===============================================================

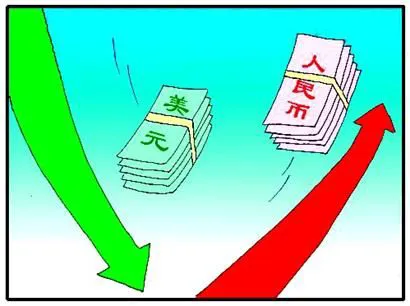

Globalization has increased cross-border trade, international investment, and multinational business operations. However, with these opportunities comes exposure to foreign exchange risk—the uncertainty caused by fluctuating currency values. Companies, investors, and even small businesses face this challenge daily. To remain competitive and financially stable, it is crucial to adopt effective exchange rate risk management strategies.

This guide provides a deep dive into exchange rate risk, explores practical methods for mitigation, compares their strengths and weaknesses, and presents actionable solutions backed by personal insights and industry trends.

Understanding Exchange Rate Risk

What Is Exchange Rate Risk?

Exchange rate risk (or currency risk) is the potential loss due to changes in foreign exchange rates. For example, if a U.S. exporter invoices a European buyer in euros, but the euro weakens against the dollar before payment, the exporter will receive fewer dollars than expected.

Why Does It Matter?

Businesses and investors exposed to multiple currencies must manage volatility to ensure predictable cash flows and profits. Without proper risk management, earnings, asset values, and long-term strategies can be severely affected.

- For exporters, exchange rate swings can erode revenue.

- For importers, costs can increase unexpectedly.

- For investors, portfolio returns may be diluted.

👉 Understanding why is exchange rate risk important is the foundation for designing robust protection strategies.

Types of Exchange Rate Risk

1. Transaction Risk

Occurs when companies settle foreign currency payments in the future, leaving exposure to price fluctuations.

2. Translation Risk

Arises when multinational companies consolidate financial statements across subsidiaries with different base currencies.

3. Economic Risk

A long-term risk affecting a company’s market value, competitiveness, and cash flows due to sustained currency movements.

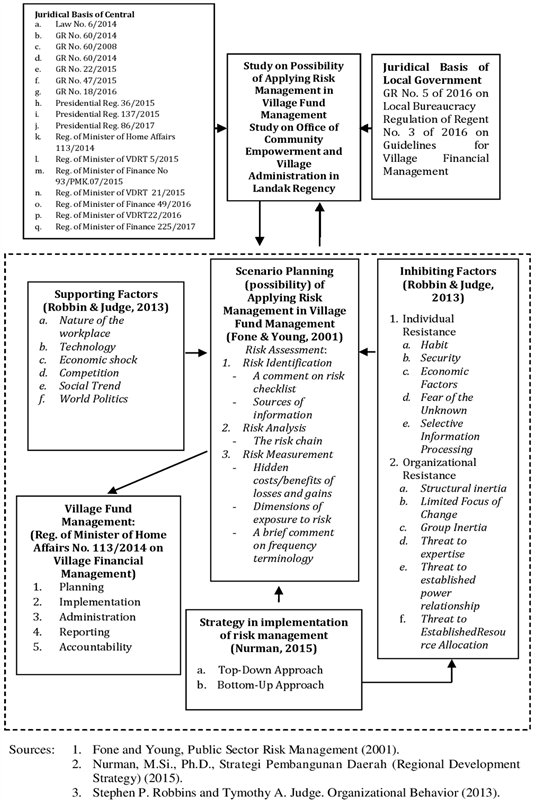

Common Exchange Rate Risk Management Strategies

1. Forward Contracts

A forward contract locks in an exchange rate for a future transaction.

Pros:

- Eliminates uncertainty.

- Tailored to specific amounts and dates.

Cons:

- No flexibility if the market moves favorably.

- May require collateral from smaller businesses.

2. Options Contracts

Currency options provide the right, but not the obligation, to exchange currency at a predetermined rate.

