=================================================================================

Introduction

In modern portfolio theory, the efficient frontier is one of the most powerful concepts for balancing risk and return. It represents the set of optimal portfolios that offer the highest expected return for a defined level of risk. Today, technology has made it possible to simulate these frontiers using advanced tools, algorithms, and software applications. This is where the efficient frontier simulation program becomes crucial—it enables investors, traders, and portfolio managers to visualize, test, and refine their investment strategies in both traditional markets and newer domains such as crypto and perpetual futures.

In this article, we will:

- Explore the fundamentals of the efficient frontier.

- Compare at least two methods of simulation: Monte Carlo simulation and Quadratic Optimization techniques.

- Provide practical insights on implementation using both retail and institutional-grade software.

- Discuss latest trends, real-world use cases, and recommended tools.

- Answer frequently asked questions with actionable insights.

By the end, you will have a comprehensive understanding of how to leverage an efficient frontier simulation program for professional-grade portfolio optimization.

Understanding the Efficient Frontier

What is the Efficient Frontier?

The efficient frontier is a curve in mean-variance space that represents portfolios with the most efficient risk-return tradeoff. Any portfolio lying below the curve is sub-optimal because there exists another portfolio with higher returns for the same level of risk.

Why It Matters for Traders and Investors

Whether you are a day trader in crypto, a hedge fund manager, or a long-term investor, understanding where your portfolio stands relative to the efficient frontier is critical. It helps in minimizing unnecessary risks while maximizing potential gains.

For example, traders in perpetual futures often ask: Why efficient frontier is important in perpetual futures? The answer is simple: it prevents overexposure to volatile assets by constructing optimal combinations of contracts.

Methods for Efficient Frontier Simulation

1. Monte Carlo Simulation

How it works:

Monte Carlo simulation generates thousands (or even millions) of random portfolios based on historical return distributions. Each simulated portfolio is plotted in risk-return space, and the efficient frontier is derived from the best performers.

Advantages:

- Handles complex return distributions.

- Flexible for non-normal data like crypto assets.

- Can incorporate fat-tail risks.

Disadvantages:

- Computationally heavy.

- Results vary depending on the number of simulations.

Best use case:

Crypto traders who deal with high volatility benefit from Monte Carlo simulation because it better reflects tail risks and extreme events.

2. Quadratic Optimization (Mean-Variance Optimization)

How it works:

Quadratic optimization solves for the exact weights of assets that maximize return for a given risk or minimize risk for a given return. It uses mathematical optimization methods under constraints.

Advantages:

- Fast and precise compared to Monte Carlo.

- Well-established in finance.

- Works seamlessly with large datasets.

Disadvantages:

- Assumes returns are normally distributed.

- Sensitive to estimation errors in expected returns and covariances.

Best use case:

Institutional traders and hedge funds often prefer quadratic optimization because it is computationally efficient and scalable across hundreds of assets.

Comparing the Two Approaches

| Factor | Monte Carlo Simulation | Quadratic Optimization |

|---|---|---|

| Speed | Slower (requires large samples) | Faster (solves equations directly) |

| Accuracy | Approximate | Exact (given assumptions) |

| Suitability for Crypto | High (handles volatility) | Medium (suffers from fat tails) |

| Institutional Adoption | Limited | Very High |

Recommendation:

For most traders, a hybrid approach works best: use Monte Carlo for stress-testing and Quadratic Optimization for baseline portfolio construction.

Practical Applications of Efficient Frontier Simulation Programs

For Retail Traders

Retail traders can use online platforms like Portfolio Visualizer or Python-based libraries such as PyPortfolioOpt to run simulations. These are affordable, flexible, and user-friendly.

For Professional Traders

Institutions use advanced tools such as MATLAB, R, or Bloomberg PORT. These platforms integrate real-time data feeds, making them suitable for large-scale, high-frequency trading environments.

When considering perpetual futures, many traders wonder: How to calculate efficient frontier with perpetual futures? The process involves integrating futures contract returns into the simulation dataset, ensuring funding rates and leverage factors are accounted for.

Step-by-Step Guide to Running a Simulation

Step 1: Gather Data

Collect historical returns, volatility, and correlations for each asset or futures contract.

Step 2: Choose a Simulation Approach

Decide whether you want Monte Carlo (flexibility) or Quadratic Optimization (speed).

Step 3: Input Constraints

Set leverage limits, diversification requirements, or maximum exposure levels.

Step 4: Run the Simulation

Use your chosen software program to calculate the efficient frontier.

Step 5: Analyze Results

Plot the frontier and identify your optimal portfolio weights.

