=========================================================================

Introduction

In today’s financial markets, trading algorithms are the engines that drive execution, risk management, and profitability for institutions and retail traders alike. However, even the most sophisticated algorithms are vulnerable under extreme market conditions. That’s where integrating stress testing into trading algorithms becomes crucial.

Stress testing helps simulate rare but impactful scenarios—such as sudden interest rate hikes, flash crashes, or liquidity squeezes—and ensures that algorithms can withstand turbulence. This practice not only strengthens a trading system’s resilience but also enhances investor confidence, risk management, and regulatory compliance.

In this article, we will dive deep into the best practices for integrating stress testing into trading algorithms, compare different approaches, highlight the latest industry trends, and provide an actionable step-by-step framework for traders and hedge funds.

We’ll also connect to essential insights like how to conduct stress testing in quantitative finance and why stress testing is important in quantitative trading, ensuring readers gain a holistic perspective.

What Is Stress Testing in Trading Algorithms?

Definition

Stress testing in trading algorithms is the process of simulating extreme, adverse, or unprecedented market conditions to evaluate how an algorithm would perform. Unlike standard backtesting, stress testing goes beyond historical performance to test resilience under “tail risk” scenarios.

Why It Matters

- Risk Management: Prevents catastrophic losses by highlighting weaknesses.

- Regulatory Alignment: Many financial authorities encourage or mandate stress testing.

- Investor Trust: Funds that conduct rigorous stress tests attract institutional investors seeking safety.

- Strategic Adaptability: Algorithms can be adjusted proactively to remain robust.

Key Benefits of Integrating Stress Testing into Trading Algorithms

- Improved Forecast Accuracy

By introducing stress testing into algorithms, traders can refine assumptions, leading to more realistic and accurate forecasts.

- Enhanced Portfolio Protection

Algorithms with built-in stress testing can dynamically adjust exposures when markets deviate from expected patterns.

- Transparency for Stakeholders

Fund managers can demonstrate preparedness through quantitative stress testing frameworks, improving transparency.

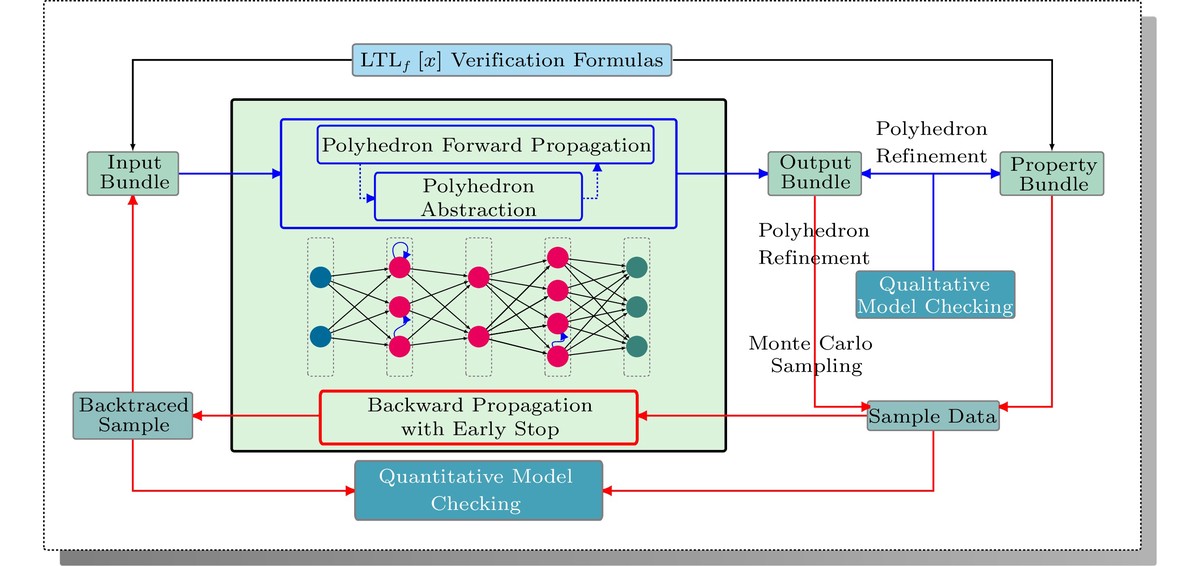

A sample framework showing how stress testing fits into trading algorithm development

Methods for Integrating Stress Testing

Method 1: Scenario-Based Stress Testing

Description

This involves constructing hypothetical but plausible scenarios—such as a repeat of the 2008 financial crisis, a pandemic-driven crash, or an energy price shock—and simulating algorithm performance.