Pros:

- Flexibility to benefit from favorable moves.

- Protection from adverse shifts.

Cons:

- Premiums can be expensive.

- Requires knowledge of options markets.

3. Natural Hedging

Aligning revenues and costs in the same currency reduces exposure. For example, a U.K. exporter invoicing in dollars may also buy raw materials in dollars.

Pros:

- Cost-free strategy.

- Reduces reliance on financial instruments.

Cons:

- Limited feasibility depending on supply chain.

- May not cover all exposures.

4. Currency Swaps

Companies exchange principal and interest payments in different currencies, often used for long-term financing.

Pros:

- Effective for multinational corporations.

- Provides stable cash flow.

Cons:

- Complex to structure.

- Involves counterparty risk.

Practical Comparison of Strategies

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Forward Contracts | Predictable cash flows | Simple, tailored | No flexibility |

| Options Contracts | Uncertain exposure direction | Flexibility, downside protection | Costly premiums |

| Natural Hedging | Businesses with cross-border ops | No financial cost | Limited scope |

| Currency Swaps | Multinational financing deals | Long-term stability | Complex, counterparty risk |

👉 Based on my experience, combining forwards for certainty and options for flexibility works best for exporters and importers, while natural hedging should be every firm’s first defense line.

Step-by-Step Framework for Managing Exchange Rate Risk

- Identify Exposure – Assess where currency risk arises in operations. (e.g., contracts, debt, supplier payments).

- Quantify Risk – Use models or tools to calculate exposure. See how to calculate exchange rate risk for detailed methods.

- Select a Strategy – Choose between forwards, options, swaps, or natural hedging based on cost and business needs.

- Monitor Continuously – Use exchange rate risk analytical tools for real-time tracking.

- Evaluate Performance – Adjust hedging strategies regularly using forecasting models and simulations.

Case Example: Exporter Risk

A German manufacturer exports machinery to the U.S. and invoices in USD. If the euro strengthens, revenue shrinks. By entering a forward contract, the company locks in EUR/USD at 1.10, securing predictable returns regardless of market volatility.

Visual Overview of Risk Management Approaches

Exchange Rate Risk Management Approaches

Latest Trends in Exchange Rate Risk Management

- AI-driven forecasting models improve accuracy in predicting exchange rate movements.

- Blockchain-based smart contracts reduce settlement risks.

- SME-friendly hedging platforms offer affordable tools for small businesses.

- Growing demand for real-time analytics among importers and exporters.

As businesses expand internationally, where to find exchange rate risk management strategies has become a common query. From online financial platforms to specialized fintech services, resources are now more accessible than ever.

FAQs on Exchange Rate Risk Management Strategies

1. How do companies decide which risk management strategy to use?

It depends on the company’s size, exposure level, and financial resources. Large corporations often use swaps and forwards, while SMEs rely on natural hedging and simpler contracts.

2. Can exchange rate risk ever be completely eliminated?

No. While hedging tools reduce volatility, residual risk always exists due to unpredictable macroeconomic events. The goal is mitigation, not elimination.

3. What tools can help in monitoring exchange rate risks?

Businesses use platforms like Bloomberg, Reuters, or fintech solutions offering exchange rate risk evaluation methods, forecasting models, and simulation examples.

Final Thoughts

Exchange rate volatility is an unavoidable reality in today’s global economy. Whether you are a multinational company, a small exporter, or an international investor, having exchange rate risk management strategies in place is crucial.

From forward contracts to options and natural hedging, there is no one-size-fits-all solution. The best approach often combines multiple tools tailored to business needs, backed by continuous monitoring and forecasting.

💡 If you found this guide insightful, share it with your network, comment with your experiences, and let’s discuss which strategies have worked best in your business or investments.

Would you like me to create a detailed infographic showing the decision-making tree for choosing the right exchange rate risk strategy? This would help readers visualize which strategy fits their specific case.