=========================================================

The rise of perpetual futures has transformed the trading landscape by offering continuous exposure to crypto markets without expiration dates. However, as traders and institutional investors seek ways to measure risk-adjusted performance, traditional metrics often fall short. This is where integrating Treynor ratio into perpetual futures analysis becomes critical.

By applying the Treynor ratio, which measures excess returns per unit of market risk (beta), traders can gain deeper insights into strategy efficiency and capital allocation. This article explores the Treynor ratio in detail, compares its application to other methods, and provides step-by-step approaches for integrating it into perpetual futures trading.

What Is the Treynor Ratio and Why Does It Matter in Perpetual Futures?

Definition of Treynor Ratio

The Treynor ratio is calculated as:

Treynor=Rp−RfβpTreynor = \frac{R_p - R_f}{\beta_p}Treynor=βpRp−Rf

- RpR_pRp: Portfolio return

- RfR_fRf: Risk-free rate

- βp\beta_pβp: Portfolio beta relative to the market

Unlike the Sharpe ratio, which uses total risk (standard deviation), the Treynor ratio isolates systematic risk.

Importance in Perpetual Futures

Perpetual futures markets are highly volatile and strongly correlated with underlying crypto assets. Thus, understanding why is the Treynor ratio important in perpetual futures lies in its ability to measure performance relative to market-wide risks, instead of random volatility.

Challenges of Applying Treynor Ratio in Crypto Perpetual Futures

- High Market Correlation

Crypto perpetual futures often move with broader market swings, making beta estimates unstable.

- Risk-Free Rate Estimation

Traditional finance uses treasury bonds; in crypto, proxies like stablecoin yields (USDT/USDC lending rates) are often used.

- Leverage and Liquidation Risks

Perpetual contracts allow high leverage, amplifying systematic risk exposure beyond beta adjustments.

Treynor ratio concept chart

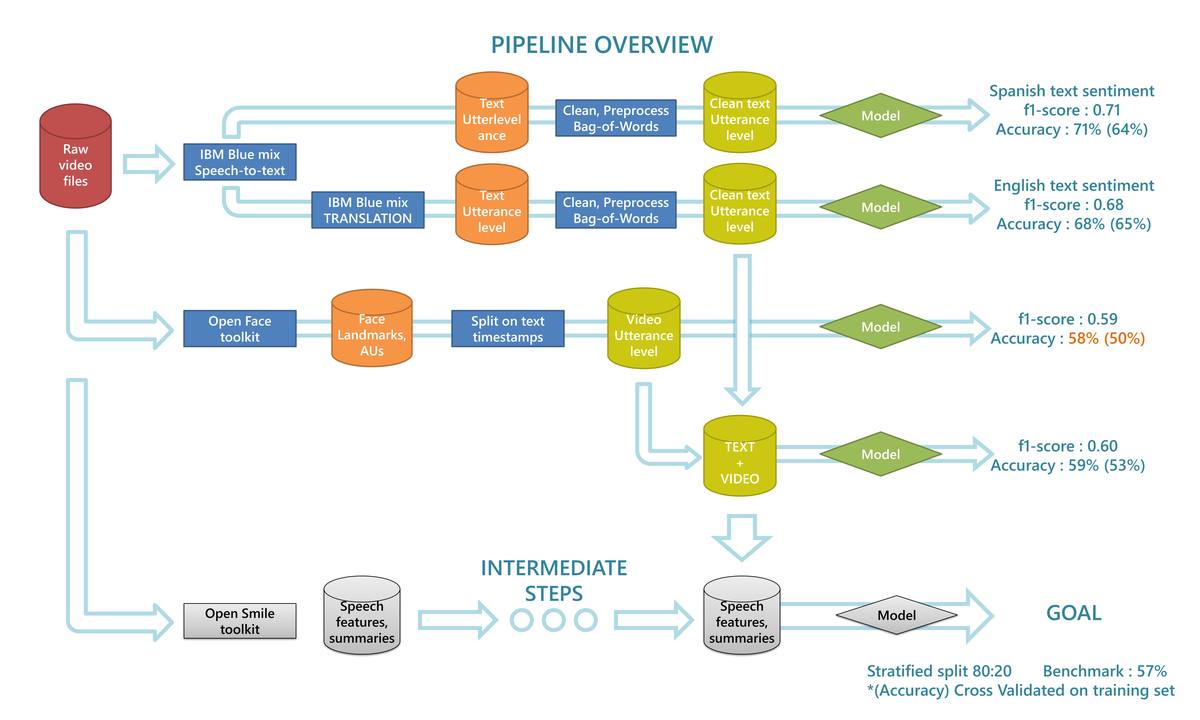

Two Methods of Integrating Treynor Ratio into Perpetual Futures Analysis

Method 1: Portfolio Beta-Based Risk Assessment

Process

- Calculate beta of perpetual futures portfolio relative to Bitcoin or a crypto index.