Advantages

- Simple to implement.

- Helps capture narrative-driven risks.

- Easy to explain to non-technical stakeholders.

Disadvantages

- Limited by imagination.

- May overlook “unknown unknowns.”

Method 2: Historical Stress Testing

Description

Algorithms are tested against actual extreme events from the past. Examples include:

- The Dot-com bubble burst (2000–2002)

- The Global Financial Crisis (2008–2009)

- The COVID-19 crash (March 2020)

Advantages

- Realistic since it uses actual market data.

- Allows comparison with industry benchmarks.

Disadvantages

- Past crises may not predict future shocks.

- Ignores structural changes in markets (e.g., algorithmic dominance today).

Method 3: Monte Carlo and Simulation-Based Stress Testing

Description

This involves generating thousands of random scenarios using probability distributions, volatility spikes, and liquidity constraints to test algorithmic resilience.

Advantages

- Comprehensive coverage of potential risks.

- Captures tail events not seen historically.

Disadvantages

- Computationally intensive.

- Requires strong statistical expertise.

Comparing Methods and Best Practices

| Method | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Scenario-Based | Narrative stress tests | Easy to communicate, targeted | Limited coverage |

| Historical | Known crises | Real data, benchmarkable | May not reflect future |

| Monte Carlo | Complex portfolios | Captures rare, unseen risks | Computationally heavy |

Recommendation: For hedge funds and professional investors, a hybrid approach is ideal—using historical crises as baselines and Monte Carlo simulations for novel risks.

Integrating Stress Testing into Algorithm Design

1. Pre-Deployment Stage

Incorporate stress testing during backtesting and validation phases. Algorithms should be tested under multiple adverse conditions before live deployment.

2. Real-Time Monitoring

Stress testing doesn’t end after deployment. Algorithms can integrate real-time stress testing modules that simulate “what-if” scenarios while trading.

3. Risk Management Frameworks

Integrating stress testing into Value-at-Risk (VaR) models and exposure dashboards ensures algorithms self-adjust when risk thresholds are exceeded.

This connects closely with how to use stress testing for risk management, since it makes stress testing not just a diagnostic tool but a proactive defense mechanism.

Illustration of a real-time stress testing dashboard used by quant teams

Industry Trends in Stress Testing for Trading Algorithms

- AI-Driven Stress Testing

Machine learning models can generate stress scenarios by analyzing correlations and non-linear risks unseen by human analysts.

- Cloud-Based Stress Testing Platforms

Firms are shifting to cloud-native infrastructures for faster simulations and scalable data processing.

- Integration with ESG Risks

Stress testing now includes climate risks, geopolitical shocks, and social governance factors.

- Regulatory Alignment

Regulators are increasingly mandating algorithmic stress testing to prevent systemic failures.

Practical Example: Stress Testing a Momentum Trading Algorithm

- Scenario 1: Sharp liquidity drop—algorithm halts trading after spreads exceed predefined thresholds.

- Scenario 2: Volatility spike—algorithm reduces position sizes automatically.

- Scenario 3: Flash crash—algorithm switches to circuit-breaker mode and closes all open trades.

These practical mechanisms show how stress testing ensures resilience and adaptability.

FAQ: Integrating Stress Testing into Trading Algorithms

1. How often should trading algorithms undergo stress testing?

For active hedge funds and institutions, stress testing should be conducted monthly or quarterly. In volatile markets, weekly testing may be necessary to capture new risks.

2. Can stress testing completely prevent losses?

No. Stress testing cannot eliminate all risks, but it significantly reduces vulnerability by preparing algorithms for adverse conditions. Think of it as a seatbelt—it won’t stop accidents, but it saves lives.

3. What are the best tools for stress testing trading algorithms?

Popular tools include MATLAB, R, Python frameworks (QuantLib, PyMC), and commercial risk systems like MSCI RiskMetrics. Many quant funds also build custom in-house stress testing engines for speed and flexibility.

Conclusion

Integrating stress testing into trading algorithms is no longer optional—it’s a necessity. From scenario-based testing to Monte Carlo simulations, each method has unique strengths. The best results come from hybrid frameworks that combine real-world crises with probabilistic simulations, supported by real-time monitoring.

As markets grow more complex and unpredictable, stress testing enhances not only forecast accuracy but also risk resilience and investor trust.

If you found this guide useful, share it with colleagues, leave a comment with your stress testing experiences, and help advance best practices in quantitative trading.

Would you like me to create a visual stress testing checklist infographic that summarizes all the steps for quick reference by quant analysts and traders?