Visualization Example

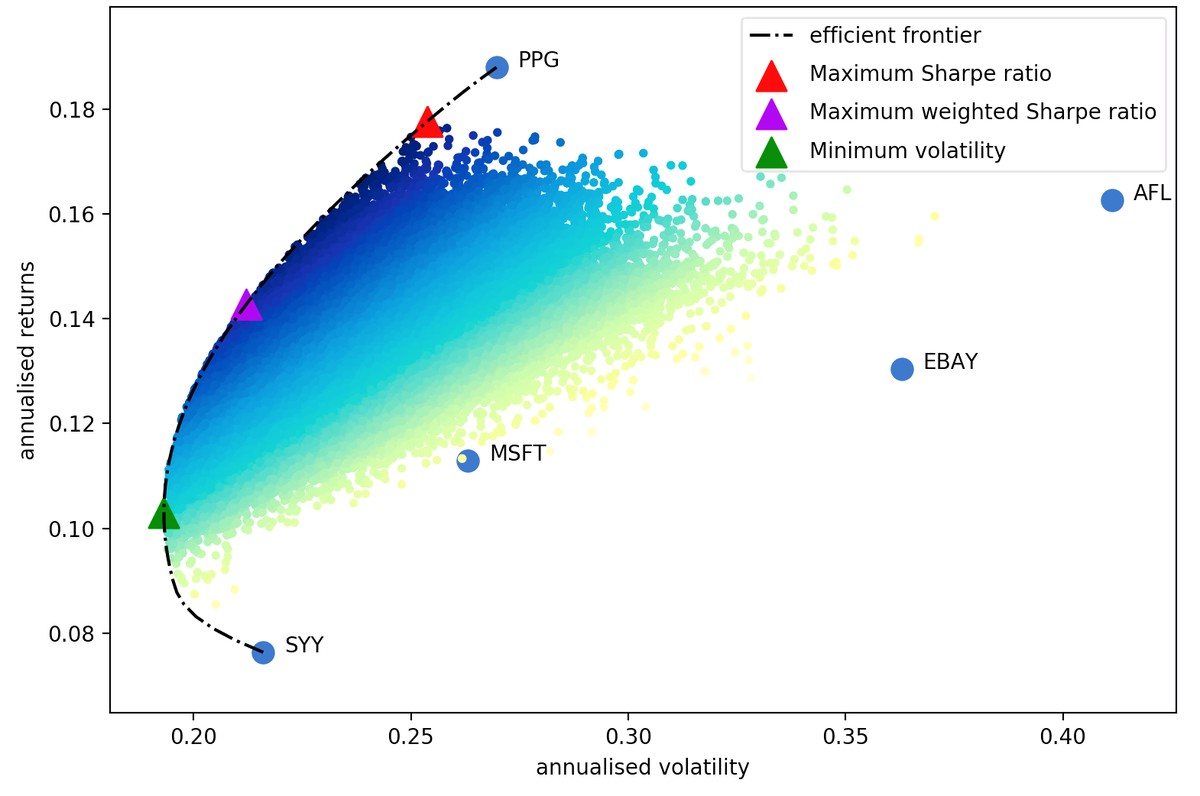

Here’s an example visualization of simulated portfolios and the efficient frontier:

Efficient frontier with simulated portfolios

This graph highlights how optimal portfolios align on the frontier while suboptimal ones cluster below it.

Common Challenges in Simulation

- Data quality issues: Poor data leads to inaccurate frontiers.

- Overfitting: Relying too heavily on historical data without stress-testing.

- Ignoring transaction costs: Can significantly distort “optimal” results.

- Misinterpreting results: Traders may select portfolios outside the frontier due to misunderstanding.

Latest Trends in Efficient Frontier Simulation

- AI-driven modeling: Neural networks improve expected return estimations.

- Crypto integration: Programs increasingly support perpetual futures and altcoins.

- Real-time frontier updates: Some platforms now calculate efficient frontier dynamically as new data arrives.

- Mobile-first applications: Retail traders can simulate directly from their smartphones.

FAQ: Efficient Frontier Simulation Program

1. What is the best software for efficient frontier simulation?

For beginners, Portfolio Visualizer or Python’s PyPortfolioOpt is recommended. Professionals should look into Bloomberg PORT, MATLAB, or R packages for advanced analytics.

2. Can efficient frontier simulations work with crypto assets?

Yes, but Monte Carlo simulation is often better because crypto markets exhibit fat tails, skewness, and extreme volatility. Programs should include funding rates when modeling perpetual futures.

3. How does efficient frontier impact real trading decisions?

It informs portfolio allocation by showing where you get the best risk-return balance. For example, efficient frontier analysis for hedge funds often reduces overexposure to correlated assets while ensuring returns remain attractive.

Conclusion

An efficient frontier simulation program is more than a mathematical model—it’s a strategic decision-making tool for traders and investors. Whether you use Monte Carlo simulations for crypto portfolios or Quadratic Optimization for institutional assets, these programs ensure disciplined and data-driven portfolio management.

To maximize results:

- Start with reliable data.

- Use hybrid approaches for flexibility and precision.

- Continuously update simulations with new market conditions.

The efficient frontier is not just for theory—it is a living framework that can guide traders to smarter and safer investment choices.

✅ If you found this guide useful, share it with your trading community, leave a comment with your questions, and let’s start a discussion on optimizing portfolios with efficient frontier tools!