===============================================================

Introduction

In the world of crypto derivatives, perpetual futures stand out as one of the most actively traded instruments. They provide traders with continuous exposure to assets without expiry, making them popular for hedging and speculation. However, their popularity comes with a challenge: the need for robust risk management. Traditional measures like Value-at-Risk (VaR) are limited because they fail to capture tail risk accurately. This is where expected shortfall enhancement for perpetual futures algorithms becomes essential.

Expected shortfall (ES), also known as Conditional Value-at-Risk (CVaR), goes beyond VaR by quantifying the average losses in extreme scenarios. For algorithmic traders, integrating ES into trading models can reduce downside risk, optimize leverage, and improve overall portfolio resilience. This article explores advanced methodologies, compares strategies, and provides actionable insights for implementing expected shortfall in perpetual futures trading.

Why Expected Shortfall Matters in Perpetual Futures

Perpetual futures differ from traditional futures because they never expire and rely on funding rates to keep prices anchored to spot markets. This unique design amplifies leverage usage and volatility exposure.

Limitations of VaR in Perpetual Futures

- Blind to Tail Risks: VaR estimates a percentile loss (e.g., 95%), but does not account for losses beyond that threshold.

- Model Dependency: VaR often relies on assumptions of normal distributions, which fail during extreme crypto market moves.

- Underestimation of Black Swan Events: Crypto markets have frequent extreme shocks that VaR fails to capture.

Why ES Is Better

- Captures Tail Risks: ES calculates the average loss beyond the VaR cutoff.

- Improves Risk Capital Allocation: Gives traders a more realistic buffer against extreme volatility.

- Aligns with Regulatory Standards: ES is increasingly favored by Basel III and professional trading frameworks.

In short, ES is not just a theoretical upgrade; it is a practical necessity for algorithmic perpetual futures trading.

Key Components of Expected Shortfall Enhancement

1. Risk Modeling Precision

Algorithms must incorporate non-Gaussian distributions, fat tails, and volatility clustering when calculating ES. This improves accuracy during crypto price shocks.

2. Dynamic Position Sizing

Integrating ES into trading models allows for risk-adjusted position sizing. For example, when ES indicates higher expected losses, the algorithm automatically reduces leverage.

3. Real-Time Monitoring

Continuous ES calculation provides early warning signals for liquidation risk in perpetual contracts, where high leverage can wipe out positions in minutes.

