=====================================

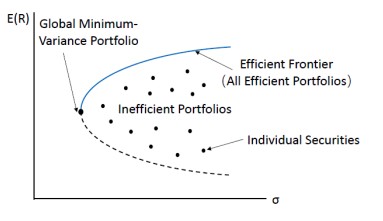

In the fast-evolving world of portfolio management and quantitative finance, efficient frontier optimization tools are becoming indispensable for traders, institutional investors, and financial advisors. The efficient frontier, a core concept of modern portfolio theory introduced by Harry Markowitz, represents the set of optimal portfolios that offer the maximum expected return for a given level of risk. Mastering efficient frontier optimization is crucial for both professionals and beginners aiming to balance risk and reward.

This article explores the most effective optimization tools, compares traditional and advanced approaches, integrates industry experience, and offers step-by-step strategies. It also addresses FAQs to help readers understand both the practical and technical dimensions of efficient frontier applications.

Understanding the Efficient Frontier

The efficient frontier illustrates how investors can maximize returns for different risk levels by diversifying across asset classes. By plotting portfolios on a risk-return graph, investors can identify whether their strategy lies on the optimal curve or falls below it.

Key factors in efficient frontier analysis include:

- Expected Return: The forecasted return based on historical or projected data.

- Volatility (Risk): The standard deviation of returns.

- Correlation: The relationship between asset movements, crucial for diversification benefits.

In perpetual futures and crypto markets, knowing how to find efficient frontier in perpetual futures allows traders to balance leverage exposure with optimized reward potential.

Why Efficient Frontier Optimization Tools Matter

Risk-Reward Balance

Efficient frontier optimization ensures investors do not take on unnecessary risk for minimal gains.

Automation and Precision

Modern tools use algorithms and machine learning models to evaluate thousands of portfolio combinations in seconds.

Customization for Different Investors

From risk-averse retirees to aggressive hedge funds, optimization tools tailor strategies based on objectives.

Types of Efficient Frontier Optimization Tools

1. Statistical Software Tools

Platforms like R, MATLAB, and Python libraries (PyPortfolioOpt, NumPy, SciPy) provide powerful statistical engines to model efficient frontiers.

- Advantages: Highly flexible, open-source (in Python), robust modeling capabilities.

- Disadvantages: Requires strong coding and quantitative skills.

2. Portfolio Management Platforms

Tools like Morningstar Direct, Portfolio Visualizer, and Bloomberg Terminal offer integrated efficient frontier modules.

- Advantages: User-friendly, rich datasets, pre-built optimization algorithms.

- Disadvantages: Subscription costs can be high, limited customization compared to coding.

3. AI-Enhanced Optimization Tools

Emerging platforms now incorporate AI-driven methods to dynamically adjust portfolios. These consider nonlinear risk factors, regime shifts, and anomalies.

- Advantages: Adaptive, predictive capabilities.

- Disadvantages: Requires trust in black-box models, higher resource demands.

