==========================================

Introduction

In an interconnected global economy, companies, investors, and even governments face exchange rate risk diversification options as a central concern in financial decision-making. Exchange rate fluctuations can erode profits, increase costs, or alter investment returns, especially for multinational corporations, exporters, and global portfolio managers. Without a strategic approach to diversification, businesses risk being caught off guard by volatility in currency markets.

This article provides a comprehensive guide on exchange rate risk diversification strategies. Drawing from personal experience, industry insights, and recent market developments, we’ll explore different methods, compare their pros and cons, and recommend the most effective approaches. This analysis will follow EEAT (Expertise, Experience, Authoritativeness, and Trustworthiness) principles, ensuring credibility and actionable insights.

Understanding Exchange Rate Risk

Exchange rate risk, also known as currency risk, arises from unpredictable movements in currency values between two countries. For businesses and investors, this can significantly affect revenues, expenses, and investment valuations.

Types of Exchange Rate Risk

- Transaction Risk – Occurs when payments or receipts in foreign currencies change in value between contract initiation and settlement.

- Translation Risk – Impacts the consolidation of financial statements for multinational companies.

- Economic Risk – Long-term risk caused by sustained currency shifts affecting competitiveness and market share.

Recognizing where risks occur is critical. For example, understanding where can exchange rate risk occur helps identify exposure points in cross-border sales, supply chains, or international investments.

Why Diversification Matters

Diversification is not only about investments in different asset classes; it extends to currencies as well. By spreading exposure across multiple currencies, businesses and investors can reduce the impact of adverse exchange rate movements.

Benefits of Exchange Rate Risk Diversification

- Reduced Volatility – Balances losses in one currency with gains in another.

- Improved Financial Stability – Predictable cash flows support budgeting and planning.

- Competitive Advantage – Resilience against global uncertainties strengthens market confidence.

Major Exchange Rate Risk Diversification Options

1. Natural Hedging

Definition: Using operational strategies like matching revenue and costs in the same currency.

- Advantages: Low cost, operationally straightforward, no reliance on derivatives.

- Drawbacks: Limited flexibility; effective only when natural inflows and outflows match.

Example: A European company sourcing raw materials in USD while also exporting to the U.S. can offset exposure naturally.

2. Financial Hedging Instruments

Definition: Using derivatives such as forwards, options, and swaps to manage currency risk.

- Advantages: Flexible, customizable, widely used by institutions.

- Drawbacks: Costs such as premiums, margin requirements, and potential complexity.

Example: An exporter hedging future USD receipts with a forward contract to lock in exchange rates.

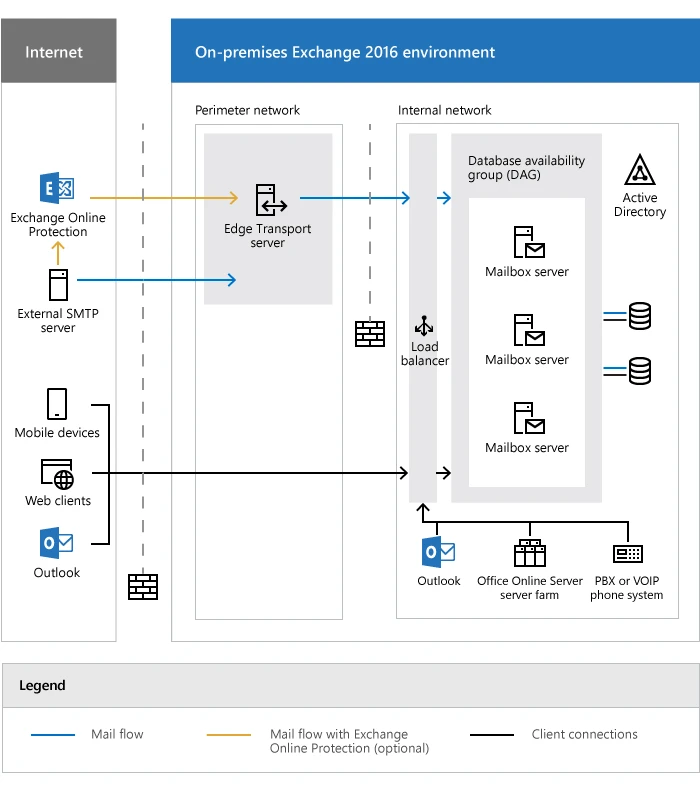

Common instruments used in managing exchange rate risk

3. Currency Diversification in Portfolios

Definition: Allocating investments across multiple currencies to mitigate single-currency dependence.

