=======================================================================

In the fast-paced world of perpetual futures trading, day traders are always on the lookout for strategies that can provide them with a competitive edge. One such strategy is mean-variance analysis, a tool that can help traders optimize their risk and return profiles. This analysis is particularly useful in the volatile environment of perpetual futures, where market movements can be sharp and unpredictable.

In this article, we’ll dive deep into the benefits of mean-variance analysis for day traders in perpetual futures, explore how it works, and explain why it is a crucial tool for maximizing returns and managing risk.

What is Mean-Variance Analysis?

Mean-variance analysis is a mathematical framework used to evaluate the relationship between the expected returns and volatility (or risk) of an asset. This method was originally developed by Harry Markowitz in the 1950s as part of Modern Portfolio Theory (MPT). It seeks to optimize a portfolio by balancing the expected return with the risk (variance or volatility) involved.

For day traders in perpetual futures, mean-variance analysis allows them to create strategies that maximize expected returns while minimizing risk exposure. It also helps to identify which assets are highly correlated and how those correlations might influence the performance of a trading strategy.

Key Elements of Mean-Variance Analysis

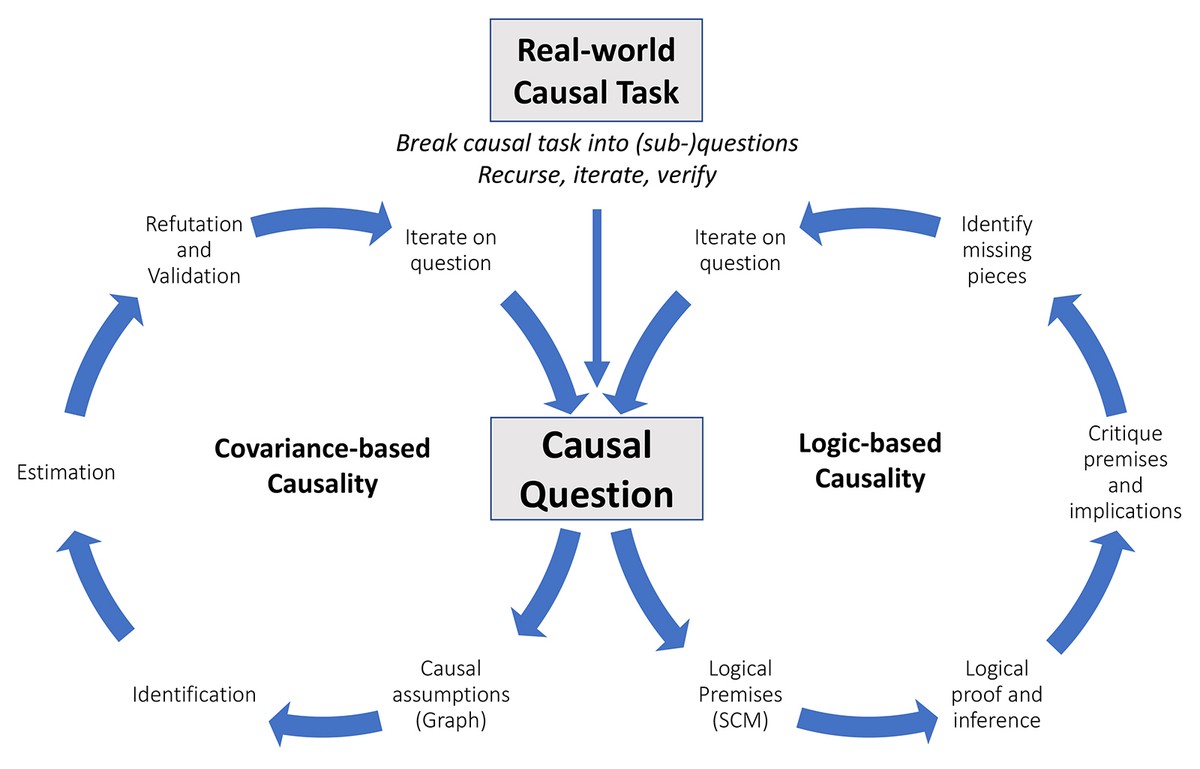

- Expected Return (Mean): This is the average return a trader expects to earn from an asset over a given period.

- Variance (Risk): Variance measures how much an asset’s returns deviate from its expected return. High variance means high volatility.

- Covariance: This measures the relationship between the returns of two assets. It can be positive (assets move in the same direction) or negative (assets move in opposite directions).

How Does Mean-Variance Analysis Benefit Day Traders in Perpetual Futures?

Day trading in perpetual futures involves taking positions in contracts that do not have an expiration date. These contracts can be highly volatile, making risk management essential for successful trading. By applying mean-variance analysis, day traders can:

1. Optimize Portfolio Construction

In perpetual futures, traders often deal with multiple assets or contracts simultaneously. Mean-variance analysis can help traders identify the optimal combination of assets to achieve the highest return with the lowest risk. By analyzing the expected returns and the variance (or risk) of each asset, traders can construct a diversified portfolio that minimizes the risk of large losses.

Example:

If a trader is considering two perpetual futures contracts, one for Bitcoin and another for Ethereum, mean-variance analysis can help determine whether combining these two assets would create a more balanced portfolio or expose the trader to unnecessary risk.