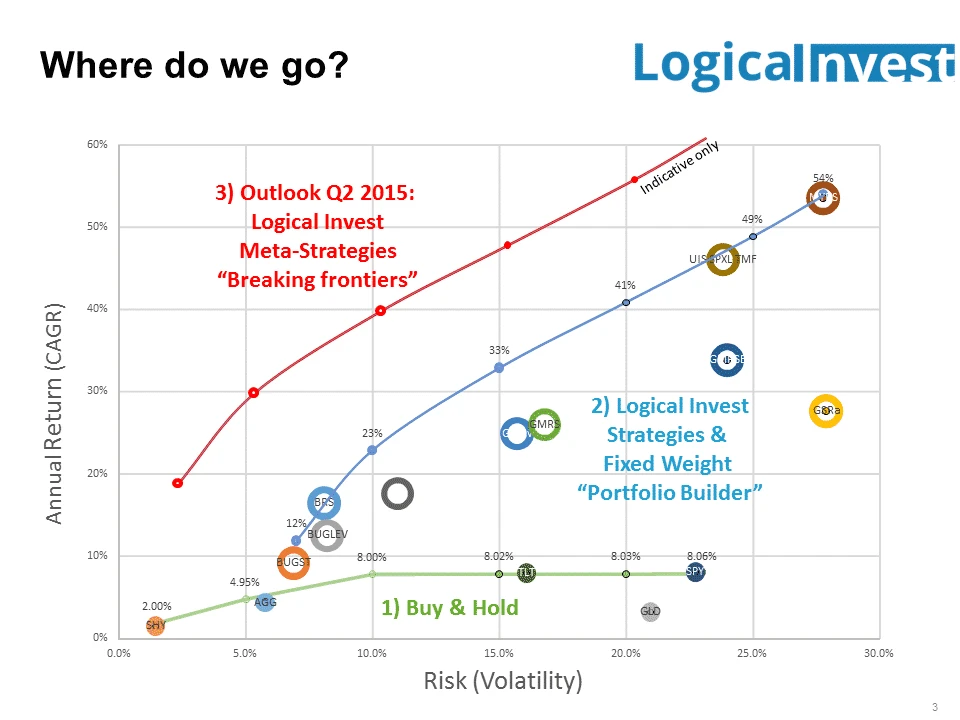

A sample efficient frontier curve showing optimal portfolios across risk-return dimensions.

Two Key Methods of Optimization

Method 1: Mean-Variance Optimization (MVO)

The classic approach uses expected returns, variances, and covariances of assets.

- Advantages: Well-understood, mathematically rigorous, widely taught.

- Disadvantages: Sensitive to input estimates, struggles in highly volatile markets.

Method 2: Robust and Machine Learning Optimization

Advanced techniques account for uncertainty in inputs and use AI models to adapt portfolios dynamically.

- Advantages: Reduces estimation error, handles large datasets, useful for perpetual futures and crypto.

- Disadvantages: Complex, requires specialized expertise.

Comparison of Methods

| Criteria | Mean-Variance Optimization | Robust/Machine Learning Optimization |

|---|---|---|

| Ease of Use | Beginner-friendly | Advanced, requires technical skills |

| Accuracy | Moderate, input-sensitive | High, adaptive to market dynamics |

| Best for | Traditional portfolios | Perpetual futures, crypto, dynamic assets |

| Cost of Application | Low to moderate | Higher (computational cost) |

Recommendation: For beginners or retail investors, start with MVO. For hedge funds or professional quants, machine learning optimization provides a competitive edge.

Applications of Efficient Frontier Tools

- Equity Portfolios: Traditional stocks and ETFs.

- Fixed Income: Balancing yield curves and credit risks.

- Crypto and Perpetual Futures: Learning where to apply efficient frontier in perpetual trading helps traders optimize leveraged instruments.

- Risk Management: Stress-testing portfolios under extreme scenarios.

Latest Industry Trends

- Cloud-Based Tools: Accessibility without heavy infrastructure.

- Integration with Trading Platforms: Direct application within brokerage software.

- Real-Time Optimization: Updating portfolios dynamically with streaming data.

- Hybrid Models: Combining MVO with AI-based anomaly detection.

