=====================================================================================

Introduction

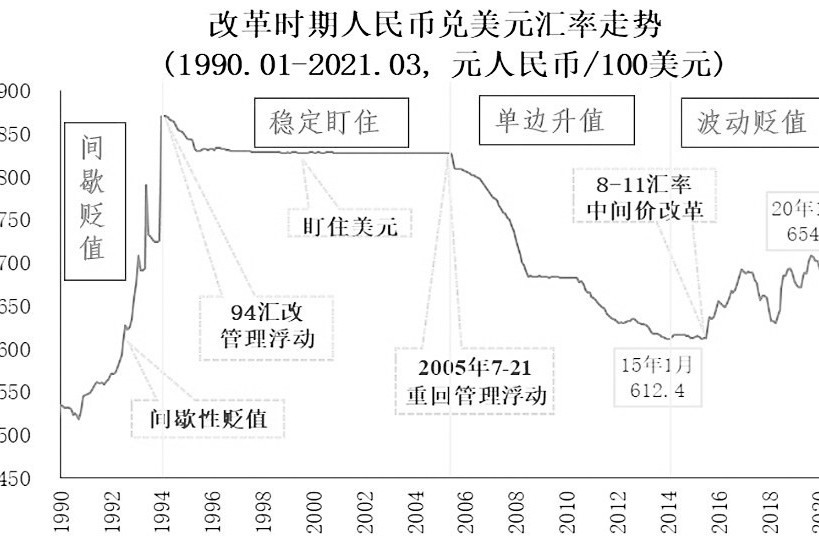

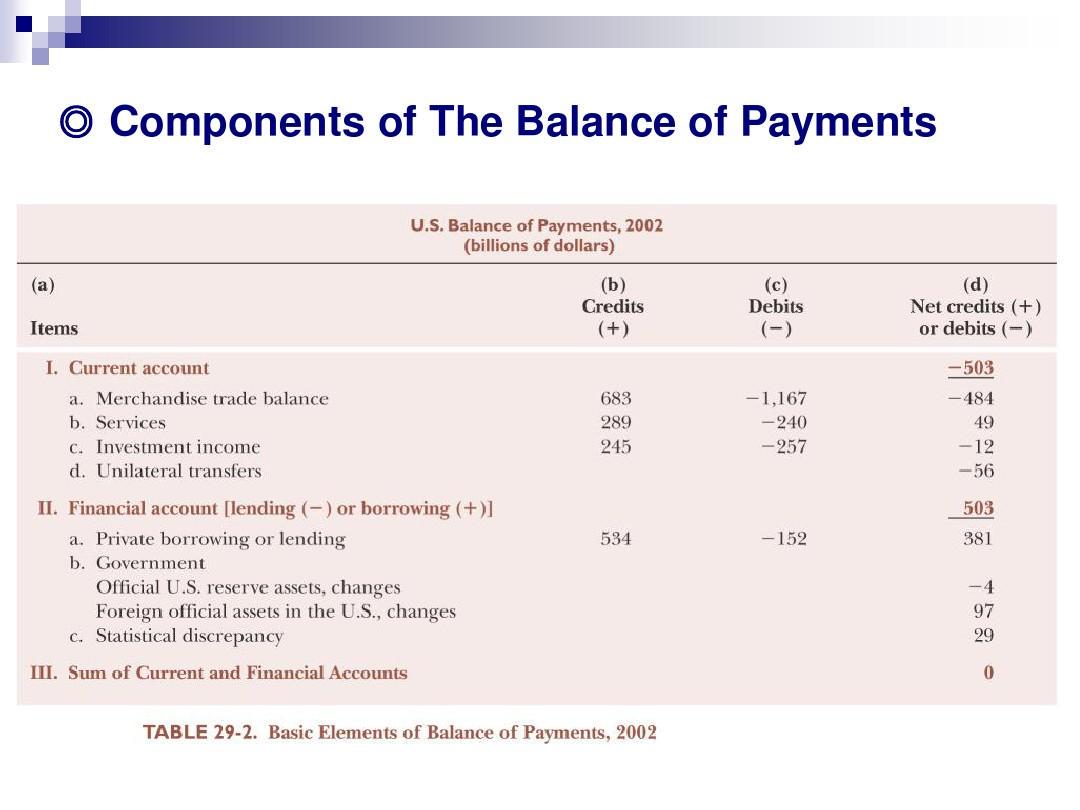

In today’s interconnected world, exchange rate fluctuations can have significant implications for businesses, investors, and financial markets. Exchange rate risk—also known as currency risk—refers to the potential for financial losses resulting from changes in the value of one currency relative to another. Managing exchange rate risk is crucial for any company or investor operating in the global market. In this article, we will explore various exchange rate risk management strategies, discuss their benefits and limitations, and provide actionable insights for businesses and investors looking to mitigate risks.

What Is Exchange Rate Risk?

Exchange rate risk arises from fluctuations in currency values, which can impact a company’s cash flow, profitability, and overall financial stability. The risk is particularly relevant for businesses engaged in:

- International trade (importers and exporters)

- Cross-border investments

- Multinational operations

- Hedging in foreign currency markets

The uncertainty surrounding future currency movements can lead to unexpected costs, affecting the pricing of goods and services, as well as the valuation of foreign investments.

1. Types of Exchange Rate Risk

There are three primary types of exchange rate risk:

- Transaction Risk: Occurs when a business has transactions denominated in foreign currencies. These transactions may include sales, purchases, or borrowing in foreign currencies.

- Translation Risk: Arises when financial statements of foreign subsidiaries or investments need to be consolidated. Exchange rate fluctuations can impact the reported earnings and balance sheet value.