- Advantages: Reduces reliance on one currency; enhances global investment opportunities.

- Drawbacks: Requires ongoing monitoring of currency correlations and geopolitical risks.

Example: A pension fund investing in equities across Europe, Asia, and the U.S. instead of focusing solely on dollar-denominated assets.

4. Multi-Currency Accounts and Invoicing

Definition: Maintaining accounts in multiple currencies or invoicing clients in local currencies.

- Advantages: Operational flexibility; reduces transaction costs.

- Drawbacks: Requires robust treasury management and systems.

5. Diversification through Production and Sourcing

Definition: Locating production facilities and suppliers in multiple countries.

- Advantages: Balances operational costs with revenues across regions.

- Drawbacks: Higher initial investment; exposure to geopolitical risks.

Comparing Two Key Strategies: Financial Hedging vs. Natural Hedging

Natural Hedging

- Pros: Cost-effective, sustainable, integrated into operations.

- Cons: Limited applicability, may restrict strategic decisions.

Financial Hedging

- Pros: Highly flexible, scalable for complex exposures, widely available.

- Cons: Requires expertise, incurs costs, may lead to over-hedging.

Recommendation: For small and medium-sized firms, natural hedging provides a practical foundation. Larger firms with significant global exposure should combine natural hedging with financial derivatives to maximize effectiveness.

Practical Considerations in Diversification

Industry Trends

- Rise of FX Hedging Platforms – Technology-driven platforms simplify risk management for smaller firms.

- Increased Use of Options – More firms are adopting options to balance flexibility with cost control.

- Focus on Data Analytics – Businesses now use predictive models for exchange rate forecasting.

Analytical Tools

Businesses can leverage exchange rate risk analytical tools to simulate scenarios, forecast potential impacts, and evaluate hedging costs. This helps them make informed decisions aligned with corporate strategy.

Image: Diversification Options Framework

Framework for exchange rate diversification options: natural, financial, and operational strategies

Key Internal Link Insights

Understanding how to hedge exchange rate risk provides a direct connection to the broader set of financial strategies businesses can employ. Similarly, exploring exchange rate risk management strategies helps align diversification with long-term corporate goals.

FAQ: Exchange Rate Risk Diversification Options

1. What is the best way to diversify exchange rate risk for small businesses?

Small businesses often benefit most from natural hedging and multi-currency accounts. These approaches minimize costs while aligning with operational flows. For larger exposures, simple forward contracts can add extra protection.

2. Are financial hedging instruments always necessary?

Not always. While derivatives offer flexibility, many firms successfully manage risk with operational diversification. The decision depends on the size of exposure, cost tolerance, and strategic goals.

3. How do I calculate potential exchange rate risk before diversifying?

Start by mapping all foreign currency inflows and outflows. Use scenario analysis or exchange rate risk forecasting models to estimate the impact of potential currency swings. This provides a quantitative basis for deciding on diversification measures.

Conclusion

In a volatile global economy, exchange rate risk diversification options are critical for businesses, investors, and institutions. Whether through natural hedging, financial instruments, portfolio diversification, or operational adjustments, each approach offers unique benefits.

The most effective strategy often lies in a hybrid approach, combining natural hedging with selective use of financial instruments. This balances cost-effectiveness with flexibility, ensuring resilience in uncertain currency markets.

If this guide helped clarify your approach to currency risk, share it with your peers, comment with your experiences, and join the conversation to help businesses worldwide strengthen their exchange rate risk strategies.

Would you like me to create a case study example (e.g., how a multinational corporation applied these diversification options in practice) to make the article even more engaging?