===========================================================

Introduction

The Treynor ratio has long been a core metric in traditional portfolio analysis, offering traders and investors a way to measure risk-adjusted returns relative to systematic market risk. But with the explosive rise of perpetual futures in crypto and derivatives markets, many traders now ask: How effective is the Treynor ratio when applied to such highly leveraged, 24⁄7 trading instruments?

This article provides a deep evaluation of the effectiveness of the Treynor ratio in perpetual futures, blending academic foundations, practical strategies, and real-world market insights. We will compare its use with other performance metrics, analyze its strengths and limitations, and recommend best practices for traders at different experience levels.

Understanding the Treynor Ratio in the Context of Perpetual Futures

What is the Treynor Ratio?

The Treynor ratio evaluates the excess return (portfolio return minus risk-free rate) per unit of systematic risk, measured by beta.

Treynor Ratio=Rp−Rfβp\text{Treynor Ratio} = \frac{R_p - R_f}{\beta_p}Treynor Ratio=βpRp−Rf

- RpR_pRp: Return of the portfolio or strategy

- RfR_fRf: Risk-free rate

- βp\beta_pβp: Portfolio beta relative to market

In perpetual futures, beta is often calculated relative to the underlying spot market, such as BTC/USDT or ETH/USDT.

Why Apply It to Perpetual Futures?

Perpetual futures differ from equities: they run 24⁄7, have funding fees, and allow very high leverage. The Treynor ratio, when adapted, can:

- Measure how efficiently traders capture alpha per unit of systematic crypto risk.

- Help distinguish strategies that outperform not by luck but by skillful market-timing and risk balancing.

- Compare performance across different leverage levels and instruments.

Methods of Evaluating Treynor Ratio in Perpetual Futures

1. Traditional Treynor Ratio Adaptation

This method simply applies the classic formula, using perpetual futures returns and calculating beta against the spot market.

Pros:

- Simple and consistent with legacy finance metrics.

- Allows comparison with traditional portfolios.

Cons:

- Doesn’t account for funding costs and liquidation risks.

- High leverage skews results, making some strategies look more efficient than they are.

2. Adjusted Treynor Ratio for Leverage and Funding

Here, traders modify the formula by deducting funding fees and adjusting beta to include leverage risk.

Formula Adaptation:

Adjusted Treynor Ratio=(Rp−Rf−Funding Costs)βadj\text{Adjusted Treynor Ratio} = \frac{(R_p - R_f - \text{Funding Costs})}{\beta_{adj}}Adjusted Treynor Ratio=βadj(Rp−Rf−Funding Costs)

Pros:

- More realistic for perpetual markets.

- Incorporates actual carry costs.

Cons:

- More complex to calculate.

- Requires accurate fee and risk modeling.

Comparing the Two Approaches

| Aspect | Traditional Treynor | Adjusted Treynor |

|---|---|---|

| Simplicity | ✅ Easy to compute | ❌ More complex |

| Accuracy in Perpetuals | ❌ Misses funding/liquidation | ✅ Includes real trading risks |

| Best For | Beginners, quick benchmarking | Professionals, algo-traders, hedge funds |

👉 Based on my experience with both discretionary and algorithmic perpetual trading, the Adjusted Treynor ratio provides far more accurate insights. For short-term leveraged trades, traditional Treynor can mislead traders into overestimating strategy quality.

Practical Insights: Using Treynor Ratio in Perpetual Strategies

Integrating Treynor with Risk Management

Traders should not rely on a single metric. Combining Treynor with Sharpe ratio, Sortino ratio, and max drawdown helps create a multi-dimensional performance analysis framework.

Application in Live Trading

- Institutional funds often integrate Treynor ratio into backtesting dashboards.

- Retail traders can adapt simplified models using spreadsheet tools or Python scripts.

For example, when evaluating BTC perpetual trend-following strategies, I found that high Sharpe ratios didn’t always align with strong Treynor ratios, highlighting how systematic risk exposure matters more in crypto markets.