- Economic Risk: Also called operating risk, this type of risk arises from long-term changes in the economic environment. Changes in exchange rates can affect a company’s competitive position, market share, and overall profitability in foreign markets.

Common Exchange Rate Risk Management Strategies

Managing exchange rate risk requires a combination of hedging strategies, diversification techniques, and careful financial planning. Let’s explore some of the most commonly used strategies:

2. Hedging with Derivatives

Hedging is a popular strategy used to reduce or eliminate the impact of exchange rate fluctuations on a business’s financial performance. Derivatives, such as forward contracts, futures contracts, options, and swaps, are commonly used to hedge currency risks.

A. Forward Contracts

A forward contract is a private agreement between two parties to exchange currencies at a predetermined rate on a specified future date. This contract is customizable, allowing businesses to hedge against exchange rate risk by locking in a future exchange rate.

Advantages:

- Provides certainty and stability by fixing exchange rates.

- Customizable to meet specific business needs.

Disadvantages:

- No opportunity to benefit from favorable currency movements.

- Potential for high costs if the currency moves favorably after entering the contract.

B. Currency Futures and Options

Futures contracts are standardized agreements traded on exchanges that require the delivery of a specified amount of a currency at a future date. Currency options give the holder the right, but not the obligation, to exchange currencies at a predetermined rate within a specified time frame.

Advantages:

- Currency options allow businesses to profit from favorable currency movements while providing protection against adverse fluctuations.

- Futures contracts offer standardized terms and ease of trade.

Disadvantages:

- Options require premium payments, which can be expensive.

- Futures contracts may be less flexible than forward contracts.

C. Currency Swaps

A currency swap is a derivative contract where two parties exchange cash flows in different currencies. These agreements are used to secure financing in a foreign currency or to hedge against currency risk in long-term transactions.

Advantages:

- Helps businesses lock in a long-term exchange rate.

- Provides flexibility for cross-border financing.

Disadvantages:

- Currency swaps can be complex and require substantial capital for execution.

- Counterparty risk if the other party defaults.

3. Diversification of Currency Exposure

Diversifying currency exposure is a non-derivative strategy that helps reduce the impact of exchange rate fluctuations by spreading risk across different currencies. Companies can achieve diversification by engaging in trade with multiple countries or holding assets in various currencies.

A. Geographic Diversification

Businesses can reduce exchange rate risk by expanding operations or investing in multiple geographic regions. By engaging in markets with different currencies, the negative impact of one currency’s depreciation may be offset by the appreciation of another.

Advantages:

- Spreads risk across various currencies, reducing dependence on a single market.

- Diversification can stabilize earnings over time.

Disadvantages:

- Expanding into new markets requires significant upfront investment and operational adjustments.

- Exposure to new regulatory environments and risks.

B. Currency Basket Strategy

A currency basket consists of holding multiple foreign currencies in a portfolio, typically weighted based on the trading volume or economic size of each currency. This approach spreads out the risk and allows companies to hedge against potential depreciation in any single currency.

Advantages:

- Reduces exposure to volatility from any single currency.

- Allows businesses to hold multiple currencies without the need for complex hedging strategies.

Disadvantages:

- Requires active management and monitoring of currency weights.

- Currency basket may not perfectly offset risks if global economic conditions change.

4. Natural Hedging

Natural hedging is a strategy where companies mitigate currency risk by matching foreign currency revenues with foreign currency expenses. This technique minimizes the need for external hedging instruments by creating an internal balance between the currencies a company earns and spends.

A. Matching Foreign Currency Revenues and Costs

A company with operations in both the U.S. and Europe might match revenue earned in euros with costs incurred in euros, such as paying European suppliers or employees in euros.

Advantages:

- Reduces the need for derivatives and external hedging instruments.

- Lowers transaction costs associated with hedging.

Disadvantages:

- May limit business flexibility in certain markets.

- Not always possible to perfectly balance revenues and costs in the same currency.

Comparing the Strategies: Which is Best?

5. Comparing Hedging, Diversification, and Natural Hedging

- Hedging with derivatives offers protection against adverse currency movements, but it comes with transaction costs and potential missed opportunities.

- Diversification helps reduce reliance on any single currency but requires more significant market exposure and careful management.

- Natural hedging is a low-cost strategy, but it may not be suitable for all businesses, especially those without significant international revenue or expenses.

The best approach will depend on the company’s size, its exposure to foreign markets, and its risk tolerance. For large multinational corporations, a combination of hedging and diversification often works best, while smaller businesses might find natural hedging to be a more cost-effective strategy.

Frequently Asked Questions (FAQ)

1. How can I calculate exchange rate risk for my business?

Exchange rate risk can be quantified by assessing the net currency exposure—the difference between foreign currency assets and liabilities. By using historical data and volatility analysis, businesses can estimate the potential financial impact of adverse currency movements.

2. Why does exchange rate risk matter for multinational companies?

Multinational companies face exchange rate risk due to the multiple currencies they engage with. Fluctuating exchange rates can affect profits, assets, liabilities, and competitiveness in foreign markets. Proper risk management helps minimize losses and ensures smoother international operations.

3. What are some of the best tools for managing exchange rate risk?

Some of the most effective tools for managing exchange rate risk include forward contracts, currency options, and currency swaps. Companies can also use financial software and hedging platforms to track currency movements and execute hedging strategies efficiently.

Conclusion

Effective exchange rate risk management strategies are essential for businesses and investors engaged in international trade and investment. By utilizing hedging strategies, diversification, and natural hedging, companies can protect themselves from the unpredictable nature of currency fluctuations. Choosing the right strategy depends on the specific needs and goals of the business, but a combination of these approaches can provide a solid foundation for mitigating exchange rate risk and ensuring financial stability in a global marketplace.