========================================

Understanding and managing exchange rate risk cost-benefit analysis is crucial for businesses, investors, and traders operating in global markets. Exchange rate fluctuations can erode profits, inflate costs, and destabilize long-term strategies. However, risk mitigation comes at a price, and deciding whether the cost is justified by the benefit requires a careful, structured analysis. This article explores how to measure exchange rate risk, assess different hedging strategies, compare their pros and cons, and highlight best practices for sustainable global operations.

What is Exchange Rate Risk?

Definition and Types

Exchange rate risk, also known as currency risk or FX risk, refers to potential financial losses resulting from changes in currency values. It is particularly significant for multinational corporations, exporters, importers, and international investors.

There are three main types:

- Transaction Risk: Losses from exchange rate movements during the settlement of cross-border transactions.

- Translation Risk: Accounting impact when consolidating financial statements of subsidiaries in different currencies.

- Economic Risk: Long-term changes in competitiveness due to currency volatility.

Why Does Exchange Rate Risk Matter?

Fluctuations in currency rates can drastically change profit margins, debt servicing costs, and investment returns. This explains why is exchange rate risk important for global businesses and why risk management strategies are critical for stability.

Global business and currency volatility

The Framework of Exchange Rate Risk Cost-Benefit Analysis

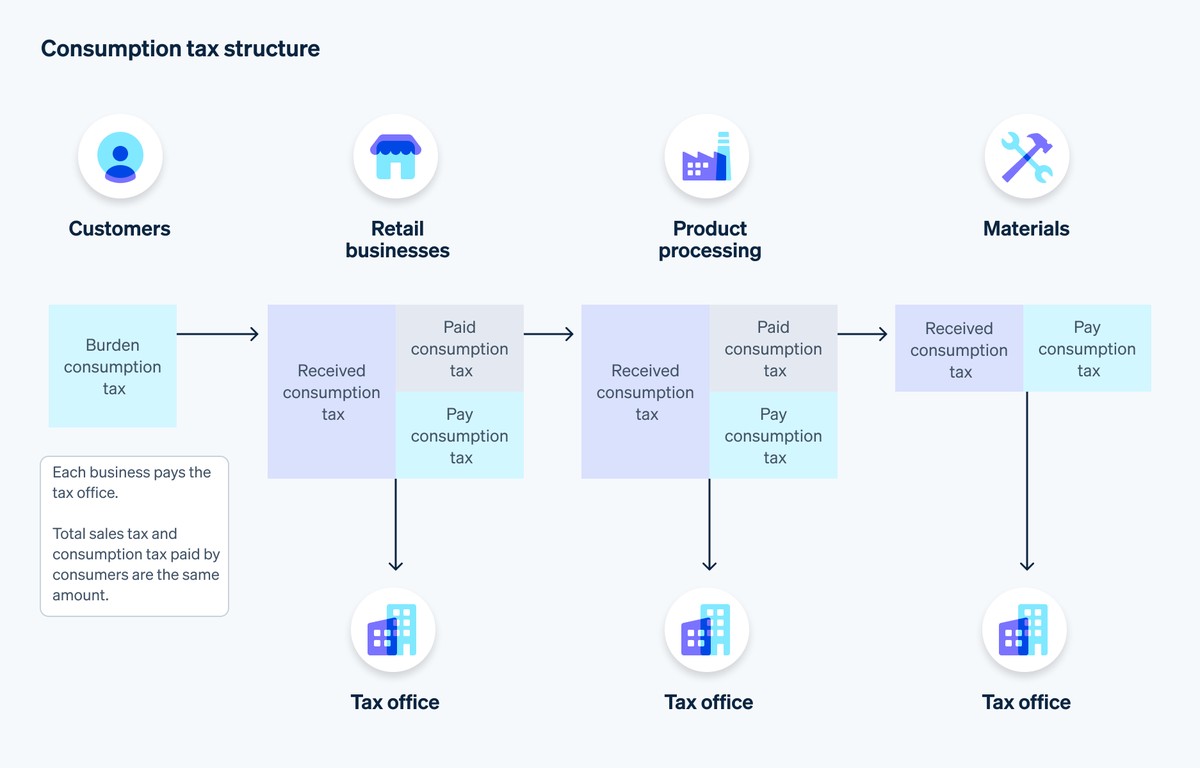

A cost-benefit analysis in FX risk management involves weighing the cost of hedging tools (like forwards, options, and swaps) against the potential savings from avoided losses.