- Use the Treynor ratio to determine whether returns justify market risk exposure.

Advantages

- Simple and directly applicable to crypto portfolios.

- Provides clear guidance on whether leverage is justified.

Disadvantages

- Sensitive to short-term volatility.

- Relies heavily on accurate beta estimation, which can be unstable in crypto.

Method 2: Factor-Adjusted Treynor Ratio

Process

- Instead of using only a single market index, incorporate factors like funding rates, liquidity premiums, and volatility indices.

- Adjust beta to reflect multi-dimensional risk exposure.

Advantages

- Captures more nuanced risks in perpetual futures trading.

- Improves accuracy for institutional and hedge fund-level analysis.

Disadvantages

- More complex, requiring advanced models and larger data sets.

- May not be practical for retail traders without quantitative tools.

Comparison: Which Method Works Best?

- Portfolio Beta-Based Approach: Best for retail traders and those who need fast, interpretable results.

- Factor-Adjusted Approach: Best for professional traders and institutions, especially when managing large capital with complex risk exposures.

Recommendation: Start with the beta-based method to build intuition, then transition into factor-adjusted analysis for more sophisticated trading systems.

Practical Applications of Treynor Ratio in Perpetual Futures

Strategy Evaluation

Traders can use the Treynor ratio to compare strategies, identifying whether high returns come from skill or excessive exposure to market risk.

Capital Allocation

When managing multiple perpetual contracts, the Treynor ratio helps decide where to allocate more capital.

Improving Trading Decisions

Understanding how does Treynor ratio affect perpetual futures decisions can guide traders to exit high-beta positions when ratios decline, signaling deteriorating risk-adjusted performance.

Perpetual futures trading dashboard

Case Study: Treynor Ratio in Bitcoin Perpetual Futures

Scenario: A trader runs two strategies:

- Strategy A: 12% annualized return, beta = 1.2

- Strategy B: 9% annualized return, beta = 0.6

- Strategy A: 12% annualized return, beta = 1.2

Risk-Free Rate: 3% (using USDC yield proxy)

TreynorA=12%−3%1.2=7.5%Treynor_A = \frac{12\% - 3\%}{1.2} = 7.5\%TreynorA=1.212%−3%=7.5%

TreynorB=9%−3%0.6=10%Treynor_B = \frac{9\% - 3\%}{0.6} = 10\%TreynorB=0.69%−3%=10%

Despite higher raw returns, Strategy A underperforms Strategy B on a risk-adjusted basis.

Integrating Treynor Ratio into Trading Tools

Many traders now seek where to find Treynor ratio data for perpetual futures via platforms that integrate portfolio analytics. Advanced trading software and Python libraries allow backtesting Treynor ratios for perpetual strategies.

Common Mistakes When Using Treynor Ratio in Perpetual Futures

- Ignoring Leverage Effects

Leverage amplifies returns and beta simultaneously—improper adjustment can mislead results.

- Using Static Beta

Beta in crypto changes quickly. Dynamic beta estimation is essential.

- Misinterpreting Negative Ratios

A negative Treynor ratio indicates underperformance relative to risk-free returns, not necessarily flawed strategy mechanics.

Risk vs return visualization

FAQ: Treynor Ratio in Perpetual Futures

1. How to calculate Treynor ratio for perpetual futures in practice?

To calculate it, first determine the portfolio return from perpetual contracts, subtract the crypto proxy risk-free rate, and divide by the portfolio beta relative to Bitcoin or a crypto index. Tools like Python or Excel make this straightforward.

2. What are the benefits of Treynor ratio in perpetual futures compared to Sharpe ratio?

While the Sharpe ratio considers all volatility, the Treynor ratio focuses on systematic risk (beta). This distinction is important in perpetual futures because much of the volatility is market-driven rather than strategy-specific.

3. How to improve Treynor ratio in perpetual futures trading?

Improving the Treynor ratio involves either increasing returns (through better entry/exit timing, funding arbitrage, or improved leverage use) or lowering beta (by hedging with inverse futures, diversifying across pairs, or reducing exposure during high volatility).

Final Thoughts

Integrating Treynor ratio into perpetual futures analysis bridges the gap between traditional risk-adjusted performance metrics and the unique dynamics of crypto markets. While the beta-based method provides a quick snapshot, factor-adjusted Treynor analysis offers deeper insights for advanced traders and institutions.

By applying these approaches, traders can refine strategies, improve capital efficiency, and make better-informed decisions in volatile perpetual markets.

If you found this guide on integrating Treynor ratio into perpetual futures analysis helpful, share it with fellow traders and leave your thoughts below. How do you measure performance in perpetual futures—do you rely on Treynor, Sharpe, or something else?