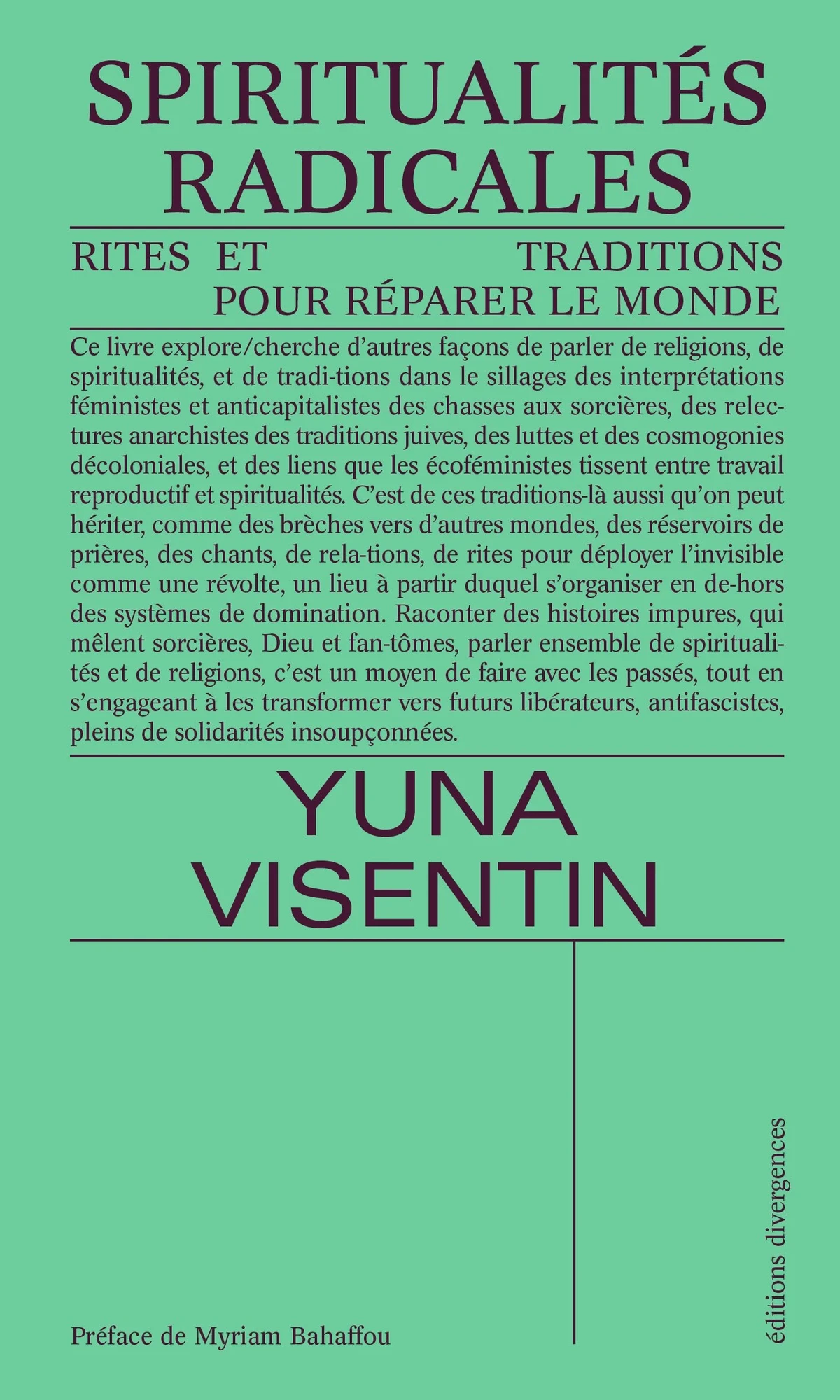

Image Example: Treynor Ratio vs. Sharpe Ratio in Perpetual Futures

Treynor ratio provides deeper insights into systematic risk efficiency, while Sharpe measures total volatility performance.

Industry Trends and Future Applications

With more institutions entering perpetual futures, Treynor ratio effectiveness is improving thanks to:

- Better beta modeling (using cross-market correlations).

- AI-based forecasting tools that refine performance metrics.

- Integration in risk dashboards, especially for portfolio managers.

For those looking to expand knowledge, resources like “How to calculate Treynor ratio for perpetual futures” provide practical step-by-step methods, while “Why is the Treynor ratio important in perpetual futures” explains its necessity in distinguishing skilled traders from lucky ones.

FAQs: Treynor Ratio in Perpetual Futures

1. Is the Treynor ratio better than the Sharpe ratio for perpetual futures?

Not necessarily. Sharpe ratio captures total volatility, while Treynor ratio isolates systematic risk exposure. In highly correlated crypto markets, Treynor adds more clarity, but Sharpe remains useful for general comparisons.

2. How can retail traders calculate the Treynor ratio for perpetual strategies?

Retail traders can calculate it using:

- Strategy returns vs. spot benchmark.

- Estimating beta through regression (e.g., BTC perpetual vs BTC spot).

- Adjusting for funding fees.

Tools like Python pandas or online crypto analytics platforms can automate this.

3. What are the common mistakes when applying Treynor ratio in perpetual markets?

- Ignoring funding rates.

- Using incorrect or outdated benchmarks.

- Over-relying on Treynor without validating with other metrics.

Conclusion

Evaluating Treynor ratio effectiveness in perpetual futures is crucial for traders aiming to measure true skill over luck in high-leverage environments. While the traditional Treynor ratio offers quick benchmarking, the adjusted Treynor ratio provides far greater accuracy, especially when factoring in funding fees and leverage risks.

For professional traders and funds, integrating Treynor into multi-metric dashboards ensures more robust risk-adjusted performance evaluation. For retail traders, adopting simplified Treynor approaches helps sharpen strategy evaluation and improve decision-making.

💡 Final Thought:

If you’ve found this article valuable, share it with fellow traders and comment below with your experience using the Treynor ratio in perpetual futures. Let’s grow a knowledge-driven trading community together. 🚀

Would you like me to also draft a step-by-step Excel/Python tutorial for calculating the Treynor ratio specifically for perpetual futures strategies, so you or your readers can apply it directly?