Strategies for Enhancing Expected Shortfall in Algorithms

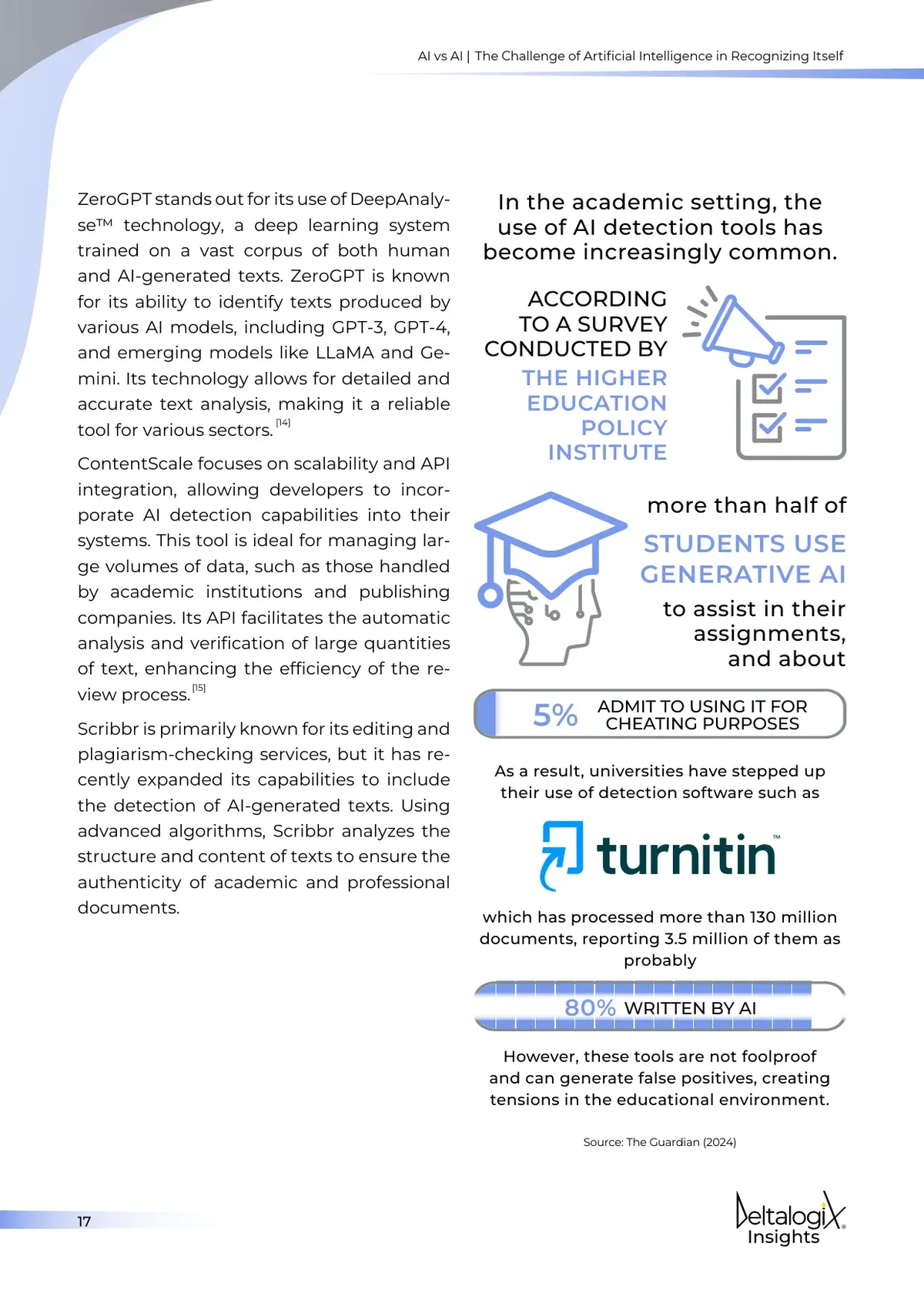

Strategy 1: Monte Carlo Simulation

Monte Carlo methods generate thousands of price paths to estimate potential tail losses in perpetual futures.

Advantages:

- Captures non-linear risk factors.

- Handles complex payoff structures (e.g., funding rate dynamics).

Disadvantages:

- Computationally intensive.

- Requires high-quality data and processing power.

Strategy 2: Historical Simulation with Stress Testing

This method uses past market data to estimate ES while incorporating stress scenarios (e.g., Bitcoin’s 2021 crash).

Advantages:

- Intuitive and based on real events.

- Easy to implement for perpetual futures portfolios.

Disadvantages:

- Limited by historical data length.

- May underestimate risks in unprecedented market conditions.

Comparing the Two Approaches

- Monte Carlo provides flexibility but is resource-heavy.

- Historical + Stress Testing is faster but less adaptive to new risks.

Recommended Best Practice: Use a hybrid approach, combining Monte Carlo for scenario exploration and historical simulation for validation. This ensures both robustness and practicality.

Visual Representation

Comparison of Monte Carlo and Historical Simulation in capturing tail risks for perpetual futures.

Real-World Applications

Leverage Adjustment

Algorithms integrating ES dynamically scale leverage. For example, if ES signals extreme downside risk, leverage can be reduced from 20x to 5x, preserving capital.

Portfolio Diversification

By applying ES across multiple perpetual futures contracts (BTC, ETH, altcoins), traders can identify correlated tail risks and diversify positions more effectively.

Risk-Based Funding Rate Optimization

Funding rate arbitrage strategies can incorporate ES to ensure positions remain sustainable even under adverse funding spikes.

Internal Linking for SEO

When discussing enhancements, it’s essential to understand how to calculate expected shortfall in perpetual futures accurately. This involves integrating fat-tail modeling and scenario-based simulations. Traders should also explore why expected shortfall is important in perpetual futures, as it directly impacts liquidation thresholds, leverage management, and overall portfolio optimization.

Best Practices for Executives and Quants

- Align ES with Business Objectives: Ensure models reflect both trading goals and risk tolerance.

- Automate ES Monitoring: Use real-time dashboards with alerts for tail risk thresholds.

- Integrate with Machine Learning: Adaptive algorithms can continuously improve ES forecasts by learning from market volatility.

- Benchmark Performance: Compare ES-based strategies against traditional VaR-based systems to measure efficiency gains.

FAQ: Expected Shortfall Enhancement for Perpetual Futures Algorithms

1. How does expected shortfall affect algorithmic trading in perpetual futures?

ES enhances trading algorithms by providing a more accurate view of tail risk. This means better leverage allocation, fewer forced liquidations, and improved long-term profitability.

2. Why use expected shortfall over Value-at-Risk (VaR)?

VaR only tells you the cutoff point for losses, while ES tells you how bad losses can get beyond that point. In highly volatile markets like crypto, ES provides the critical insights needed for capital preservation.

3. What tools are available to calculate expected shortfall in perpetual futures?

Traders can use Python libraries like Riskfolio-Lib and Quantlib, or institutional platforms with expected shortfall calculation tools for perpetual futures, often integrated with machine learning models.

Conclusion

The integration of expected shortfall enhancement for perpetual futures algorithms represents a significant step forward in crypto risk management. By moving beyond VaR and adopting ES-driven frameworks, traders and executives can strengthen resilience against extreme volatility. Whether through Monte Carlo simulations, historical stress testing, or hybrid methods, ES provides the depth and accuracy needed to survive in fast-moving perpetual futures markets.

🔹 What’s your experience with expected shortfall in algorithmic trading? Share your insights below and help others refine their strategies.

Would you like me to expand this into a quantitative research-style whitepaper with sample Python code for expected shortfall simulations in perpetual futures?