===========================================================

In modern portfolio management, the efficient frontier remains one of the most powerful concepts for balancing risk and return. With the advancement of computational finance, investors and traders now rely on efficient frontier modeling software to visualize, simulate, and optimize portfolios in real time. Whether you are a retail investor, hedge fund manager, or quant researcher, understanding and applying these tools can significantly improve decision-making and long-term profitability.

This article will dive deep into the role of efficient frontier modeling software, explore different strategies and tools, compare their strengths and weaknesses, and provide actionable advice for investors at all levels.

What is Efficient Frontier Modeling Software?

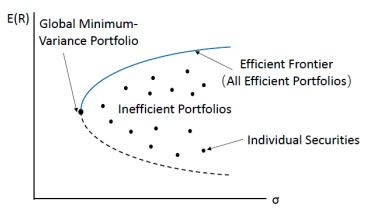

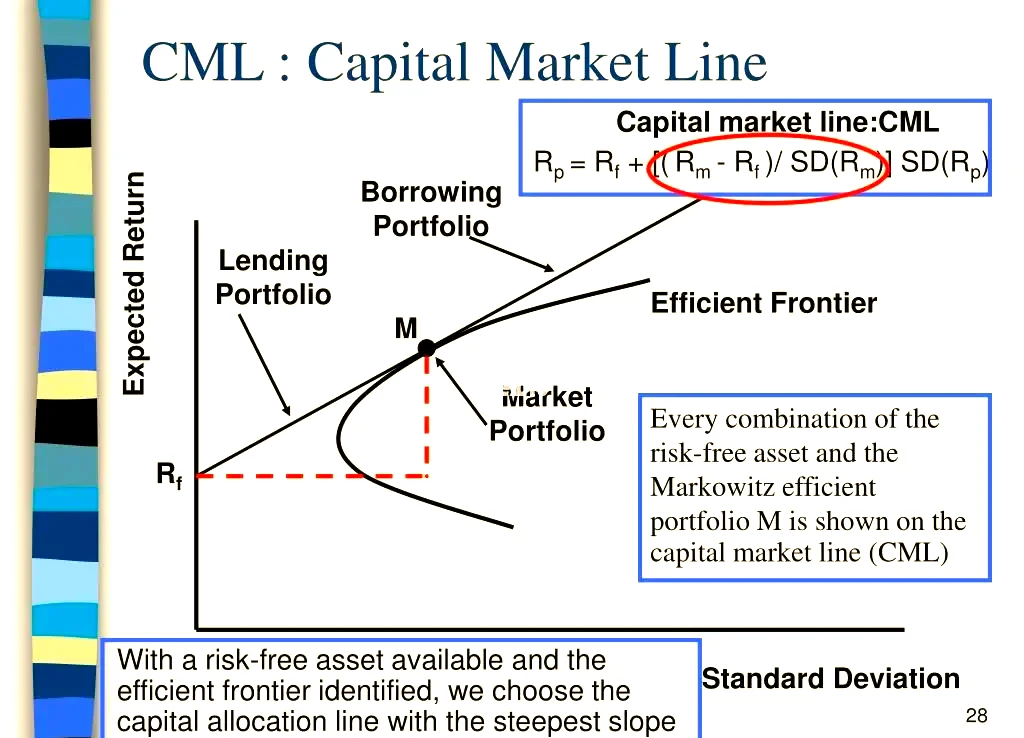

Efficient frontier modeling software helps investors calculate and visualize the set of optimal portfolios that maximize expected returns for a given level of risk. Based on Harry Markowitz’s Modern Portfolio Theory (MPT), the efficient frontier represents the boundary where no higher return can be achieved without taking on additional risk.

Such software integrates mathematical optimization algorithms, statistical models, and data visualization techniques to guide investors in making data-driven portfolio choices.

Why Efficient Frontier Modeling Software Matters

Data-Driven Decision Making

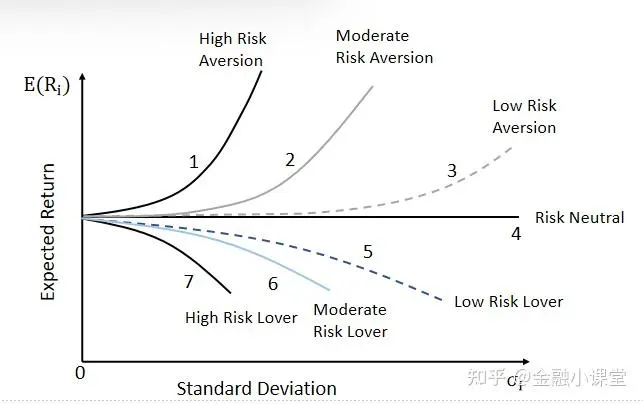

Instead of relying on gut instinct, investors can use real-time simulations to build portfolios that reflect their risk tolerance, investment horizon, and market conditions.

Personalized Portfolio Optimization

The software allows investors to create tailored portfolios, whether they prefer aggressive, conservative, or balanced strategies.