Key Steps in the Analysis

- Identify the Risk Exposure

Understand where FX risks occur across revenues, expenses, assets, and liabilities. For instance, where can exchange rate risk occur includes cross-border sales, import contracts, or foreign-denominated loans.

- Quantify the Potential Impact

Use historical volatility, Value at Risk (VaR), or scenario testing to estimate potential losses.

- Evaluate Hedging Options

Assess derivatives (forwards, options), natural hedges (matching costs and revenues in the same currency), or diversification strategies.

- Measure Costs of Hedging

Include direct costs (premiums, fees) and indirect costs (opportunity loss if hedged position prevents benefiting from favorable currency moves).

- Compare Net Benefits

Weigh avoided risks against costs. This provides clarity on whether to hedge, how much to hedge, and which instruments to use.

Methods for Managing Exchange Rate Risk

Strategy 1: Forward Contracts

How It Works

A forward contract locks in an exchange rate for a future transaction. For example, an importer can secure today’s rate for a payment due six months later.

Pros

- Eliminates uncertainty in cash flows.

- Easy to implement.

Cons

- No opportunity to benefit from favorable exchange rate moves.

- Requires credit line with counterparties.

Strategy 2: Currency Options

How It Works

Options give the right, but not the obligation, to exchange currency at a specific rate. This flexibility allows businesses to protect against adverse moves while still benefiting if rates move in their favor.

Pros

- Provides downside protection with upside potential.

- Flexible and customizable.

Cons

- Premiums can be expensive.

- Complexity in structuring strategies.

Forward contracts vs options hedging cost-benefit chart

Comparing the Two Strategies

- Forwards: Best for companies prioritizing certainty and budgeting accuracy.

- Options: Better for firms willing to pay a premium for flexibility.

Ultimately, the choice depends on a firm’s risk tolerance, cost sensitivity, and strategic outlook. In practice, many companies use a combination of both.