- Positive Correlation: If Bitcoin and Ethereum have a high positive covariance, they tend to move in the same direction, which may increase the overall risk.

- Negative Correlation: If their covariance is negative, holding both contracts can reduce the risk, as the assets will likely offset each other’s movements.

2. Enhance Risk Management

Risk management is crucial for any day trader, especially in the volatile world of perpetual futures. Using mean-variance analysis, traders can assess the risk of their positions by analyzing the variance of returns for each asset. This helps to manage the overall portfolio risk and ensure that no single position exposes the trader to excessive losses.

How Mean-Variance Analysis Aids in Risk Management:

- Diversification: By combining assets with low or negative correlation, traders can reduce the overall risk of their portfolio. For example, pairing a highly volatile crypto asset like Bitcoin with a more stable asset like USDT can provide balance.

- Avoiding Overexposure: Traders can use the analysis to avoid overexposure to any single position or asset, reducing the risk of a significant loss.

3. Improved Trade Execution

Mean-variance analysis helps day traders decide when to enter or exit positions based on risk-return calculations. This is particularly useful in perpetual futures trading, where markets can change rapidly within short time frames.

- Optimal Timing: By using mean-variance analysis, traders can determine the optimal timing for executing trades by analyzing how changes in market conditions may affect their positions’ volatility and potential returns.

- Minimizing Drawdowns: A key benefit of using mean-variance analysis is its ability to minimize drawdowns (the peak-to-trough decline in value), which is crucial for traders looking to preserve capital in volatile markets.

Comparing Mean-Variance Analysis with Other Strategies

While mean-variance analysis offers many advantages, it is important to compare it with other common trading strategies. Below, we compare mean-variance analysis with momentum trading and technical analysis to see where it excels and where it might fall short.

1. Mean-Variance Analysis vs. Momentum Trading

Momentum trading is a strategy that involves buying assets that have been trending upwards and selling those that are trending downwards. This strategy relies heavily on technical indicators and market trends rather than underlying statistical analysis.

Advantages of Mean-Variance Analysis over Momentum Trading:

- Risk-Return Balance: Momentum trading often focuses only on short-term trends, potentially missing the bigger picture. Mean-variance analysis helps traders balance risk and return over the long term.

- Portfolio Diversification: Mean-variance analysis allows for better diversification, reducing the risk of large losses in highly volatile markets.

Disadvantages of Mean-Variance Analysis:

- Doesn’t Predict Market Moves: Unlike momentum trading, which can capture short-term market movements, mean-variance analysis does not directly predict price direction. It’s more focused on optimizing overall portfolio performance.

2. Mean-Variance Analysis vs. Technical Analysis

Technical analysis involves using past price and volume data to predict future price movements. It relies heavily on chart patterns and technical indicators, such as moving averages, RSI, and MACD.

Advantages of Mean-Variance Analysis over Technical Analysis:

- Focus on Risk Management: While technical analysis helps in predicting price movements, it doesn’t provide insights into the risk associated with each trade. Mean-variance analysis focuses on both risk and return, helping traders optimize their portfolios.

- Scientific Approach: Mean-variance analysis is grounded in statistical principles, providing a more systematic approach to decision-making compared to the often subjective nature of technical analysis.

Disadvantages of Mean-Variance Analysis:

- Requires Data Analysis: Unlike technical analysis, which can be done using visual tools, mean-variance analysis requires quantitative data analysis and software tools, making it more complex for novice traders.

Frequently Asked Questions (FAQs)

1. How can mean-variance analysis improve perpetual futures trading returns?

Mean-variance analysis improves returns by helping traders optimize the balance between risk and reward in their portfolios. By choosing assets with favorable risk-return profiles and minimizing risk through diversification, traders can improve their chances of achieving consistent profits.

2. What are the key challenges when using mean-variance analysis in perpetual futures?

While mean-variance analysis offers a structured approach to risk management, it requires accurate historical data and sophisticated tools for calculation. The volatility in perpetual futures markets can also lead to rapidly changing correlations between assets, which means that constant reevaluation of the portfolio is necessary.

3. Can mean-variance analysis be used by retail traders in perpetual futures?

Yes, mean-variance analysis can be effectively used by retail traders in perpetual futures. Tools like Excel, Python, or specialized trading platforms make it accessible to retail traders. However, it’s essential for traders to have a basic understanding of statistical analysis and risk management techniques to use this method effectively.

Conclusion

Mean-variance analysis offers day traders in perpetual futures a systematic and data-driven approach to optimizing their portfolios. By helping traders balance risk and return, it enhances decision-making, improves risk management, and contributes to better trade execution. While not without its challenges, mean-variance analysis remains a powerful tool for traders looking to navigate the volatile world of perpetual futures with greater confidence.

Whether you’re a novice trader or a seasoned pro, implementing mean-variance analysis into your strategy can provide a clear advantage in managing risk and improving returns. If you’re looking to dive deeper into this powerful tool, consider exploring additional resources and trading platforms that can help you apply mean-variance analysis effectively.

Feel free to share your thoughts or questions in the comments section below. Happy trading!