Advanced Applications in Futures and Crypto

Modern tools also extend efficient frontier modeling into perpetual futures and crypto assets, where volatility and leverage significantly impact risk-return dynamics. For instance, knowing how to find efficient frontier in perpetual futures provides retail and institutional traders with a framework for hedging risk in high-leverage markets.

Key Features of Efficient Frontier Modeling Software

1. Risk-Return Visualization

Graphical displays that show the efficient frontier curve, individual asset plots, and portfolio points help investors visually compare opportunities.

2. Scenario Analysis and Stress Testing

Investors can simulate different market conditions—like interest rate changes, inflation shocks, or crypto market crashes—and see how their portfolios shift.

3. Multi-Asset and Multi-Period Support

Advanced software includes equities, bonds, derivatives, and even alternative assets like commodities or crypto. Some tools also allow dynamic rebalancing over time.

4. Integration with Real-Time Market Data

Many platforms connect directly to exchanges and data providers, updating portfolio models in real-time for actionable insights.

Types of Efficient Frontier Modeling Software

1. Excel-Based Tools with Add-Ons

Many investors start with Excel add-ins such as Solver or plug-ins like Risk Solver and XLSTAT.

Pros: Low cost, accessible, easy learning curve.

Cons: Limited scalability, slower with large datasets, less robust for real-time trading.

2. Quantitative Finance Software (e.g., MATLAB, R, Python Libraries)

Professional quants and institutional investors often use MATLAB Financial Toolbox, R packages like PortfolioAnalytics, or Python libraries such as PyPortfolioOpt.

Pros: Highly customizable, advanced algorithms, excellent for researchers.

Cons: Requires coding knowledge, steep learning curve for beginners.

3. Commercial Platforms (e.g., Bloomberg PORT, Portfolio Visualizer)

These platforms offer enterprise-grade solutions with built-in efficient frontier modeling and integration into financial markets.

Pros: User-friendly, real-time data, enterprise-level support.

Cons: Expensive, may be overkill for individual investors.

4. Specialized FinTech Applications

Emerging FinTech platforms focus on retail investors, offering easy-to-use efficient frontier calculators with AI-driven optimization.

Pros: Affordable, no coding required, designed for individuals.

Cons: Limited flexibility compared to institutional tools.

Comparing Traditional vs. Advanced Approaches

| Approach | Tools | Advantages | Limitations |

|---|---|---|---|

| Traditional | Excel Solver, simple regression models | Accessible, low cost, beginner-friendly | Not scalable, lacks automation |

| Advanced | Python, R, MATLAB, Bloomberg PORT | Powerful, accurate, supports real-time optimization | Requires skills, higher costs |

Recommendation: Individual investors benefit most from FinTech platforms or Python-based solutions, while hedge funds prefer advanced commercial platforms.

Efficient Frontier in Perpetual Futures

One of the most exciting applications today is in perpetual futures trading, where leverage amplifies both returns and risks. Efficient frontier modeling software allows traders to simulate positions across contracts and optimize allocations.

For example, understanding where is the efficient frontier in perpetual futures helps investors balance exposure between stable pairs like BTC/USDT and more volatile altcoin contracts, ensuring better long-term risk-adjusted returns.

Personal Insights on Using Efficient Frontier Software

In my own experience, Python’s PyPortfolioOpt library stands out for its flexibility and balance between academic rigor and practical use. When combined with real-time APIs like Binance or Interactive Brokers, it provides a seamless tool for crypto, equities, and futures portfolios.

However, for investors without coding experience, platforms like Portfolio Visualizer or Wealthfront can deliver a strong balance of automation and customization.

Visual Example of Efficient Frontier

Below is a visualization of an efficient frontier for a mixed portfolio of stocks, bonds, and crypto assets:

Efficient frontier curve showing optimal portfolios at different levels of risk

FAQs on Efficient Frontier Modeling Software

1. What is the best efficient frontier software for beginners?

For beginners, online platforms like Portfolio Visualizer or Excel add-ons are the most accessible. They require no coding and offer pre-built visualization tools.

2. How accurate are efficient frontier models in real-world trading?

While efficient frontier models are grounded in mathematics, their accuracy depends on data quality, assumptions, and market conditions. They are most useful as guidelines, not predictions.

3. Can efficient frontier software be used for crypto trading?

Yes, many modern platforms now support crypto assets. Traders can model portfolios of Bitcoin, Ethereum, and altcoins, applying volatility-adjusted strategies for perpetual futures.

Conclusion

Efficient frontier modeling software bridges academic finance with practical investing. From Excel spreadsheets to advanced quant platforms, the choice depends on investor goals, technical skills, and budget.

- Retail investors should explore user-friendly platforms.

- Professional traders benefit from coding-based or enterprise-grade solutions.

- Futures and crypto investors can leverage frontier models for hedging and optimizing leveraged positions.

By integrating efficient frontier modeling into your investment process, you gain clarity, discipline, and a data-driven edge in an unpredictable market.

If this guide gave you insights, feel free to share it with fellow investors, comment with your favorite tools, and spark a discussion about the future of portfolio optimization!

Would you like me to build a Python code snippet for generating efficient frontier graphs (using PyPortfolioOpt) so readers can replicate and apply it directly?