Exchange Rate Risk Cost-Benefit Analysis: Real-World Examples

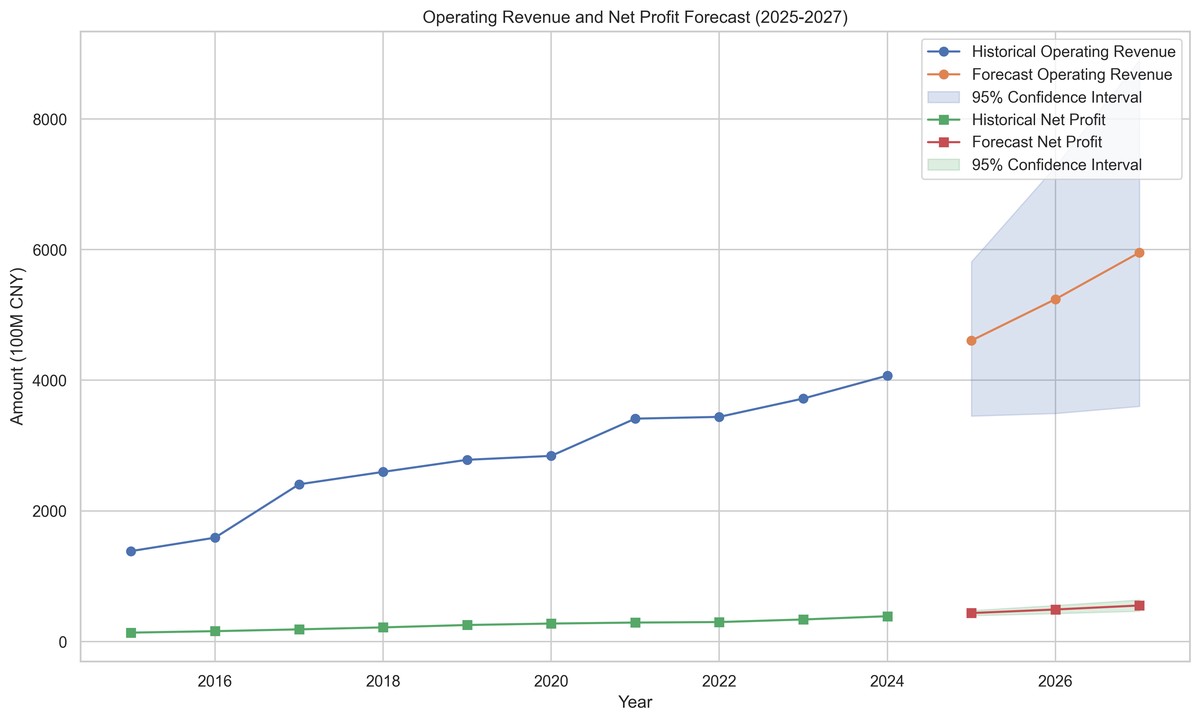

Case Study 1: Exporter in Europe

A European exporter selling to the U.S. faced euro appreciation risk. Using forwards locked in predictable margins, but the company missed profits during unexpected USD rallies. This demonstrates the trade-off between certainty and opportunity cost.

Case Study 2: Multinational Corporation

A U.S.-based multinational used options to hedge large-scale overseas revenue. Despite paying significant premiums, the flexibility saved billions during sharp USD appreciation phases, proving the benefit outweighed the cost.

Case Study 3: Small Business Importer

A small business importing raw materials avoided hedging to save costs. When local currency depreciated 15%, expenses soared, threatening survival. The lack of hedging revealed that cost avoidance could be more expensive than hedging fees.

Advanced Cost-Benefit Approaches

1. Scenario Testing

Simulating different exchange rate environments helps identify the value of hedging under varied outcomes.

2. Monte Carlo Simulation

Generates thousands of potential FX scenarios to estimate risk exposure distribution.

3. Hedging Ratios

Partial hedging (e.g., 50% of exposure) balances protection and cost control.

4. Benchmarking Against Peers

Comparing hedging strategies across industries helps companies assess competitiveness and best practices.

Cost-benefit analysis process for FX risk

Best Practices in Exchange Rate Risk Cost-Benefit Analysis

- Regularly Reassess Risks: Currency volatility shifts with geopolitics, interest rates, and market conditions.

- Align with Business Strategy: A short-term trader’s approach differs from a long-term multinational’s.

- Avoid Over-Hedging: Excessive hedging may lock in costs and reduce flexibility.

- Leverage Analytical Tools: Use software for scenario testing and forecasting.

- Educate Decision-Makers: Financial managers must understand both technical hedging tools and real-world trade-offs.

This aligns with where to find exchange rate risk management strategies, since businesses must continually explore updated tools and education.

Frequently Asked Questions (FAQ)

1. How can I calculate exchange rate risk?

You can calculate FX risk using historical volatility, Value at Risk (VaR), or regression models. For practical steps, check guides on how to calculate exchange rate risk, which provide formulas and examples for different industries.

2. Is it always worth paying for hedging?

Not necessarily. The decision depends on volatility, exposure size, and firm objectives. High-volatility environments often justify hedging costs, while stable periods may not. A cost-benefit analysis ensures balanced decisions.

3. What is the most cost-effective way to hedge exchange rate risk?

Forward contracts are often the cheapest method, but they lack flexibility. Currency options, though more expensive, allow participation in favorable market moves. A hybrid strategy—hedging core exposure with forwards and variable exposure with options—balances cost and benefit.

Conclusion: Balancing Costs and Benefits for Long-Term Success

Exchange rate risk is unavoidable in global finance, but its impact can be managed. A robust exchange rate risk cost-benefit analysis helps organizations make informed decisions about whether to hedge, how much to hedge, and which tools to use.

While hedging has costs, ignoring currency risks can be far more expensive. The most resilient businesses combine analytical rigor with strategic flexibility—ensuring they not only survive but thrive in volatile global markets.

Join the Discussion

How do you manage exchange rate risks in your business or investments? Do you prefer cost-effective forwards, flexible options, or a blended approach? Share your experiences and insights in the comments—your perspective could help other businesses refine their strategies. 🌍💹

要不要我把这篇文章做成一个 可下载的可视化报告(含图表和案例分析),让你在业务或课堂演示中更直观地展示 exchange rate risk cost-benefit analysis?