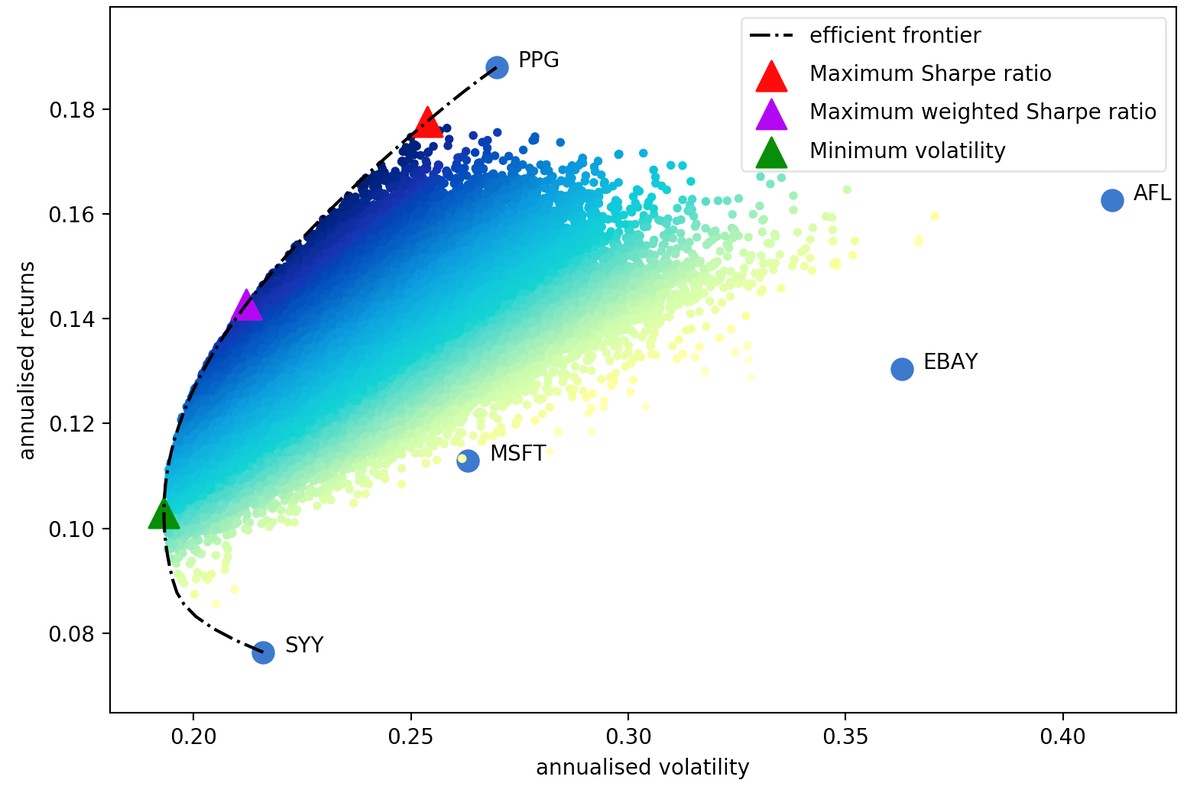

Example of an efficient frontier tool with visualization and portfolio allocation outputs.

Practical Experience: Lessons from the Field

As someone who has tested both Python-based open-source libraries and Bloomberg’s integrated efficient frontier tool, I found:

- Python (PyPortfolioOpt): Best for customization and research-driven strategy building.

- Bloomberg: Better for institutional investors needing immediate insights with reliable datasets.

- AI Tools: Most effective in high-volatility markets like crypto, where correlations shift quickly.

FAQ: Efficient Frontier Optimization Tools

1. What are the best tools for beginners to start efficient frontier optimization?

Beginners should start with Portfolio Visualizer (web-based) or Python libraries like PyPortfolioOpt. Both provide clear visualizations and step-by-step allocation outputs.

2. How does efficient frontier optimization apply to perpetual futures?

Efficient frontier methods balance leverage exposure by optimizing contract combinations. By calculating volatility and correlation of perpetual futures pairs, traders can minimize risk while maximizing expected returns.

3. Are machine learning optimization tools reliable for portfolio management?

Yes, especially in dynamic markets. They outperform traditional methods in adapting to regime changes, but users must validate results through backtesting and avoid overfitting.

Final Thoughts

Mastering efficient frontier optimization tools is essential for anyone aiming to optimize portfolio performance in today’s volatile markets. From traditional mean-variance methods to advanced AI-driven strategies, traders and investors have access to a diverse toolkit.

The best approach is to start simple—understand the basics of portfolio diversification, then progressively adopt advanced tools. Whether you’re a retail trader experimenting with perpetual futures or an institutional investor managing billions, efficient frontier analysis ensures your portfolio decisions are data-driven and optimized.

If you found this guide helpful, share it with colleagues, leave a comment with your experience, and join the conversation about the future of portfolio optimization.