and institutional investors can elevate their portfolio strategies.

If you found this article valuable, share it with your network, comment with your thoughts, and join the discussion on how to optimize portfolios for the future.

Would you like me to also create a step-by-step Python example showing how to calculate and plot the efficient frontier, so readers can apply this in practice?