====================================================================================

The concept of the efficient frontier is often reserved for institutional investors and academics. Yet, with the rise of accessible trading platforms, retail investors now have the opportunity to apply this powerful framework to optimize their portfolios. This article provides efficient frontier tips for retail investors, blending theory, practical steps, and industry insights to help individuals make smarter investment decisions.

Understanding the Efficient Frontier

What Is the Efficient Frontier?

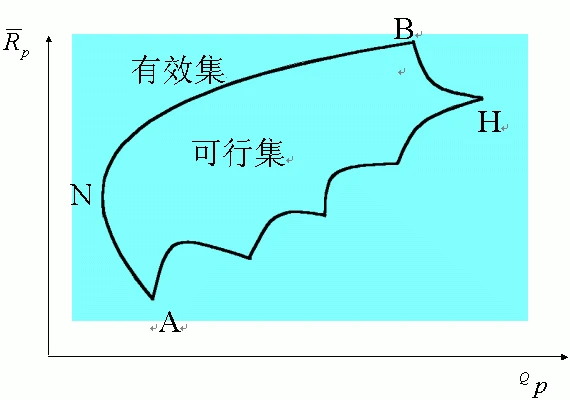

The efficient frontier, introduced by Harry Markowitz in Modern Portfolio Theory (MPT), represents the set of optimal portfolios that offer the highest expected return for a given level of risk. Portfolios below the frontier are inefficient, while those above it are unattainable.

Why It Matters for Retail Investors

For retail investors, the efficient frontier helps in:

- Identifying the right balance between risk and return.

- Avoiding overexposure to high-volatility assets.

- Structuring portfolios that align with long-term financial goals.

Efficient Frontier Graph showing risk vs return trade-off

Core Components of the Efficient Frontier

Risk and Return

Every asset carries a unique risk-return profile. The efficient frontier combines them to maximize performance for a given volatility level.

Diversification

Diversification reduces portfolio volatility by spreading investments across uncorrelated assets.

Correlation

Correlation is key. If two assets move differently under the same conditions, combining them improves portfolio efficiency.

Practical Tips for Retail Investors

Tip 1: Start with Low-Cost Index Funds

Index funds and ETFs offer diversified exposure at a low cost, making them the backbone of many efficient frontier portfolios.

- Pros: Simple, cost-efficient, widely available.

- Cons: Limited customization.

Tip 2: Add Bonds or Fixed Income for Stability

Mixing equities with bonds shifts portfolios closer to the efficient frontier by reducing volatility.

- Pros: Stabilizes returns, useful for risk-averse investors.

- Cons: Lower long-term growth potential.

Tip 3: Use Alternative Assets Cautiously

Assets like REITs, commodities, or crypto can increase diversification. But volatility should be carefully measured.

- Pros: Expands opportunity set.

- Cons: Can push risk higher if unbalanced.

Strategies for Applying Efficient Frontier

Strategy 1: Mean-Variance Optimization

This involves calculating the expected return, variance, and covariance of each asset to identify the most efficient portfolios.

- Advantages: Quantitative and data-driven.

- Limitations: Relies on historical data, which may not predict future performance.

Strategy 2: Heuristic (Rule-Based) Allocation

Instead of heavy modeling, investors apply rules (e.g., 60⁄40 equity-bond split, risk parity).

- Advantages: Simple and easy for retail investors.

- Limitations: Less tailored to individual goals.

Comparing Both Strategies

| Approach | Best For | Pros | Cons |

|---|---|---|---|

| Mean-Variance Optimization | Data-driven retail investors | Precision, academic grounding | Requires complex calculations |

| Heuristic Allocation | Beginners or time-limited | Simplicity, accessibility | Less optimized, may ignore correlations |

From my experience, a hybrid approach works best: start with rule-based allocation, then refine with optimization tools over time.

Tools and Resources for Retail Investors

- Portfolio Visualizer: Online software for running efficient frontier simulations.

- Excel or Google Sheets: Simple but effective for basic optimization.

- Brokerage Platforms: Many now integrate risk-return analytics.

This connects to efficient frontier optimization tools, which are increasingly designed for retail use.

Efficient Frontier in Emerging Trading Contexts

With the rise of perpetual futures in crypto markets, the efficient frontier is evolving. For instance, learning how to use efficient frontier for better perpetual futures can provide insights into balancing leverage, volatility, and returns in digital asset portfolios.

Current Trends in Efficient Frontier Application

- AI and Machine Learning Integration

Retail investors now have access to robo-advisors that apply optimization models dynamically.

- Crypto Assets on the Frontier

Crypto introduces high-risk, high-reward opportunities, shifting traditional efficient frontier curves.

- Retail Education Growth

Increasingly, online courses and simulations make advanced portfolio theory accessible to everyday investors.

Visualization of efficient frontier shifting with crypto assets

Case Study: Applying Efficient Frontier as a Retail Investor

Anna, a 35-year-old retail investor, builds a portfolio of 60% global equity ETFs, 30% bonds, and 10% REITs. Using free online tools, she finds her portfolio lies close to the efficient frontier. Later, she experiments with a small crypto allocation. The analysis shows a higher expected return but with significantly more volatility, leading Anna to limit her crypto allocation to 5%.

This practical example demonstrates the efficient frontier’s role in guiding rational decision-making.

FAQ: Efficient Frontier Tips for Retail Investors

1. How can a beginner calculate their efficient frontier?

Beginners can use free tools like Portfolio Visualizer or start with Excel. Input expected returns, standard deviations, and correlations of chosen assets. Automated software then generates efficient frontier graphs.

2. Is the efficient frontier still useful in volatile markets?

Yes. In fact, during volatility, the efficient frontier highlights the importance of diversification. However, it should be updated frequently to reflect new market data.

3. Can retail investors realistically use the efficient frontier?

Absolutely. While it was once an institutional tool, retail investors can now apply it using robo-advisors, low-cost ETFs, and online optimization platforms.

Conclusion: Making the Efficient Frontier Work for You

For retail investors, the efficient frontier is not just theory—it’s a practical guide to making smarter, risk-adjusted investment choices. By combining efficient frontier tips for retail investors with modern tools, individuals can build portfolios that match their risk tolerance, goals, and market outlook.

As investing becomes increasingly global and tech-driven, mastering these concepts will separate disciplined investors from those chasing returns blindly.

If you found this guide useful, share it with fellow investors, leave your thoughts in the comments, and help spread the knowledge of smarter portfolio building.

要不要我帮你生成一份 SEO 优化的 Meta Title 和 Meta Description,让这篇文章在 Google 上更容易排名?